INTRODUCTION

The income trust phenomenon has been a uniquely Canadian experience. Starting in the late 1990s, these publicly-traded unit trusts expanded rapidly beyond their traditional sphere of oil and gas royalty investments and came to dominate the Canadian public real estate market, as well as to occupy a central position in the Canadian capital markets for virtually all business sectors. Their structure as flow-through entities for tax purposes required that they provide a high level of cash-flow to investors. This found much favour in the Canadian capital markets, satisfying a demand for higher yield investments. At the same time, this structure enabled significant Canadian tax savings for both Canadian and foreign unitholders.

Income trusts were a victim of their own success, however, and to deal with a perceived drain of tax revenues the Canadian government announced in the fall of 2006 changes to the Canadian tax rules that apply to the trusts. These changes eliminated the tax benefits for income trusts, other than qualifying real estate investment trusts (REITs). The implementation of these tax changes was deferred until 2011 for existing income trusts in order to allow the market time to react. As a result, 2010 will be a critical year for income trusts. With the prospect of taxability next year, trusts will have to consider whether to convert (or in many cases convert back) into traditional corporate form. Special tax rules to facilitate this will add pressure to the need to act now, as they will only apply until the end of 2012. REITs will be engaged in a different process, ensuring that they continue to qualify for flow-through treatment under new, more stringent requirements that also take effect in 2011.

There are currently over 150 publicly-listed income trusts in Canada. It is expected that most if not all of these trusts will be evaluating their options in light of this looming deadline. Many will choose to convert to corporate form. However, just as the initial announcement of changes to the tax treatment of income trusts sparked a flurry of acquisition and privatization transactions, the current situation is likely to see an increased interest in acquisition opportunities on the part of the trusts and investors who have adequate access to capital to fund acquisitions.

This Guide is intended primarily to provide potential acquirors and other interested parties with a summary of the principal legal and regulatory considerations relevant to acquisitions of Canadian income trusts.

For information regarding Canadian mergers and acquisitions more generally, we invite you to consult our separate publication entitled "Canadian Mergers & Acquisitions". For more information regarding the rules applicable to income trusts, please consult our publication entitled "Perspective: The Rise and Fall of Canadian Income Trusts". Both are available on our website at www.dwpv.com.

CANADIAN INCOME TRUSTS

Principal Types And Structures

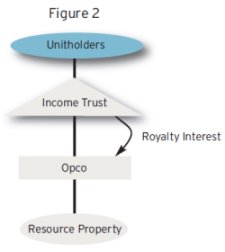

An income trust is a publicly-traded unit trust. Income trusts are typically categorized as business income trusts, royalty trusts or real estate investment trusts (REITs). Royalty trusts hold one or more royalty interests in resource properties. REITs principally invest in and operate rental real property, whether residential, commercial or industrial. The term "business income trust" is a catch-all describing income trusts that are not REITs or royalty trusts.

The precise legal form of an income trust will depend on a variety of factors, often related to tax considerations taken into account at the time the trust was established. These differences in structure may affect a purchaser's evaluation of the relative merits of the acquisition options available to it, which are discussed in the following pages.

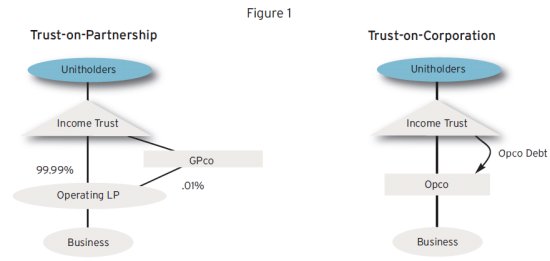

Business income trusts are typically structured in one of these ways:

A typical royalty trust structure is shown here:

Declaration Of Trust

An income trust is governed by a declaration of trust, which corresponds to a corporation's articles of incorporation and by-laws. The declaration of trust governs the affairs of the trust and the relationship between its unitholders and trustees, and generally includes:

- features and entitlements of the income trust's units;

- the role and responsibilities of the board of trustees;

- the operating and investment guidelines of the income trust;

- the process for calling and holding unitholder meetings and voting units, including in respect of unitholder approval of the sale of all or substantially all of the income trust's assets and other major transactions and material amendments to the declaration of trust; and

- a compulsory acquisition procedure that can be used to squeeze out non-tendering unitholders following a take-over bid.

Usually, the declaration of trust provides that fundamental changes, such as the dissolution of the income trust, the sale of all or substantially all of its assets, or material amendments to the declaration of trust, require approval by unitholders representing 66⅔% of the units held by unitholders present or represented by proxy at a meeting called for such purpose.

Retained Interests

In some income trusts, certain key investors may hold an equity ownership in the underlying business of the income trust, often through an interest in a partnership or corporation that is a subsidiary of the income trust.

These retained interests, in turn, may carry voting or veto rights at the income trust level and are often exchangeable for units of the income trust. Retained interests can have significant implications for the acquisition of an income trust given that a significant retained interest holder may be able to force a negotiated transaction by blocking the possibility of a compulsory acquisition or a second step going-private transaction. In addition, these retained interests often exist for tax reasons, adding an additional set of considerations to transactions where they are present.

Current Tax Benefits And Upcoming Tax Changes

From a Canadian tax perspective, income trusts have traditionally been able to flow-through income to their unitholders without it being taxed at the trust level. This feature has provided significant tax benefits to investors and has been particularly attractive to tax-exempt and non-resident investors. This tax benefit played a principal role in the decision of many Canadian public corporations to convert into income trusts in the late 1990s and early 2000s.

However, on October 31, 2006, the Department of Finance (Canada) announced rules (the "SIFT Rules"), generally effective for existing income trusts on January 1, 2011, that will impose entity-level tax on publicly-traded income trusts and eliminate this tax benefit. Under the SIFT Rules, income trust distributions to unitholders will be taxed in a manner similar to distributions to shareholders of a Canadian corporation.

The SIFT Rules provide an exemption for qualifying REITs. This exemption is narrowly drafted and generally only REITs that earn passive income may qualify. This has caused REITs that historically have undertaken development activities or have operating components (e.g., hotels, seniors' housing, health care facilities, etc.) to evaluate whether they can reorganize their business to fit within the new regime.

Since the announcement of the SIFT Rules, there have been approximately 70 acquisitions of Canadian income trusts and 40 conversions of income trusts to corporations. There are still over 150 publicly-traded income trusts, with only approximately 20 of them expected to qualify for the REIT exemption. Although it is possible for income trusts to remain as such beyond January 1, 2011 and be taxed in a manner similar to corporations, it is expected that most remaining income trusts will determine that their current structures are cumbersome (from a financial, commercial and tax perspective), and will move to restructure before the new rules take effect, either through an acquisition transaction or a conversion.

OVERVIEW OF PRINCIPAL ACQUISITION STRUCTURES

Selecting Transaction Structure: Take-Over Bid vs. Unitholder-Approved Transaction

Generally speaking, there are two principal ways to structure the acquisition of a Canadian income trust:

- an acquisition by way of take-over bid, in which the acquiror makes an offer to purchase units of the income trust directly from its unitholders. The offer can be negotiated with the board of trustees of the income trust or can be made on an unsolicited basis; or

- an acquisition by way of a unitholder-approved transaction, in which the unitholders approve a fundamental transaction that gives control of the business underlying the income trust to the acquiror. This alternative may involve a sale of all or substantially all of the assets of the income trust, an acquisition of units of the income trust through a plan of arrangement, or another material transaction requiring approval by the unitholders of the income trust.

Since both of these alternatives may be appropriate for a negotiated or friendly transaction, a target trust and a friendly acquiror can usually agree to an optimal acquisition method based on the specific structure of the target income trust, the strategy and plans of the acquiror, and the relevant tax consequences. A hostile or unsolicited acquiror does not have this choice: as a practical matter, an unsolicited income trust acquisition must be effected by way of take-over bid.

The chart below outlines the principal differences between the acquisition of an income trust by way of takeover bid and an acquisition by way of unitholder-approved transaction:

|

Take-Over Bid |

Unitholder-Approved Transaction |

|

|

What is it? |

|

|

|

How is it accomplished? |

|

|

|

Consideration |

|

|

|

Timing and process |

|

|

|

Unitholder approval/ acceptance requirements |

|

|

|

Conditions |

|

|

|

Dissent rights |

|

|

ACQUISITIONS OF INCOME TRUSTS BY TAKE-OVER BID

This section describes the principal considerations relevant to the acquisition of an income trust by way of takeover bid. Acquisitions by way of take-over bid can range from a friendly, negotiated acquisition to an unsolicited take-over bid followed by a complex reorganization. The basic structure of a take-over bid generally includes:

- if the bid is friendly, the negotiation and entering into of a support agreement with the target income trust (which would typically include deal protection measures such as break fee provisions, nonsolicitation covenants and matching rights in favour of the acquiror in the event of a competing proposal by a third party), and lock-up agreements with significant unitholders;

- the mailing by the acquiror to unitholders of a take-over bid circular containing an offer to acquire units of the income trust on specified terms;

- the mailing by the board of trustees of the target income trust of a trustees' circular containing a recommendation to unitholders regarding how to respond to the bid;

- a decision by unitholders whether or not to tender their units under the bid;

- if the conditions of the offer are met (or, where permitted, waived by the offeror), the acquisition of the tendered units by the offeror; and

- if the acquiror intends to take the income trust private, a second-step transaction or compulsory acquisition process allowing the acquiror to acquire units not tendered under the bid.

The Definition Of "Take-Over Bid"

- A take-over bid is made when an offer is made to unitholders in a Canadian jurisdiction to acquire a number of units of an income trust that, when combined with any units beneficially owned or controlled by the acquiror and its affiliates and joint actors at the time of the offer, constitute 20% or more of the outstanding units of the income trust (partially diluted).

- When calculating the offeror's current beneficial ownership, any securities convertible within 60 days into the class of income trust units for which the offer is made must be included.

- At this time, take-over bids are regulated province by province, but provincial securities regulators have generally harmonized the take-over bid regime across Canada.

Equal Treatment Rules

- Offer to all:

-

- Take-over bid must be made to all unitholders, but does not necessarily have to be made for all units.

- The take-over bid circular must also be sent to holders of all securities that are convertible into units subject to the bid.

- Identical consideration:

- All unitholders must be offered identical consideration (or an identical choice of consideration).

- If the acquiror increases the price during the bid, all unitholders get the new price, even those whose units had already been tendered and taken up.

- Bid for less than all of the outstanding units must be made pro rata to all unitholders.

- No "side deals":

-

- An acquiror may not attempt to avoid the identical consideration requirement by offering some unitholders collateral benefits or side agreements which effectively increase the consideration paid (e.g., agreements with individuals in senior management).

- Recent amendments to the take-over bid regime permit an acquiror to offer certain employment and severance arrangements for management and other employees of the target.

- An acquiror may seek a ruling from the applicable securities regulators to permit a collateral agreement where there is a clearly established business or financial purpose relating to the making of the bid or the ongoing operations of the target.

- Pre-bid integration:

-

- An acquiror may not acquire units in private transactions within the 90 days preceding the bid unless in the bid they also offer at least equal consideration and offer to acquire at least as high a percentage of the units as was acquired from any seller in such private transactions.

- Purchases and Sales During a Bid:

-

- While a bid is open for acceptance, an acquiror may not offer to acquire or enter into any agreement or understanding to acquire the units subject to the bid otherwise than pursuant to the bid.

- Nevertheless, an acquiror that states its intention to do so may purchase on a recognized stock exchange up to 5% of the outstanding units outside the bid. Such purchases must be reported daily by press releases disclosing the price and number of units so acquired.

- Subject to the relevant provisions of the declaration of trust, units purchased outside of the bid will generally not count towards the 90% compulsory acquisition threshold or the "majority of the minority" vote on a second-step going private transaction.

- Post-bid integration:

-

- In the 20 business days after the expiry of the bid, an acquiror who wishes to acquire units outside of the bid must do so on terms identical to the bid.

- Selling restrictions:

-

- An acquiror may not sell or enter into an agreement to sell target units between the date when the intention to make a bid is first announced and the date when the bid expires.

- An acquiror may agree to sell units taken up under the bid at a future date, but only if it discloses its intention to do so in the bid circular.

Timing Rules

- The minimum deposit period under a take-over bid is 35 days.

- Where the bid conditions have been satisfied or waived, the acquiror must take up and pay for units deposited not later than 10 days after expiry of the bid.

- Units that have been deposited under the bid can be withdrawn:

-

- at any time before the units are taken up by the acquiror;

- within 10 days after a change in the bid; and

- if units have not been paid for within three business days of take-up.

- The bid must be kept open for 10 days after any amendment (unless the amendment is solely a waiver of a condition in an all-cash bid).

Information Rules

- A take-over bid may be commenced either by mailing a take-over bid circular or by advertisement. The bid may be commenced by advertisement if, before or concurrently with the advertisement, the bid is filed and delivered to the target, a unitholders' list is requested, and the take-over bid circular is sent to unitholders on the list within two business days of the receipt of such list.

- The acquiror must prepare and mail the take-over bid circular to all holders of the class of units sought and holders of securities convertible into units.

- Additional mailings must be made if the terms of the bid are changed or if important information has changed or arisen (except changes not within the acquiror's control and not relating to the value of securities being offered in a securities exchange bid).

- The board of trustees of the target income trust must prepare and mail a trustees' circular within 15 days of the bid containing an acceptance/rejection recommendation by the board.

- If the target's board is unable to make a recommendation, the circular must disclose the reasons for not making a recommendation.

- Bids may contain any conditions except a financing condition.

- Bids typically include a minimum deposit condition, usually requiring a deposit of at least 66⅔% of the outstanding units, to ensure that the acquiror can obtain the remaining units not deposited under the bid through a compulsory acquisition or a second-step going private transaction.

- If the bid is an "insider bid" or "related party transaction", a valuation of the target's units and of any non-cash consideration being offered may be required unless an exemption is available.

- In Canada, in contrast to the U.S., no securities commission clearance is required for share-exchange take-over bids.

Rules Against Abusive Transactions

- Securities regulators may intervene to halt a take-over bid, even if it complies with all of the foregoing rules, if the regulator believes the bid is abusive of the target's unitholders, the public or the capital markets.

- Securities regulators may also intervene to prohibit the target's boards of trustees from taking inappropriate defensive measures to block a bid.

Rules Governing Blocking Positions And Toeholds

- To acquire a blocking position, an acquiror technically needs to acquire at least one-third of the outstanding units of an income trust (assuming that the declaration of trust contains the conventional provision requiring that important matters be decided by special resolution requiring a two-thirds majority). However, in certain circumstances, such as where the target income trust has historically had low turn-outs at unitholder meetings, an acquiror can obtain an effective blocking position with less than one-third of the outstanding units.

-

- Any acquisition of 20% or more of the outstanding units would trigger take-over bid rules and require an offer to all unitholders on the basis described above, unless carried out under certain prescribed exemptions.

- Toehold acquisitions (i.e., less than 10% of the outstanding units) can be considered. The acquiror should consider making toehold purchases through a special purpose subsidiary incorporated in Canada to avoid potential issues in the conventional declaration of trust that restrict ownership by non-residents of Canada.

- An acquisition of 10% or more of the outstanding units requires the acquiror to:

-

- issue forthwith a press release;

- file within two business days an "early warning" report;

- disclose the terms of any agreement with respect to the acquired securities, the price paid, the purpose of the acquisition and any future intention to acquire additional securities;

- file an additional report upon the occurrence of a material change in the initial report, including upon the acquisition of an additional 2% of the outstanding units; and

- file an insider report within 10 days after acquiring ownership (to be reduced to five days in respect of changes in beneficial ownership, control or direction over units held by an insider of the income trust).

Consideration: Cash Or Securities?

- If securities are offered as consideration, the issuer of the securities must provide prospectus-level disclosure of its own affairs, including:

-

- financial statement disclosure;

- pro forma combined financial information; and

- detailed disclosure of plans and proposals the acquiror has for the target post-closing.

- The bid circular is not reviewed by the securities commission, so there is usually no material timing disadvantage (other than time required to compile the necessary disclosure concerning the acquiror's securities) where consideration includes securities of the acquiror.

- An acquiror that offers share consideration will generally become a "reporting issuer" and is subject on an ongoing basis to Canadian public company disclosure requirements.

- If a TSX-listed acquiror proposes to make a securities exchange offer, the acquiror may be required to obtain approval of the share issuance from its own securityholders where the number of new securities of the acquiror to be issued would exceed 25% of the number of issued and outstanding securities at the time of the offer.

Unitholders List

- Securities laws require that an income trust provide a list of its unitholders to a proposed acquiror within 10 days following written request. The list of unitholders may be used only in connection with a formal take-over bid by the proposed acquiror.

- Declarations of trust also generally provide that a unitholder can request a list of unitholders from the income trust by following the procedure specified in the declaration of trust.

- An acquiror is permitted to commence the bid by advertisement, but must request the list of unitholders on or before the date the bid is advertised, and must send the bid to unitholders within two business days of receiving such list.

U.S. Holders Of Income Trust Units

- If units of an income trust are registered under the U.S. Securities Exchange Act of 1934:

-

- U.S. procedural and substantive tender offer rules apply unless an exemption is available.

- MJDS permits tender offers to U.S. holders of securities of certain Canadian targets to be made pursuant to applicable Canadian take-over bid rules rather than in full compliance with U.S. tender offer rules.

- Offerors in tender offers for qualifying Canadian targets are deemed to satisfy disclosure and certain other requirements of the U.S. tender offer rules by complying with applicable Canadian take-over bid rules if, among other things, the target is a "foreign private issuer" under applicable U.S. Federal securities laws and less than 40% of all target units are held by U.S. unitholders and the take-over bid is filed with the U.S. Securities and Exchange Commission (the "SEC").

- U.S. going-private rules apply and U.S. beneficial ownership reporting rules apply to an offeror directly or indirectly acquiring beneficial ownership of more than 5% of the target's units.

- Full compliance with U.S. tender offer rules would apply if the income trust is not a "foreign private issuer" under applicable U.S. Federal securities laws. A trust or other entity organized under the laws of a non-U.S. jurisdiction is not a foreign private issuer if: (a) more than 50% of its outstanding voting securities are held by persons in the United States and (b) any of the following is true: (i) a majority of the entity's directors or executive officers are U.S. citizens or residents; (ii) more than 50% of the entity's assets are located in the U.S.; or (iii) the business is administered principally from the United States.

- If securities are offered as consideration, the offering of securities must be registered under the U.S. Securities Act of 1933 unless an exemption is available.

-

- Qualifying Canadian-organized offerors that are foreign private issuers may file a prospectus with the SEC prepared in compliance with Canadian requirements under the cover of certain MJDS registration statements in connection with exchange offers for Canadian organized targets that are foreign private issuers. Such registration statements are generally given a "no review" status, except for situations where the SEC staff perceives a problem.

- The U.S. registration of securities in connection with an exchange offer will not in itself subject a Canadian offeror relying on MJDS to ongoing reporting requirements in the United States, as long as certain requirements are met.

- An exemption is available in connection with exchange offers for targets that are foreign private issuers, provided that no more than 10% of the targets units are held by U.S. holders.

- If there is a limited number of target unitholders resident in the United States, the acquiror may be able to issue securities in certain circumstances to U.S. unitholders on a private placement basis or rely on a vendor placement of the securities that would otherwise be issued to U.S. unitholders and remit cash to U.S. holders.

- Compliance with U.S. state securities ("Blue Sky") laws will be required unless an exemption is available.

- U.S. antifraud rules apply to any transaction involving U.S. unitholders.

Conditions

- Any conditions (except as to financing) are permitted and frequently include:

-

- Minimum tender: if seeking 100%, minimum tender should generally be 66⅔% to allow the acquiror to acquire the units not tendered under the bid;

- No rights plan applicable to the bid;

- Competition, Investment Canada, HSR approvals and any other regulatory approvals for change of control; and

- No material adverse change.

Key Canadian Tax Consequences Of Take-Over Bid

- The tax consequences to unitholders of a take-over bid for units of an income trust generally parallel those arising on a take-over bid for shares of a corporation, including in some cases the possibility of providing a tax-free rollover where the units of the income trust are exchanged for shares of a Canadian corporate acquiror.

- Non-resident unitholders generally are not taxed in Canada on the disposition of their units unless their units constitute "taxable Canadian property" (i.e., generally a holding by the unitholder of 25% or more of the outstanding units).

- The Canadian tax consequences to the acquiror will depend on the particular circumstances of the target income trust. In many cases, it will be possible to wind up the income trust structure and integrate the target's business or assets into the acquiror's desired corporate structure without Canadian income tax cost. However, in some fact patterns, additional complications may arise, and any delays in undertaking a second-stage squeeze-out transaction can present tax exposure where the value of the trust assets changes during the process. Further, where the acquiror intends to reorganize the target's business and transfer foreign operations to a non-Canadian holding company or dispose of unwanted assets, an acquisition of the income trust's assets by way of a unitholder-approved transaction generally will provide more flexibility than a take-over bid to undertake such steps in a tax-efficient manner.

Lock-Up Agreements

- Unitholders' commitment to tender into the offeror's take-over bid.

- Often include unitholders' right to withdraw and tender to higher competing offer.

- Advantage: contributes to certainty of execution; locked-up units count towards 90% (or 66⅔%, if amended) compulsory acquisition threshold.

- Caution: Locked-up unitholders must be treated identically to all other unitholders under the offer so that locked-up units can be counted towards the majority of minority vote on the second-step going private transaction.

- Entering into a lock-up agreement may trigger the target income trust's poison pill.

- Lock-up agreements must be filed publicly.

- U.S. beneficial ownership reporting rules may also apply if the target's units are registered under the United States Securities Exchange Act of 1934.

Compulsory Acquisitions And Second-Step Transactions

- Income trusts generally have a compulsory acquisition mechanism in their declarations of trust that allows an offeror to acquire 100% of the target if at least 90% of the outstanding units have been tendered to the bid.

- There may be differences between compulsory acquisition procedures for income trusts and those typically found in corporate statutes (e.g., the time period to utilize the compulsory acquisition mechanism may be shortened from 120 days under corporate statutes to 45 or 90 days under the declaration of trust).

- If the compulsory acquisition mechanism is not available but at least 66⅔% of outstanding units are tendered to a bid, offerors can sometimes elect to acquire the remainder of the outstanding units through an amalgamation, unit consolidation or other unitholder-approved going private transaction.

- As part of the compulsory acquisition or second-step transaction, the offeror can generally amend the target's declaration of trust by written resolution of unitholders representing 66⅔% of outstanding units.

- Amending the declaration of trust is effected by coupling a tender to the take-over bid with a power of attorney to the offeror to approve an amendment to the declaration of trust allowing for the compulsory acquisition mechanism to be available if 66⅔% of the outstanding units are deposited to the offer and to shorten the time period to utilize the compulsory acquisition mechanism.

Defensive Tactics

- The board of trustees of an income trust targeted by an unsolicited take-over bid can generally employ defensive tactics similar to those available to the board of directors of a Canadian public corporation, including the implementation of a shareholder rights plan (i.e., a poison pill).

- In responding to a bid and approving any defensive tactic, the trustees must satisfy themselves that they are discharging the fiduciary duties that are imposed on them both at common law and, usually, in the declaration of trust.

- Canadian courts have generally compared the duties of trustees of public income trusts to those of corporate directors. While the provisions contained in declarations of trust may vary, these duties generally include:

-

- a duty to exercise powers honestly, in good faith, and in the best interests of the trust and its unitholders; and

- a duty to exercise the degree of care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

UNITHOLDER-APPROVED TRANSACTIONS

The other main alternative for the acquisition of an income trust or its assets usually involves a transaction approved by unitholders of the income trust at a unitholder meeting. In many cases, an acquiror will find a unitholder-approved transaction preferable to a take-over bid where circumstances permit. While these transactions are not subject to the take-over bid requirements of Canadian securities laws, they are generally subject to proxy solicitation and information circular requirements.

This section of the Guide reviews the principal forms of unitholder-approved transactions and certain considerations relevant to such transactions.

Principal Forms Of Unitholder-Approved Transactions

Unitholder-approved transactions are generally effected through the following principal forms:

- Asset Purchase: The acquiror may purchase all or substantially all of the assets of the income trust or all of the equity and debt securities of one or more subsidiary entities of the income trust, with the consideration for such assets or securities being distributed to unitholders, and the trust then wound-up and terminated; or

- Plan of Arrangement: The acquiror or the income trust may use a previously-formed or new corporation to access the plan of arrangement regime available under certain corporate statutes to acquire the units or assets of the target income trust.

Asset Purchase

- The first step in an asset purchase transaction is the negotiation of an asset purchase agreement, which sets out the structure and terms of the transaction in addition to containing representations, warranties, covenants, and deal protection measures such as break fees, non-solicitation covenants and the right of the acquiror to match competing offers by third parties.

- Once the asset purchase agreement is signed, the sale of the income trust's assets and subsequent dissolution of the income trust must be approved by the income trust's unitholders. The transaction may also require amendments to the declaration of trust.

- The terms on which unitholders must approve the transaction are found principally in the declaration of trust. Typically, the support of 66⅔% of units represented at the meeting is required.

- Retained interests and exchange rights of key unitholders can have a significant impact on the asset purchase and should therefore be considered at the outset.

- In many cases, Canadian resident unitholders will be essentially indifferent as between the sale of their units under a take-over bid or plan of arrangement, and a sale by the trust of securities of its underlying operating entities followed by a termination of the trust. Canadian resident unitholders may be worse off under an asset sale where the property disposed of by the trust is not capital property (e.g. not securities of an underlying business entity). In addition, where the consideration offered by the acquiror includes shares of a Canadian corporation, no rollover will be available to unitholders in the asset sale scenario.

- Non-resident unitholders may be subject to Canadian withholding tax on the distribution to them of their portion of the proceeds of an asset sale. Accordingly, non-resident unitholders will generally seek to dispose of their units in the market before the closing of the transaction.

- There may be tax benefits to an acquiror in an asset purchase, such as where the acquiror would benefit from the Canadian tax bump in paragraph 88(1)(d) of the Income Tax Act (Canada) or where the acquired assets provide for accelerated tax write-offs (e.g., certain royalty interests).

- In addition, an asset purchase may allow the target's business to be reorganized and non-Canadian components transferred to non-Canadian holding companies or unwanted assets sold more efficiently than can be done under a take-over bid.

Plan Of Arrangement

- The first and most critical step in a plan of arrangement is the negotiation of an arrangement agreement between the acquiror and the target, which sets out the steps involved in the arrangement in addition to containing representations, warranties, covenants, and deal protection measures such as break fees, non-solicitation covenants and the right of the acquiror to match competing offers by third parties.

- Once the arrangement agreement is signed, an information circular containing details of the proposed arrangement is prepared and sent by the income trust to its unitholders.

- The approval of a plan of arrangement is usually structured around two court hearings: an interim hearing and a final hearing. In order to access the arrangement procedure available under certain corporate statutes, the applicants for the court orders often include a corporation formed by the acquiror for the purpose of completing the arrangement and one or more corporate subsidiaries of the target income trust.

- At the interim hearing, the court sets out the approval requirements for the plan of arrangement. The interim order prescribes the details for calling and holding the unitholder meeting and sets the thresholds of unitholder support required for approval.

- Typically, the support of 66⅔% of units represented at the meeting is required to approve the arrangement.

- Often, dissenting unitholders are provided with dissent rights under the arrangement.

- If unitholders approve the plan of arrangement, the court will evaluate the fairness of the arrangement at the final court hearing, and will then approve the arrangement.

- The Canadian tax consequences of a plan of arrangement will depend on the steps involved in the plan. Where the plan mimics an asset sale, the consequences will be essentially the same as in an asset sale without a plan. Where the plan involves additional steps, the additional tax consequences will be based on an analysis of those particular steps.

Potential Advantages Of Unitholder-Approved Transactions

- Lower acceptance thresholds than a take-over bid (unless the acquiror in a take-over bid succeeds in lowering the threshold for a compulsory acquisition to 66⅔%).

- "One-step" acquisition can eliminate "bridging" and financing risks.

- Greater flexibility in dealing with the target income trust's assets, particularly where a plan of arrangement structure is used.

- Flexibility in dealing with retained interests, exchange rights, stock options and warrants.

- Pre-bid purchases are not prohibited (but disclosure issues should be considered).

- Possible to offer "unequal" consideration and certain collateral benefits (but minority approval issues should be considered).

- Permissibility of financing conditions.

- Flexibility in dealing with public debt (and other creditors).

- If the transaction is court approved, as in a plan of arrangement, a registration exemption may be available in the U.S. for the issuance of the acquiror's securities as consideration.

- However, given that the calling and holding of the unitholder meeting and the court applications are initiated and controlled by the target income trust (subject to contractual restrictions and fiduciary duties), an acquiror generally has less control over the acquisition process in a unitholder-approved transaction as compared to a take-over bid structure.

REVIEW UNDER COMPETITION ACT (CANADA)

The acquisition of a Canadian income trust can raise competition law issues in either of two ways:

- if the acquisition of the income trust exceeds certain thresholds, it must pass through a pre-merger notification regime; and

- for up to one year after closing, any acquisition can be challenged on substantive grounds.

Pre-Merger Notification

A proposed acquisition of an income trust that carries on an operating business is subject to pre-merger notification requirements only if all the following thresholds are met:

- Size of transaction – the book value of the assets in Canada of the income trust or the gross revenues from sales in or from Canada generated from those assets exceed CDN$70 million (this amount is subject to adjustment annually based on changes in nominal gross domestic product and is expected to drop to CDN$67 million for 2010);

- Size of parties – all parties and their affiliates (in aggregate) must collectively have over CDN$400 million in Canadian assets or gross revenues (sales in, from or into Canada); and

- The interest held in the combination following the transaction entitles the acquiror to receive more than 35% of the profits of the combination or of its assets on dissolution, or, if that threshold is already exceeded, 50%.

For the purpose of determining whether the "size of parties" threshold is exceeded, "affiliate" is defined in terms of control of corporations and partnerships, which, in turn, is defined in terms of de jure control, i.e., when: (a) direct or indirect ownership of more than 50% of the votes which may be cast to elect directors of a corporation is held, directly or indirectly, otherwise than by way of security, by or for the benefit of a person; and (b) the votes attached to those securities are sufficient, if exercised, to elect a majority of the directors of the corporation or in the case of partnerships, when a person is entitled to receive more than 50% of the profits of the partnership or more than 50% of its assets on dissolution. Trusts are not considered to have affiliates for the purposes of the Competition Act.

Timing

If the proposed acquisition exceeds all of the thresholds, then the parties must file a notification with the federally appointed Commissioner of Competition. After notification, there is a 30-day statutory waiting period during which the transaction may not be completed. If the Commissioner of Competition issues a "supplementary information request" (SIR), then a new waiting period is triggered and expires 30 days following compliance with the request. Otherwise, the transaction may proceed when the waiting period expires.

In the case of an unsolicited take-over bid for units of an income trust, the Competition Act does not expressly address how and when the waiting period(s) may commence, as it does with respect to unsolicited bids for shares of corporations. In our experience, the Commissioner of Competition has been prepared to enter into a timing agreement with the proposed acquiror to ensure that an income trust that is the target of an unsolicited bid is not in a position to hold up the commencement of the waiting periods or the Competition Bureau's review of the proposed transaction.

ARCs And "No Action" Letters

The Commissioner may terminate or waive the waiting period at any time by:

- issuing an Advance Ruling Certificate ("ARC") indicating that the Commissioner does not intend to challenge the proposed acquisition; or

- issuing a "no-action" letter indicating that the Commissioner has decided not to challenge the proposed acquisition at that time, but reserves the right to do so within one year following closing.

Substantive Review

The substantive test for merger review in Canada is whether the proposed acquisition is likely to lessen or prevent competition substantially in a market affecting Canada. The Commissioner may challenge an acquisition on substantive grounds until one year following closing.

REVIEW UNDER INVESTMENT CANADA ACT

The acquisition of a Canadian income trust will be subject to review or notification requirements under the general "net benefit to Canada" review provisions of the Investment Canada Act (the "ICA") if it involves:

- the acquisition of control of a "Canadian business";

- by a non-Canadian.

Acquisition Of Control

For the purposes of the ICA, the acquisition of a majority of the voting interests of an entity and the acquisition of all or substantially all of the assets used in carrying on a Canadian business are deemed to be an "acquisition of control". With respect to an entity other than a corporation (e.g., an income trust or a partnership), the acquisition of less than a majority of the voting interests of the entity is deemed not to be an acquisition of control under the ICA.

Canadian Status

An individual is a "Canadian" for the purposes of the ICA if he/she is a Canadian citizen or, in some circumstances, a permanent resident of Canada. A trust, corporation or partnership is a "Canadian" for the purposes of the ICA if the ultimate controlling unitholders, shareholders or partners are "Canadians". In the case of a widely-held corporation or where the partnership or trust is not controlled in fact through the ownership of its voting interests, the determination is based upon the citizenship or permanent resident status of the members of the board of directors, general partners or trustees, at least two-thirds of whom must be "Canadians" for the entity to be considered "Canadian".

Reviewable Transactions

Review Thresholds

Where either the investor or vendor is controlled by a "WTO Investor":

- a "direct" acquisition of control will generally be reviewable if the book value of the assets of the Canadian business being acquired, and all other assets in Canada the control of which is being acquired, exceeds CDN$299 million (this threshold will be raised to CDN$600 million in "enterprise value" once proposed regulations come into force, which is expected in 2010); and

- an "indirect" acquisition of control, which occurs where a foreign investor acquires the voting interests of an entity that controls directly or indirectly an entity in Canada carrying on the Canadian business, will generally not be reviewable but will be subject to post-closing notification only.

Where no "WTO Investor" is involved as the investor or the vendor or where the acquisition of control of a "cultural business" (i.e., a business that is engaged in the publication, production, distribution, sale or exhibition of books, magazines, periodicals, newspapers, film or video recordings, audio or video music recordings and radio, television and cable broadcasting services) is involved:

- a "direct" acquisition will be reviewable if the value of the relevant assets involved exceeds CDN$5 million; and

- an "indirect" acquisition will be reviewable if the value of the relevant assets involved exceeds CDN$50 million.

The definition of a "WTO Investor" is complex. In general, an individual will be a "WTO Investor" if he/she is a "national" of a country (other than Canada) that is a member of the World Trade Organization ("WTO") or has a right of permanent residence in a WTO member country. A corporation, trust or other entity will be a "WTO Investor" if it, in turn, is not a Canadian-controlled entity and is ultimately controlled by one or more "WTO Investors". A widely-held public company, partnership or trust that is not a Canadian-controlled entity will generally be a "WTO Investor" for the purposes of the ICA (i) if it can be established that a majority of the voting shares or units is owned by WTO Investors, or (ii) where no person or voting group controls the company, partnership or trust and at least two-thirds of the members of the company's board of directors, general partners or trustees are any combination of WTO Investors and Canadians.

Standard For Review And Timing

Foreign investors whose acquisitions are subject to review under the ICA must satisfy the Canadian government that the acquisition is likely to be of "net benefit to Canada". The Minister of Industry (or the Minister of Canadian Heritage in the case of a cultural business) must reach a decision within 45 days of receiving an application for review. This period may be unilaterally extended by the Minister for a further 30 days and thereafter with the consent of the investor. The review process generally takes place prior to closing and the transaction normally cannot be completed until approval is granted. Foreign investors may be required to provide binding undertakings in order to obtain approval. These can involve commitments to undertake capital expenditures, maintain employment levels, ensure Canadian participation in management of the business, and keep a head office presence in Canada, among other things.

Relevant factors for assessing "net benefit" include: the effect of the investment on economic activity and employment in Canada, the degree and significance of continued Canadian participation in the business, the effect on competition, the compatibility with "national, industrial, economic and cultural policies", and the contribution to Canada's ability to compete globally.

Notifiable Transactions

Acquisitions of control that do not exceed the prescribed review thresholds described above are notifiable. Notifications may be made up to 30 days after closing and involve the filing of only very basic information concerning the investor and the acquired business.

National Security Review

Irrespective of whether an investment is subject to a "net benefit to Canada" notification or review, investments by non-Canadians in a Canadian business may be reviewed to determine if they "could be injurious to national security". The term "national security" is not defined and is of potentially broad scope. The federal cabinet may prohibit completion of a transaction it considers to be injurious to national security or require divestiture in the case of already completed transactions. Also, if a national security review is commenced before closing, closing may be prohibited pending the outcome of the review.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.