On November 22, 2011 Ontario's Lieutenant Governor delivered the new Liberal minority government's Speech from the Throne outlining its legislative priorities for the coming session of the Legislature. In addition, on November 23, 2011 the Minister of Finance delivered his Fall Economic Outlook and Fiscal Review outlining the state of Ontario's economic and fiscal position, as well as providing additional information on key policy priorities of the new Liberal government. This bulletin provides a summary of both of these announcements.

SPEECH FROM THE THRONE

In the context of continuing economic uncertainty globally and slower economic growth over the next four years, the government's key priority is to create jobs and stimulate long term economic growth. The government made it clear that it is committed to moving forward with modernizing the electricity system with new clean and renewable forms of generation, while continuing to make new investments in the transmission grid. The government is also maintaining its commitments to develop the mining sector in Ontario's North through the "Ring of Fire" Initiative. The government will also move forward to build further ties to emerging markets in China and India.

The government is also committed to delivering public services in a more cost effective and efficient manner. It's on track to reduce the public service by 5 per cent by March 2012. It is also attempting to find savings of $200 million by 2014 by reducing the number of government agencies. The forthcoming report from the Commission on the Reform of Public Services chaired by Don Drummond ("Drummond Commission") will provide a key blueprint for how the government will restructure its core services.

The initiatives that were outlined in the Speech from the Throne

largely reflect the election platform commitments of the

Liberals:

- Reduce postsecondary education tuition by 30 per cent for families earning less than $160,000 annually and selecting three new sites for undergraduate campuses;

- Introduce a Health Homes Renovation Tax Credit to assist seniors to live independently;

- Increase home care services for seniors;

- Press the federal government for a 10 year Health Accord to fund health care services;

- Adding two-way, all day GO train services in the GTA;

- Introduce a Great Lakes Protection Act;

- Work with the federal government to improve educational opportunities for First Nations communities; and

- Re-commit to balancing the budget by 2017-18.

ECONOMIC OUTLOOK AND FISCAL REVIEW

Gross Domestic Product ("GDP")

Over the last eight months, the global economy has seen a widespread, downward shift in projections for economic growth. In March, when the government released its 2011 Budget, the average private-sector forecast for Ontario's economy was real gross domestic product (GDP) growth of 2.6 per cent for 2011. This has declined to 2.0 per cent. The degree of change is even greater for 2012. In March 2011, the average private-sector forecast placed GDP growth at 2.8 per cent but, by November, those forecasts had fallen to1.9 per cent. The Ontario Ministry of Finance is now projecting continued growth of 1.8 per cent in 2012, 2.5 per cent in 2013 and 2.6 per cent in 2014.

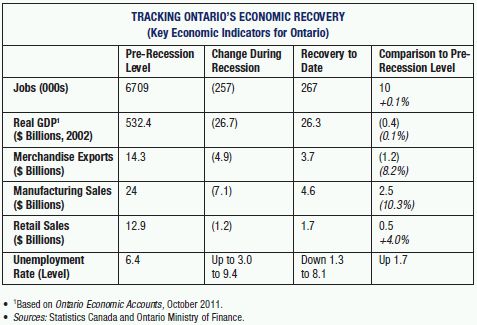

Below is a table taken from the Economic Outlook and Fiscal Review that illustrates changes to key economic indicators in Ontario:

FISCAL PERFORMANCE AND OUTLOOK

In terms of fiscal performance, the current deficit IS $16.0 billion 2011-2012, slightly below the forecast in the March Budget of $16.3 billion. The current forecast projects declining deficits of $15.2 billion in 2012-2013 and $13.3 billion in 2013-2014. The government is still targeting the elimination of the deficit by 2017-2018 but that will require fundamental reform of how the province provides services. This is where the recommendations of the Drummond Commission will have their impact.

GOVERNMENT REVENUE AND EXPENSE

Slower economic growth since the March Budget has lowered the revenue projections by roughly $443 million. Program expenditures levels have been maintained at the 2011 budget levels but total expense is forecast to decrease by $264 million due to lower interest rates than those forecast in the March Budget.

The table below provides a snapshot of the current revenue and expenditures of the province:

Total revenues are expected to rise to $116.3 billion by 2013-14 based on the Ministry of Finance's economic outlook.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.