- within Family and Matrimonial topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Canada

- with readers working within the Banking & Credit, Insurance and Healthcare industries

OVERVIEW

On May 2, 2013, the Honourable Charles Sousa, Ontario's Minister of Finance, introduced the province's 2013 budget. Unlike last year's budget that was focused on deficit elimination and reducing overall program spending by $17.7 billion over three years, the 2013 budget is designed to advance various new program and policy initiatives central to both new liberal Premier Kathleen Wynne and New Democratic Party ("NDP"). Within the minority government context in Ontario, it is essential that the governing liberal party find support from one of the two opposition parties to avoid a non-confidence motion that could bring down the government and force an election. Toward that end, the liberals have been working closely with the province's NDP to ensure the budget satisfies that party's policy and program objectives. The official opposition, the Progressive Conservative Party, have indicated that they will not support the government's budget.

The provincial deficit for 2013-2014 is estimated to be is $11.7 billion, a difference of more than $1 billion from the projection in last year's Budget.

This bulletin provides a summary of key features of the Ontario 2012 budget of interest to BLG's clients.

HEALTH CARE REFORM:

- Increase investment in home and community care by an additional one per cent annually over the four per cent increase announced in the 2012 Budget. This would result in a total increase of more than $700 million by 2015-16 above 2012-13 investments, including $260 million in 2013-14.

- Focus new investments on providing care in the community to increase options available to seniors.

- Invest to reduce home care wait times for nursing services and improve personal support services for clients with complex care needs, with a target of providing service within five days following a Community Care Access Centre ("CCAC") assessment.

- Invest in community Health Links that will promote collaboration in patient care, where different providers caring for the same person will have one unified plan of care for that person. Investing $20 million annually to help small and rural hospitals improve patient care and transform their organizations.

- Launching Ontario's Action Plan for Seniors to provide better access to health care, quality resources, and improved safety and security for Ontario's seniors.

- Moving forward with the Comprehensive Mental Health and Addictions Strategy, focused to date on children and youth, with funding growing to $93 million per year by 2013-14.

- Continuing to support mental health and addiction services across the province, including early intervention, community-based counselling, employment training, supportive housing, residential treatment, and prevention of and treatment for substance abuse and problem gambling.

- Working with First Nation communities to increase access to care and community supports for those addicted to prescription narcotics. The government is investing in five new Community Wellness Development Teams with mental health and addictions expertise, blending traditional and cultural practices, and supporting the use of telemedicine to help patients in remote communities.

ELECTRICITY SECTOR:

The government indicated that it will continue to make investments in smart-grid technology and energy conservation, and will see the creation of new-economy jobs through the deployment of leading energy-efficiency technologies in the province. In addition, as these new investments in renewable generation unfold, the government will consult with affected communities to inform the process and ensure projects are successfully integrated in these areas.

PUBLIC INFRASTRUCTURE:

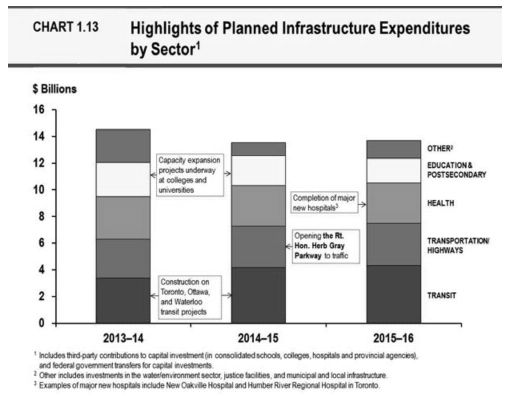

The government plans to invest more than $35 billion over the next three years, including almost $13.5 billion in 2013-14. Infrastructure investments would remain focused areas such as transportation, health care and education, consistent with the government's long-term infrastructure plan, Building Together.

REDUCTION IN AUTO INSURANCE RATES:

To achieve the premium reduction, the government will introduce legislative amendments that would, if passed:

- Legislate a premium reduction of 15 per cent on average within a period of time to be prescribed by regulation

- Require insurers to offer lower premiums for consumers with safe driving records

- Give the Financial Services Commission of Ontario (FSCO) the authority to license and oversee business practices of health clinics and practitioners who invoice auto insurers

- Provide the Superintendent of Financial Services with the authority to require insurers to file for rates

- Make the Superintendent's Guidelines binding - incorporated by reference in the Statutory Accident Benefits Schedule

- Expand and modernize the Superintendent's investigation and enforcement authority, particularly in the area of fraud prevention

- Consolidate statutory automobile insurance reviews.

To increase accountability and transparency, a new independent annual report by outside experts will look at the impact of reforms introduced to date on both costs and premiums. The report will review industry costs and changes to premiums, and recommend further actions that may be required to meet the government's reduction targets.

FISCAL SITUATION AND ECONOMIC OUTLOOK:

The deficit for 2012-13 is now estimated to be $9.8 billion - a $5 billion difference compared with the 2012 Budget forecast. The deficit projection for 2013-14 is $11.7 billion, a difference of more than $1 billion from the projection in last year's Budget. Beyond 2013-14, the government is on track to meet the steadily declining deficit targets outlined in the 2012 Budget and to return to balanced budgets beginning in 2017-18.

Private-sector economists are forecasting continued growth for the Ontario economy in 2013 and the following three years. On average, private-sector forecasters are projecting growth of 1.6 per cent in 2013, 2.4 per cent in 2014, and 2.5 per cent in both 2015 and 2016.

Job creation is expected to strengthen over the medium term, with employment increasing by 1.2 per cent in 2013, 1.4 per cent in 2014, and 1.5 per cent in both 2015 and 2016. By 2016, Ontario will have created nearly 400,000 net new jobs compared to 2012. The gains in employment will allow the unemployment rate to decline steadily from 7.7 per cent in 2013 to 6.6 per cent by 2016.

NEXT STEPS:

The budget will be debated for several days in the Ontario Legislature and them a budget motion will be voted on towards the end of May. If that motion fails to secure a majority of votes from all three parties, then the minority liberal government will lose the confidence of the Legislature and an election will be triggered.

About BLGThe content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.