- within Insurance topic(s)

INTRODUCTION & OVERVIEW

- For a more detailed commentary see the Charity & NFP Law Bulletin No. 524

- Information is current as of February 9th, 2024, but subject to change

A. SETTING THE STAGE

- Implementing effective healthcare philanthropy requires a working knowledge of what healthcare charities can and cannot do with the funds that they raise

- In this regard, many healthcare charities may need to work with other organizations from time to time in order to achieve their charitable purposes

- When those other organizations are Canadian registered charities or other types of qualified donees ("QD") listed in the Income Tax Act ("ITA"), it is possible to do so because a Canadian registered charity is able to make gifts to other QDs

- However, when a healthcare charity is wanting to work with an organization that is not a qualified donee ("Non-QD"), compliance issues become more challenging

- Examples of working with Non-QDs could include:

- A healthcare charity wanting to fund a community health initiative run by a community organization that is a Non-QD

- A hospital foundation with broad community purposes wanting to make a grant to a local indigenous healthcare charity that is a Non-QD

- As a result of amendments to the ITA on June 23, 2022 (Bill C-19), there is now a new option of making qualifying disbursements to Non-QDs in the form of either a "gift" or "otherwise making resources available" as discussed below ("Qualifying Disbursement Regime")

- The CRA describes this as making a "grant" to a Non-QD

- CRA released a draft guidance on November 30, 2022 ("Draft Guidance"), followed by the release of its final guidance on December 19, 2023, CG-032 Registered charities making grants to non-qualified donees ("Final Guidance")

- The Final Guidance is a significant rewrite of the Draft Guidance

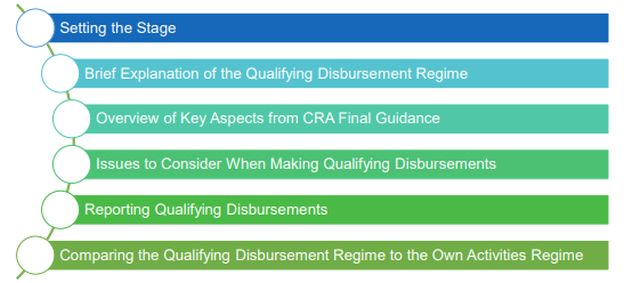

- This presentation reviews the following:

- What the new Qualifying Disbursement Regime involves

- A brief overview of key aspects of the Final Guidance

- Issues to consider with the Qualifying Disbursement Regime

- How the new Qualifying Disbursement Regime compares to the existing Own Activities / Direction & Control Regime ("Own Activities Regime")

- Some practical comments that healthcare charities may want to consider

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.