Business Interruption policies typically set out the measure of recovery on a commercial insurance claim as either a Gross Earnings Form or a Profits Form. In practice, these two forms are often confused or improperly applied.

In an effort to help illustrate the differences between the two forms we have included a brief case study highlighting the major steps in calculating a business interruption loss under each form and have set out the major conceptual differences between the forms.

Case Study – The Delicious Cookie Store

On October 31, 2014, The Delicious Cookie Store ("the Store") was raided by the Cookie Monster and his cronies, the Cookie Crusaders. Thankfully, the Cookie Crusaders were contained by local authorities, but not before they destroyed the premises and ate all of the cookies ("the Loss"). It took 6 months to repair the damage done by the Cookie Crusaders (the Store reopened on May 1, 2015) and an additional 3 months for sales to return to pre-Loss levels (on August 1, 2015).

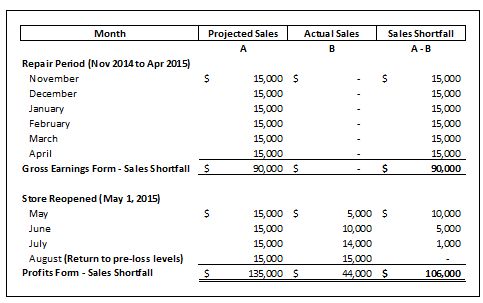

The Store's sales didn't experience any seasonality and consistently amounted to $15,000 per month prior to the Loss. After the repairs were complete, the Store earned the following sales from May to July 2015:

- May 2015 - $5,000

- June 2015 - $10,000

- July 2015 - $14,000

Further, the Store didn't pay any of its hourly staff until it reopened.

STEP 1: PROJECT SALES LOSS

(Reference: Major Conceptual Differences - Indemnity Period, as below)

First, we project what sales would have been had the Loss not occurred and then we deduct actual sales during the same period to calculate the sales shortfall. The indemnity period under a gross earnings form is restricted to when repairs are completed, whereas, under a profits form the indemnity period extends until sales return to their pre-loss levels. Remember that, in both cases, the indemnity period is typically restricted to a maximum 12 month period.

The gross earnings form refers to the sales shortfall as the "Reduction in Sales" and the profits form calls it the "Reduction in Turnover." For simplicity, we will refer to the sales loss as "sales shortfall."

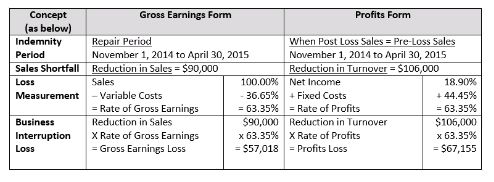

STEP 2: CALCULATE RATE OF GROSS EARNINGS / RATE OF PROFITS

(Reference: Major Conceptual Differences - Loss Measurement & Ordinary Payroll, as below)

Next, we calculate the percentage of sales that is insured. Since the purpose of insurance is to return the insured to the position that they would have been in had the loss not occurred, the Store is not "insured" for 100% of their lost sales. This is because, had the loss not occurred, they would not have retained 100% of their sales because they had to incur certain expenses in order to make those sales.

So what portion of the sales are "insured"?

Under a gross earnings form, the Store is insured for their sales less any costs that directly vary with sales. Under a profits form, the Store is insured for their net income plus any fixed expenses. In many cases, this percentage is equivalent.

STEP 3: CALCULATE BUSINESS INTERRUPTION LOSS

Finally, we multiple the sales shortfall by the rate of gross earnings or rate of profits (which are equal in this case study) as follows:

CASE SUMMARY

In this instance, the gross earnings form results in a lower business interruption loss payable than the profits form. This may not always be the case; however, the purpose of this exercise is to illustrate how variations in wording can culminate in different loss calculations.

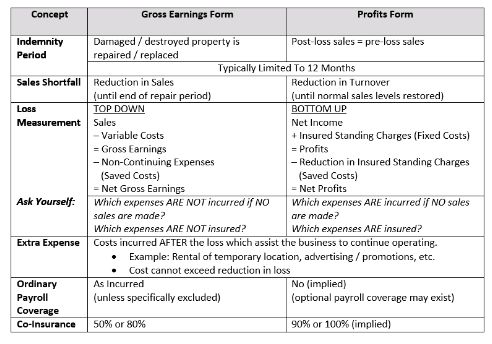

Major Conceptual Differences

The following table outlines the major conceptual differences between the Gross Earnings and Profits forms. Please note that the concepts discussed below are not to be used as a comprehensive guide, as each form is specific to the policy.

Please feel free to contact your Collins Barrow advisor should you have any claim preparation questions or inquires.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.