1 IT Enabled Transformation

The application of technology in financial services is not a new phenomenon. The financial services industry typically ranks as the largest investors in technology when compared to other industries.

It is clear that this investment in technology has changed the way that financial services companies operate, however, there is much press that suggests it may not have delivered the performance improvement that we anticipated/expected/desired with that investment. [can technology continue to drive performance or have we reached the limit]

1.1 Previous investments didn't deliver

There is plenty of literature that talks about the success of IT projects at an individual level. Most will focus on the question of on time, on budget. Some may go as far as to look at benefits delivered, but this is notoriously hard to quantify. That aside, I feel the general sentiment is we have progressed, not as quickly as we had hoped and with a few bumps along the way, but we are more productive and efficient. Over recent years, some economists have taken a macro view to attempt to quantify how far we have progressed in aggregate. How much more productive are we following 25 to 35 years investment in technology and the answers are a bit surprising.

The IMF conducted a study to look at the change in productivity driven by IT. They concluded that in the period 1975-2000, IT investments had increased productivity by only ¼%. They also showed that of the annual GDP growth of 2-3% between 1990 and 2000, only 0.3-0.5% was attributable to the use of IT. These figures pale in comparison to the actual investment in IT over those periods. The study concludes that the majority of this investment has gone into capital deepening, establishing the required infrastructure to operate the new technology, into enriching the technology providers, not into increasing productivity.

Other economic commentators have previously identified a two stage process in the adoption of new technologies. In stage one, the technology is adopted and utilized, during this initial period little productivity improvement is experienced. In the second phase, innovative applications of the new technology appear, which allow for significant productivity gains. Ford is a great example. Manufacturing production through the 19th century was steam driven. Typically a large steam generator would be centred in the factory and the production machines would be arrayed around it in a star configuration. This was entirely because of the difficulty of converting steam into mechanical power. With the adoption of electricity, factories could now power their machinery without the steam generators. Most simply removed the generator and replaced it with an electricity supply. Ford, however, noticed that electricity was more portable and that his machinery no longer had to be arranged in a star configuration. This revelation allowed him to develop the concept of the production line and to transform the economics of car production and the whole of manufacturing. This occurred some 20 years after the use of electricity became widespread.

1.2 There is pressure to change

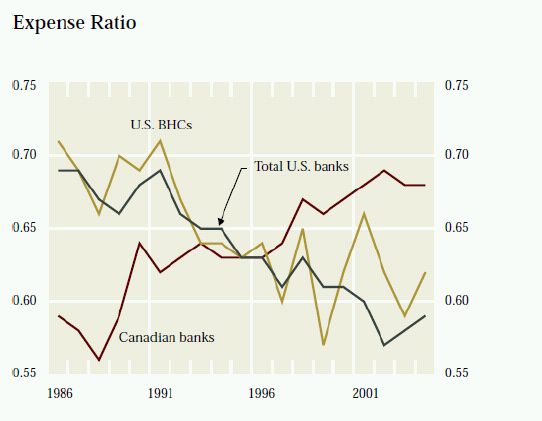

There is always pressure for improvement. However, there seem to be some very specific drivers affecting financial services firms in Canada right now. Over the last 25 years, the efficiency of Canadian banks has been declining. In a study by the Bank of Canada, the non-interest expense ratio has risen from around 58% to approximately 68%. Contrast this to the US banks who have seen the exact opposite trend, with their expense ratio falling from around 69% to about 58%.

Since this study was completed, the economic crisis has put even greater pressure on costs. While Canadian banks weathered the problems well, it has left behind it a very low interest environment. On top we have seen a steep increase in the regulatory oversight and the cost to banks of meeting these regulatory requirements.

And finally, during this period, many banks discovered how inflexible there systems where and how costly it was to change them. With IT accounts for as much as 50% of the operating costs, this combination is raising some serious questions about the investments they have made and the continuing cost to operate.

1.3 Following our process can deliver better results

While KPMG has a detailed framework for undertaking a technology led transformation, we believe that rigorously developing a target operating model may be the way to unlock the productivity gains that have eluded organizations previously.

In my terminology a business model defines your markets, what you offer to these markets and which clients you target, your revenue. An operating model deals with your core business processes, organizational structure, governance, culture, operational infrastructure and technology, your costs.

What seems very interesting at the moment is that the leading technology innovations of today appear to be focusing entirely on changing the operating model. While previous innovations brought technology automation, removing repeatable manual tasks, the current technologies are focusing not on what we do, but more on how we do it.

Focusing on core competencies is a key element of developing your operating model. Understanding what you are truly exceptional at and what others could perform better for you. Three current innovations are leading us to be even more granular and flexible over our core competencies: cloud computing, server virtualization and business process outsourcing. Combined they allow you to identify non-core processes, extract them from your organization and find a partner to complete them for you. In addition, moving between partner organizations is also becoming easier.

The combination of mobile computing, pervasive connectivity and service oriented architectures is really enabling flexible organization design. SOA offers the promise of much easier and more flexible redesign of tasks and processes, combined with mobility we really can start to think about who does what activities in your organization. A recent example is ING, who have opened there first branch in Toronto. Having started with an online banking model, they have opened the branch, not to complete transactions for customers, but guide customers to do transactions themselves. There are no tellers, in fact the branch resembles a Starbucks more than a bank.

While business intelligence has been around for a while now, it has really matured in recent years and is starting to deliver on its original promise. Within financial institutions there is no end of data, the real problem is deciding what to measure. What really drives performance in your organization? How successful have you been executing your strategic plans? What process do we use to take our performance measures and use the information they provide to change the way we operate?

1.4 Successful transformation

A successful transformation, defined by significantly improved performance is certainly achievable today and technology can be a critical tool. Using the key technology innovations of today, organizations are able to radically redefine their operating models in ways previously not possible. With careful thought they can create a near real time feedback system that can inform key decisions at all levels of the organization. We may be at the point in our development when the return on technology investments has a dramatic impact on productivity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.