INTRODUCTION

The following is a guide for international public companies seeking to obtain an interlisting on the Toronto Stock Exchange (TSX). An interlisting can also be referred to as a "dual listing" or "cross listing."

As Canada's senior equities exchange providing domestic and international investors access to the Canadian marketplace, the TSX is the choice of most international companies for a Canadian interlisting.

The TSX Venture Exchange (TSX-V), Canada's junior listings exchange, provides companies at the early stages of growth the opportunity to raise capital and can be suitable for a junior company interlisting.

WHY CONSIDER AN INTERLISTING ON THE TSX?

International companies may wish to consider interlisting on the TSX because a TSX interlisting is straightforward and cost effective, the TSX ranks with the world's leading stock exchanges, and an interlisting can provide many benefits to an international public company, particularly in the natural resource sectors.

Straightforward Process Interlisting on the TSX is straightforward and cost effective:

- Companies can utilize their home country disclosure documents for the listing application;

- Companies from certain countries can use their home country disclosure documents to satisfy Canadian continuous disclosure obligations;

- Effective 2011, Canada has adopted International Financial Reporting Standards (IFRS) for financial statements; and

- Listing fees are reasonable.

TSX Ranks with the World Leaders

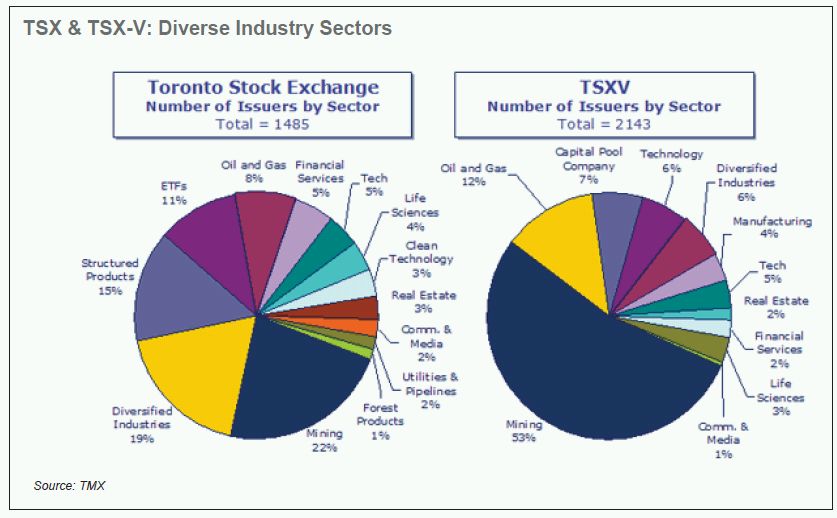

With over 3,000 issuers listed, the TSX and TSX-V rank among the world's leading stock exchanges and are home to the largest number of issuers in North America.

At the end of 2010, over 300 international issuers were listed on the TSX and TSX-V, which accounted for approximately 10 per cent of the companies listed on these exchanges.

Benefits of an Interlisting

An interlisting on the TSX offers many benefits to an international public company, such as:

- Access to a large active market for raising additional capital;

- Diversifying and broadening the company's investor base with North American investors;

- Increasing marketability and liquidity of the company's shares;

- Achieving greater global brand recognition;

- Opportunities for greater analyst coverage, including, if applicable, analyst coverage at fairly early stages of a company's growth cycle; and

- Access to North America's institutional investors.

For international mining companies, a TSX interlisting has many additional advantages:

- Canada is home to unparalleled mining and metals knowledge and expertise;

- Worldwide, 55 per cent of all public mining companies raise capital in Canada and list on the TSX and TSX-V;1

- Over 1,500 mining companies are listed on the TSX and TSX-V.1, 2 These companies control vast amounts of international mineral resources;

- In 2010, over $17 billion was raised by listed mining companies on the TSX and TSX-V in over 2,400 financings;1

- Over 130 international mining companies are listed on the TSX and TSX-V, representing a combined market capitalization of $52 billion;2

- $4.8 billion was raised in 2009 through 140 financings by international mining companies;2 and

- In 2009, 12 billion shares of international mining companies were traded in 6 million transactions.2

The TSX and TSX-V have more than 390 listed oil and gas issuers, accounting for a world-leading 20 per cent of total market capitalization.1 This outranks the next closest exchange in this sector, the Australian Stock Exchange, which has 216 oil and gas issuers listed.1

Other sectors on the TSX and TSX-V include diversified industries such as technology, life sciences, clean technology, financial services, real estate, communications and media, utilities and pipelines, and forest products.

FREQUENTLY ASKED QUESTIONS (FAQs)

THE APPLICATION HOW LONG DOES THE TSX LISTING PROCESS TAKE?

The time will vary in each case, but it usually takes between six and 10 weeks to complete the initial processing of a listing application.

WHAT ARE THE KEY LISTING APPLICATION DOCUMENTS?

The listing documents for a TSX application are set out in Appendix C. Key listing documents, in addition to the application, include:

- Principal Disclosure Document

- Fees

- Financial statements

- Personal Information and criminal record consent forms for insiders

- Sponsorship report (if applicable)

- Technical reports for mining and oil and gas applicants

- Projected sources and uses of funds (if applicable)

- Legal opinion

During the review process, additional documents relating to the applicant, such as material contracts and security-based compensation arrangements may be requested.

WHAT IS THE "PRINCIPAL DISCLOSURE DOCUMENT"?

The Principal Disclosure Document provides a general description of the business and affairs of the applicant — similar to a Form 10-K in the U.S. For an interlisting, a document already created for use in the issuer's home jurisdiction can sometimes be submitted as a Principal Disclosure Document, or a document created for use in Canada or the U.S., depending on the circumstances of the issuer.

If the interlisting application is made concurrent with a prospectus filing in Canada, then a Canadian long-form prospectus is typically used as the Principal Disclosure Document.

If the interlisting application is made without a prospectus filing, then the issuer can file one of:

- A Canadian Annual Information Form (AIF) using form NI 51-102F2;

- An Annual Report for U.S. Issuers (Form 10-K) (if applicable);

- An Annual Report for Foreign Private Issuers (U.S.) (Form 20-F) (if applicable); or

- Another document or form from another jurisdiction including similar information to that contained in the AIF, provided it is dated within one year of the listing application submission and pre-cleared by the TSX.

WHAT ARE THE FEES?

A non-refundable application fee of $7,500 must be submitted with the initial documents for a company incorporated outside of Canada that is already listed on another exchange. The listing fees and continuing fees for listing on the TSX and TSX-V, as at the date of this document, are set out in Appendix D and Appendix E.

WHAT IS A "PERSONAL INFORMATION FORM"?

The TSX requires that a Personal Information Form (PIF) must be submitted for all company insiders including all senior officers and directors of the company and holders of greater than 10 per cent of the outstanding shares. A PIF provides background information regarding these persons. Alternatively, a Statutory Declaration may be filed where a PIF for an insider has been filed with the TSX in the last three years and there have been no changes.

WHAT ARE THE FINANCIAL STATEMENT REQUIREMENTS FOR A LISTING APPLICATION?

Financial statement requirements depend on whether the applicant's Principal Disclosure Document is an annual filing such as an AIF or its equivalent, or a prospectus for a Canadian public financing.

Applicants who are not filing a prospectus in Canada would be required to file their audited financial statements for the most recently completed financial year and unaudited financial statements for the most recent quarter (or half-year), depending on the jurisdiction.

Canada has converted to IFRS for financial years beginning on or after January 1, 2011.

Applicants filing a prospectus in Canada in connection with their listing application are required to meet the prospectus financial statement requirements. These include a statement of income, retained earnings and cash flow for each of the three most recently completed financial years, and a balance sheet as of the end of the two most recently completed years, all of which must be accompanied by an auditor's report.

There are exceptions to the rule if neither the issuer nor a predecessor entity has completed three financial years. Also, an issuer may be allowed to omit the statement of income, retained earnings and cash flow for the third most recently completed financial year as well as the balance sheet for the second most recently completed financial year, if the prospectus includes audited financial statements for a financial year ended less than 90 days before the date of the prospectus. They may also be omitted in a situation where the business of the issuer is not seasonal, and the issuer includes audited financial statements for a period of at least nine months commencing the day after the most recently completed financial year.

For any quarterly period ending subsequent to the most recently completed financial year, the prospectus must also include quarterly financial statements with comparatives for the corresponding period in the immediately preceding financial year.

WHAT ARE THE "PROJECTED SOURCES AND USES OF FUNDS" REQUIREMENTS?

Mining and oil and gas applicants must file a projected sources and uses of funds statement for a period of 18 months, including related assumptions, presented on a quarterly basis and prepared by management, unless the applicant qualifies as an "exempt issuer" for TSX purposes. Technical reports required by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101) and National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities (NI 51-101) should include a recommended work program that is consistent with the 18-month projection of sources and uses of funds.

Technology applicants must file a projected sources and uses of funds statement, including related assumptions, for a period of 12 months, presented on a quarterly basis, prepared by management.

Research and development applicants must prepare the same for a period of 24 months.

WHAT IS THE "SPONSORSHIP" REQUIREMENT?

A TSX listing applicant may be required to obtain "sponsorship" by a participating organization or member of the exchange. This is a one-time requirement at the time of the original listing. Following a due diligence review of the applicant to confirm compliance with TSX listing requirements, the sponsor provides comments in writing to the exchange as part of the listing application.

Sponsorship is not required for a company applying to list as an "exempt issuer." Sponsorship may also be waived if a company completes a prospectus offering or brokered financing immediately before or concurrently with the listing.

WHAT IS AN "EXEMPT ISSUER"?

Exempt issuers are exempt from certain approval and notice requirements normally imposed by the TSX, as well as certain application criteria such as projected sources of funds and sponsorship. For example, "non-exempt" issuers must give notice to the TSX of any proposed material change in the business or affairs of the issuer.

Exemption criteria include: a) net tangible assets of $7,500,000; b) earnings from ongoing operations of at least $300,000 before taxes and extraordinary items in the fiscal year immediately preceding the filing of the listing application; c) pre-tax cash fl ow of $700,000 in the fiscal year immediately preceding the filing of the listing application and an average pre-tax cash fl ow of $500,000 for the two fiscal years immediately preceding the filing of the listing application; and d) adequate working capital to carry on the business and an appropriate capital structure.

Exceptional circumstances may justify the granting of an exempt issuer status, such as an affiliation with a substantial established enterprise and/or an exceptionally strong financial position.

WHAT ARE THE "TECHNICAL REPORT" REQUIREMENTS FOR MINING AND OIL AND GAS APPLICANTS?

Applicants are required to commission full and up-to-date technical reports on their material properties, in compliance with NI 43-101 for mining properties, and NI 51-101 for oil and gas properties.

Reserve and resource reporting under NI 43-101 incorporates the standards adopted by the Canadian Institute of Mining, Metallurgy and Petroleum. Certain foreign resource and reserve standards are permitted for foreign issuers for the purpose of reporting under NI 43-101, including the Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee Code (JORC Code); the U.S. SEC Industry Guide 7; the Reporting Code of the Institute of Materials, Minerals and Mining in the United Kingdom; and the South African Code for Reporting of Mineral Resources and Mineral Reserves (SAMREC Code), provided that certain aspects are reconciled to Canadian standards. Proposed amendments to NI 43-101 published for comment at the time of writing this guide would eliminate the need for reconciliation and expand the list of acceptable foreign codes.

Reserve and resource reporting under NI 51-101 must comply with standards set out in the Canadian Oil and Gas Evaluation Handbook, unless an exemption is obtained.

Under NI 43-101 and NI 51-101, when filing a technical report, a company must file a certificate of each qualified person responsible for preparing each portion of the report, and the certificate must be dated, signed and, if the qualified person has a seal, sealed.

The purpose of NI 43-101 and NI 51-101 is to prevent the dissemination to potential investors of false or misleading information regarding mineral properties. NI 43-101 and NI 51-101 apply to all disclosure, oral or written, and must be prepared by qualified persons specified in these national instruments.

WHY IS THE LEGAL OPINION REQUIRED AND CAN MY LOCAL COUNSEL PROVIDE IT?

The purpose of the legal opinion is to confirm that the applicant is a legal entity, and that the securities listed have been legally created and will be validly issued. The opinion is required for all TSX listing applicants. Counsel in the local jurisdiction of the applicant can provide this legal opinion. The TSX-V does not require a legal opinion for a listing application.

To view this document in its entirety please click here.

Footnotes

1 "G&A" means general and administrative expenses.

2 "advanced exploration property" refers to one on which a zone of mineralization has been demonstrated in three dimensions with reasonable continuity indicated. The mineralization identified has economically interesting grades.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.