- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Insurance industries

INTRODUCTION

A taxpayer's interaction with the Canada Revenue Agency (the "CRA") can give rise to two distinct legal proceedings. The first is a court proceeding to determine whether the amount of tax assessed is correct. The second is a court proceeding to challenge the behaviour of the CRA's personnel in carrying out their work.1

This article is concerned with the second type of court proceeding: instances where the actions of the CRA (or provincial revenue authorities) are called into question. Generally, the taxpayers lose these lawsuits. Many of these types of lawsuits are probably frivolous: CRA personnel are generally reasonable. There are, however, a number of suits in which CRA personnel have engaged in behaviours that are fundamentally incompatible with the rule of law and shock the conscience of the reader.

Only recently have taxpayers had some success against the revenue authorities in civil suits. In these cases, the taxpayer has typically been rendered impecunious. The result is an injustice – a pauper plaintiff fighting Leviathan. These cases are very much manifestations of Thomas Hobbes, Friedrich Hayek and John Rawl's reflections on the coercive power of the state. Only with Archambault and Leroux, each considered below, does it now appear that courts may be willing to take the CRA and provincial revenue authorities to task for instances of misconduct.

LAWSUIT SHOULD NOT COLLATERALLY ATTACK UNDERLYING ASSESSMENT

It is important to distinguish between taxes assessed and the conduct of the CRA. They are two very different things, although the facts are generally intertwined. While the CRA may act unfairly or even illegally in arriving at an assessment or reassessment of taxes, that conduct is generally not relevant to determining whether the underlying tax liability is valid. A survey of the case law reveals that taxpayers often conflate these issues.

Indeed, in Main Rehabilitation Co. v. Canada,2 the Federal Court of Appeal has explained that section 169 of the Income Tax Act (the "ITA"),3 which provides the statutory basis of appeals to the Tax Court of Canada (the "TCC"), is the vehicle by which the TCC establishes the validity or invalidity of an assessment. The issue on appeal is not the process by which the assessment is established.4 What is in issue at the TCC is whether amounts can be properly shown to be owing in accordance with the provisions of the ITA.5 This logic undoubtedly extends to Excise Tax Act assessments and reassessments.

STATUTORY SCHEME AND CONCURRENT JURISDICTION

The case law reviewed herein reveals that civil actions taken against the CRA are generally launched in provincial superior courts. However, there exists concurrent jurisdiction with the Federal Court of Canada. It is important that an aggrieved taxpayer not attempt to commence a civil suit (or attempt to graft the underpinnings of a civil suit) onto a proceeding at the TCC. This is because the TCC lacks the jurisdiction to grant any such relief.

It remains to be seen – although the author is very doubtful of the same – whether conduct so egregious by the CRA would ever come before the TCC that the TCC would vary or set aside an assessment on the basis of the impropriety or misconduct of the CRA. In any case, the jurisdiction of the TCC is specifically circumscribed by the Tax Court of Canada Act, which limits the court to the consideration of matters arising, generally speaking, from federal revenue statutes.6As such, a decision of the TCC rendered on the basis of CRA impropriety would be an error of law.7

Cases against the CRA typically allege negligence and misfeasance. These claims can be brought in either provincial superior court or the Federal Court of Canada. If the claim is brought in a provincial superior court, then the province of residence of the taxpayer would be the appropriate forum in which to launch the claim, unless circumstances would otherwise dictate.

The Supreme Court of Canada has explicitly endorsed concurrent jurisdiction.8The Crown Liability and Proceedings Act (the "CLPA") provides for concurrent jurisdiction.9 Under the CLPA, the Crown is liable for damages resulting from torts by servants of the Crown.10 The Federal Courts Act, in turn, provides that the Federal Court has concurrent original jurisdiction in respect of claims for damages under the CLPA.11

RECENT CASE LAW

No Duty of Care in Respect of another Taxpayer's Assessment (783783 Alberta Ltd. v. Canada)

This case involved a competition between Edmonton's free weekly newspapers. Vue Weekly sued the CRA in an attempt to force the CRA to deny deductions to advertisers in its competitor, SEE Magazine. This suit was brought on the basis that Conrad Black, SEE Magazine's ultimate owner, had renounced his citizenship.12

Section 19 of the ITA enables taxpayers to deduct expenses incurred from advertising in a Canadian newspaper, but not from advertising in a non-Canadian newspaper. In this way, if it could be shown that SEE Magazine was non-Canadian, then the deductions should not be allowed.

Ultimately, the Alberta Court of Appeal (the "ABCA") did not endorse Vue Weekly's anti-competitive behaviour. The decision engaged in an analysis of the elements of a negligence action. The ABCA noted that there "was no prior case establishing liability on the part of tax collectors to one group of taxpayers based on the taxes imposed on another group of taxpayers"13 and "the relationship is not one where the tax assessors should be responsible for protecting taxpayers from losses arising from competitive disadvantages of the type pleaded".14 The ABCA concluded that policy considerations precluded a private law duty in tort (but see Leroux, below) and that the relationship between each taxpayer and the assessor is personal and private.15

The ABCA can be commended in this judgment for their practical approach to the problem of tax assessing. It would be practically impossible to assure that tax laws are applied consistently from taxpayer to taxpayer. Further, the plaintiff in this case was actuated by a desire to stymie their market competitor. Even if the arguments of the plaintiff were correct as a matter of law (which was not relevant to the disposition of the case) there is a strong public policy rationale to deny the relief sought.

The Use of Information Obtain in Discoveries (506913 N.B. Ltd. v. McIntyre)

In 506913 N.B. Ltd. v. McIntyre,16 the taxpayer sought to rely on answers given by a CRA representative in the TCC proceeding at his examination for discovery for a separate civil proceeding. Tax appeals were ongoing in respect of input tax credits under the Excise Tax Act.17

Normally, and as was the case here, there is an implied undertaking that answers given to questions at examinations for discovery are to be used only in the litigation to which they relate. The plaintiff, however, argued that it was in the public interest to set aside the implied undertaking. Justice Rideout disagreed.18

Charter Equality Rights Not Infringed by Differing Assessments (Tennant v. Minister of National Revenue)

Although not explicitly stated in the judgment, the Tennant case19 appears to involve subsection 15(1) of the ITA – a benefit conferred by a corporation on the taxpayer. The plaintiff taxpayer sued on the basis that, while he was assessed for the benefit, a similarly situated taxpayer who had engaged in a very similar transaction had not been assessed as having received a benefit.

The lawsuit was brought on the basis of section 15 of the Canadian Charter of Rights and Freedoms,20 which provides for equality before and under the law, except to the extent it is circumscribed by section 1. Justice Sanderman held that section 15 was intended to cover differential treatment based on immutable personal characteristics, such as race, religion, sex or disability. The plaintiff failed because he was unable to show that the differing treatment resulted from an immutable personal characteristic.21

Tax Court does not have Jurisdiction to Hear Civil Claim (Ereiser v. Canada)

As explained, the validity of a tax assessment is separate and apart from any liability of the CRA. In Ereiser, the Federal Court of Appeal considered this issue.22 The Crown had successfully moved to strike a number of paragraphs of Ereiser's Notice of Appeal.

The underlying allegations of fact were this: the CRA officer attempted to have the taxpayer plead guilty to criminal charges, rather than face an assessment nearing $2 million, despite the fact that the taxpayer was never actually the subject of a criminal investigation. There were other abuses by the CRA officers.

Justice Sharlow provided a useful overview of this area of law. She explained that the Federal Court and provincial superior courts will often decline to entertain an application that is a collateral attack on the validity of an assessment.23 She also used the Leroux appeal (related proceedings considered herein) to illustrate that actions against tax officials may raise justiciable issues apart from the correctness of the assessment.24The latter is not justiciable in such a forum.

She arguably provides the clearest, most precise statement of this area of law:25

It may be that in this case, the reassessments under appeal will be found to be valid and correct. In that case, they will represent a correct statement of Mr. Ereiser's statutory obligations under the Income Tax Act, and they will not be vacated as part of the statutory appeal process for income tax appeals. However, they will be vacated if they are found to be invalid or entirely incorrect. If they are found to be incorrect in part, they will be vacated and referred back to the Minister for reassessment. But regardless of the outcome of Mr. Ereiser's income tax appeal, it will remain open to him to seek a remedy in the Federal Court or the superior court of a province, depending upon the circumstances, if he has a tort claim or an administrative law claim arising from the wrongful conduct of one or more tax officials.

Faulty Pleadings and Limitations Issues Can Bar an Action (Foote v. Canada)

The Foote decision26 stands as an important reminder that pleadings and limitations issues must be considered. In this case, the taxpayer was assessed for underreported income. The CRA's investigation included searches at his home and place of business. Upon declaring bankruptcy, the taxpayer's objections were abandoned.

Much of the claim was struck as challenging the underlying assessment, which was outside of the jurisdiction of the Supreme Court of British Columbia.27 In the case of the negligence claim, it was struck as the facts to support such a claim were not properly pleaded.28 As the misfeasance claim related to actions that were limitation barred (the execution of the search warrant in 2007), that claim could not proceed.29 Ultimately, most of the claim was struck, but the misfeasance action was allowed to proceed.30

The CRA Commences Criminal Proceeding against Taxpayer on Invalid Basis (McCreight v. Canada (Attorney General))

This case represents astonishing allegations of misfeasance against the CRA. It is also a warning to professional advisors about the lengths to which the CRA will go. In McCreight,31 the CRA investigated the use of research and development tax credits. The investigation included tax advisers in a large accounting firm.32 There were wranglings over the retention of seized documents by the CRA.

Ultimately, and somewhat shockingly, Justice Quinn found that the CRA investigator had sworn an information alleging fraud and conspiracy against, inter alia, the accountants "primarily to retain possession of the seized documents".33 The charges were dismissed against the accountants and the corporate taxpayers on the basis of unreasonable delay pursuant to section 11(b) of the Charter.34 The litigation is ongoing, and the claims for misfeasance in public office, negligence, and abuse of process have been allowed to proceed.35

Freeman/Natural Person/OPCA-based Claims are Frivolous (Sinclair-McDonald v. Her Majesty the Queen)

This case was bound to fail. The taxpayer, Sinclair-McDonald, asserted that she had waived her rights as a person under the law.36 The notion that someone can unilaterally waive the state's jurisdiction to tax is risible, but that was the taxpayer's position. She further sought an order that the CRA pay back all taxes collected from her for the past 10 years.37 This latter position was also incorrect.

It was correctly held that Parliament has the authority to legislate with respect to taxation and that Crown employees cannot be held liable for doing something that they are authorized to do by statute.38 For these reasons, the statement of claim was struck as frivolous, vexatious, and an abuse of process.39 For more on the puerility of tax protestor arguments see Meads v. Meads.40

Damages Assessed against Revenu Québec for Malicious Behaviour (Archambault v. Revenu Québec)

The Archambault case,41 currently under appeal, is one example of substantial success in Canada against a revenue authority – in this case Revenu Québec. The case involves successful allegations of bad faith brought against Revenu Québec. Justice Reimnitz held that Revenu Québec acted intentionally and breached the taxpayer's rights under the Québec Charter.42

Revenu Québec was held to have withheld the taxpayer's research and development tax credits to put financial pressure on the taxpayer, seized the taxpayer's bank account when it had no right to do so and kept the taxpayer in the dark about proceedings, making a defence difficult or impossible.43 Justice Reimnitz explained that this case was far from a simple error: it was malicious and intentional.44

Damages were assessed at $4,000,000, of which $2,000,000 constituted punitive damages. This is the only case of which the author is aware in which a Canadian revenue authority has been reasonably punished for highhanded abuse.

CRA Owed Duty of Care and Breached that Duty (Leroux v. Canada Revenue Agency)

The Leroux decision is the second case in which the CRA has been found to be in breach of a legal standard.45 However, liability was not assessed in this case.

The CRA took the position that it owed no private law duty of care to an individual taxpayer.46 However, Justice Humphries held that CRA auditors owe a duty of care to taxpayers.47 This duty includes a duty of care to take reasonable care in assessing penalties.48 She further explained that the gross negligence penalties, as were considered and assessed in this case evidenced a clear breach of the standard of care.49 The issues were in fact highly complex.50

The taxpayer was ultimately unsuccessful on the basis that no causation was shown, in combination with issues of contributory negligence and failure to mitigate.51 The case, however, remains important as specifically describing a standard of care owed to the taxpayer.

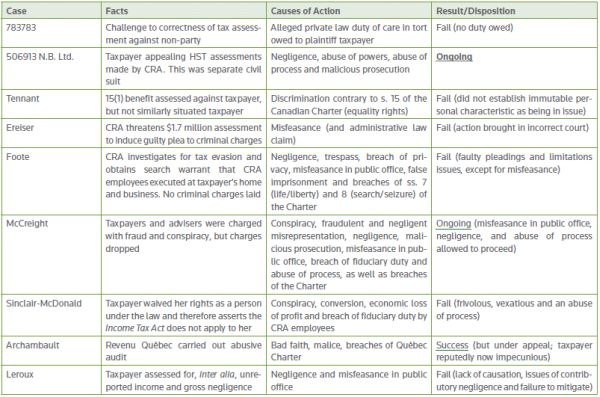

CHART OF OUTCOMES

CONCLUSION

The primary considerations when suing the CRA are as follows: Ensure that the claim is brought in the proper jurisdiction. Ensure that the claim is supportable at law. Ensure that the actions of the CRA are actually highhanded or malicious and there is strong underlying evidence to support such a claim. Ensure that the claim is brought in a timely fashion. Ensure that the claim is does not conflate the issue of the validity of an assessment with the issue of CRA liability. Ensure that the facts and elements necessary to sustain each cause of action are sufficiently pleaded.

Footnotes

1 See Notes to D. Sherman's Annotated Income Tax Act at ss. 171(1).

2 Main Rehabilitation Co. v. Canada, 2004 FCA 403.

3 Income Tax Act, R.S.C. 1985, c. 1 (5th Supp.).

4 Supra note 2 at para. 8.

5 Ibid.

6 Tax Court of Canada Act, R.S.C. 1985, c. T-2, s. 12.

7 As the TCC lacks jurisdiction to grant equitable remedies, a wronged taxpayer would have to look elsewhere for relief.

8 Canada (Attorney General) v. TeleZone Inc., 2010 SCC 62. See, inter alia, para. 22.

9 Crown Liability and Proceedings Act, R.S.C. 1985, c. C-50, s. 21(1).

10 Ibid., s. 3(b)(i).

11 Federal Courts Act, R.S.C. 1985, c. F-7, s. 17(2)(d).

12 783783 Alberta Ltd. v. Canada, 2010 ABCA 226, para. 5.

13 Ibid., para. 44.

14 Ibid., para. 45.

15 Ibid., para. 46.

16 506913 N.B. Ltd. v. McIntyre, 2012 NBQB 225.

17 Ibid., para. 4.

18 Ibid., para. 26.

19 Tennant v. Minister of National Revenue, 2012 ABQB 108.

20 Part I of the Constitution Act, 1982, being Schedule B to the Canada Act 1982 (UK), 1982, c. 11.

21 Tennant, supra note 19 at para. 17.

22 Ereiser v. Canada, 2013 FCA 20.

23 Ibid., para. 35.

24 Ibid., para. 36.

25 Ibid., para. 38.

26 Foote v. Canada, 2013 BCCA 135.

27 Ibid., at para. 8.

28 Ibid.

29 Ibid., at para. 16.

30 Ibid., at para. 17.

31 McCreight v. Canada (Attorney General), 2013 ONCA 483.

32 Ibid., para. 3.

33 Ibid., para. 6.

34 Ibid., para. 8.

35 Ibid., para. 74.

36 Sinclair-McDonald v. Her Majesty the Queen, 2013 ONSC 4900, para. 1.

37 Ibid., para. 1.

38 Ibid., para. 22.

39 Sinclair-McDonald, supra note 36 at para. 23.

40 Meads v. Meads, 2012 ABQB 571.

41 Archambault v. Revenu Québec, 2013 QCCS 5189.

42 Charter of Human Rights and Freedoms, C.Q.L.R., c. C-12.

43 I would like to thank my colleague Romain Baudemont for his assistance in translating a case summary of the Archambault decision into English for me.

44 Archambault v. Revenu Québec, supra note 41 at para. 699.

45 Leroux v. Canada Revenue Agency, 2014 BCSC 720.

46 Ibid., para. 6.

47 Ibid., at para. 305.

48 Ibid., at para. 306.

49 Ibid., at para. 355.

50 Ibid., at para. 348.

51 Ibid., at para. 375.

Originally published by Taxes & Wealth Management, May 2015.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]