Copyright 2010, Blake, Cassels & Graydon LLP

Originally published in Blakes Bulletin on Mining, July 2010

In the most recent provincial budget tabled on March 30, 2010, the Government of Quebec proposed substantial changes to the mining duties regime set forth in the Mining Duties Act (Quebec) (the Act) in order to support its objective of balancing the provincial budget by fiscal year 2013-2014. The proposed amendments are expected to generate an additional C$240-million over the next five years. Officially, this reform is motivated by the government's desire to correct certain shortcomings such as the calculation of the gross value of annual output and the recognition of certain expenditures and allowances and to see the province fairly compensated for the depletion of its non-renewable natural resources belonging to the public domain. This reform is also in line with province's Mineral Strategy unveiled in June 2009. See our July 2009 Blakes Bulletin on Mining: Quebec Government Unveils Mineral Strategy for a discussion of this new mineral strategy.

This bulletin summarizes some of the more noteworthy measures proposed under the mining duties regime reform. It is not intended to be an exhaustive review of all of the proposed amendments and is based solely on the budget documents published by the government, as the draft legislation has yet to be released. In general, most of the proposed changes apply to fiscal years that include the budget date March 30, 2010.

I. Quebec Mining Duties Rates Increased

Under the existing regime, a mine operator must pay a 12% mining duty on the annual profit generated from its mines in Quebec (the Consolidated Annual Profit). In general terms, the current rules provide that an operator determines its Consolidated Annual Profit by subtracting from the gross value of its consolidated annual output (generally the market value of mineral substances sold or consumed by the operator) certain specific reasonable expenses and certain allowances provided for under the Act whether or not they relate to one or more mines.

The specific expenses include: (i) expenditures attributable to the mining operation; (ii) expenditures incurred for scientific research and experimental development work (SR&ED); and (iii) gifts made in the Province of Quebec.

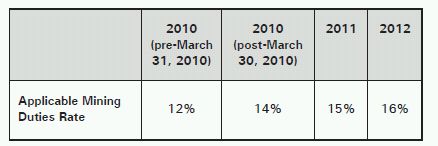

The allowances include: (i) a depreciation allowance; (ii) an allowance for exploration, mineral deposit evaluation and mine development expenses (the Global Allowance); (iii) an additional exploration allowance; (iv) a processing allowance; (v) an additional depreciation allowance; and (vi) an additional allowance for a mine located in northern Quebec. In order to obtain what the Government of Quebec deems to be fair compensation for the use of the province's non-renewable resources, the existing 12% tax rate will gradually be raised to 16% by January 1, 2012 as follows:

Where a mine operator's fiscal year straddles the rate change date, the rate will be a weighted average rate reflecting the number of days of the fiscal year included in each of the periods concerned. Installment payments will generally have to be determined using the weighted average rate applicable to such year.

II. Calculation of Mine Operator's Annual Profit or Loss : A Two-Step Approach

The basis currently used to determine the Consolidated Annual Profit for a fiscal year may enable a mine operator that operates more than one mine to pay very low mining duties, notwithstanding that the value of the resources at the mine shaft head of one of these mines is significant. In order to address this particular issue, the reform introduces a two-step approach that will generally apply to determine the operator's Consolidated Annual Profit:

1. Computation of the operator's annual profit on a mine-by-mine basis; and

2. Computation of the operator's Consolidated Annual Profit.

Step 1: Computation of Operator's Annual Profit for Each Mine

For each particular mine situated in Quebec, an operator will establish its annual profit using the same general guidelines as those currently used to establish the Consolidated Annual Profit, subject to the following rules:

- the included items will be the portion of the operator's gross value of annual output and other income that is reasonably attributable to the particular mine;

- the deducted items will be the total of (A) the portion of the following amounts that are reasonably attributable to the operation of the particular mine: (i) the expenditures; (ii) the amount of the depreciation allowance; (iii) the amount of the additional depreciation allowance; and (iv) the amount of the additional allowance for a Far North (as hereinafter defined) mine or the amount of the additional allowance for a mine located in Northern Quebec (as hereinafter defined), as the case may be; and (B) the amounts determined from: (x) the processing allowance; and (y) the additional allowance for Post-EDA (as hereinafter defined).

The effect of this movement from a consolidated computation to a computation per individual mine reform may jeopardize certain deductions in circumstances where the operator generates annual losses for a particular mine.

Step 2: Computation of the Operators' Consolidated Annual Profit

The operator's Consolidated Annual Profit for a fiscal year will correspond to the excess of the sum of the annual profits from each of the mines it operates over the aggregate amount comprised of: (i) the exploration allowance; (ii) general and administrative expenditures relating to exploration work; (iii) the additional exploration allowance; (iv) the allowance for Pre-EDA (as hereinafter defined); (v) EEA (as hereinafter defined); (vi) gifts made in the Province of Quebec as deductible under the existing rules (without exceeding 10% of the sum of the annual profits of each mine); and (vii) expenditures for SR&ED as deductible under the current rules. When the preceding computation is made, the annual loss of the mine operator from another mine for a given fiscal year will be deemed to be zero.

These changes will apply to fiscal years beginning after March 30, 2010.

III. Allowances Revised

Changes will be made to three of the allowances mentioned above which a mine operator may claim in computing its Consolidated Annual Profit.

Depreciation Allowance Rate Reduced

The rate of the depreciation allowance will be reduced to better reflect the useful life of assets.

Under the current regime, the depreciation allowance an operator may deduct in respect of property of a particular class in calculating its Consolidated Annual Profit generally corresponds to the lesser of: (i) a percentage of the capital cost of the property of such class, and (ii) the undepreciated capital cost of property of such class at the end of the year. For roads, buildings and equipment actually used in mining operations, a class exists according to the purchase date. For property purchased prior to April 1, 1975, the allowance rate is 15%, and for property acquired after March 31, 1975 but before May 13, 1994, the allowance rate is 30%. For roads, buildings, equipment and service property actually used in mining operations acquired after May 12, 1994, the depreciation allowance rate is 100%.

Subject to certain transitional rules, a fourth class will be created for such property acquired after March 30, 2010. The depreciation allowance rate for such new class will be 30%. In order to gradually limit the 100% depreciation of the third class property, the rules will specify that an operator may not claim a depreciation allowance regarding the fourth class property until the balance of the undepreciated capital cost of the third class property equals zero. This represents a considerable change.

Processing Allowance Changed

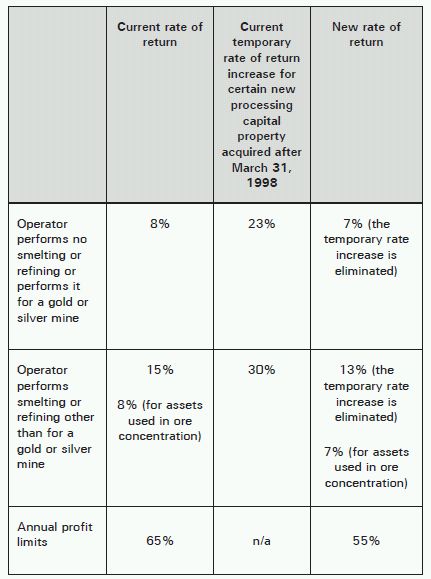

A component of a mine operator's Consolidated Annual Profit may be attributable to value added beyond the mine shaft head through the processing of the mineral substance. For this reason, the mining duties regime provides for an allowance computed with statutory rates of returns that are applied on the capital cost of properties used by the operator in processing which are in its possession at the end of the fiscal year. This is the processing allowance.

The actual processing allowance may not exceed the lesser of the amount determined based on the statutory rates of return and 65% of the operator's Consolidated Annual Profit, determined before claiming the processing allowance, the additional depreciation allowance and the additional allowance for a northern mine, if applicable. The changes regarding the statutory rates of return are summarized in the table below:

These new rates and the elimination of the temporary rates will apply in respect of an operator's fiscal year ending after March 30, 2010. For fiscal years that include such date, the rates actually applicable for such fiscal year will be weighted rates reflecting the number of days of the fiscal year preceding and following March 31, 2010.

Northern Mine Additional Allowance Replaced

Prior to March 30, 2010, in calculating its Consolidated Annual Profit for the first 10 fiscal years of operation of a mine located north of 55° North latitude (Far North), a mine operator was allowed to claim an additional allowance for such mine. This allowance was based on the capital cost for the operator of each Quebec asset acquired after May 9, 1995 and used in processing ore from the mine, less any allowance for a northern mine previously deducted. This additional allowance for a northern mine will be replaced with an additional allowance for a mine located in the Far North and the Mid-North, which will cover a larger territory (Northern Quebec). The Mid-North will refer to:

- the territory included between 50°30' North latitude and 55° North latitude and limited to the East by the Grenville Front; and

- the part of the territory of the Côte-Nord located between 59° West longitude and 66° West longitude.

In addition, the allowance will no longer be based on the capital cost for the operator of the mine of each asset situated in Quebec and used in processing ore from the mine; rather, the amount of the new additional allowance will correspond, over a 36-month period, to C$2-million for each new mine located in the Mid-North and C$5-million for each new mine located in the Far North, up to the annual profit from such new mine, calculated before such allowance.

The allowance will only apply with respect to annual profit derived from the new mine and attributable to the 36-month period beginning on the date when such mine reaches the stage of production where it is producing reasonable commercial quantities (see below). To the extent that the amount of C$2-million or C$5-million, as the case may be, in respect of a mine is limited by the annual profit from the mine for a particular fiscal year, the excess may be carried over to a later fiscal year included in such 36-month period.

The current additional allowance for a northern mine will continue to apply to a mine for which ore processing has started no later than March 30, 2010. Therefore, unless a mine operator can still claim the current additional allowance, the new additional allowance for a mine located in Northern Quebec will apply to a new mine that enters production in reasonable commercial quantities after March 30, 2010.

IV. Changes to Exploration, Mineral Deposit Evaluation and Mine Development Expenses Pool

Exploration, mineral deposit evaluation and mine development expenses are important items in the calculation of a mine operator's Consolidated Annual Profit. A significant part of these expenses can give rise to the Global Allowance which the operator can deduct in calculating its annual profit for a given year. Other expenses that can also be qualified as mineral deposit evaluation and mine development expenses, but that are not covered by the Global Allowance, are deducted in calculating the annual profit for the fiscal year during which they are incurred.

Substantial changes will be made to the treatment applicable to the exploration, mineral deposit evaluation and mine development expenses an operator may claim, in particular by dividing the expenses into three separate cumulative accounts giving rise to three separate allowances (all three accounts being used in computing a mine operator's annual profit in Section II above). The definitions of the expenses covered by each of these separate cumulative accounts will draw broadly from the definitions of "Canadian exploration expenses" and "Canadian development expenses" found in the Taxation Act (Quebec).

The concepts of a "mine which has come into production in reasonable commercial quantities" and a "new mine that enters production in reasonable commercial quantities" used in the definitions of the Taxation Act (Quebec) will also be used for the new definitions of the expenses covered by each of these cumulative accounts.

First Cumulative Account: Cumulative Exploration Expenses

The exploration expenses that will be added to this cumulative account (EEA) will include expenses incurred to determine the existence of a mineral substance in Quebec, to locate such substance or determine its extent or quality, including those expenses incurred during prospecting, geological, geophysical and geochemical studies, drilling and digging of exploration trenches or holes or preliminary sampling, other than any mineral deposit evaluation and mine development expenses before production, any mineral deposit evaluation and mine development expenses after production and any expense that can reasonably be related to a mine that has come into production in reasonable commercial quantities or to a real or possible extension of such mine. Under the actual regime, most of these expenses form the Global Allowance.

Particular measures are also proposed to maintain the 25% increase already applicable to certain exploration expenses incurred in the Mid-North and the Far North.

The maximum amount deductible in relation to the EEA will depend on whether or not the operator is an eligible operator. An eligible operator is an operator who: (i) develops no mineral substance in reasonable commercial quantities at the end of the fiscal year; and (ii) is not associated (for income tax purposes) with another entity that develops a mineral substance in reasonable commercial quantities.

An eligible operator will be allowed to deduct an amount not exceeding the balance in its EEA at the end of the fiscal year. An operator other than an eligible operator will be allowed to deduct from the EEA an amount not exceeding the lesser of: (i) the balance of his EEA at the end of the year; and (ii) 10% of its annual profit for the year calculated before such allowance and the Pre-EDA (as hereinafter defined).

This EEA will apply to an operator's fiscal year ending after March 30, 2010 as regards exploration expenses incurred after such date. For an operator with a fiscal year which includes March 30, 2010, the EEA will be reduced in proportion to the number of days that are in the fiscal year but prior to March 30, 2010.

Second Cumulative Account: Cumulative Mineral Deposit Evaluation and Mine Development Expenses Before Production

The mineral deposit evaluation and mine development expenses before production that will be added to this cumulative account (Pre‑EDA) will include expenses incurred to bring a new mine for a mineral substance in Quebec to the stage of production in reasonable commercial quantities, including expenses for excavation, clearing and removal of surface layers, for boring a mine shaft and for the construction of an adit or other underground entry, provided such expenses were incurred before the new mine enters into production in reasonable commercial quantities.

An operator will be able to deduct an amount not exceeding the balance of its Pre-EDA at the end of the fiscal year on account of this allowance.

This allowance will apply to an operator's fiscal year ending after March 30, 2010 as regards Pre-EDA incurred after such date.

Third Cumulative Account: Cumulative Mineral Deposit Evaluation and Mine Development Expenses After Production

The mineral deposit evaluation and mine development expenses after production (Post-EDA) that will be added to this cumulative account will include expenses incurred, other than the capital cost of a depreciable property, either:

- to bore or excavate a mine shaft, a main haulageway or similar underground structure designed for continuous use for a mine for a mineral substance in Quebec which is built or excavated after the mine goes into production in reasonable commercial quantities; or

- for the extension of such a shaft, haulageway or structure.

For a fiscal year beginning after March 30, 2010, the operator will be able to deduct on account of the Post- EDA allowance of each mine an amount corresponding to the lesser of:

- 30% of the balance of its cumulative mineral deposit evaluation and mine development after production account of such mine at the end of such fiscal year; or

- the annual profit from such mine calculated before such Post-EDA and the processing allowance.

Subject to particular rules, this third new allowance will apply to an operator's fiscal year that includes March 30, 2010 as regards Post-EDA incurred after that date.

Other Proposed Measures Affecting Exploration Expenses

The existing regime provides for an additional exploration allowance which is based on the expenses incurred by the operator after May 12, 1994 in respect of exploration or underground core drilling work carried out in Quebec, where the mineral substances in respect of which the work is carried out form part of the domain of the state and where the work is performed in connection with the operator's mining operation: (i) elsewhere than on land under a mining lease or mining concession and before ore is extracted; or (ii) on land under a mining lease or mining concession, except land from which ore has been or was extracted in the five fiscal years preceding that time.

Such expenses incurred after March 30, 2010 will no longer be eligible for the additional exploration allowance.

V. Adjustments Made to Credit on Duties Refundable for Losses

The credit on duties refundable for losses (Credit for Losses), which has substantial effects on the net compensation the Quebec government collects under the mining duties regime, will be modified. Briefly, under the existing rules, the Credit for Losses an operator may claim for a fiscal year corresponds to 12% of the lesser of:

- the "adjusted annual loss" for that fiscal year; and

- certain exploration, mineral deposit evaluation and mine development expenses incurred for the fiscal year which may not exceed the amount deducted on account of the Global Allowance in calculating the Consolidated Annual Profit for the fiscal year.

Pursuant to the proposed amendments to the Act, the rate for the Credit for Losses will gradually be increased at the same pace as the mining duties rate, reaching 16% on January 1, 2012. As well, the determination of the Credit for Losses will depend on whether or not the operator is an eligible operator (i.e., the corporate group did not reach a commercial development stage).

Thirdly, the Credit for Losses will be limited to 50% of the expenses an eligible operator deducted on account of the EEA. The portion of such expenses that the operator does not claim as a deduction in calculating its annual profit for the fiscal year will remain allowable in calculating its annual profit for a subsequent fiscal year.

Because of the increase in the tax rate to 16%, the Credit for Losses an eligible operator may claim regarding its exploration expenses can reach the lesser of 8% of such expenses and 16% of the operator's adjusted annual loss.

Finally, the amount of the Credit for Losses will also vary depending on whether the operator qualifies as an eligible operator.

In the case of an eligible operator, the 16% tax rate will be applied to the lesser of:

- the operator's adjusted annual loss; and

- the total of (i) 50% of the expenses the operator incurred, not exceeding the amount it deducted on account of the EEA, and (ii) the mineral deposit evaluation and mine development expenses before production it incurred, not exceeding the amount it deducted on account of the Pre-EDA.

In the case of an operator, other than an eligible operator, the 16% tax rate will be applied to the lesser of:

- the operator's adjusted annual loss; and

- the mineral deposit evaluation and mine development expenses before production it incurred, not exceeding the amount it deducted on account of the Pre-EDA.

The new rules will generally apply to fiscal years ending after March 30, 2010. Special rules have been proposed to deal with a fiscal year that includes March 30, 2010.

VI. Other measures Precious Stones

The Government of Quebec is of the view that the current regime is not well-adapted to diamonds, emeralds, rubies or sapphires, particularly as regards the determination of the gross value of annual output. Special rules will be proposed to facilitate the determination of the gross value of annual output attributable to this resource.

These new rules will apply to a mine operator's fiscal year beginning after March 30, 2010.

Amounts Paid to a Community or a Municipality

In the past, amounts paid under agreement by an operator to a community or a municipality which are intended to provide such community or municipality with benefits or spinoffs have been considered to be non-deductible for the reason that they do not relate directly to the operator's mining operation. Under the new legislation, it will be clarified that such amounts are not deductible unless they represent a gift that is otherwise deductible.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.