The Canadian Government has introduced new tax rules which may subject corporate contractors to a 13% increase in the rate of income tax payable. These rules received Royal Assent on June 26, 2013 and are effective for all tax years beginning after October 31, 2011.

The increased tax rate will apply to all income earned by a corporate contractor which is income from a "personal services business" or "PSB" (within the meaning of the Income Tax Act (Canada) (ITA)). Given the draconian impact of the proposals, it is advisable for all corporate contractors to review whether the corporation is carrying on a personal services business and, if so, to evaluate the impact of the tax rate increase in determining how to structure the corporation's affairs.

Personal Services Business

The ITA defines a personal services business as being a services business carried on by a corporation where the corporation is used as a substitute for what would normally be considered an "employer-employee relationship". The definition provides that a corporation is carrying on a PSB where an individual (referred to as an "incorporated employee") who provides services on behalf of the corporation, or any person related to the incorporated employee, owns not less than 10% of any class of shares of the corporation and the incorporated employee would "reasonably be regarded as an officer or employee of the person or partnership to whom or to which the services were provided but for the existence of the corporation". There is an exception if the corporation employs in the business more than five full-time employees throughout the year or if the services are provided to an associated corporation (in the latter case, the small business deduction would need to be shared by the associated corporations in any event).

The question of whether the individual should be viewed as an employee or as an independent contractor is one of fact which is to be determined on a case-by-case basis. The relevant factors include the degree of control the service provider is subject to by the service recipient, whether the service provider provides his/her own tools, whether the service provider hires its own assistants and subcontractors, the degree of financial risk taken by the service provider, the degree of responsibility for investment and management held by the service provider, and the service provider's opportunity for profit.

Although other situations could be caught, the classic example of a corporation carrying on a PSB is where an individual agrees to provide full-time services to a corporation or partnership which are similar to services provided by employees but provides such services through a corporation. Potentially high-profile examples include well-paid executives or officers who incorporate and provide their services through the corporation.

Impact of Having a PSB Corporation

A corporation carrying on a PSB is denied the small business deduction and is limited in its deductions to salaries paid and employment benefits provided to the incorporate employee, plus certain expenses which would also be available to an employee. Under the new rules, a corporation's income from carrying on a PSB will also be excluded from income that is eligible for general rate reductions, such that PSB income will be subject to federal corporate income tax at a rate of 28%, plus applicable provincial tax.

The result of the new rules is to subject a corporation carrying on a PSB to corporate-level tax at a rate similar to the rate that would have been paid had the incorporated employee earned the income directly. Upon payment of the after-tax funds to the incorporated employee as dividends, an element of double tax accordingly results.

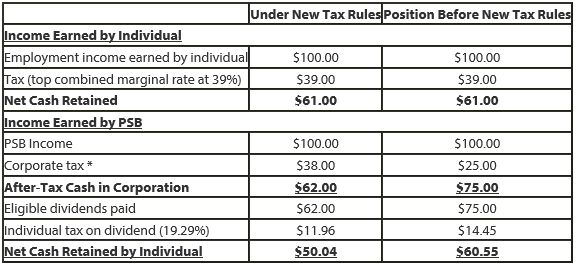

As an example, consider the circumstance where an individual provides employment services directly in Alberta, as compared to a circumstance where the services are provided by a corporation carrying on a PSB. The tax results are summarized in the table below.

* Federal rate of 28% plus Alberta rate of 10% under new tax rules vs. Federal rate of 15% plus Alberta rate of 10% before new tax rules

As is seen in the example, the cost of earning income in a PSB corporation, as opposed to directly, amounts to $11 for every $100 of income earned.

Potential Defences and Restructuring

The best result for a service provider, under the existing or new rules, is if a successful argument can be made that the corporation is not carrying on a PSB but rather, absent the corporation, the individual would be viewed as an independent contractor to (and not an employee of) the service recipient corporation. Practically, this argument stands a far greater chance of success where the corporation has a history of providing services to a number of clients. Where the facts are that the corporation provides services only to one service recipient on, essentially, a full-time basis, the risk of an adverse tax result increases. It is particularly in this situation that re-structuring should be considered to avoid the punitive impact of the PSB rules.

One possibility would be to wind-up the corporation so that the individual is employed directly by the service recipient. In some cases, however, such a re-structuring may be considered undesirable from the service recipient's perspective, since it will impose obligations on the service recipient (now an "employer") to deduct and make remittances in respect of source withholdings such as tax, workers' compensation, Canada Pension Plan contributions, and Employment Insurance contributions, and lead to other employment and labour law concerns such as hours of work limitations, overtime pay requirements, severance upon termination of employment without cause and other requirements imposed by applicable employment standards legislation. As well, an employment relationship may lead to further expenses in respect of employee benefits. Due to the relative expense of such additional benefits and responsibilities, it may well be the case that the salary which can be paid to the individual directly is lower than the service fee previously payable to the corporation.

Another possibility would be for the corporation carrying on the PSB to pay out all of its income in the form of salary to the incorporated employee. The effect should be that the corporation's income is reduced to nil (i.e., no corporate tax would be paid) and the individual pays tax on essentially the same basis as if the income had been earned directly. From a tax perspective, this removes any benefit or detriment from incorporating and, from a commercial perspective, may be preferable, at least in the short-term, since contractual arrangements with third-parties would not need to be amended.

Other more complicated options may also be considered depending on the specific circumstances. Clearly, no one solution will work in all situations. What is important is that, if a corporation carries on a personal services business, the impact of the tax rate increase should be evaluated in determining how to structure the corporation's affairs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.