Adjusting EBITDA for non-recurring items, determining a maintainable level of EBITDA and selecting an appropriate discount rate are some of the key challengers a business valuator faces when valuing a company. Situations arise where the value of only a division or business unit must be determined as opposed to an entire company. While these challenges are equally applicable to a division, inherent difficulties arise unique to the determination of a division's maintainable level of EBITDA.

Division A may have sales of $10 million on production of 1,000 units while Division B may have sales of $5 million on production of 10,000 units. If we are valuing only one of the divisions, how much of the company's fixed corporate overhead costs belong to each division? Should sales be used as the basis of allocation for all types of fixed overhead or is the number of units produced a better indicator? As EBITDA is a measure of a division's financial performance, it must include all operating expenses incurred by that division, including any corporate fixed overhead if these costs are not already allocated. As such, cost allocation becomes a fundamental issue when determining a division's EBITDA and consequently it can have a significant impact on its value.

Some companies use a cost accounting system to push all overhead down to the business-unit level. Others do not track net earnings on a divisional basis. Divisional financial statements may shed light on a division's direct cost and gross profit but silent when it comes to allocating fixed overhead costs – a significant cost for many companies. Improper allocation can have a material impact on value. In this article, we'll dive deeper into the impact on value and methods of allocating corporate overhead to a division.

What is Fixed Overhead?

In simple terms, overhead is the ongoing cost of running a company. It is sometimes difficult to allocate these costs to a particular division or product. They are typically incurred at the corporate level to support of the entire company's operations – essentially a division cannot operate without them. Specific examples of corporate overhead are:

- Corporate employees' salaries and benefits (such as accounting, HR, marketing);

- Building rent and utilities;

- General advertising;

- Office supplies and IT expenditures;

- Professional fees;

- Office furniture depreciation; and,

- Insurance.

The difficulty arises in grouping the costs by an appropriate allocation base. An allocation base is a factor that drives the cost of a particular activity. For variable overhead costs, this task is generally easy as most variable costs are driven by output. For example, the utility cost of a manufacturing building would presumably increase with an increase in units produced. For fixed overhead costs, this task becomes difficult as the cost drivers are not as evident. How much general advertising should be allocated to Division A and Division B? Each dollar increase in general advertising may not be directly related to an increase in sales or another observable measure. On the other hand, each additional dollar of utility cost may produce one additional unit.

The first step is to group overhead costs into cost pools. Each cost in a particular cost pool would use the same allocation base. Different cost pools may use the same or a different allocation base depending on what drives those costs.

When choosing an allocation base, you want to determine what drives the cost group. If corporate employees spend approximately half a day in support of Division A and the other half in support of Division B, time working in support of each division would be the proper allocation base. In such a case, their salaries and benefits would be allocated evenly between both Divisions. If they spent 3 months of the year in support of Division A and 9 months in support of Division B, 25% of their salaries and benefits would be allocated to Division A and 75% to Division B. This relationship is not always clear. A cost such as professional fees does not directly support the activities of a particular division but the company as a whole. The business valuator must determine an allocation base that most closely approximates the cost driver.

The following example illustrates potential cost groups and allocation bases for a manufacturing company that has two separate operating divisions:

- Rent, supplies, utilities, property taxes and depreciation for a warehouse building may all be lumped together in a cost group. The allocation base would be the building's square footage as this is what drives the activity level. Warehouse costs would be allocated to each division based on their proportionate use of warehouse space;

- Salaries, benefits, and payroll taxes for the accounting group may all be lumped together in a cost group. The allocation base would be time working in support of each division as this drives the activity level. The salaries and related costs would be allocated to each division based on the proportionate use of the group's time; and,

- General advertising, IT expenditures, professional fees and other sales, general and administration costs ("SG&A") may not have a direct link to any activity, however these costs increase relative to the company's overall growth. An appropriate allocation base would be one that most closely approximate the burden of the division on the company as a whole, or the efforts incurred supporting the division. In such a case, the proportionate level of actual or budgeted sales may be the best indicator.

An important consideration when grouping fixed overhead is to consider certain costs that may fall under fixed overhead but are directly attributable to a specific division. These costs must be backed out of the cost pool and added in their entirety to the division. By grouping them with fixed overhead, you are underestimating costs by allocating only a percentage of directly attributable costs. For example, if corporate advertising costs for a company is $1,000,000 but $50,000 of the cost relates to a specific division, the full $50,000 needs to be allocated to the division (if it does not appear on their divisional financial statements) and total advertising costs of $950,000 would be allocated among the divisions using an appropriate allocation base.

Impact on Value

Improperly allocating overhead to a division can materially underestimate or overestimate its value. Using an allocation base that does not closely approximate the activity levels incurred by the division can result in an over allocation or under allocation of corporate overhead leading to a maintainable EBITDA that does not represent its true earning potential. The following hypothetical example demonstrates how using an improper allocation base can affect value.

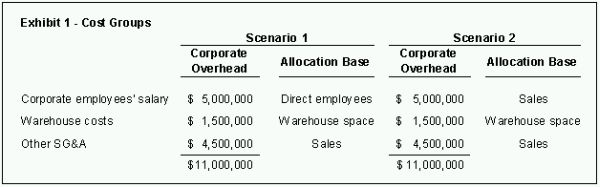

Let's assume that we have grouped the company's overhead costs into three cost groups as follows:

In this example, we are using two scenarios to demonstrate how using a different allocation base can impact value. In Scenario 1, we determine that the following allocation bases drive the activities for those cost groups:

- Corporate employees' salary is driven by the number of direct employees working in each division;

- Warehouse costs are driven by the size of the warehouse; and,

- Other SG&A costs are driven by overall sales.

In Scenario 2, we determine that it is not the number of direct employees working in each division that drive the corporate employees' salary costs but rather sales. The support for sales is that the corporate employees spend more time supporting divisions that generate higher sales than others regardless of the number of direct employees working for that division. Scenario 1 improperly concludes that the corporate employee's activity level is driven by the number of direct employees working in a division.

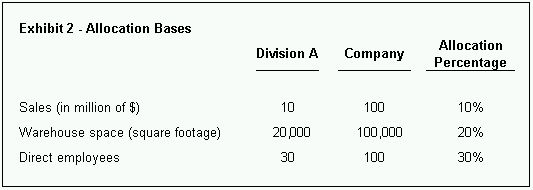

The following Exhibit summarizes the allocation percentage for each allocation base.

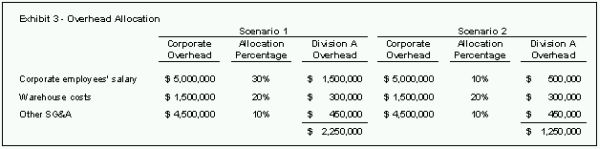

We see that while Division A accounts for only 10% of the entire company's sales, it uses 25% of the warehouse space and employs 30% of the direct employees. This leads to an overhead allocation as follows under both Scenarios:

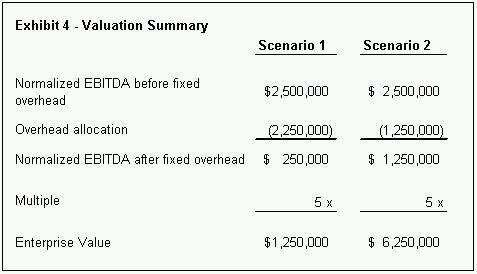

In Scenario 1, $2,250,000 of fixed overhead costs are allocated to Division A (or approximately 20% of the total corporate overhead of $11,000,000). In Scenario 2, only $1,250,000 of fixed overhead costs are allocated due to a lower allocation percentage for the corporate employees' salary (i.e. 10% versus 30%). We see the impact on the valuation as follows:

Under Scenario 1, after a deduction for fixed overhead allocation, normalized EBITDA is $250,000. Applying a multiple of 5x EBITDA results in an enterprise value of $1,250,000. Under Scenario 2, after a deduction for fixed overhead allocation, normalized EBITDA is $1,250,000 resulting in an enterprise value of $6,250,000.

The preceding example demonstrates how sensitive a division's value can be to an allocation of fixed overhead costs. A business valuator must closely examine the cost groups and allocation bases used to allocate fixed overhead to a division. Posing the question "What causes costs?" can help you determine what type of activity drives cost. As costs are incurred for various reasons, determining the cost's business rationale can provide the best indicator of what drives it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.