Welcome to The Harris Pension Chronicles.

I recall as a teenager watching Mr. Spock, of Star Trek fame, raising his hand in the Vulcan salute and uttering the immortal words 'live long and prosper.' I wonder now whether prosperity necessarily follows from a longer life? Many in the pension industry would argue "no" and one of the main reasons is 'longevity risk' and the accompanying fear of many pensioners that they will outlive their money.

What the numbers tell us

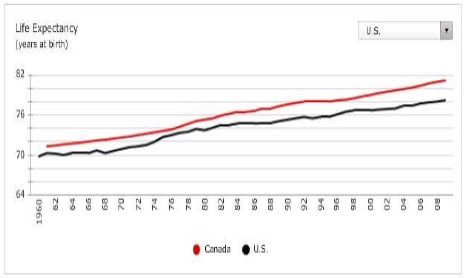

According to the Canadian Association of Retired Persons (CARP), the biggest fear of Canadians over 50 today is outliving their retirement savings. The graph below illustrates the problem.

Canadian Demographics: Life Expectancy at Birth

Canada/US

Source: Conference Board of Canada

An average Canadian born today can expect to live about 10 years longer than one born in 1961 (about 3 years longer than his or her American counterpart).

According to the Human Mortality Database, Canadian life expectancy rose 27% between 1939 and 2009. More important from a pension and retirement planning perspective, according to that same database, life expectancy for Canadians who reach normal retirement age (65) has increased significantly over the last 80 years. In fact, recently compiled United Nations statistics suggest that North Americans who attain the age of 65 have a 50% chance of living to age 90. That probability would likely be higher if our heftier U.S. cousins were not included in the mix.

Clearly Canadians are living longer and they are living longer in their retirement years when they rely on government pensions and their personal savings to cover living expenses. The problem is that while government pensions tend to be paid for a lifetime, certain personal savings vehicles, like RRSPs or investment accounts, can run out of money if you live longer than expected.

Those concerned about outliving their money should begin by considering some of the key findings from a global study commissioned by HSBC and appearing in 'The Future of Retirement: Life after work?'.

A key finding in the HSBC study is that Canadians who are not fully retired expect to live 19 years in retirement but anticipate their retirement savings to run out after eleven years, while fully retired Canadians expect their savings to last only thirteen years in retirement. Other key findings include:

- globally, 38% of retirees say their retirement income is lower than expected, while 52% say their living expenses in retirement were the same or greater than before retirement;

- globally, 65% of retirees have planned for their retirement but mostly informally, with just 26% having used a professional adviser; and

- in North America, the main reason for retirees having lower income than expected is insufficient planning.

What this means for your employees and retirees

Defined benefit pension plans (DB Plans) are exposed to the risk of higher than expected payouts because of increased life expectancy among pensioners – called 'longevity risk' – however, DB Plan participants are not directly exposed to longevity risk. DB Plan participants typically enjoy a guaranteed lifetime retirement benefit and so can rest easy knowing that their monthly cheques will continue to arrive regardless of how long they live. However if they rely on additional sources of retirement income, they may want to reassess those other sources to take longevity into account.

DB Plan participants who are still working may be asked by their employer to contribute more to offset the longevity risk in their plan. They may also want to consider working a few years longer, saving more for retirement or both.

Defined contribution plans (DC Plans) are not exposed to longevity risk per se, rather it is the DC Plan participants who face that risk. Unless longevity risk is transferred to an insurer at retirement (e.g., through the purchase of a guaranteed life annuity), DC Plan participants face the worrisome prospect of outliving their retirement savings. And even where life annuities are purchased to offset longevity risk, longer life expectancies and the current low interest rate environment means significantly smaller monthly cheques from insurance companies. Those same dire prospects face Group RRSP participants.

DC Plan participants (and those in similar circumstances) need to reassess their retirement plans to determine if their retirement savings will be sufficient to support their increased life expectancies. They may need to save more and work longer to ensure sufficient savings for their retirement.

Those currently saving for retirement should engage in more sophisticated planning. Modern modelling tools use current life expectancies to assess if individuals have saved "enough" for a their retirement. A recent study by the BMO Wealth Institute concluded that Canadian baby boomers are more than $400,000 short of their retirement goals. The study suggests that almost half of boomers are not confident about their retirement financial security and that many will be postponing retirement and/or working part-time in retirement to supplement their retirement savings.

The Chronicles Take-Away

Canadians are living longer and this fact has serious implications for retirees and those saving for their retirement because, all things being equal, the longer people live in retirement, the more money they need to maintain a specific lifestyle. Once properly recognized, longevity risk should convince employees and retirees to take positive steps to protect their financial security.

Active employees should consider steps to transfer longevity risks to others better able to manage those risks. They should also consider ways to increase their retirement savings through a combination of better financial planning, new savings initiatives or delayed retirements.

Retirees, especially those who are not members of DB Plans, need to carefully assess the adequacy of their retirement plans to determine whether they run the risk of outliving their retirement savings. Retirees must manage their assets prudently to avoid running out of money during their retirement.

If concerned about their retirement plans, active employees and retirees should seek professional assistance so that they can enjoy all those extra years of retirement with greater financial security.

In my next post, I will consider how longevity risk affects company pension plans.

Stay Healthy, Wealthy & Wise

Issue 2, Volume 1

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.