Introduction

Shariah (i.e. Islamic Law) compliant finance has grown rapidly over the past few years and is now considered an increasingly important element of the global financial market. These products have come to cover the full spectrum of banking, capital markets, asset management and more recently, insurance (Takaful) business. The Banker's 2010 survey of financial institutions practising Islamic finance reveals that Shariah-compliant assets rose by 8.85% from $822 billion in 2009 to $895 billion in 2010. Islamic finance has had a compound annual growth rate (CAGR) of 23.46% from 2006 to 2010.

Since its inception almost four decades ago, the number of Islamic financial institutions has increased to more than 650 hundred across 54 countries. Though primarily concentrated in Middle East, African and South East Asian countries, a number of Islamic financial institutions are expanding into Europe and North America. Many of the growing number of companies being attracted to Islamic finance are conventional institutions looking to tap into rising market demand, alternative investment opportunities and fresh sources of funding. Major conventional banks have established Shariah-compliant subsidiaries and counters within their Western style branches. According to The Banker's "Top 500 Islamic Financial Institutions 2010" report, 199 of these conventional institutions have opened Shariah- compliant counters. In fact, HSBC's Islamic finance subsidiary, HSBC Amanah, is amongst the top 10 Islamic finance institution with over $15 billion in Shariah-compliant assets at June 30, 2008. The other top Islamic financial institutions are Middle Eastern domiciled institutions.

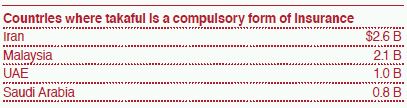

Takaful, like other Islamic finance concepts, has more than 1,400 years of history, but the growth in Takaful-dedicated companies is in its early stages. Iran, where Takaful is the compulsory form of insurance, is the largest market, with premiums of $2.6 billion. It is followed by Malaysia ($2.1 billion), UAE ($1.0 billion) and Saudi Arabia ($0.8 billion). Together, these four countries account for over three quarters of the global market. Other key markets for Takaful are Kuwait, Indonesia, Bahrain and Qatar.

As Muslin countries have grown outside of the Middle East, a number of Western countries, including Canada, have shown an interest in Islamic finance. Some countries, such as the United Kingdom have become significant centres.

Canada: Scope and Development

The young Canadian Muslim community, with an average age of 28 years, is estimated to be over one million people and expected to reach around 5% of the total Canadian population by 2017. With growth concentrated in major cities and the fact that the community is generally highly educated, the demand is increasing for Islamic financial services. This demographic trend, when combined with the strengths of Canadian banks, which we have outperformed their counterparts in recent years with their sound financial management and low default rate on obligations, suggests there is every reason to believe that Canada could emerge as a North American centre for Islamic finance.

In recent years, a number of Canadian financial entities have focused and catered to this growing demand from the Muslim and non-Muslin communities. Some of the key developments in Canada include:

- Standard & Poor's has launched a Shariah-compliant version of the S&P/TSX 60. The S&P/TSX 60 Shariah Index is highly correlated to the S&P/TSX 60 Index and as such provides a comparable investment index while adopting explicit selection criteria defined by Shariah.

- An Islamic Finance Advisory Board (IFAB) has been formed to respond to the need of independent advisory and audit services for the industry.

- The Co-operators has launched auto Takuful in partnership with Ansar Cooperative Housing Corporation.

- At least two mutual funds, frontierAlt and Global Prosperata, have launched mutual funds that are designed to hold only investments that are Shariah-compliant.

- UM Financial's real estate investment subsidiary is offering Shariah-compliant home financing.

- Launch by UM Financial of Shariah-compliant pre-paid MasterCard.

Shariah-Compliant Products Explained

Shariah refers to the body of formally-established laws based primarily on Quranic commandments. Shariah not only governs the religious matters but also political, economic, civil, criminal, ethical, social and domestic affairs of practicing Muslims. The basic ends of Islamic economy as explained by some scholars are:

- Economic well-being of the communities with full employment and optimum rate of economic growth should be ensured.

- Socio-economic justice and equitable distribution of income and wealth should always be considered.

- The medium of exchange should be a reliable unit, a just standard of deferred payments and a stable store of value. This in itself will lead to stability in the value of money.

- Savings should be mobilized and invested for economic development in an equitable manner as such that a just return is ensured to all parties concerned.

Islamic commercial jurisprudence consists of principles and rules that must be observed in transactions acceptable in Islam. These principles are:

- Elimination of uncertainty (Gharar)

- Prohibition against Gambling (Maisir)

- Prohibition against charging interest (Riba)

All these principles not only apply to transactions between the financial institutions and their customers but also to other aspects of the business like Retakaful (reinsurance).

How Does it Work?

Takaful, similar to mutual insurance, allows for the transparent sharing of risk by pooling individual contributions for the benefits of all subscribers. Under the Takaful Act of MalayTakaful, similar to mutual insurance, allows for the transparent sharing of risk by pooling individual contributions for the benefits of all subscribers. Under the Takaful Act of Malaysia, Takaful is defined as, "a scheme based on brotherhood, solidarity and mutual assistance, which provides for mutual financial aid and assistance to the participants in case of need whereby the participants mutually agree to contribute for that purpose". In literal terms, Takaful is derived from an Arabic word that means a joint guarantee.

The core of Takaful contract is "tabarru", which means a donation, gift or contribution that makes the element of uncertainty allowable. A Takaful contract is a combination of tabarru (gifting) and agency and/or profit sharing contract between the policyholder and the pool of insured. The operations often have a two-tier structure consisting of one or more funds belonging to the Takaful policyholders, above which sits an operating company with share capital responsible for overall governance, risk underwriting and investment management.

In practice, Takaful policyholders pay their contributions/premiums based on an actuarially-determined model similar to a conventional model without a margin for profit, but including a margin for risk. The aim is that premiums cover the expected losses and a component of expenses directly related to policyholders. Policyholders pay management fees to the shareholders of the Takaful operating company as a compensation for managing their policies. This model is referred to as al-Wakala (agency-fee model) which is prevalent in the Middle East.

Alternate model, commonly used in Malaysia, is referred to as al-Mudaraba (profit-sharing model) is structured as a profit-sharing arrangement between the operating company and the Takaful policyholders' fund, usually based on the fund's underwriting result.

Under both models, Takaful operating companies make their loss expectation conservatively. Surplus is returned to the Takaful policyholders by way of reductions of future premium or through refunds. Theoretically, deficits, if any, should be reimbursed by the policyholders similar to the reciprocal insurance exchanges that we see in Canada. However, in practice, the shortfalls are bridged through an interest-free loan from the operating company with an expectation to recover through the surpluses in the future policy periods.

Another important aspect of Takaful operations is to ensure that the investments of the Takaful fund are made in accordance with the Shariah. Any investment in prohibited businesses involved with alcohol, arms and ammunition, conventional financing products based on interest, gambling, pornography and pork production. Any unintentional income generated from such activities needs to be donated to charitable causes.

Key Challenges Faced

While Takaful operators globally are excited by the industry growth statistics, some critical challenges are faced by businesses in Canada include:

- Licensing from Regulators: There is no evidence currently that Canadian regulators are considering an entirely separate regulation system for Islamic banking institutions. Rather, the focus is likely to be on considering the extent to which, if at all, current rules may need to be revised to accommodate banking business that is compliant, in whole or in part, with the requirements of Islamic commercial law.

- Availability of Shariah Scholars: For Islamic finance providers, gaining approval of Shariah compliance for a product before its launch is vital. Equally important is recognizing that Shariah compliance is a continuous process that means their products and services are adequately monitored. Shortage of suitable, trained and qualified scholars in Canada is perhaps the biggest obstacle to growth.

- Inconsistency of Certain Shariah Law: While Shariah law is generally based on explicit religious texts some rules are derived from Shariah scholars' interpretations and understanding of the law. These interpretations can and do differ between Shariah scholars and schools.

- Awareness and Education of Takaful Products: Awareness and consumer education is low for Takaful products, even amongst Muslims, as they are relatively new. It will take considerable effort by market participants to promote a greater understanding of the unique product features and benefits and profit-sharing mechanism.

- Shariah-Compliant Investments: Though availability of suitable Shariah-compliant investments has increased over the years, the options are still limited. What's more, certain types of derivatives that are used for hedging against currency, interest rates and other risks are not acceptable to most Shariah scholars.

- Reinsurance: The absence of strongly capitalized local and/or global Retakaful players may limit the development of the Takaful market. Currently, some Takaful companies rely on conventional reinsurers, although this approach is frowned upon by the Islamic scholars.

- Dispute Resolution: In the case of disputes arising from contracts for Islamic transactions, the enforceability of terms and conditions depends on the governing law. It is unlikely that a Canadian court will give a verdict based on Shariah law.

What this Means for the Canadian Insurance Industry

Examples in other developing Islamic finance centres suggest that challenges faced by a new centre can be overcome. Regulatory hurdles can be fixed with minimum bureaucratic effort without significant change to the existing infrastructure. In the UK, the Financial Services Authority (FSA) made little to no changes to their existing regulations and is able to govern Islamic financial institutions in the same way as a conventional institution. FSA's experience may provide a framework for considering how best to address these issues in the Canadian context.

As the industry develops and demand grows, new direction and resolution are discovered constantly. Scholars are realizing the pressing need for standardizing Shariah. This has led the Accounting and Auditing Organization for Islamic Financial Institution (AAOIFI) to adopt a more focused approach in preparing accounting, auditing, governance, ethics and Shariah standards that are acceptable to all scholars.

Global Takaful premiums have steadily grown over the years and industry pundits estimate this growth to continue. However, in Canada, other than some auto Takaful, nothing noteworthy has been written so far. Now is the time for Canada to get on board this growing market.

Learning from the success stories of other countries with similar markets and regulatory standards provides the Canadian insurance industry with the opportunity to become a successful and developing Islamic finance centre'.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.