Introduction

In 1973, the federal government introduced measures aimed at stimulating investments in residential mortgages by the private sector. One of those was the introduction in the Income Tax Act (ITA) of the "Mortgage Investment Corporation" ("MIC"), a corporation subject to a special tax regime. Generally, it provides its shareholders with monthly distributions from a mortgage portfolio generating stable cash flows on a long-term basis as if they directly owned this asset.

Opportunities to Be Had in Québec?

In provinces other than Québec, there exist several mortgage funds, both listed and unlisted on the Toronto Stock Exchange, many of which are MICs.

Thus, in Québec, there are no MICs with exchange-listed securities, nor probably any unlisted MICs. In the rest of Canada, there are eight MICs listed on one of the stock exchanges of the TMX Group and a significant number of unlisted MICs.

Among those that are not exchange-listed, there is a mortgage fund with a mortgage portfolio of more than one billion dollars, namely Romspen Mortgage Investment Fund.

For a listed MIC, its shares are a permanent source of capital since they usually are not subject to redemption requests by its shareholders. Also, for the investors, these securities are freely tradable on a stock exchange.

Nature of the investment

MICs, whether or not listed, are corporations subject to a special tax regime. The MIC's assets usually include only mortgages generating interest and, occasionally, capital gains. Generally, the income generated by the mortgage portfolio (interest and capital gains) is not taxed in the hands of the MIC but in those of its shareholders. The purpose of such single level of taxation is to place the investors in the same tax position as if they owned the mortgages directly.

What makes the MIC attractive for investors is the stability of its cash flow. A study conducted by Dundee Capital Markets1 reveals the following findings regarding the nature of MICs, mainly those listed on a stock exchange:2

- On average, 80% of their mortgages are first-ranking.

- On average, the ratio of the amount of loans to the value of encumbered property is 54%, a large safety cushion in the event that lenders should run into difficulty.

- Loans are generally short-term, from 18 to 36 months.

- Where interest rates are floating, they provide a protection against interest rate increases. Furthermore, the short-term nature of the loans is another form of protection against rate fluctuations.

- The provision for losses is on average 0.4% of the portfolio value. By way of comparison, from 2008 to 2012, the allowance for doubtful accounts of Canadian and American banks stood at 0.9% and 4.37%.

- Loans generally remain repayable at any time. Therefore, the lender runs a certain risk of prepayment which is mitigated by the short-term nature of the loans.

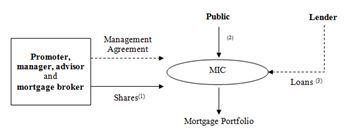

Typical Structure

(1) Some MICs are controlled by their promoter.

(2) Shares or debentures.

(3) Bank financing is usually used to finance the loans granted

which will ultimately be repaid after the closing of subsequent

rounds of financing with the public (e.g. warehousing of mortgage

loans to be refinanced), as well as the working

capital.

A management agreement may set out annual fees, performance bonuses, the sharing of the loan origination fees and service fees. In some cases, the promoter is also a shareholder of the MIC.

Taxation

The MIC is a conduit for income tax purposes. More precisely, it may deduct from its income dividends that it pays to its shareholders. The corporation may also deduct fifty percent of dividends originating from its capital gains realized during the year. The net result of this tax rule is that the MIC should not have any taxes to pay on its income if it distributes all of its income as dividends to its shareholders.

For a shareholder, dividends received, other than those related to capital gains, are deemed to be interest on bonds and not dividends from a corporation. As for net capital gains realized during the year which the MIC has chosen to distribute to its shareholders, they are deemed to be capital gains realized by the shareholder, only 50% of which are to be included in the computation of their income.

Eligible Investments

The shares of a MIC are investments eligible for a number of deferred income plans, and TFSAs. It is an interesting investment for these plans where they receive dividends (deemed to be interest) before income taxes.

Mortgage Investment Corporation

A corporation is a MIC if, for a taxation year, it meets all of the following conditions throughout the year:

- Residence and Incorporation – It was incorporated in, and is a resident of, Canada.

- Restricted Activities – Its sole activity is the investment of its funds and it does not manage or develop real or immovable property. Therefore, it may own real or immovable property, subject to the restrictions described below, but may not manage or carry out activities related to its development.

- Canadian Property – None of its property

consisted of the following:

- indebtedness secured by real or immovable property situated outside Canada;

- indebtedness owed by non-residents, except for the debts secured by real or immovable property situated in Canada;

- shares of a corporation that does not reside in Canada;

- real or immovable properties located abroad, or a leasehold interest on such properties.

- Shareholders and Shareholding Threshold – It

must have at least 20 shareholders, none of whom, alone or together

with related persons, held more than 25% of issued shares of a

class of its share capital.

Note that, to be listed on the TSXV or TSX exchange, a company must have at least 200 or 300 shareholders. - Preferred Shareholders' Rights – Preferred

shareholders, after preferred dividends have been paid out to them

and after the same amount has been paid to the common shareholders,

they are entitled to receive the same proportion of any additional

distribution of dividends as the common shareholders.

There is no prescribed condition regarding voting rights. For example, it is possible that the preferred shares may carry the right to vote, but not the common shares.3 See above the restriction on maximum holdings per class of shares. - Residential Mortgages, Cash and Deposits – At least 50% of the "cost amount"4 of all of its assets must originate from loans secured by "houses" or property included within a "housing project" within the meaning of the National Housing Act5 from its cash and deposits with a bank or a company, some of which are insured by the Canada Deposit Insurance Corporation or by the Régie de l'assurance-dépôts du Québec, or with a credit union. On certain property, mortgage loans must be on a "house" or a housing project within the meaning of the National Housing Act. It can be a completed building or a building under construction.

- Maximum Real Property – The cost amount of its real or immovable property, including any leasehold interest on such property (without taking into account those repossessed as a result of a default), must not exceed 25% of the cost amount of all its assets.

- Leverage – Its "liabilities"6 must not exceed the difference between the cost amount of all of its assets and its liabilities, multiplied by three (three for one), if, at any time of the year, the cost amount of its mortgages on residential property and its deposits described in the paragraph above and its cash represent less than two thirds of the cost amount of all of its assets. In other cases, its liabilities should not exceed the difference between the cost amount of all of its assets and its liabilities multiplied by five (five for one).

Footnotes

1 Dundee Capital Markets, Mortgage Investment Corporations (MICs), Stable Yield From Mortgage Investments, July 4, 2013.

2 Based on a sample of seven exchange-listed MICs as at July 4, 2013 along with Romspen Investment Fund, an unlisted mutual fund trust which has a mortgage portfolio of more than 1 billion dollars.

3 It should be noted that the ITA, for such purposes, defines a common share and a preferred share. What distinguishes one from the other is the right to participate upon a reduction or redemption of shares.

First, a preferred share is a share that is not a common share. A common share is a share the holder of which is not precluded on the reduction or redemption of the capital stock from participating in the assets of the corporation beyond the amount paid up on that share plus a fixed premium and a defined rate of dividend.

4 In general terms, "cost amount" means, for depreciable property or capital property, its non-amortized cost and, in other cases, the cost of the property used for income tax purposes;

5 Section 2 of the National Housing Act defines this word and expression as follows:

"house" means a building or movable structure, or any part thereof, that is intended for human habitation and contains not more than two family housing units, together with any interest in land appurtenant to the building, movable structure or part thereof;

"housing project" means a project consisting of one or more houses, one or more multiple-family dwellings, housing accommodation of the hostel or dormitory type, one or more condominium units or any combination thereof, together with any public space, recreational facilities, commercial space and other buildings appropriate to the project, but does not include a hotel.

6 "Liabilities" means all of the company's debts and all other obligations to pay sums of money that have become due.

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© McMillan LLP 2014