The global economy has undergone significant changes over the last several years leading to an increasingly complex and rapidly shifting business climate. Investor confidence has been shaken, and the need for deeper insight on business trends and current and future business performance has increased. Chief financial officers (CFOs) are now required to respond in a more agile, accurate and insightful manner to these changing conditions by transforming their financial planning process.

Financial planning (i.e. longer term strategic planning, budgeting and forecasting) is a key component in managing and driving business performance, but is often mired with conservatism, which can reduce the value that it delivers for many organizations, especially in today's market conditions. In many organizations, planning processes are inefficient and do not deliver the full value possible. Lengthy financial planning and cycle times can delay decision making, and if financial drivers and metrics are not properly aligned with business strategies, the usefulness of financial outputs to monitor business performance will be reduced.

The changing mindset towards financial planning

The typical budgeting process is an annual exercise where each functional area develops detailed plans, financial estimates and targets to reflect the anticipated outcomes from planned activities over the course of the coming year. This process results in the establishment of performance targets, against which actual results are typically reviewed on a monthly basis. This analysis of actual results versus budget, including the explanation of variances to plan, is a key part of the performance management process. Generally, this variance analysis is compiled by finance, and distributed to middle and senior management part way through the following month.

This traditional process does not allow adequate time for the organization to address issues that emerged in the previous month and then plan and drive business decisions for future periods to address issues or take advantage of opportunities. The variance analysis performed at many organizations focuses on explaining why actual results differ from plan, but doesn't provide an understanding of the impact on results for the remainder of the year or identify remedial actions required to bring results back in line with plan.

In this 'budget mindset', the finance department is primarily asked to explain historical variances and performance providing only a rearward-looking view of a business. However, the enormity of the economic downturn has prompted the analyst community and other stakeholders to demand more insight and foresight than what traditional monthly budget reviews can offer. Traditional budget processes are now too slow for today's rapidly changing environment, and don't provide enough forward-looking guidance on future performance. Additionally, in many cases, the variance analysis provided is superficial, and fails to establish clear accountability and timelines to take actions or make decisions based on the variances.

To meet new expectations the role of finance needs to adapt, transitioning from being an aggregator and reporter of

variance results to an advisor and business partner, and helping their organizations plan for the future. CFOs need to reshape the financial planning process, making it more agile, responsive and forward looking. This requirement for foresight is applicable to not only publicly listed organizations, but also to privately held organizations, which have financial stakeholders such as banks, private lenders and private equity funds who, like shareholders and analysts, are increasing their demands for better information on future performance.

Robust forecasting

To address these challenges, CFOs and their organizations must move away from the annual budget planning approach and focus on building a continuous planning process that is forward looking and delivers predictive insight on business performance. The objective of this process is not to develop variance explanations, but to monitor the progress of the business towards its strategic objectives, identify the course corrections necessary to stay on track and to deliver on the plan for the coming year. Finance should not be focused on looking at holes in the forecast and comparing it to the budget but should proactively use it to mitigate risks or identify and capitalize on new opportunities.

By increasing forecasting frequency, such as continuous or rolling forecasting, businesses gain a better view into swiftly emerging trends by incorporating new data into their forecasts as it becomes available. This not only helps address issues on time, but also helps trend ahead. Continual planning also reduces the cycle time and effort required to develop annual budgets, and increases the agility and responsiveness of the organization.

Planning ahead with rolling forecasts

Many leading organizations have adopted an 18-month rolling forecast to help look beyond the boundaries of the current fiscal year. With rolling forecasts, teams such as operations, sales and marketing provide finance with the most current information they have for the coming quarter, and at a higher level for the remainder of the forecast period. This practice helps CFOs plan for the future and mitigate potential issues, making the process more timely and responsive to market conditions. In this way the forecast process can adjust the lens of senior executives, encouraging them to take a forward looking perspective on managing the business.

Maintaining agility and responsiveness

To maintain agility and increase responsiveness, the rolling forecast process should be kept simple, since complexity slows down cycle times. As a leading practice, the business should plan to spend a total of two to four business days (based on leading practice benchmark performance) on updating the forecast at the end of each month. Other factors that slow down cycle times are extensive data requirements, the number of performance drivers for predictive modelling and the number of people who are engaged in the forecasting process. A leading practice for the forecasting process is to use a small number of key performance drivers to evaluate alternatives or scenarios, to bring performance back in line with plan as actual events and conditions evolve.

A fine balance has to be sought in the level of detail in the budgeting and forecasting process. While details are often useful to manage accountability for cost performance and different organizations require different levels of it, gathering extensive information by budgeting in great detail often extends planning cycle times, which can then result in delayed analysis. The analysis of a larger number of accounts and detail does not necessarily correlate to the overall accuracy of forecasting and planning, and in fact can negate the goal of agility and responsiveness. The level of detail should be minimized adequately to enable CFOs to focus on the key business drivers. Detailed updates at the general ledger account level add little value to the forecast, and can usually be eliminated or automated in order to speed up routine processes. If time is used effectively, additional versions and forecasts can be run to understand earning impacts, which can propel the business forward. Accountability for performance can be managed at a higher level as part of the overall financial performance of the firm.

To minimize data requirements, rolling forecasts are normally designed with between five and ten key performance drivers, which reflect the information that the organization needs in order to understand its performance and plan its next steps. The responsibility for identifying these key drivers should not lie solely with the CFO; it requires a cross-functional team of employees with a deep understanding of the business to come to terms with what really drives their performance and validate these drivers. The drivers need to be linked to the business' goals and strategic objectives. There should also be seamless integration between the key drivers and others forms of performance management, such as management reporting and key performance indicators (KPIs) for teams.

Realizing the transformation: the three pillars of success

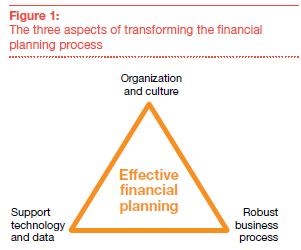

Transforming the financial planning process extends well beyond just making the process or function more robust. It also requires integrating the system change with simultaneous changes in management's approach to the planning process and organizational culture, without which the process changes will not have the intended impact. Technology is an essential enabler of any financial planning process and a sustained transformation in the process cannot occur without strong supporting technology. All three factors have to be considered when organizations look to improve their financial planning and forecasting processes (see figure 1). If all three aren't aligned, improvement in only one area often will not yield sustainable results.

People are at the heart of the change process

One of the biggest challenges in transforming the planning process is gaining buy-in and alignment across the organization. The planning process is a cross-functional exercise that engages a significant part of the organization, and as such, involves many stakeholders from different parts of the business. When businesses undertake initiatives to improve their planning processes or adopt a rolling forecast, there's a fundamental shift in attitude from being historical focused to future-facing. Organizations undergoing this change also need to recognize that this is as much a cultural transformation as a process or technology change.

The success of a new financial planning process is dependent on the tone-at-the-top. While part of the change is getting the process and technology components in place, executive management must also have ownership and buy into the process or it will not be sustainable. While finance typically administers the budgeting and forecasting process, planning is a strategic business process that must be owned jointly by the entire executive team.

Another critical component of transformation success is also dependent on the operations team, which gathers all data inputs and addresses the deviations on the ground for the forecasting process. Because the integrity of forecasting is reliant on the integrity of the information provided by operations, it is very important that they are also fully engaged in the transition.

The change shouldn't be viewed within the organization as another level of bureaucracy or a command from head office, since it's the people on the ground that have to take appropriate actions to provide continuous analysis. Engagement is a key factor in rolling out the change successfully, and it may fall upon the CFO to first develop a

robust plan, obtain management engagement and endorsement, and work with operations to embed the process.

Technology supports the process

While technology improvements are integral to financial planning transformations they should be pursued to support a change not used as a basis for change. Far too often, organizations rush towards implementing a new technology solution in the market thinking it will solve all their problems but the solution fails due to the lack of attention to process and organizational factors.

Organizations undergoing financial planning transformation need to understand that it is first and foremost a process and change management issue and not a technology improvement project. In the interim, it is sufficient for organizations to work with spreadsheets until the process and people factors have been worked out.

Organizations should first design the new process to address business requirements and issues, seek adoption and acceptance throughout the organization, and integrate processes within operations. Only then should technology be obtained as a tool to support the transformation. Selecting the right technology should be conducted through a robust evaluation process based on an assessment of requirements.

Transforming the organization through continuous planning

A financial planning system that helps focus a business on aligning its future performance to its strategic objectives will produce more accurate budgets and forecasts. By implementing 18-month rolling forecasts, the time and effort involved in the budgeting process will be significantly reduced or replaced, as the forecast will become the starting point for the budget, which can then be developed in greater detail or expanded to provide the necessary financial targets for the coming year. The rolling forecast process not only saves time and effort, but also creates a streamlined budgeting process that is easier to manage.

Rolling forecasts are not only used to improve performance measurement, but also provide finance with more timely and relevant metrics that are important for the business. In this way, rolling forecasts can pave the way for finance to take on a more strategic advisory role within the business, allowing them to be proactive in identifying and capturing improvements to shareholder value in addition to financial reporting.

If done well, the transformed financial planning process can also facilitate:

- Smoother and more efficient decision-making processes

- Improved ability to mitigate risks through more informed decision-making

- More coherent and effective ways of understanding the key drivers impacting business performance

- Understanding the business' future opportunities and threats, and supporting the evaluation of alternatives

The changed economic environment requires organizations to be more agile, and the time is right for them to transform their financial planning processes from the traditional annual budgeting approach to a more continuous planning cycle. The mandate for this cultural and process overhaul falls to CFOs, who must find the right balance between detail and agility to take their role to the next level.

Having more reliable and timely views of financial performance continues to be at the top of the agenda for many CFOs. Through collaboration, planning through key business drivers and reducing cycle times, businesses can truly benefit from an enhanced financial planning process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.