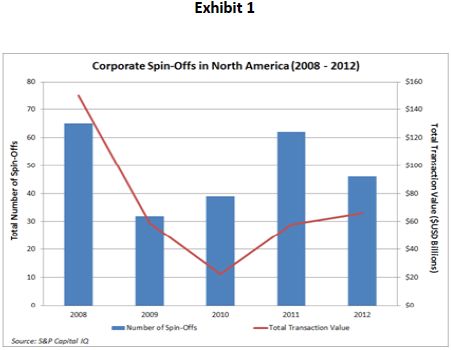

Corporate spin-offs (or “carve-outs”) have regained popularity in recent years (see Exhibit 1) as many corporations look to divest of a subsidiary or business division that is viewed as being “off-strategy” in an effort to increase shareholder value. Spin-offs also provide the parent company with the financing needed to strengthen its balance sheet or to invest in other segments of its operations. In some cases, such as high-growth and turnaround situations, the spin-off is considered necessary because the parent corporation does not have sufficient capital to fund the operations of the business segment in question.

Whatever the reason for the spin-off, financial executives should consider the different types of buyers that might be interested in acquiring the business division as well as deal structuring opportunities and challenges in completing the transaction.

Who’s Buying?

The most obvious buyers for a corporate spin-off are strategic acquirers, preferably those who are willing to pay a premium for the synergies that can be realized by combining the division with their existing operations. The ideal buyer is a “platform buyer”, who views the acquisition as an opportunity to increase revenues by leveraging the division’s proprietary product and service offerings, customer base, or employee capabilities. Platform buyers tend to be more willing to pay for the synergies and strategic advantages associated with revenue growth, as contrasted with buyers that aim to achieve synergies through headcount reductions and other cost-cutting measures. In addition, a platform buyer is more likely to retain the division’s employees to support the expected revenue growth. This helps to facilitate the transition and reduce or avoid negotiations regarding the assumption of severance costs.

But dealing with strategic buyers, even platform buyers, has its challenges. This is particularly the case where the strategic buyer has operations that are competitive to those of other facets of the parent company, which are not being spun-off. In addition, many strategic buyers move slowly. Prolonging the divestiture process can result in additional risks and complications, particularly where key employees and major customers of the division being spun-off become concerned about the ultimate outcome.

As an alternative, many private equity firms are aggressively pursuing corporate spin-off opportunities. Most private equity firms prefer dealing with corporate boards in a spin-off transaction as opposed to individual business owners selling their entire company because corporate boards are less emotional about the sale decision.

Private equity firms tend to move more quickly than strategic buyers, and the parent company can often maintain a higher degree of confidentiality. Unlike many strategic buyers, private equity firms normally want to engage the existing management team of the division, which helps to facilitate the transition.

While private equity firms no longer utilize high amounts of financial leverage that was the hallmark of the industry in the 2005-2007 era, they often are aggressive bidders. According to the Q4 2012 Private Equity Breakdown Report published by Pitchbook, private equity firms have an estimated $430 billion of capital available for investment. Much of this capital is geared toward “mid-market” types of opportunities, which are loosely defined as transactions ranging from $10 million to $250 million in size. For private equity firms that seek larger size investments, corporate spin-offs can provide attractive “bolt-on” opportunities. Bolt-on type transactions can be attractive to the seller, since the private equity firm offers the combination of available capital as well as prospective synergies.

The key point to remember when selling to a private equity firm is that their focus is on the exit strategy. Therefore, the private equity firm’s interest will be geared toward how and when they can re-sell the acquired entity and the likelihood that they will generate a satisfactory return on equity (generally 25% or more on a compounded basis).

Another alternative that is often overlooked in spin-off transactions is a management buyout (“MBO”). The advantages of an MBO are that it is quicker and more confidential than a sale to a strategic buyer, since the management team is already familiar with the operations. In addition, an MBO may help the parent company to avoid severance costs. While the management team usually has limited financial resources, in many cases it’s possible to find a private equity sponsor to support management in their bid.

When selling to management, it may be prudent (and in some cases even required) for the board of the parent company to commission an independent fairness opinion to ensure that the transaction is fair from a financial point of view. The fairness opinion should be provided by an investment bank or qualified valuation firm that was not otherwise engaged in the transaction to ensure that independence is maintained.

Structuring the Transaction

The terms of a transaction are just as important as the stated purchase price. One of the opportunities in a corporate spin-off is the flexibility that often can be afforded in deal structuring. Where the parent company is in need of cash from the spin-off to finance other parts of its operations, deal structuring opportunities may be limited. However, where the parent company is divesting of a division for strategic alignment or other reasons, then creative deal structuring may be a more viable option.

Where the parent company can accept deferred payment terms (e.g. through a promissory note), it can often result in greater buyer interest and/or a higher purchase price. Deferred payment terms can also facilitate a management buyout. Where the division being divested is in a turnaround situation or has high growth potential, an earnout component may also be a viable option. However, it’s important to recognize that any dollar not received at the closing of a transaction represents a dollar at risk. The seller (parent company) has to be satisfied that the prospective reward is worth the risk.

Another deal structuring opportunity that pertains to corporate spin-off transactions is customizing the assets and liabilities of the division to be sold. The division might have under-utilized assets that could be transferred to the parent company rather than sold at a discount. It may also be possible for the parent company to retain certain liabilities that would otherwise have prepayment penalties.

The parent company should not overlook the possible hidden value of real estate. If the division owns real estate that does not need to be sold, then it may be better for the parent company to retain the real estate assets and lease them to the buyer of the division or sell them separately. In many cases, quality real estate assets fetch a higher valuation multiple than operating businesses. For example, assume that a division generates EBITDA (earnings before interest, taxes, depreciation and amortization) of $25 million and that a valuation multiple of 6x EBITDA is applicable, for a total value of $150 million. Let’s say that the division owns quality real estate that can be leased for $5 million per year, and that the applicable real estate multiple is 10x EBITDA. By segregating the components, the total value increases to $170 million, as illustrated in Exhibit 2.

Finally, it’s important to remember that there are three parties to every transaction: the buyer, the seller and the government. Corporate spin-offs need to be carefully structured for an income tax perspective to ensure that the transaction is conducted in a tax-efficient manner. In some cases, a corporate spin-off may allow the parent company to accelerate the use of tax losses.

Common Challenges

While a corporate spin-off to a strategic buyer, private equity fund or management can help the parent company to achieve its objectives, such transactions are not without their challenges. This is particularly the case where the operations of the division to be divested are intertwined with those of the parent company, such as accounting and information systems, management oversight, logistics and other functions. In many cases, the separation of these common functions leaves the parent company with underutilized resources or incremental restructuring costs following the transaction.

Another challenge with any divestiture is managing “transition risk”, which is the risk of losing key employees and major customers that are concerned with the potential outcome of the process. Customer and employee erosion during the sale process can quickly reduce the value of the division being spun off. The situation is further complicated where a major customer acquires products or services from both the divested operations as well as the remaining operations. This could limit the number and type of prospective buyers to those that are not competitive to the parent company’s remaining operations.

A key element in a corporate spin-off (as well as any major transaction) is to have a well-conceived and properly executed communication strategy. It’s generally best to make key employees aware of the pending divestiture before the process gets underway. The parent company may need to offer pay-to-stay bonuses or other incentives to secure the commitment of key individuals. While such costs will reduce the net proceeds to the parent company, the consequences of losing key people can be devastating.

Where a management buyout is pursued, it can create an inherent conflict of interest. This is because the management team will want to acquire the division for the lowest price, whereas the parent company will want to receive the highest price. The matter becomes even more complicated where offers from strategic bidders are thwarted due to management’s uncooperative nature to third parties, in favour of their own self-interest.

A possible resolution to this conflict is to have management (and their private equity sponsor) put forth their best offer. If another buyer offers a higher price, then the management team is entitled to receive a portion of the premium. This means that the parent company is giving up some of the upside potential. However, that’s better than not having any viable alternatives.

Where the parent company is publicly held, and the pursuit of a corporate spin-off is publicly announced, it can create significant issues with employees, customers, suppliers, investors, analysts and other groups. Again, the communication strategy must be carefully crafted and effectively delivered to avoid the erosion of shareholder value. However, if done effectively, the parent company’s announcement could raise investor interest in the remaining business. Furthermore, a well-executed announcement could attract prospective buyers that might otherwise have been overlooked, and create the foundation for a more vibrant auction, thereby increasing the selling price of the division.

Finally, the parent company (particularly public companies) should be cognizant of the financial accounting consequences of the spin-off transaction. The divestiture of an operating division could result in write-downs of goodwill and other intangible assets where the value of these things is below their book value.

A best practice is for the Board of Directors to strike an independent committee to oversee the spin-off. The independent committee is responsible for engaging the investment bank and working with them to ensure that the divestiture process runs smoothly and to establish any necessary parameters, such as acceptable buyers, deal terms and minimum price range. The independent committee is also charged with ensuring that any concerns or challenges relating to the corporate spin-off are promptly addressed.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.