- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Banking & Credit and Insurance industries

As the end of 2013 approaches, taxpayers should be aware of some important tax planning deadlines in the Canadian tax system. Some of these are recurring matters that arise every year, while others are specific to 2013. (Prior coverage: Tax Notes Int'l, Nov. 19, 2012, p. 747.) In either case, it is useful to review some of the most important of these pending deadlines to ensure that opportunities for reducing or eliminating Canadian taxes are not missed. These deadlines are discussed below with reference to a corporation that is resident in Canada for Canadian tax purposes (Canco).

I. Deadlines Unique to 2013

Extension of Thin Capitalization Rules

The thin capitalization rules in subsection 18(4)-(8) of the Income Tax Act (Canada) (sections 18(4)-(8)) limit the amount of debt owing to related nonresidents that a Canco (or a partnership of which Canco is a member) can deduct interest expense on for tax purposes. The debt covered by these rules is debt owing by Canco to ''specified nonresidents''1 — nonresidents who either are 25 percent-plus shareholders (by votes or value) of Canco or do not deal at arm's length with such 25 percent-plus Canco shareholders. Under the current rules that came into effect in 2013, Canco cannot deduct interest on any such debt to the extent that it exceeds 1.5 times Canco's ''equity'' (essentially the sum of Canco's unconsolidated retained earnings and the paid-up capital of Canco shares held by nonresident group members).

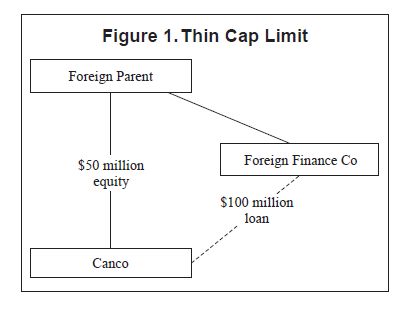

For example, a Canco that owes $100 million to its foreign parent (or another foreign group member) and has only $50 million of equity will be able to deduct interest expense relating to only $75 million of that debt. (See Figure 1.) Interest on the remaining $25 million of debt will be nondeductible for Canadian tax purposes and will be recharacterized as a dividend to which Canadian nonresident dividend withholding tax will apply at a 25 percent rate (subject to reduction under an applicable tax treaty), instead of as interest (which would generally be received by most U.S. recipients free of Canadian withholding tax).

As a result of changes announced in the 2013 federal budget, the thin capitalization rules will be extended to apply to Canadian-resident trusts (and to partnerships in which a Canadian resident trust is a member) for tax years beginning after 2013. The same 1.5-1 debt-to-equity limit will apply to Canadianresident trusts. In determining the amount of debt owing to ''specified nonresidents,'' specified nonresidents are defined as nonresidents who either are 25 percentplus Also, a trust's ''equity amount'' for a tax year2 is calculated as the trust's tax-paid earnings for the year, plus the average amount of all equity contributions made to the trust by specified nonresidents before the beginning of each month in the year, minus the average amount of certain capital distributions made by the trust to specified nonresidents before the beginning of each month in the year.3

A trust to which these rules apply can designate the nondeductible interest as a payment of income of the trust to the nonresident recipient of the interest. In beneficiaries (by value) of the trust or do not deal such a case, the trust will be able to deduct the payment in computing its income, but the payment will be subject to Canadian nonresident withholding tax at a 25 percent rate (subject to reduction under an applicable tax treaty) and potentially to tax under Part XII.2 of the ITA, depending on the character of the income earned by the trust.

Also effective for tax years beginning after 2013, the thin capitalization rules will apply to nonresident corporations and trusts that either carry on business in Canada or elect to be taxed as a Canadian resident under section 216 ITA (and to partnerships of which such a nonresident corporation or trust is a member). The same 1.5-1 debt-to-equity limit will apply to these corporations and trusts. However, since a Canadian branch is not a separate legal person from the nonresident entity and therefore does not have its own equity for purposes of the thin capitalization rules, a 3-5 debtto- assets ratio is used to determine a notional amount of equity for the branch.4 In addition, loans from a nonresident who does not deal at arm's length with the nonresident corporation or trust are included in ''outstanding debts to specified nonresidents.'' For a nonresident corporation, the application of the thin capitalization rules could increase its liability for branch tax under Part XIV of the ITA.

Entities affected by the upcoming changes to the thin capitalization rules should review amounts owing to relevant foreign creditors and, if necessary, reduce the amount of such debt (for example, by replacing it with debt owing to a Canadian or arm's-length lender) or increase the entity's ''equity amount'' for thin capitalization purposes by the end of 2013, to ensure compliance with applicable debt/equity limitations starting on January 1, 2014.

B. Tax Avoidance Transaction Reporting

The mandatory tax avoidance transaction reporting regime in section 237.3 ITA applies to certain tax avoidance transactions (''reportable transactions'') if the transaction is either:

- entered into after 2010; or

- part of a series of transactions completed after 2010.

Legislation implementing the mandatory reporting regime, which was first proposed in 2010, was enacted on June 26, 2013.

For a transaction to be a reportable transaction, it must be an avoidance transaction for purposes of the general antiavoidance rule in the ITA — that is, a transaction that would result, or is part of a series of transactions that would result, in a tax benefit (a reduction, avoidance, or deferral of tax), unless the transaction has been undertaken or arranged primarily for bona fide purposes other than to obtain the tax benefit. Moreover, the avoidance transaction must also satisfy at least two of the following three conditions:

- Fee condition: An adviser or a promoter (or a person

who does not deal at arm's length with an adviser or promoter)

is entitled at any time (either absolutely or contingently) to a

fee that is to any extent either:

- based on the amount of a tax benefit from the transaction or series;

- contingent on obtaining a tax benefit from the transaction or series; or

- attributable to the number of persons who participate in, or who have been provided access to, advice given by an adviser or promoter about the tax consequences of the transaction or series (or a similar transaction or series).

- Confidential protection condition: An adviser or a promoter obtains in respect of the transaction or series ''confidential protection''; that is, anything that prohibits the disclosure of the details or structure of the transaction or series under which a tax benefit results (or would result but for the GAAR).

- Contractual protection condition: A taxpayer, a person who entered into the transaction for the benefit of a taxpayer, an adviser, or a promoter (or a person who does not deal at arm's length with any of them) has ''contractual protection'' in respect of the transaction or series.5

Footnotes

1 August 16, 2013, draft legislative amendments released by the Department of Finance propose to exclude from the calculation of outstanding debts to specified nonresidents a debt obligation entered into as part of a series of transactions that includes the creation of a debt to Canco that is subject to the section 17.1 interest imputation regime (discussed in Section II.C of this article). The amendment, which applies to tax years that end after March 28, 2012, is intended to ensure that the thin capitalization rules do not impede the ability of Canco's parent to finance Canco with debt where Canco in turn uses the borrowed funds to lend to its foreign affiliate and elects to have section 17.1 apply to that loan.

2 An elective transitional rule allows a trust to compute its equity as at March 21, 2013 (the date the changes to the thin capitalization rules were originally announced), based on the net fair market value of the trust's assets on that date computed in accordance with specified rules. While the election is available to all Canadian resident trusts, it is intended to assist trusts that have insufficient historical information available to determine their equity amounts on March 21, 2013.

3 Excluded from the capital distribution calculation are distributions that are:

- included in the specified nonresident's income under subsection 104(13) ITA;

- subject to nonresident trust income withholding tax; or

- paid or payable to a person other than a specified non-resident beneficiary of the trust.

4 Based on this 3-5 debt-to-assets ratio, the equity amount for a nonresident corporation or trust is generally computed as 40 percent of the amount by which the cost (determined on an averaged monthly basis) of all property (other than partnership interests) that is (a) used or held by the corporation or trust in the year in the course of carrying on business in Canada or (b) an interest in real property or timber resource properties and timber limits in Canada in respect of which the corporation or trust files an income tax return under section 216 ITA exceeds all outstanding debts (determined on an averaged monthly basis) of the corporation or trust relating to its Canadian business or to a property interest described in (b) above that are not included in its outstanding debts to specified nonresidents.

5 ''Contractual protection,'' which excludes a fee described in the fee condition, includes any form of:

- insurance (other than standard professional liability insurance) or other protection (such as an indemnity, compensation, or a guarantee) that protects against a failure of the transaction or series to achieve a tax benefit or that pays for or reimburses any expense, fee, tax, interest, penalty, or similar amount that may be incurred in a dispute regarding a tax benefit from the transaction or series; or

- undertaking by a promoter (or by a person who does not deal at arm's length with a promoter) that provides assistance in a dispute regarding a tax benefit from the transaction or series.

To view this article please click here.

Reprinted from Tax Notes Int'l, November 11, 2013, p. 551

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.