91 DAYS, 776 DEALS, $49 BILLION

The Canadian M&A market, now 10% of global M&A, continues to defy gravity. Against a backdrop of slowing global M&A activity, Canadian deal values and volumes were up 24% and 7% over the prior quarter respectively.

Emerging market demand for resources, changes in regulation and government policy and disruptive technologies were the common themes driving Canadian M&A in Q1. The resource rich provinces and innovation clusters continue to be the winners in the new Canadian M&A paradigm, largely at the expense of the "old economy" in the East.

Our quarterly roundup presents PwC's insights on the Q1 2012 Canadian M&A dynamics, as well as our perspective on the fact there is still much work to be done by Canadian entities in growth markets.

Kristian Knibutat

Canadian Deals Leader

KEY METRICS

SNAPSHOT

776 Canadian1 M&A transactions worth $48.7 billion were announced during Q1 2012. Values and volumes were up 24% and 7% over the prior quarter respectively. As depicted in the accompanying graph, when measured by value, outbound buying activity dropped by 51% while domestic buying activity rose by 38% and inbound activity rose by 8%.

Q1 2012

FIVE KEY OBSERVATIONS

1. The financial, real estate and mining sectors take a back seat to energy and agribusiness.

Post-crisis, metals & mining, financial (banking and insurance), real estate and energy players have "co-dominated" the M&A landscape. In Q1 2012, we observed notable shifts in M&A market share by sector.

- The energy sector was the clear frontrunner in Canadian M&A, representing 28% of all deal value, up 90% over 2011 proportions.

- Two new additions to our top industries for Q1 2012 were agribusiness and utilities. Agribusiness made a respectable showing with a 15% market share, while utilities came in fifth with 7% market share.

- Real estate and mining were the third and fourth most active sectors, although both saw market shares drop (by 20% and 50% respectively over 2011).

- Notably absent from the list was diversified financials, which claimed only negligible market share in Q1 2012, after representing 12% of the M&A last year.

We briefly review some of the drivers behind these shifts in the accompanying commentary.

A closer look at energy M&A activity in Q1 2012

Q1 2012 saw 116 Canadian energy transactions worth $13.8 billion. While there were a variety of sub sectors within the broader energy sphere that were busy, M&A in the gas segment was by far the most notable. A prolonged slump in the price of natural gas has prompted numerous natural gas producers to investigate ways to create new demand, open new markets (most notably Asia) and seek out deals to improve capital efficiencies or access enabling technology. The price slump has also prompted many producers to shift production mix away from "dry" natural gas (methane), in favour of "wet" gas, which is a mixture of methane and natural gas liquids (NGL's) such as ethane, propane, butane and condensate. NGL's are used to make, amongst other things, petrochemicals and plastics and have a much more favourable outlook because their pricing is positively correlated to the price of oil.

Notable "all Canadian" gas deals included Pembina/ Provident ($3.2 billion), and Pengrowth/NAL ($1.3 billion). These mega transactions were well covered in the press and partially overshadowed a continued trend in the broader energy sector of partnerships and transactions between Canadian entities and foreigners. Two notable foreign buys in Q1 were:

- Japan's Mitsubishi Corp., which acquired a

40% Partnership interest in Encana Corp.'s Cutbank Ridge gas

assets in northeastern British Columbia for $2.9 billion. Junichi

Iseda, a Mitsubishi vice president, noted that the purpose of the

transaction was twofold:

"...to contribute to the development of natural gas resources in Canada and to help diversify Canada's gas export market."

These remarks are indicative of a new paradigm in which foreign buyers are cognisant of the need to demonstrate a net benefit to Canada when acquiring Canadian companies or assets. - Cretaceous Oilsands Holdings Ltd., a subsidiary of PetroChina International Investment Ltd., which is set to acquire the remaining 40% of the MacKay River oil sands project from partner Athabasca Oil Sands Corp ("AOSC"). The transaction was the result of AOSC exercising an option to sell its interest in the project to PetroChina, which in late 2009 bought a 60% stake for $1.9 billion and was the first instance of a Chinese entity taking full control of an Alberta oil sands asset.

Foreign ownership is a "hot topic" of late due to the fact that many buyers of energy assets have been state owned national oil companies (NOC). In recognition of the uniqueness and complexity of transacting with NOCs, PwC has partnered with Eurasia Group, the world's leading political risk consultancy, to author a paper entitled "Free Markets vs. State Capitalism" in the oil and gas sector. We have also authored a white paper "Nothing to Fear" which outlines five reasons that Canada should welcome foreign investment in the oil sands and shale sectors.

A closer look at agribusiness

The second busiest sector of the quarter was the agribusiness sector. The debut of this sector to our top targeted industries list is largely thanks to the pending $6.1 billion acquisition of Viterra by Glencore. In conjunction with the acquisition, Glencore has entered into agreements with Agrium Inc. and Richardson International for the sale of assets which comprise a majority of Viterra's existing Canadian operations. Agrium is set to acquire the majority of Viterra's retail agri-products business for $1.8 billion while Richardson International is set to acquire 23% of Viterra's Canadian grain-handling assets, certain agri-centres and certain processing assets in North America for $800 million. The deal will essentially leave Glencore with Viterra's infrastructure, including 63 grain elevators and seven port terminals in Canada, and eight port terminals in Australia. The deal did not come as a surprise to the market, which was expecting takeover activity in the Prairie Provinces subsequent to the federal government's move to deregulate the Canadian Wheat Board, a game-changer we profiled in our provincial M&A roundup.

Increases in food demand as well as the rising cost of labour and energy are some of the key drivers of M&A activity in the agribusiness and food spaces. Witness the FAO food price index, a measure of the monthly change in international prices of a basket of food commodities. As depicted in the accompanying graph, the index has risen by over 100% since the start of the millennium. The intensity of price strengthening has been an incentive for companies to transact in order to secure supply and achieve economies of scale. As featured in our 2011 market outlook, food prices are expected to stay high for the near term due to two structural shifts in demand side dynamics:

- Rising incomes in developing countries are prompting a shift away from grain-based diets to meat based diets, increasing demands for proteins but, also increasing demand for grain as animal feed.

- Current technology limits the global biofuels drive to corn and sugarcane (for ethanol) and oilseed (for biodiesel), thereby creating new and significant demand for these commodities.

Our view on the "less active sectors"

Notably less active this quarter were the Canadian real estate and metals & mining sectors. As highlighted in our table of top targeted industries, these sectors experienced market share declines of 20% and 50% over 2011 respectively. We view both these drops as temporary anomalies in the market, rather than the start of cyclical downturns. An extremely busy Q4 2011 of M&A in these sectors left many large players busy digesting acquisitions. As discussed at length in our flagship M&A related publications about the mining and real estate sectors, fundamentals support continued robust mining and real estate activity for the remainder of 2012.

2. "The West" continues to be the preferred Canadian investment destination.

M&A activity in Canada has historically been relegated to the skyscrapers of Toronto and Montreal. However, as highlighted in our 2011 provincial M&A analysis, the tide is turning.

- Today, the western provinces of BC, Alberta, and Saskatchewan are the investment destinations of choice in Canada. This resource rich region was home to 67% of all Canadian M&A targets (measured by value) in Q1, including 15 of the top 20 acquisitions in Canada.

- Ontario and Quebec were home to 19% and 14% of Canadian targets (measured by value), respectively. Despite Ontario's eroding market share of takeover value, it is still home to 29% of Canadian M&A takeover volume, moderately higher than Alberta's 22% share.

This geographic shift is, not surprisingly, the result of a flurry of activity in Canada's resource sectors. Interesting however, is the fact that the gap between the East and West is widening at a rapid pace. The accompanying table illustrates that when the provincial market share of M&A in Q1 2012 is compared to the 2007 peak, which saw numerous multi-billion dollar deals in the resource sector, Canada's Western provinces have still gained approximately 26% of takeover value market share.

We do not believe this is dire news for the East. Ontario and Quebec have already begun the process of "re-tooling" to adapt to the realities of a post-crisis world. In recent remarks to the Greater Kitchener Waterloo Chamber of Commerce, Governor of the Bank of Canada Mark Carney noted:

"One out of twelve oil sands manufacturers and suppliers are from this region, and Ontario's exports to Alberta of miningrelated services grew 44% in the last year measured. The opportunity to capture more of the value added in commodity production from energy to agriculture remains a tremendous opportunity for all of Canada."

Certainly the lion's share of activity in BC, Alberta and Saskatchewan remains in the energy, mining & metals and agriculture sectors. However, prolonged prosperity in the West has also spurred a much more diverse body of potential M&A targets. Q1 2012, for example, saw two interesting transactions in BC's technology sector:

- OMERS Ventures announced one of the largest Canadian venture capital transactions to take place in the past 10 years. The venture arm of the financial giant is buying a $20 million ownership stake in BC based social media startup HootSuite.

- Twitter announced the acquisition of BC based Context Media Technologies Inc., creator of social media aggregation software called Summify (for an undisclosed amount).

3. Contraction in real estate M&A activity hits the Canadian middle market hard, masking an uptick in deal values.

While overall M&A volumes and values were robust in Q1, the Canadian middle market experienced a fourth consecutive quarter of contraction. In the $100-$500 million transaction size segment, 42 Canadian transactions worth $9 billion were announced, 11% and 6% lower than the prior quarter respectively. The drop off in the middle market was especially notable at the "upper end" of the middle market. In the $250-$500 million deal segment, aggregate values were $4.9 billion, down 21% over the prior quarter.

At face value, this trend is rather alarming. However, it may be somewhat reassuring (depending on your perspective!) that the single most significant pocket of weakness in the middle market was the commercial real estate sector ("CRE"). Pension funds and REITS took a break in Q1 from a buying spree that commenced in late 2009, driving middle market CRE M&A values down 57% to $1.6 billion. Simple math reveals that, absent CRE, the middle market actually registered a 26% increase in deal values.

Similar to the broader Canadian M&A market, the resource and resource related sectors did feature heavily in the universe of middle market transactions. Two notable examples included:

- Finning International Inc., which holds the franchise selling rights for Caterpillar Inc. in Canada, acquired the distribution rights to mining equipment producer Bucyrus for $465 million. For Finning, the single largest near-to-midterm benefit of the deal is access to hydraulic shovels and cable shovels.

- Sieman's Canada acquired Canadian rugged communications company, RuggedCom Inc., for $440 million. The target is a leading provider of rugged communications networking solutions designed for mission-critical applications in harsh environments such as those found in oil refineries and metals and minerals processing. The purchase price was a 50% increase over an unsolicited hostile bid from St. Louis-based Belden Inc.

4. Private equity quiet, focused on bolt-ons, middle market.

We are nine pages into our Q1 2012 M&A roundup and have yet to mention private equity (PE). This, in and of itself, is noteworthy. Where were the "titans of M&A" this past quarter?

As a percentage of total Canadian deal value, private equity2 transactions were a meagre 8% in the first quarter. This was the lowest contribution to Canadian M&A by private equity since the first quarter of 2010 when PE deals represented 13% of total activity. It is also well off the post crisis high of 48% observed in Q4 2009.

Subdued private equity activity this quarter is consistent with global PE trends. Because most funds are focused on small to medium size bolt-on deals rather than LBOs, annual private equity capital activity has remained well off pre-crisis highs across nearly all developed world geographies. In Canada, a flurry of multi-billion dollar deals in 2010 and 2011 led by the private equity arms of Canadian pension funds partially masked this trend. Absent Canadian pension funds, private equity activity in Canada has actually trended in the 8%-12% range of total deal values post-crisis. Given that Q1 saw most pension funds sit on the sidelines digesting large 2011 buys, PE market share this quarter is actually not atypical.

Why so few LBOs?

We need only to turn to the leveraged loan market to understand the shift in private equity buying behaviours. A fundamental driver of private equity M&A activity is the availability and pricing of leveraged debt. Although the all-in funding costs of leveraged debt was attractive in Q1 at an average 6.19%, leverage multiples were still prohibitively high. On average, 43% equity was required to successfully finance a North American LBO, nearly in line with the 45% peak observed in 2009 and notably higher than the lows of between 29%-31% through the 2006-2007 market peaks.

At these leverage levels, PE buyers would be challenged to achieve IRR hurdles. Indeed, according to S&P LCD "... private equity firms kept a low profile in the M&A arena [in Q1 2012], focusing on refinancing and extending debts as well as dividends...LBO loan activity, therefore, slumped to a two-year low of $7.4 billion in the first quarter, from $14.5 billion in the fourth quarter...".

Notwithstanding the overall slowdown in large pension fund deals in Q1 2012, there were some interesting developments in the middle market PE space during the quarter. Consistent with the broader market, the theme of resources and resource-related entities was also prominent in the PE community:

- Birch Hill Equity Partners acquired 10 of Secunda Marine Services's offshore supply vessels from McDermott International of Houston, Texas. Newly formed Secunda Canada LP will operate the fleet, which will aim to service the East Coast offshore energy sector from its Dartmouth headquarters. Terms of the transaction were not disclosed.

- The Caisse de dépôt et placement du Québec ("the Caisse") increased its investment in Storm Resources Ltd., a Calgary based energy exploration company. The Caisse has subscribed to 2,353,000 common shares of Storm – representing approximately 5.17% of the company's outstanding common shares for a total investment value of approximately $8 million.

5. Canadians shy away from growth markets. Buy side volumes into the BRIC countries hit historic low.

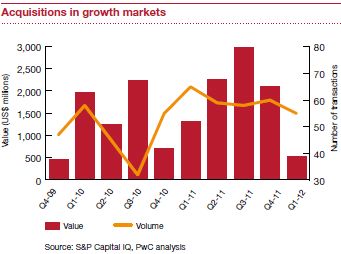

Despite continued evidence that the world's economic centre of gravity is shifting in favour of growth economies, Canadian acquisitions into growth markets experienced a sharp slowdown in Q1 12. Transaction values nosedived 75% quarter over quarter to their lowest levels since Q4 09 and were 82% lower than their post-crisis peak in Q3 11. Volumes saw a more modest decline, falling 8% from Q4 11 and 15% from peak volumes seen in the Q1 11.

These results are consistent with various studies by PwC, as well by a number of Canadian regulatory bodies, which have concluded that Canadians are lagging their developed market counterparts in capitalizing on M&A opportunities in emerging markets. The actions and policies of our federal government are also supportive of a diversification strategy. In a recent interview with Jane Harman, President and CEO of the Woodrow Wilson Center in Washington DC, Prime Minister Stephen Harper, speaking on the diversity of Canada's energy exports said:

"The United States cannot be our only export market...We cannot take this to the point where we are creating risk in significant economic penalty to the Canadian economy. And to not diversify to Asia when Asia is the growing part of the world just simply makes no sense to Canada."

Our perspective is that a deceleration in China's growth rate was likely the biggest, though not the only, culprit of the first quarter slowdown in growth market M&A. On a year-over-year basis, Chinese GDP growth slipped from 9.7% in Q1 11 to 8.1% in Q1 12, an eighth consecutive quarterly deceleration. Declining Chinese growth rates are likely culpable for the complete standstill in Canadian-led acquisition activity in China's consumer and financial sectors during Q1 12 and may also be to blame for the 97% decline in Canadian-led buying activity in South America's mining sector (which depends on Chinese resource demand).

Many China analysts regard the negative western reaction to China's decelerating growth as a fundamental misunderstanding of China's economic prowess. China's ruling Communist Party has been extremely forthright regarding the fact that deceleration is necessary in order to effect rebalancing and shift the makeup of Chinese growth toward consumption (away from exports and investment) – a shift that, in the long run, will ensure China's prosperity.

Deal making in growth markets did not come to a complete standstill. Two notable Canadian-led buys included:

- Valeant Pharmaceuticals International announced the largest Canadian-led acquisition in a growth market of the quarter, the $180 million buy of Natur Produkt International, JSC, a specialty pharmaceutical company in Russia. Valeant also acquired Probiotica Laboratorios Ltda., a Brazil based leader in sports nutrition and food supplements, and made a 19.9% minority equity investment in Pele Nova Biotecnologia S.A. a Brazilian research company focused on tissue regeneration. (terms undisclosed).

- Great Slave Helicopters, a subsidiary of Discovery Air, completed the purchase of Servicios Aéreos Helicopters. cl Ltda ("SAL") in Chile. SAL provides helicopter services to domestic and multinational customers in the mining, power construction, and forestry sectors of the Chilean economy. Terms of the transaction were not disclosed.

Footnotes

1. Canadian transaction refers to an announced M&A transaction involving at least one Canadian entity (as a majority or minority party), inclusive of real estate transactions.

2. Private equity transactions, for the purposes of this report, are deals in which: at least one party to the transaction is a private equity firm and at least one party to the transaction is a Canadian entity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.