Introduction

On April 23, 2015 Finance Minister Charles Sousa tabled his third Budget.

The deficit for the 2015-16 fiscal year is projected to be $8.5 billion, which is less than had been forecasted in the 2014 Budget. The deficit is projected to drop to $4.8 billion for 2016-17 and to be eliminated by 2017-18. Unlike the 2014 Budget, the 2015 Budget does not comment on achieving a surplus.

The Budget does not include any changes to Ontario's tax rates for individuals or corporations. From a business prospective, Ontario has decreased many of its tax credits including the Apprenticeship Training Tax Credit, the Interactive Digital Media Tax Credit and the Film and Television Tax Credits. It is proposing to eliminate the Sound Recording Tax Credit.

Measures Affecting Individuals

Personal Income Tax Rates

The Budget does not propose any changes to personal income tax rates.

As announced in 2015 federal Budget, the gross-up factor and federal dividend tax credit rate that applies to non-eligible dividends will change. As a result, the combined Ontario and federal tax rates for non-eligible dividends will increase starting in 2016 as a result of the 2015 federal Budget.

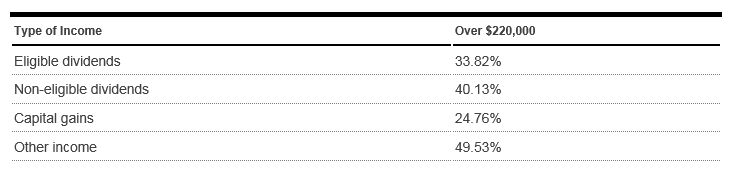

The combined federal and Ontario top marginal rates for 2015 are unchanged, and set out in the following table:

Measures Affecting Businesses

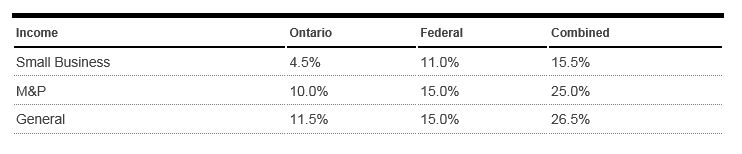

The Budget proposes no changes to corporate income tax rates which remain as follows for 2015:

As a result of the 2015 federal Budget, the proposed increase in the small business deduction will lower the income tax rate for small business by 0.5% per year. The income tax rate on the first $500,000 of active business income will decrease from 15.5% to 13.5% over the period from 2016 to 2019.

Apprenticeship Training Tax Credit

For eligible expenditures related to apprentices who commenced an apprenticeship program after April 23, 2015 the government proposes to decrease the general tax credit rate from 35% to 25% and the rate for small business with salaries or wages under $400,000 per year from 45% to 30%.

Ontario Interactive Digital Media Tax Credit (OIDMTC)

The government proposes to amend the OIDMTC to focus the credit on entertainment products and on educational products for children under the age of 12.

Ontario Production Services Tax Credit (OPSTC) and Ontario Computer Animation and Special Effects Tax Credit (OCASE)

Both the OPSTC and OCASE will reduced as announced in the 2015 Budget. With respect to the OPSTC, this credit will decrease from 25% to 21.5% for qualifying production expenditures incurred after April 23, 2015. In order to ensure the credit fosters employment in Ontario, a qualifying corporation's Ontario labour expenditures would have to amount to at least 25% of total expenditures.

The OCASE is proposed to be reduced from 20% to 18% for expenditures after April 23, 2015.

Ontario Resource Tax Credit and Additional Tax on Crown Royalties

Ontario will eliminate the Ontario Resource Tax Credit and the Additional Tax on Crown Royalties that are provided in lieu of a deduction for royalties and mining taxes. It will provide a deduction for royalties and mining taxes paid, effective April 23, 2015.

Paralleling Federal Changes

After having studied the taxation of trusts and estates, Ontario proposes to change the way it taxes testamentary trusts and estates, by paralleling the federal approach of applying the highest personal income tax rate to all trusts, with some exceptions, beginning for taxation years ending after December 31, 2015, pending introduction of legislative amendments.

Graduated Rate Estates will be eligible for the graduated federal rates for the first 36-months, as will trusts created as a consequence of the death of an individual who has beneficiaries eligible for the federal Disability Tax Credit.

The Ontario tax credit for charitable donations over $200 would be raised to 17.41% for trusts that pay the top marginal personal tax rate.

Other Measures

Tackling Climate Change

Ontario intends to join Quebec and California in moving forward with a cap-and-trade system as its carbon pricing mechanism. Ontario will consult throughout the summer, listening to experts, industry and environmental groups, as it develops the design of a cap-and-trade program.

Registration of Road Building Machines

The government is currently reviewing potential registration and licensing requirements to be imposed on some of these vehicles, developing a registration process and meeting with various stakeholders to receive input on this measure.

Transfer tax for electricity assets

Municipal electricity utilities (MEUs) are subject to a transfer tax of 33% on the fair market value of electricity assets sold to the private sector, less any payments in lieu or Ontario corporate income tax paid up to the time of the transfer. The budget will reduce the transfer tax from 33% to 22%, exempt MEUs with fewer than 30,000 customers from the transfer tax, and exempt gains arising under the payment in lieu of tax deemed disposition rules, for the period beginning January 1, 2016 and ending December 31, 2018.

Property Tax Measures

Ontario announced that it is working to improve the property tax assessment system before the next province-wide reassessment in 2016. Further to what was announced in the 2013 Economic Outlook, Ontario continues consultations on the Provincial Land Tax, which applies to land outside municipal areas in Northern Ontario. Currently this tax is significantly lower than the property tax levied by adjacent municipalities.

Pension Programs

The Budget includes several programs to take effect over a period of several years.

Ontario Retirement Pension Plan (ORPP)

As first announced in the 2014 Budget, and introduced in Bill 56, the government is moving forward with a new mandatory provincial pension plan, the ORPP to take effect by January 1, 2017. Required contributions are not to exceed 3.8% of earnings (up to a maximum annual earnings threshold of $90,000, in 2014 dollars), with half to be funded by each of the employer and the employee. The Ontario Retirement Pension Plan Administration Corporation will be established for administering the ORPP.

Pooled Registered Pension Plans (PRPP)

On December 8, 2014, Ontario introduced the Pooled Registered Pension Plan Act, 2014. The proposed Act provides a legal framework for the establishment and administration of PRPP. PRPPs would give both employees and self-employed individuals a new voluntary, low-cost, tax assisted option to help increase retirement savings.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.