Introduction

Approximately 70 companies in Canada, including a majority of the TSX 60, held a say-on-pay vote in 2011, making it the first year that a significant number of management advisory votes on executive compensation were submitted to shareholders. Leading up to the proxy season, many issuers and boards were concerned about the ramifications of say-on-pay and what might be in store:

- How willing would shareholders be to vote against management and would shareholder concerns about executive compensation manifest itself through high levels of negative votes?

- How should boards and compensation committees interpret and respond to different levels of shareholder support?

- What could be expected from the proxy advisory firms, given that many had expressed concerns about the increase in influence that say-on-pay might provide to firms such as ISS and Glass Lewis?

Now that proxy season is over, what conclusions can be drawn from the say-on-pay voting results? It seems a fair assessment to say that the first year was uneventful. Based on the voting results filed by Canadian issuers that had an advisory vote this year:

- None of the advisory votes failed

- The average level of support was 94%

- Only 11 companies received support below 90%, and of those only two were below 80%1

- The lowest levels of support were 64% at Thompson Creek Metals, and 75% at Pan American Silver

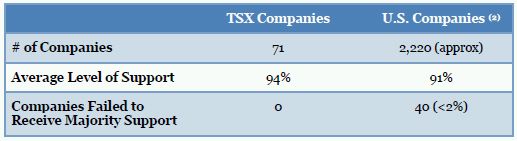

How do these results compare with the U.S. experience, given 2011 was the first year that Dodd-Frank mandated say-on-pay vote for public companies? As the following table indicates, U.S. companies in general received lower levels of support than their Canadian counterparts:

Commentators in the U.S. have disagreed about how to interpret these results: they have been viewed variously as a "non-event", a success for shareholders, a bust, an endorsement by shareholders of the current executive pay model and finally as a distraction from more serious shareholder concerns3.

Most do agree, however, that say-on-pay in the U.S. has increased shareholder engagement and improved disclosure. A similar consensus about these consequences of say-on-pay seems to exist in Canada.

Fighting Back

In the U.S. say-on-pay has also given rise to a new phenomenon: companies responding publicly to negative voting recommendations from proxy advisors ISS and Glass Lewis, perhaps most notably the venerable GE (see our May 2011 briefing For Shareholders and their Advisors, Pay for Performance Remains a Work in Progress at: http://www.hugessen.com/pdf_docs/Briefings-Shareholder%20and%20advisor%20views%20-%20PFP%20May%202%202011.pdf). Over 100 companies either filed additional proxy materials or issued press releases rebutting the claims or analysis of the proxy advisors4. While we have seen no sign of this yet in Canada, it may only be a matter of time until the practice migrates north.

Impact of Proxy Advisors' Recommendations

U.S.

It is clear from the U.S. experience that proxy advisors, in particular ISS, have a significant impact on say-on-pay vote results. All of the companies whose say-on-pay vote failed had received a negative recommendation from ISS and the average support rate with a negative voting recommendation was 25% lower than for those without5. However, it is also clear that a negative recommendation is not determinative. Indeed, less than 15% of the issuers where ISS issued a negative voting recommendation (approximately 13% of the companies covered by ISS) failed their say-on-pay vote6.

Canada

It would not be surprising if proxy advisors have a similar influence in Canada though the smaller sample makes it harder to confirm, as does the fact that information on the number of negative recommendations made in Canada and the names of the companies affected does not become publicly available to the extent it does in the U.S.

It is our understanding that ISS issued a negative recommendation on say-on-pay for only two Canadian companies this year (or approximately 3% of the 71 companies covered), one of which was Thompson Creek, which received, as noted above, only 64% votes in favour, the lowest support in Canada reported this year. The name of the second company and its voting results are not public. Glass Lewis issued a negative recommendation on Pan American Silver‟s advisory vote, which received the second lowest support level of 75% (ISS had issued a positive voting recommendation). These results are consistent with the expectation that Glass Lewis‟ recommendations would not have as great an impact as those of ISS given the latter‟s market dominance.

Based on the 2011 results, Glass Lewis was apparently more willing to make negative voting recommendations on say-on-pay than was ISS, suggested by the fact that Glass Lewis issued eight negative recommendations on say-on-pay this year out of 56 companies covered (or 14%).

What Should Boards Do?

Keep up to date with changes in proxy advisors guidelines. Given the influence of advisors, boards of say-on-pay companies would be wise to stay up to date on advisors‟ policies with respect to executive compensation practices. Negative voting recommendations from ISS, for example, are in the majority of cases based on a company‟s failure to pass ISS‟ own pay for performance test, as was the case with Thompson Creek7. Other ISS policies that provide the basis for negative recommendations deal with "problematic pay practices", such as tax gross ups or excessive severance. It is our understanding that the second negative ISS recommendation on say-on-pay was the result of the company‟s having a tax gross up provision.

Determine rationale for shareholder negative votes even when substantial majority in favour e.g. negatives greater than 10%. While the majority of support levels were high (greater than 90%), there is still sufficient variability among say-on-pay voting results in Canada that boards and compensation committees will want to remain vigilant. They will want to:

- Satisfy themselves that the executive compensation policies in place are consistent with rewarding long term performance that is tied to company strategy

- Confirm the high quality of disclosure in the CD&A

- Consider, if they have not already done so, putting processes in place for communicating with shareholders beyond the annual meeting forum so that they are not blindsided by shareholder responses to compensation policies

Where appropriate, prepare for a negative scenario. Based on this year‟s reported voting results, shareholder support level below 80% is clearly anomalous, with only two of 71 companies in that category. The board of a company in that position should be prepared to:

- Confirm that it is committed to the pay policies that prompted the negative votes

- Reach out to the company‟s shareholders, and perhaps proxy advisors if appropriate, to determine which compensation practices are the source of shareholder dissatisfaction. We have seen direct engagement lead to resolution of shareholder concerns and a change in proxy advisor‟s recommendation. Engagement can also help to avoid a similar or more negative result the following year, in the form of a majority negative vote or withhold votes from compensation committee members.

- If a reasonable effort to engage with proxy advisors does not lead to a common understanding, or if there is no opportunity to engage, consider the option of a public response to a negative proxy advisor recommendation, either through additional SEDAR filings or a press release. This allows the board to respond fully to criticism, present the board‟s position, and defend its compensation decisions.

Arguably, given that only 15% of Canadian say-on-pay companies received less than 90%, any level of support below 90% should also prompt some inquiry as to what concerns shareholders have and lead to discussions with shareholders and a potential re-affirmation of executive compensation policies and practices.

Conclusion

All in all, it was a relatively uneventful say-on-pay season for Canadian companies, particularly when compared to the U.S. experience (which arguably was in itself relatively tame). This is not surprising given the differing governance backdrops between the two countries – the Canadian environment is less confrontational and litigious and thankfully lacks the more fractious issuer-shareholder relationship frequently observed in the U.S.

To recap, to help ensure a continued calm, there are several relatively easy steps that boards and compensation committees may want to take:

- Stay informed of the latest developments on the executive compensation and governance front

- Periodically assess their issuer‟s plans and practices against guidelines set out by institutional shareholders and shareholder advisors

- When making any executive pay decision, always ask "how will this be disclosed"

- Where there may be a contentious matter, engage with shareholders as appropriate, and prepare contingencies, including a potential public defense of the board‟s position

Say-on-pay has arrived with none of the drama that some were expecting and most issuers will want to take reasonable steps to help ensure that it stays that way. For the majority of situations, the few steps outlined above should allow the calm to continue. In some cases, further engagement with shareholders and their advisors will be warranted. We expect very few situations will require that differences be addressed in a public forum.

Footnotes

1 Note that because some companies choose to disclose only whether the advisory vote passed and not levels of approval and disapproval, there may be additional companies with less than 90% support

2 U.S. data is from James Barrall of Latham & Watkins LLP, Say-on-pay in 2011: Lessons and Coming Attractions, Harvard Law School Forum on Corporate Governance and Financial Regulation, August 5, 2011

3 See for example:

- James Barrall, (ibid) "those that expected Say-on-pay to be a non-event‟, as it has historically been in the UK, have been sorely disappointed‟"

- Say-on-pay – A Victory for Shareholders and the Executive Pay Model, Ira Kay, Pay Governance LLC, The Harvard Law School Forum on Corporate Governance and Financial Regulation, August 8, 2011 - voting results show that Say-on-pay is a success, that the results demonstrate an endorsement by shareholders of the current executive compensation model

- Investors 'Say-on-pay" is a Bust John Helyer, Businessweek.com, June 16, 2011

- Governance eminence grise Robert Monks has said that the results show that Say-on-pay is a "cruel hoax" and a distracting sideshow from the real issue of providing shareholders with the ability to effectively remove directors. Regulation Whack-a-Mole: Bob Monks' Take on Say-on-pay, Governance Metrics International blog, July 12, 2011

- Others have parsed the results and concluded that support level below 80% is the threshold below which companies should be concerned and view the results as a failure. The Votes Are in - Deconstructing the 2011 Say-on-pay Vote, Michael R. Littenberg, of Schulte Roth &

4 Say-on-pay Results: Russell 3000 - Shareholder Voting and Responses to Proxy Advisers, Semler Brossy, May 11, 2011

5 Latham & Watkins

6 Semler Brossy

7 Briefly, ISS has a two part pay for performance test: a company will fail if (i) its one and three year TSR are below the median of companies in its four digit GICS group, and (ii) CEO compensation has gone up in the last fiscal year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.