Aligning business models to support customer-driven innovation and growth is the most significant transition facing the insurance industry today. In this first part of a two-part article, we examine developments in market share of the property and casualty (P&C) insurance distribution channels. In the second part, we address how demographics and channel access impact insurer results.

Insurance companies utilize two main distribution channels: the independent channel, where products are sold by independent agents or brokers representing several companies; and the direct channel, where products are sold through captive agents, by mail, telephone, the Internet and other means. Many insurance companies pursue a straddling strategy, simultaneously operating both independent and direct channels.

A significant amount of academic research has been devoted to reviewing property and casualty insurance distribution, in particular to investigating the persistent co-existence of multiple channels. The "efficient market theory" suggests that a channel with cost advantages should eventually overcome a more costly channel. While several research studies show that the independent channel has higher costs to the insurer than the direct channel, there is no definitive conclusion on why the independent channel endures.

Popular opinion on the future of the independent channel is similarly mixed. Some point to a steady drop in broker market share in North America as evidence of the channel's inevitable decline, while others claim the market is simply seeking a new equilibrium in response to recent changes in the macro-and micro-environment.

Applying linear regression to net premiums written in Canada over the last 11 years, the data suggests that the independent channel1 is losing market share to the direct channel at a rate of approximately 0.43% per year. At that rate, the independent channel's 2009 market share of 64% will drop to about 60% by 2019. However, viewing the same data by line of business reveals other insights into the independent channel:

- Automobile Insurance – losing approximately 0.81% market share per year

- Personal Property Insurance – losing approximately 1.27% market share per year

- Commercial Property Insurance – gaining approximately 0.13% market share per year

- Liability Insurance – gaining approximately 0.82% market share per year

With the slight exception of liability insurance, the data remains insensitive to the hard and soft market insurance cycle; although the rate of change is small, it appears to be steady. If we apply the efficient market theory to the data, it suggests that the cost advantages of the direct channel are slowly winning over the less efficient independent channel for automobile and personal property insurance.

Therefore, absent a transformative event in the economic model of the independent channel, this theory also implies that insurers selling automobile and personal property insurance should be considering an exit strategy for their use of the independent channel as a distribution methodology.

But if the direct channel has intrinsic cost advantages, why has the rate of change in market share been so slow? Despite known cost differences between the channels, research has found that little meaningful variation exists in profitability. This appears to be supported by evidence in Canada – as the table below shows, there is less than a 1% variation in the combined expense ratio between the independent and direct channel.

Consequently, from an insurer's perspective, cost alone does not appear to provide significant explanatory power for the trend in market share. But is the trend currently evident in Canada representative of all jurisdictions? Interestingly, in Germany the independent channel is gaining market share despite insurers owning the client list in both the independent and direct channels.

Arguably, there is a natural balance for both the independent and direct channel, and as a result, factors other than cost explain their co-existence. If this is true, it may not be the right time or place for insurers to consider applying an exit strategy.

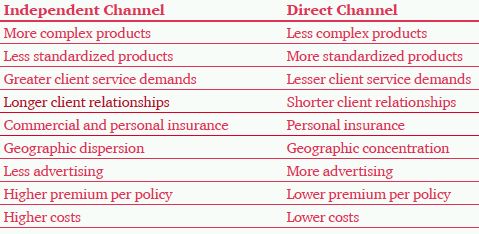

Researchers have analyzed many factors in an attempt to explain the co-existence of these distribution channels including: the degree of lateral and vertical integration, insurer size and geography, product complexity, consumer search and transaction costs, profitability, ownership of client lists, consumer uncertainty, channel compensation and service quality. While synthesis of such varying factors is challenging, the research identifies several characteristics generally shared by insurance companies active in each channel.

According to these findings, a client requiring complex commercial insurance products is more likely to use the services of a broker who can:

- Identify and explain the type of coverage required;

- Match the need of the client with the appropriate market;

- Assist in managing the claims avoidance, mitigation and resolution processes; and

- Maintain an ongoing relationship to minimize the renewal costs associated with remarketing.

On the other hand, a client who requires a simpler personal lines product may feel comfortable with simply the information provided by online quote comparison tools and may seek to purchase a lower cost product directly from the insurer.

More so than insurer costs, it is this consumer preference that drives insight into the question of channel usage. Put quite simply, the two channels co-exist because they serve different segments of the market. A client selecting the independent channel likely has different needs than one selecting the direct channel even if the insurance coverage ultimately purchased is nearly identical. Over time, consumers will self-select channels that are appropriate to their needs. Insurance companies applying a singular cost-reduction philosophy between channels or even across a single channel without regard to client segmentation risk alienating their clients. Insurers lacking insight into consumer needs or, failing that, the requisite channel choice will find themselves struggling to achieve organic growth.

PwC's 2009-2010 Global Sales Survey supports this finding. The responses identified three key takeaways:

- Sales excellence is a differentiator. We found that developing companies continually struggle with fragmented customer segmentation, channel, and coverage strategies that limit their actual and potential penetration in the marketplaces they target. Developing companies also remain product-centric rather than client-centric.

- Leaders focus on developing more advanced selling capabilities. Companies that deliver greater results focus on better understanding customer needs and tailoring solutions to those needs; developing companies focus on qualifying opportunities and increasing the number of qualified opportunities.

- There are significant opportunities for improvement. We believe that both leading and developing companies do not adequately leverage the right dimension of data, resulting in issues such as channel confusion and opportunity loss due to gaps in client management.

Overall, many companies are caught between two conflicting objectives: deliver greater organic revenue while reducing overall costs. The results of PwC's Sales Effectiveness study revealed that 86% of leading organizations believe that the ability to see "one view of the customer" improves sales performance compared to 50% of developing organizations. Meanwhile, 78% of leading companies feel that they know the cost of their relative sales channels while only 42% of developing companies agree.

Customer needs, preferences and buying behaviors are changing and thus so are insurance distribution market shares. Changing customer demands and intense competition are forcing insurers to rethink their customer strategy. Aligning business models to support customer-driven innovation and growth is the most significant transition facing the insurance industry today; consumers want to choose how they interact with insurers, including seamless transition between web, agents and call centers.

For automobile and personal property insurance, direct channels will continue to capture incremental market share from the independent channel as consumers increasingly demand channel access alternatives. Better market segmentation and sales management can help drive profitable growth and sustainability in the independent distribution channel. For commercial and liability insurance, independent channels will remain the dominant distribution methodology - a perfect opportunity to consider reducing the additional costs inherent to this channel.

Footnote

1. The independent channel in this analysis excludes ICBC, SAF and Lloyd's.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.