PwC predicts that infrastructure speed will be the fastest improving component of the seven enabling technologies in the PwC Mobile Technology Index through 2015.

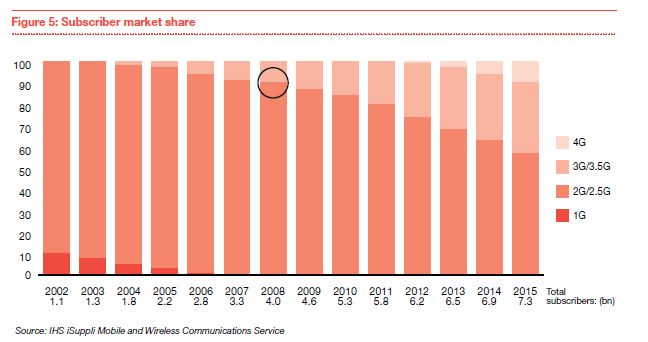

By 2015, we also expect three factors associated with the transition to 4G technology share of infrastructure investment, share of devices and share of subscribers to reach levels that could trigger a robust period of 4G innovation. We base this expectation on the pattern we saw in the same three factors in the 2G-to-3G transition. As this pattern repeats with 4G it creates the potential for a surge of 4G innovation starting no later than 2015 [see Figure 1]. We expect this 4G innovation to include new business models based on capacity improvements, and new use cases based on better video streaming and other technologies. We explore all this later in the article.

First, our forecast, and how we derived it.

The technology innovations that establish the speed at which data can travel to and from a mobile device happen in two places: the infrastructure speed capability outside the device, and the connectivity speed from the modem capability inside the device. [See Device connectivity article at www.pwc.com/ca/mobileinnovations.] The Index includes both factors as separate, equally weighted components.

For myriad reasons, the actual speed for the user cannot be precisely predicted. At any point in time, the wireless infrastructure is a mix of technology generations. Carriers, for good business reasons, don't normally make available to end users the maximum speed the underlying technology is capable of supporting. For the user, the mobile experience is only as fast as the slowest point on the network at that moment.

But it is not the purpose of the PwC Mobile Innovations Forecast, of which the Index is just one part, to predict with precision the real speed, or even the average, that a user might experience in the future. The purpose is to understand and forecast mobile innovation. That is, to use infrastructure speed as we calculate it and all the other metrics in the Index to suggest direction and magnitude, both individually and collectively, and, in turn, to use these as vectors to help us identify patterns that suggest new inflection points for mobile innovation.

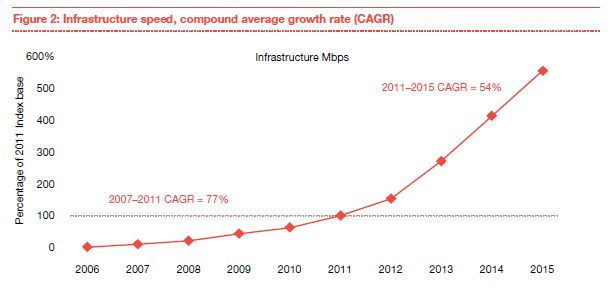

For infrastructure speed, PwC forecasts a global CAGR through 2015 of 54 per cent [see Figure 2], as measured in average Megabits per second (Mbps). This makes it the fastest improving component, just ahead of processor speed 53 per cent CAGR in GigaHertz per dollar.

The forecast CAGR for infrastructure speed is less than the rate of improvement from 2007 to 2011 when it was a staggering 77 per cent. The CAGR is slowing down mainly because 2007 era speeds started off so slow; speeds in 2011 and beyond are in a different part of the S curve.

Estimating improvements in average infrastructure speed over time is a complex formulation, involving several judgment calls. First, it is important to recognize that the metric we use is really a measure of infrastructure speed capability, meaning the maximum speed at which a single device could communicate with the wireless infrastructure under optimal conditions a bit like automotive fuel efficiency ratings.

In practice, the speed at which bits are streamed to individual devices by wireless infrastructure is determined by several variables. Among these are the limits placed on the network by the operators themselves for technical, service quality or business reasons. Other variables include geography, the generation of technology used by the cell tower, the number of other devices sharing the total capacity of the tower, the type of data the devices are accessing (text or video, for example) and the signal's generation, strength and exposure to interference.

The goal of tracking the relative changes in speed from one year to the next makes this task a bit easier, with the caveat that average infrastructure speed refers to speed where wireless services are offered to begin with.

With all of these factors in mind, we sought to create logic that resulted in an average network infrastructure speed capability across generations of technology and over time. Here is how we calculated the metric:

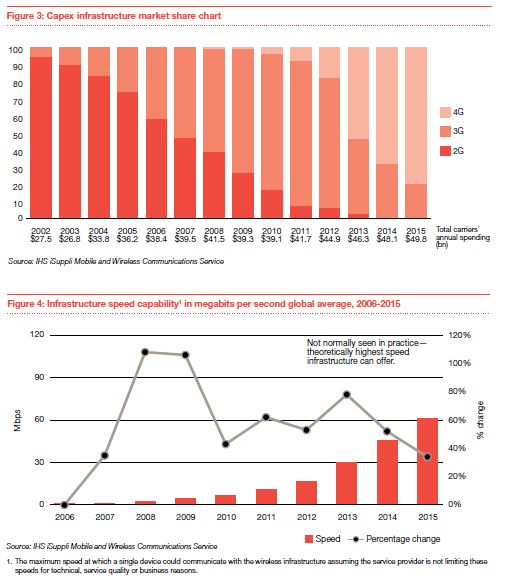

a) we sum the cumulative capital spend in any given year on each generation of wireless infrastructure [see Figure 3]

b) factor in "end of life" for infrastructure by discounting past investment by subtracting past years' investments in 33 per cent increments beginning three years after their deployment

c) then create the weighted average network speed where the weights are the percentage of discounted, cumulative spend and the speeds are global industry values for specified generations (3G, 4G, etc.) [see Figure 4]

To reiterate the earlier caveat, the speed data in Figure 4 are the anticipated optimal capabilities, not the actual speeds any user would experience.

We now turn to a pattern that suggests the timing of a new market opportunity for mobile innovation. We considered both the infrastructure and the device. Understanding how these impacted 3G helped us to pinpoint a comparable 4G innovation opportunity.

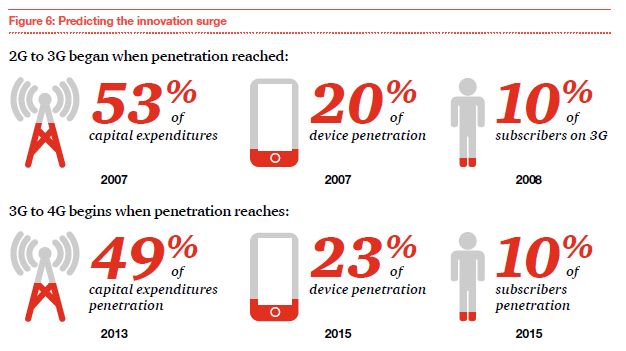

In the device connectivity speed article we offered this rule of thumb for mobile innovation: when new capabilities reach a device penetration level of 20 per cent, game-changing services can be launched and market disruption can ensue. The 3G modem technology reached device penetration of 20 per cent in 2007 [see Figure 6].

For 3G, capex spending hit 50 per cent and device penetration hit 20 per cent in the same year 2007. Our forecast predicts 4G capex spending reaches close to 50 per cent in 2013 (49 per cent to be exact), but 4G device penetration lags, not reaching 23 per cent until 2015. The 4G subscription rate reaches 10 per cent in 2015, comparable to 3G in 2008.

Based on the 3G pattern, we expect a surge of 4G-based innovation that would start no later than 2015. If infrastructure capex or device penetration were to accelerate faster than forecast, the 4G-based innovation surge could start as early as 2014.

Whether it starts in 2015 or 2014, this surge of 4G-based innovation could trigger another shift in the wireless value chain's major players, although such a shift would depend on some vendors recognizing the same potential tipping point that we see, and seizing the opportunity ahead of others by creating innovations that 4G networks bring to life.

What kind of innovation can we expect?

We anticipate that 4G innovation could spawn new use cases, involving more and better streaming video, including more satisfactory viewing of commercial film and TV content from the cloud and multiplayer mobile gaming with minimal latency. Other use cases are likely to come in mobile video conferencing and voice-over-Internet services that rival or exceed the quality of traditional wire-line offerings; new device form factors better attuned to augmented reality; and other applications involving the movement of large amounts of information.

We also expect new vertical industry use cases. For example, when paired with improved image sensing, innovative new sensors and artificial intelligence, 4G could support new use cases such as remote medical diagnosis and repair efforts by field service representatives and bring back house calls by the family physician in virtual form.

Some of these applications and use cases are possible even with 3G technology, but 4G will certainly accelerate their adoption by making them more widely available and by improving the user experience through somewhat faster downloads and lower latency. But whatever the new use cases are, we also expect the period of 4G innovation beginning in 2015 to differ somewhat from the 3G transition.

There is some speculation that 4G may not impact mobile innovation the way 3G did. Unlike 3G where we saw use case and application innovation, with 4G we will see more second order effects. It not only offers an advantage in capacity and speed, but operators will be able to deliver a more consistent experience at a lower cost, which enables them to make money and turn a profit.

We expect operators to take advantage of 4G capacity and speed to achieve service level expectations but not necessarily go beyond them. The burst of 4G innovation will also offer operators the opportunity to reduce the costs of network operations through improvements in workforce productivity and other innovation.

It might be that the network operators and their business models could benefit most directly from the 4G inflection point we identify. And yet, there is also another way to think about the 4G transition, based on what happened with 3G.

The initial transition to 3G started several years before the highly disruptive introduction of devices such as the iPhone, Android phones and tablets that took advantage of the newer technology. There were early great expectations, of course new 3G-only carriers started in various places in the world with little initial business success because the user experience was not that different from 2G. This was before devices had the component power of a true mobile computer (the very components we track in the Index), and before the existence of application ecosystems that offered compelling new use cases.

Instead, the early 3G value proposition mostly appeared to be lower operating costs for carriers rather than disruptive new capabilities for users. The predictions today that 4G will once again reduce operating costs for carriers has good reasoning behind it, especially because the software in 4G infrastructure is automating more and more management functions.

But predicting that 4G will mainly reduce carrier operating costs would appear to deny the kind of impact from 4G that 3G eventually had in creating the setting for highly disruptive innovations. Our future research on 4G will explore this matter in greater detail.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.