INTRODUCTION: TIME FOR SOME CREATIVE THINKING

When 2012 began, it appeared as though it would be another busy year for mining mergers and acquisitions (M&A), a continuation of the active deal making that took place during each of the two previous years.

Glencore International plc and Xstrata plc burst out of the gate in early February with their blockbuster $53.6 billion* transaction, marking the long-awaited return of the "mega" mining deal. There were also a handful of other $1 billion-plus deals announced in the first few weeks of the year, such as POSCO's purchase of Roy Hill Holdings Pty Ltd., Pan American Silver Corp.'s bid for Minefinders Corp. Ltd. and Eurasian Natural Resource Corp.'s offer for Kolwezi Investments Ltd.

The price of commodities such as copper, iron ore, coal and nickel were performing well in those early months of 2012, although down from the same time period one year earlier. Mineral development and mining companies were cautious, but forging ahead with growth and expansion plans, despite continuing debt troubles in Europe and a slower pace of growth in China, the world's largest consumer of metals.

Then, investors started to lose faith. Growing global economic uncertainty led to a steady decline in commodity prices and a dramatic pullback in equity financing, making it difficult to do deals. As a result, M&A activity dropped off in the first half of 2012 compared to the same period in 2011, with a similarly listless start to the second half of the year. While markets began to show signs of recovery in mid-September, after the U.S. and European central banks announced fresh stimulus plans, M&A is expected to remain moderate in the second half of the year as investor jitters persist.

Meantime, miners continue to feel squeezed. Companies are being conservative with their cash amid rising capital and operating expenses and falling commodity prices. Development and production of certain mining projects are also being threatened by an increase in resource nationalism and civil unrest in some parts of the world. These cost and operating pressures have led to spending cuts and in some cases major project delays, at least until markets gain a more solid footing. At the same time, investors unimpressed by falling stock prices are looking for some satisfaction through increased cash flow to shareholders.

Still, if there is a theme for 2012 so far it's not doom and gloom. After all, most miners are in much better financial shape than during the 2008-2009 global financial crisis, and wiser having gone through it.

While there is upheaval in today's market, companies with cash are properly viewing it as an opportunity to start taking advantage of lower valuations by entering M&A discussions and finding innovative ways to fund projects. An example is the number of agreements made recently with streaming companies, where miners receive upfront cash for a discount on future production. It's just one form of alternative financing that is expected to increase in popularity if the markets stay skittish, making traditional equity raises less attractive. The recently announced, long-awaited initial public offering for Ivanplats Ltd. will be a good indication of whether the market is ready for a comeback, especially given the U.S.'s new round of quantitative easing.

A sustained rise in investor sentiment could restart M&A talks, and support the mining industry's belief that the "super cycle" is on track. Meantime, mining companies will continue to treat this dip in the cycle as an opportunity to scoop up smaller competitors at discount prices, before a rebound. The challenge of course will be convincing target companies to sell at prices much lower than where they sat only a year earlier. Some smaller miners may have no choice, especially if their shareholders are impatient. Others may choose to sell an asset, or group of assets, to raise funds to advance another project given that there are few other financing alternatives. We could also see "mergers of equals," between junior or mid-tier companies that decide collaboration would be their best chance to achieve long-term success.

While deal making has been lethargic so far in 2012, mining industry players are working furiously to figure out how to best take advantage of this downward phase in the cycle. The market is rough right now, but when the going gets tough there's no better time to get creative.

OVERVIEW OF 1H 2012 - GLENCORE/XSTRATA STEALS THE SHOW

The $53.6 billion Glencore/Xstrata deal has dominated deal-making news so far in 2012. Without this mega mining transaction and the very public negotiation of offer price and retention bonuses, there would be very few M&A headlines in 2012.

Global mining M&A deal volume has been slack so far this year, falling 31 per cent in the first half of 2012 to a total of 940 transactions, as compared with 1,371 for the same period in 2011, which was the busiest half year of M&A in the mining sector's history. Volatile capital markets and global economic uncertainty are to blame for this significant drop in activity, as Europe continues to sort out its debt crisis and growth in China slowed to a more moderate annual rate of 7.6 per cent in the second quarter of 2012, compared to an annual average of around 10 per cent for the past three decades. In the U.S., money has also been sitting idle, as many investors wait for the result of the Presidential election in November before deciding how to deploy their cash.

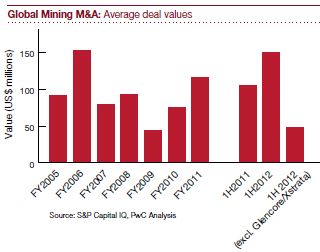

Total deal values for the first half of 2012 came in at $79 billion, higher than $71 billion for the same period a year earlier. The bulk of the 2012 value comes from the Glencore/Xstrata transaction announced in February (and revised in September). Excluding that blockbuster transaction, which had yet to be approved at the time of writing this report, the total deal value dropped to $25 billion, which is about one-third of last year's first half-year total.

The average deal value during the first half of 2012 was $149 million, including the Glencore/Xstrata transaction, as compared with $104 million in the first half of 2011. Taking out Glencore/Xstrata, the average decreased significantly to $47 million, or less than half of last year's total, once again proving the impact of the mega merger on overall trends. It should also be noted that deals values have dropped as a result of lower valuations, a result of the market malaise.

With deal volumes down across the board, and the continued slump in mining share prices, we saw far fewer larger deals in the first half of 2012. There were eight deals valued at more than $1 billion in the first half of 2012, a 27 per cent drop as compared with 11 in the same period in 2011. Two deals in the first half of 2012 were valued between $500 million and $999.9 million for the first half of 2012, down 83 per cent from 12 last year, and 36 were valued between $100 million and $499.9 million, down 14 per cent from 42 in the first six months of 2011. The number of smaller deals valued at less than $100 million dropped to 394 for the first half of 2012, from 591 a year earlier.

These figures demonstrate the reluctance of mining companies to do deals in these turbulent times. However, some deals are still being made by two types of companies: those looking for a lifeline and those looking to reel in a bargain. That includes Asian investors on the prowl for M&A as part of a vertical integration strategy, with the continued belief that commodity demand in their own economies will remain strong in the long term.

All signs point to slow second half of 2012 for M&A in the global mining sector; and another mega deal is unlikely given market fears. While there were 143 deals announced in July, compared with 141 in June, volumes fell dramatically in August to 69. Deals values have averaged $3 billion per month since June, which continues to be very low.

The sluggish pace of M&A activity comes as senior miners are distracted with managing shareholder demand for higher equity prices and more distributions, alongside increasing capital and operating costs and falling commodity prices. That has led to a change in direction among many miners, including an abandonment of the growth-at-all cost mantra that once dominated the industry.

At Barrick Gold Corp., the world's largest gold producer, new CEO Jamie Sokalsky has been hammering home the message to investors that "returns will drive production - production will not drive returns," as part of a promise to focus on returns and free cash flow.

The market downturn has also led to some major project delays, including BHP Billiton Ltd.'s decision to temporarily halt the $20 billion development of Olympic Dam in Australia, which also reflects the industry's renewed focus on driving shareholder value.

Also weighing on M&A activity is a rise in resource nationalism, which has the potential to scupper potential deals. An example is the recent decision by Chalco, China's biggest aluminum producer, to abandon its $938 million bid for a stake in SouthGobi Resources as a result of apparent political opposition in Mongolia, where the assets are located. The Mongolian government passed a new law on foreign investment after the deal was announced in April. Chalco's acquisition would have required parliamentary approval, which the transaction principles did not view as likely to be possible within an acceptable time frame.

Expropriation of resource assets in countries such as Venezuela, Bolivia and Argentina, export duties and downstream processing requirements in Indonesia, and growing civil unrest in countries such as Peru, are also considered risks for potential acquirers of projects in these countries. That has the effect of driving up valuations in regions considered less risky; this in times of market turmoil could also prove unattractive to potential bidders. While it may ultimately have a negative effect on foreign investment, Indonesia's recently issued regulation requiring foreign stakes in mining companies to be divested down to not more than 49 per cent within 10 years of production commencing could see a spur in M&A activity over the coming years.

Finally, shareholders are weary of companies spending substantial amounts on takeovers as a result of recent high-profile write-downs and uncertainty of the future.

These are some of the main factors preventing miners from entering serious M&A discussions in the coming months, as they to try manage costs and gauge which direction markets are headed.

GOLD OUTSHINES OTHER COMMODITIES IN M&A

Gold dominated M&A transactions in the first half of 2012, re-establishing its first-place position against other metals such as copper and coal, the values of which have fallen while the price of bullion remained steady. This is a change in direction from the first half of 2011, when steelmaking ingredients metallurgical coal, iron ore and niobium dominated deal making with more than 30 per cent of activity.

Gold's ranking is little surprise given recent currency debasements and the global economic unease, which causes investors to turn to the precious metal as a hedge against inflation and general economic uncertainty. For example, the price of gold hit a seven-month high in mid-September after the U.S. Federal Reserve launched its aggressive new stimulus campaign to help boost its economy.

Gold M&A is being driven by a drop in the price of gold equities, largely as a result of higher costs across the industry for everything from raw materials to a shortage of skilled labour. These lower valuations are causing producers to seek out future growth at cheaper prices through M&A. We anticipate more gold transactions to take place in the coming months as a result of these lower valuations, a rising gold price and the growing challenge to find new resources to fuel future growth. Goldcorp Inc. CEO Chuck Jeannes told Bloomberg in mid-September that mining acquisition targets are looking more attractive as tougher financing conditions have depressed share prices. "The development-company valuations have come down to where, at least on paper, it looks like there's some opportunities," Jeannes was quoted as saying. "There's a lot of looking going on."

Gold represented the highest value of transactions at 26 per cent in the first six months of the year, and the highest volume at 29 per cent, excluding the diversified metal deal between Glencore and Xstrata. However, the value of gold deals dropped to nine per cent with Glencore/Xstrata in the mix.

Copper was the second-highest resource targeted in M&A activity in the first half of 2012, excluding Glencore/Xstrata, also driven by bullish producers looking for a discount and future production growth. The value of copper deals was 23 per cent, as compared with other metals, and volumes were 14 per cent. Including Glencore/Xstrata, the value of copper deals fell to eight per cent.

The value of diversified metals deals was boosted by the Glencore/Xstrata combination, representing 69 per cent of transactions in the first half of 2012.

While not large enough to make it into our list of top resource transactions, we did see a significant deal in the rare earths sector, with Molycorp Inc.'s acquisition of Neo Material Technologies Inc., for $1.3 billion. The deal closed in June, as producers scramble to react to fluctuating market prices for rare earths and repeated export restrictions in China.

CANADA LEADS M&A BUT CHINA SEEN AS GAINING MOMENTUM

Canada was at the forefront of M&A activity in the first half of 2012, followed by the United Kingdom, when excluding Switzerland-based Glencore's transaction with Xstrata.

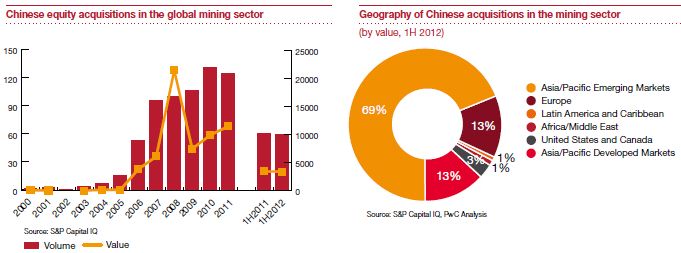

China is the next largest acquirer in the mining sector and continues to be very active with resource M&A outside of its home turf in the Asia-Pacific. While outside of the mining sector, the most obvious recent example of this is Chinese state-owned CNOOC Ltd.'s recent $15.1 billion offer to buy Calgary-based oil giant Nexen Inc.

While the number and value of Chinese-led mining deals was relatively flat in the first half of 2012 compared to the prior year, with overall deal volumes down, China-led deals nearly doubled from seven per cent in the first half of 2011 to 13 per cent in the first half of 2012.

We anticipate more mining transactions from Chinese corporations could come as the country ramps up its foreign investment targets and looks to invest in metals needed to feed its rapid pace of infrastructure building. While China has slowed, the world's second-largest economy is still growing quickly at around eight per cent, and its appetite for resources is expected to remain robust. That includes demand for key metals such as copper, used in manufacturing and construction, and the steelmaking ingredients coal and iron ore. Chalco's aborted bid for SouthGobi at nearly $1 billion is an example of a larger deal, although we are also seeing more interest by Chinese miners in smaller deals, less than $500 million.

China is also becoming a big buyer of gold, with demand reaching record levels in the first quarter of 2012, according to the World Gold Council. China, the world's largest producer of gold, is also forecast to surpass India this year as the largest market for gold.

2012 TOP 10 GLOBAL MINING DEALS

TOP DEALS IN 1H 2012

Glencore's bid for Xstrata was highly anticipated once the Swiss commodities giant went public in 2011. The size of the offer and the initial lack of support from Qatar's sovereign wealth fund, Xstrata's largest shareholder, have monopolized M&A news so far in 2012.

The timing of the Glencore/Xstrata deal also marked the continuation of the downward trend for metal prices that began around mid-2011 and the subsequent gearing down of M&A activity thus far in 2012. While many miners are holding off on making acquisitions, due in part to tight credit conditions, some are renewing their hunt as lower valuations open up some buying opportunities.

Some examples include Rio Tinto plc doubling its holdings in Richards Bay Minerals (RBM) by purchasing BHP Billiton's 37 per-cent interest for $1.9-billion, including contractual adjustments. Rio and BHP announced in February that the two companies had exercised an option for BHP to sell its interest in RBM as part of a restructuring of the South African mineral sands miner and smelting operator. Rio said it wanted the extra stake to boost its titanium dioxide portfolio, while BHP said selling its stake, "reflects the company's commitment to a simpler, more scalable upstream portfolio."

Some large miners are using these markets to buy junior players at a time when their stock prices have plummeted. Consider Yamana Gold Inc., which reportedly had its eye on Extorre Gold Mines Ltd. for more than a year before swooping in with its $445 million bid in June. While Yamana offered a 54 per-cent premium to Extorre's 20-day volume weighted average price, the value was one-third of what Extorre shares traded at a year earlier. Extorre owned a gold and silver property in Argentina that ran into financing challenges and its share price was knocked down as a result of that, along with an overall drop in equities.

It's a dilemma for many juniors in today's raucous markets: sell now at lower valuations, or potentially face bigger losses if the equity markets remain weak, making projects difficult to move ahead.

The new, uncertain reality and lower equity valuations are also forcing miners to rely on alternative sources of financing to help fund project development. Examples include recent streaming agreements between Inmet Mining Corp. and gold-focused royalty and stream firm Franco-Nevada Corporation, as well as HudBay Minerals Inc. and Silver Wheaton Corp., the world's largest silver streaming company. Silver Wheaton CEO Randy Smallwood told Bloomberg News in September that about a third of the talks it's involved in right now are with companies interested in doing streaming deals to help fund acquisitions. This form of funding, to date provided by North American companies only, could also start to crop up in other jurisdictions around the world.

Overall, we expect miners will continue to pursue these and other alternative forms of funding as long as shaky markets continue to cut into equity financings, and debt costs remain high.

CONCLUSION: TAKING ADVANTAGE OF A TOUGH MARKET

To date, 2012 is proving to be a tough year. The combination of low commodity prices and high costs is making investors, including mining companies, reluctant to make any big moves.

While the M&A market is expected to stay relatively quiet for the rest of 2012, strategic deals will be done, backed by a conviction across the industry that the mining "super cycle" is still underway.

PwC is also a firm believer that, despite the lull in recent months, demand for commodities will remain steady for the long-term, propelled by still-strong growth in China and other emerging nations such as India and eventually Africa.

As most in the mining industry well know, markets don't grow in a straight line and slower phases of the cycle are the best time to find good buys. History has proven it, time and again.

M&A in the coming months will be spurred by both opportunity and survival. Companies with cash will take advantage of lower valuations to buy smaller rivals considered too expensive just a few months ago. Meanwhile, those suffering from a shortage of funds could have no choice but to succumb to a takeover bid. Others could decide to combine through a "merger of equals" if it means being able to move projects forward in this tight financing market.

Of course, not all mining companies will be able to capitalize on the opportunities this phase of the cycle may present. However, those with the funding capability could recall this period as when they looked past the pessimists and made the right call.

It's time for miners to take advantage.

METHODOLOGY

Our methodology for M&A analysis is set out below:

- MM&A data includes announced mergers or acquisitions (including less than 100% acquisitions / divestitures). Cancelled, dismissed, expired or withdrawn deals are excluded from data (often, however, deals can be cancelled post publication, although we have attempted to exclude larger deals that we have learned were cancelled before mid-September 2012).

- The acquisition of rights, special warrants and convertible debt are not included in M&A statistics (unless utilized as equity sweeteners). Strategic partnerships which do not involve the acquisition/divestiture of an equity stake are also excluded from our analysis.

- The geography of a buyer is determined by its headquarters. The geography of a target is determined by the location of its major projects (when such information was available).

- Certain transactions involved buyers from more than one geography. As a result, for buyer by region analysis, we utilized appropriate weighting to arrive at aggregate figures.

- For M&A by resource, we classified targets by their primary disclosed resource where possible. In certain cases, a primary resource was not identified. These deals were excluded from our analysis.

- The main source of our data is S&P Capital IQ. S&P Capital IQ includes real estate and property deals in its data.

- Deal currency is US$, historical rate, unless otherwise noted.

- Transaction value refers to total consideration to

shareholders, calculated as:

Total Consideration to Shareholders - plus Total Other Consideration

- Total Earn-outs

- Total Rights/Warrants/Options

- Net Assumed Liabilities + Adjustment Size

- Total Cash

- Short-term Investments

- Mega deals are defined as transactions valued at > $10 billion.

- Mining includes Anthracite Coal Mining, Bituminous Coal and Lignite Mining, Chemical and Fertilizer Mineral Mining, Diversified Metal Ores (Copper, Lead, Nickel, Radium, Tin, Titanium, Uranium, Vanadium and Zinc Ores), Gold, Precious Metals and Minerals, and Iron Ores.

Footnote

* The $53.6 billion figure takes into consideration the value of common shares in the transaction valued at $36 billion (which includes the 34 per cent of Xstrata already owned by Glencore), as well as the debt and preferred shares, among other items, on Xstrata's balance sheet. This figure includes the most recent revision to the merger agreement on September 7, 2012.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.