Measures pertaining to Individuals

Restructuring of the health Contribution

Varying the health contribution on the basis of income

The health contribution will vary, as of 2013, on the basis of an individual's income, instead of on the basis of the family income.

Furthermore, an adult who belongs to one of the categories of taxpayers currently exempt from payment of the health contribution will continue to be exempt from payment of the new contribution.

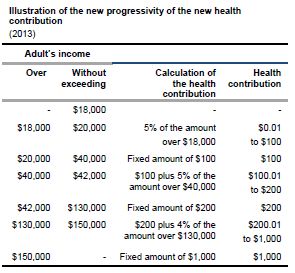

The following table shows the progressivity of the new health contribution.

As of 2013, the health contribution will be subject to a source deduction.

The amount of the instalment payments determined by Revenue Québec will take into account the new health contribution as of 2013.

Additional income tax for high income Individuals

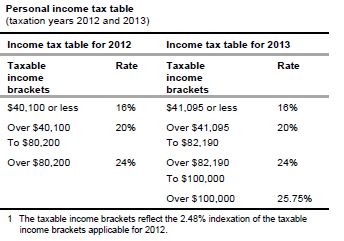

As of the 2013 taxation year, a fourth level will be added to the personal income tax table. A rate of 25.75% will apply to the level, which will be comprised of the taxable income bracket over $100,000.

Increase in the rate applicable to the calculation of the income tax payable by an inter vivos trust

The rate for determining the income tax payable by an inter vivos trust (including a mutual fund trust and a specified investment flow-through trust) will be raised from 24% to 25.75% as of the 2013 taxation year.

To reflect the fact that the applicable tax rate for inter vivos trusts will be increased by 1.75 percentage points as of the 2013 taxation year, the tax rate to which inter vivos trusts not resident in Canada will be subject on their property income derived from the rental of an immovable property located in Québec used primarily for the purposes of earning or producing gross revenue that constitutes rent will be raised from 5.3% to 7.05% as of the 2013 taxation year.

Consequential amendments

Tax rate respecting split income of children The rate for calculating income tax on children's split income will be raised from 24% to 25.75% as of the 2013 taxation year.

Rate of the special tax relative to an incomeaveraging annuity payment respecting artistic activities.

The special tax rate relative to an income-averaging annuity payment respecting artistic activities will be raised from 24% to 25.75% as of the 2013 taxation year.

Tax rate on excess profit sharing plan amounts Tax on excess profit sharing plan amounts must be calculated, with respect to its application to a taxation year after 2012, at the rate of 25.75%.

Capital gains inclusion rate for the purposes of calculating the alternative minimum ta

The proportion of capital gains realized that must be taken into account in the calculation of adjusted taxable income will be raised from 75% to 80% as of the 2013 taxation year.

Mechanisms applicable to the disposition of taxable Québec property by non-residents

The 12% tax rate will be raised to 12.875% for all dispositions planned or carried out after December 31, 2012.

Introduction of a refundable tax credit for youth activities

Determination of the tax credit

An individual, other than an excluded individual, who is resident in Québec as of December 31 of a particular taxation year may claim for that year a refundable tax credit equal to 20% of the aggregate of all amounts each of which is, with respect to an eligible child of the individual for the year, the lower of the applicable limit for the year and the total of the eligible expenses paid in the year by the individual or the individual's eligible spouse for the year.

Eligible spouse

The eligible spouse of an individual for a particular taxation year is the person who is the individual's eligible spouse for the year for the purposes of the transfer to the spouse of the unused portion of nonrefundable tax credits.

Eligible child

An eligible child of an individual for a particular taxation year is any child of the individual who, at the beginning of that year, is at least 5 but not yet 16 years of age, or not yet 18 years of age if the child has a severe and prolonged impairment in mental or physical functions.

Excluded individual

An excluded individual for a particular taxation year is an individual whose family income for the year exceeds $130,000.

Applicable limit for the purposes of calculating the tax credit

Eligible expenses

An eligible expense of an individual will be any amount paid by the individual in the year to a person - other than a person who, at the time of the payment, is the individual's spouse or under 18 years of age - to the extent that the amount is attributable to the cost of registration or membership of the child in a recognized program of activities offered by the person.

The cost of registration or membership will include the cost to the person or partnership with respect to the program's administration, instruction, rental of required facilities, and uniforms and equipment that are not available to be acquired by a participant in the program for an amount less than their fair market value at the time, if any, they are so acquired.

However, the cost must not include the cost of accommodation, travel, food or beverages.

The amounts paid for the registration or membership of a child that are deducted in the calculation of a person's income or taxable income or taken into account in the calculation of eligible costs or expenses for the purposes of another refundable or non-refundable tax credit claimed by a person will not give entitlement to the refundable tax credit for youth activities.

However, government assistance that consists of tax relief granted under the federal tax system need not be applied against an individual's eligible expenses.

Recognized programs of activities

The recognized programs of activities are similar to those applicable for the federal children's fitness and arts tax credits.

Application date

The refundable tax credit for youth activities will apply to amounts paid after December 31, 2012 for the registration or membership of an eligible child in a recognized program of activities, provided the amounts are attributable to activities that take place after that date.

Deferral of measures applicable in 2013 regarding experienced workers

The tax system allows workers age 65 or older to claim a tax credit that eliminates the tax payable on a portion of earned income in excess of $5,000. The excess earned income cap will remain at the level applicable for taxation year 2012, i.e. $3,000, for an indefinite period.

Changes relating to the obligation on certain trusts to file a return

Addition of situations where a trust is required to file a tax return

The tax legislation will be amended so that a trust, other than an excluded trust, liable for Québec tax, for a taxation year, is required to file a tax return for such taxation year if it satisfies one of the following conditions:

- it deducts in calculating its income for the taxation year an amount allocated to a beneficiary regardless of the place of residence of the beneficiary;

- in the case of a trust that is resident in Québec on the last day of the taxation year, it owns, at any time in such taxation year, property the total of whose cost amounts exceeds $250,000;

- in the case of a trust that is not resident in Québec on the last day of the taxation year, it owns, at any time in such taxation year, property that it uses in carrying on a business in Québec the total of whose cost amounts exceeds $250,000.

Excluded trust

The expression "excluded trust" means, for a taxation year, a trust that, throughout the year, is one of the following trusts:

- a succession;

- a testamentary trust that is resident in Québec the last day of its taxation year and for which the total of the cost amounts of its property is, throughout its taxation year, less than one million dollars;

- a testamentary trust that is not resident in Québec the last day of its taxation year and for which the total of the cost amounts of its property located in Québec is, throughout its taxation year, less than one million dollars;

- a unit trust;

- a segregated fund trust of an insurer;

- a mutual fund trust;

- a specified investment flow-through trust;

- a tax-exempt trust.

Measures pertaining to Businesses

Introduction of a new tax holiday for large investment projects - the THI

The government has decided to eliminate tax holiday for a major investment project and replace it with a new tax holiday for large investment projects - the THI.

Implementation of a tax holiday for large investment projects - the THI

A corporation that, after November 20, 2012, carries out a large investment project in Québec may, under certain conditions, benefit from a tax holiday regarding tax on the income from its eligible activities relating to such project and from a holiday from employer contributions to the Health Services Fund (HSF) regarding the portion of wages paid to its employees that is attributable to the time they spend on such activities.

This tax holiday will last for ten years and may not exceed 15% of the total eligible investment expenditures relating to such project.

Terms and conditions for obtaining the tax holiday To receive the THI, a corporation will have to obtain an initial certificate as well as annual certificates issued by the Minister of Finance and the Economy who will administer the sectoral parameters of this measure. The initial certificate application must be submitted to the Minister of Finance and the Economy before November 21, 2015. This initial certificate must be applied for before the large investment project begins to be carried out.

Large investment project

Activity sectors

The project must concern activities described in one or more activity sectors grouped under the following codes of the North American Industry Classification System (NAICS), namely:

- 31-33 Manufacturing;

- 41 Wholesale trade;

- 4931 Warehousing and Storage;

- 518 Data Processing, Hosting and Related Services.

Investment threshold

The total investment expenditures attributable to the carrying out of the large investment project in Québec must reach $300 million no later than the end of the 48-month period starting on the date the initial certificate relating to such project is issued.

Other application details

To benefit from the portion of the THI that applies to income tax, for a taxation year, a corporation must enclose with its tax return, for the year, a copy of the annual certificate issued to it, for its taxation year, for the large investment project it is carrying out, or of the annual certificate issued to the partnership of which it is a member, for its fiscal year ending in the taxation year, for the large investment project the latter is carrying out.

To benefit, for a calendar year, from the holiday from employer contributions to the HSF, a corporation or partnership that carries out a large investment project must enclose with the Summary of Source Deductions and Employer Contributions, for the year, a copy of the annual certificates issued to it for the calendar year in question.

In addition, the corporation and the partnership will have to file separate financial statements with Revenu Québec relating to the separate business relating to the large investment project for which the tax holiday is claimed.

Lastly, an investment expenditure attributable to the carrying out of a large investment project may not give rise to the tax credit for investments.

Improvement to the tax credit for investments relating to manufacturing and processing equipment

Extension until 2017 of the tax credit for investments relating to manufacturing and processing equipment

The tax legislation will be amended to allow an additional period of two years for the acquisition of property qualifying for the tax credit for investments, other than property used mainly in the course of ore smelting, refining or hydrometallurgy activities, other than ore from a gold or silver mine, extracted from a mineral resource.

Accordingly, property may qualify as qualified property, for the purposes of the tax credit for investments, if it is acquired before January 1, 2018 and satisfies the other conditions stipulated in the tax legislation.

Further increase in the rate of the tax credit for investments for certain administrative regions and regional county municipalities (RCM)

The tax legislation will be amended so that the higher rate of the tax credit for investments, that may be claimed by a qualified corporation that acquires qualified property for use mainly in the eastern part of the Bas-Saint-Laurent administrative region1, which currently can reach 30%, may henceforth reach 35%.

Similarly, the tax legislation will be amended so that the higher rate of the tax credit for investments, that may be claimed by a qualified corporation that acquires qualified property for use mainly in an intermediate zone2, which currently can reach 20%, may henceforth reach 25%.

However, a corporation that receives the tax credit for job creation in the resource regions, in the Aluminium Valley or in the Gaspésie and certain maritime regions of Québec (hereunder: "tax credit for job creation"), for a calendar year ending in a taxation year, may not receive, for such taxation year, the further increase in the tax credit for investments.

Application date

The further increase in the rate of the tax credit for investments will apply for eligible expenses incurred regarding qualified property acquired after November 20, 2012.

Temporary increase from 17.5% to 27.5% in the rate of the refundable tax credit for R&D salary in relation to biopharmaceutical activities

Increase in the rate of the refundable tax credit for R&D salary

The tax legislation will be amended so that an eligible biopharmaceutical corporation may receive, for a taxation year, a refundable tax credit for R&D salary equal to 27.5% of its eligible R&D expenditures for such year.

To benefit from the higher rate of this tax credit, a corporation will have to enclose with its tax return, for a taxation year, the eligibility certificate that Investissement Québec will issue to it certifying that it qualifies, for such year, as an eligible biopharmaceutical corporation.

In addition, to give full effect to this increase in the rate of this tax credit, an eligible biopharmaceutical corporation that qualifies as an SME and that benefits from an increase in the rate of this tax credit of up to 37.5%, will continue to benefit from the increase in the rate, which will be reduced linearly from 37.5% to 27.5%, where its assets calculated according to the rules applicable to such increase range from $50 to $75 million.

Application date

For R&D spending incurred after November 20, 2012 and before January 1, 2018.

Standardization of taxation of refundable tax credits

The following refundable tax credits will henceforth have to be included in calculating the income of a taxpayer who receives them:

- the refundable tax credit for scientific research and experimental development;

- the refundable tax credit for credit for university research and for research carried on by a public research centre or a research consortium;

- the refundable tax credit for fees and dues paid to a research consortium;

- he refundable tax credit for private partnership pre-competitive research;

- the refundable tax credit for on-the-job training periods;

- the refundable tax credit for design;

- the refundable tax credit for the construction or conversion of vessels.

Application date

This amendment will apply to a refundable tax credit that a taxpayer receives after November 20, 2012 and that relates to an expenditure the taxpayer incurs for a taxation year starting after November 20, 2012.

Contribution to the Health Services Fund (HSF) - Experienced workers

Moreover, it was announced, as part of the 2012- 2013 budget speech, that private sector employers that employ workers age 65 or older could claim, as of 2013, a reduction in their Health Services Fund contributions. The implementation of this measure will be deferred to a later date to be set by the government.

Measures pertaining to commodity taxes

Increase in the specific tax on tobacco products

The rates of this tax will be changed as follows as of November 21, 2012:

- the rate of the specific tax of 10.9 cents per cigarette will be raised to 12.9 cents per cigarette;

- the rate of the specific tax of 10.9 cents per gram of loose tobacco or leaf tobacco will be raised to 12.9 cents per gram;

- the rate of the specific tax of 16.77 cents per gram of any tobacco other than cigarettes, loose tobacco, leaf tobacco and cigars will be raised to 19.85 cents per gram; the minimum rate applicable to a tobacco stick will be raised from 10.9 to 12.9 cents per stick.

Taking of inventory

Persons not under an agreement with Revenue Québec who sell tobacco products in respect of which the specific tax has been collected in advance or should have been will have to take an inventory of all these products they have in stock at midnight November 20, 2012 and remit, before December 22, 2012, an amount equal to the difference between the tax applicable at the new rates and the tax applicable at the rates in effect prior to midnight, November 20, 2012.

Increase in the specific tax on alcoholic beverages

The rates of the specific tax on alcoholic beverages will be raised as of 3 a.m. November 21, 2012.

Generally speaking, following this increase, the new rates of the specific tax applicable to alcoholic beverages sold for consumption in an establishment will be $0.82 per litre for beer and $2.47 per litre for all other beverages, while those applicable to alcoholic beverages sold for consumption other than in an establishment will be $0.50 per litre for beer and $1.12 per litre for other beverages. An inventory count will have to be undertaken.

Other measures

Voluntary retirement savings Plans

The government will table, by the spring of 2013, a bill to implement the new voluntary retirement savings plans (VRSP). The bill will in particular reflect the committee's recommendations.

Creation of the Banque de développement économique du du Québec

The Banque de développement économique du Québec (BDEQ) will consolidate the activities of Investissement Québec and the front-line activities of the Ministère des Finances et de l'Économie du Québec.

The chief mission of the BDEQ will be to support the creation and growth of businesses in Québec by offering a complete range of financial and support services, from obtaining equity capital to support for promoters.

Footnotes

1. The eastern portion of the Bas-Saint-Laurent administrative region consists of the following RCMs: La Matapédia, Matane and La Mitis.

2. Intermediate zones consist of the following administrative regions and RCMs: the Saguenay–Lac-Saint-Jean and the Mauricie administrative regions, and the Antoine-Labelle, Kamouraska, La Vallée-de-la-Gatineau, Les Basques, Pontiac, Rimouski-Neigette, Rivière-du-Loup and Témiscouata RCMs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.