M&A deals involving public companies in Canada are typically structured in one of three ways:

- Takeover bid

- Amalgamation

- Plan of arrangement

The type of structure that is suitable for a particular transaction depends on a variety of factors relating to the deal.

1. Takeover bid

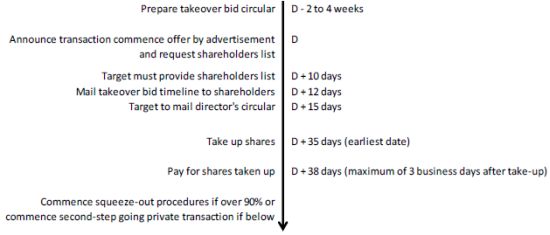

In a takeover bid, the acquiring company makes an offer directly to the target company's shareholders to acquire the company's voting or equity securities. The bid must be made to all shareholders and all must be offered the same consideration. A takeover bid circular and a directors' circular are issued to the shareholders of the target company. In general, the entire deal process takes at least 35 days. If the terms of the bid are amended or the bid deadline is extended, the process can take even longer.

Takeover bid timeline1

If over 90% of the target's outstanding securities are tendered, the acquiring company can obtain full control by forcing out the remaining shares. If the shareholder approval falls short of 90% but is over 66.7%, the acquirer must carry out a secondary "squeeze-out" transaction to secure the rest of the shares, usually done through an amalgamation. A takeover bid can be the fastest acquisition process and is the only one that is suitable for unsolicited bids, as the offer is made directly to shareholders, without need to obtain agreement from the target company.

2. Amalgamation

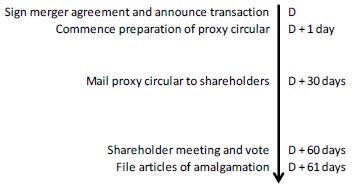

In an amalgamation, an agreement is reached between the acquirer and the target to merge together and form one entity. The target company issues proxy documents to its security holders and a special shareholder meeting is held to approve the proposed transaction. Generally, a 2/3 majority of votes cast is required for shareholder approval. This request is then filed for regulatory approval.

Amalgamation timeline2

While an amalgamation process can be easier for the acquiring company to secure 100% ownership of the target company, the process can take significant effort and time to negotiate and agree on the terms of the deal. The deal process generally takes around 60 days. Unlike in a takeover bid where the offer terms must be as favourable as any pre-offer transactions, there are no pre-offer transaction restrictions in an amalgamation process.

3. Plan of Arrangement

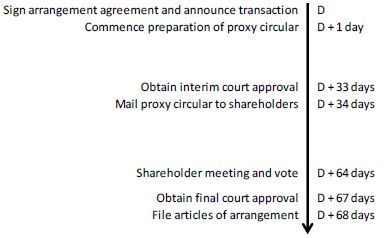

A third common type of M&A transaction structure is in the form of a plan of arrangement. Similar to an amalgamation, an agreement for the deal is first reached between the acquirer and the target. The target company may set up an independent committee of the board of directors to handle any potential issues and conflicts of interest that may arise during the deal process.

Plan of arrangement timeline3

With an agreement in place, the target applies for an interim order from a court of the plan of arrangement and subsequently issues the proxy documents to its shareholders. A special shareholder meeting and a 2/3 majority of the votes cast is required for approval. The arrangement becomes effective once it receives final approval from the court, deeming it to be "fair and reasonable". The two conditions that must be satisfied are:

- the arrangement has a valid business purpose; and

- the objections of those whose legal rights are being arranged are being resolved in a fair and balanced way.

A plan of arrangement process takes approximately 60 to 90 days as it requires court approval and negotiation of deal terms can take a significant amount of time. However, it does offer greater flexibility for more complex acquisitions compared to takeover bids and amalgamations.

Advantages and Disadvantages

The type of deal structure selected depends on the particular circumstances of the engaged parties and the advantages and disadvantages of each type of acquisition process should be carefully weighed before proceeding. A takeover bid generally takes less time than an amalgamation or plan of arrangement. It is also the only option if the bid is unsolicited. However, there is a risk that less than 90% of the outstanding shares are tendered, in which case a secondary "squeeze-out" transaction is required. An amalgamation is a one-step process that is subject to fewer restrictions than a takeover bid, though it typically takes more time to complete. A plan of arrangement is also a single-step process that is subject to fewer restrictions than a takeover bid. However, unlike in an amalgamation, court approvals are required in a plan of arrangement, which means the deal process can take even longer. However, a plan of arrangement does offer greater flexibility in more complex acquisitions.

Footnotes

1,2,3 Davies. (2013). Canadian Mergers and Acquisitions Guide for Foreign Investment Bank and Bidders, 4th edition.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.