Keywords: new ruling, income tax, employee profit sharing, PLR

Employee Profit Sharing (PLR) is regulated by Law No. 10.101 of December 19, 2000. It is considered an integration instrument between Employers and Employees, and stimulates productivity, pursuant to Article 7, paragraph XI of the Brazilian Constitution.

The implementation of profit sharing to Employees requires the establishment of goals by the company, which shall be achieved in a certain period, in order to the Employees be eligible for the distribution of profits. Companies that distribute profits to Employees without setting goals, either for productivity or results, reduce the effectiveness of the profit sharing principle established by law.

The Profit Sharing Agreement shall be negotiated between the company and its employees through: (i) a commission chosen by the parties, with participation of a class representative trade union; and (ii) collective convention or collective bargaining agreement.

The terms of the collective agreement shall contain clear and objective rules establishing the substantive rights of participation and procedural rules, including mechanisms for measuring relevant information in compliance with the schedule for the distribution, duration period of the program and terms for circumstance of review of the agreement. The following criteria and conditions may be considered among others: (i) rates of productivity, quality and profitability of the company; and (ii) goals program, results and deadlines previously agreed.

The PLR performed in accordance with the mentioned law has the legal disclaimer that it does not constitute labor charges, thus, in this case, the principle of habituality does not apply. However, if PLR is paid outside the terms of Law No. 10.101/2000, it shall be considered as bonus, and thus be paid with repercussions on 13th salary, vacation, remunerated weekly day-off, prior notice, maternity allowance, and on other benefits. In regard to taxes, the payment of Unemployment Compensation Fund (FGTS) and social security contributions to the National Social Security Institute (INSS) will be due.

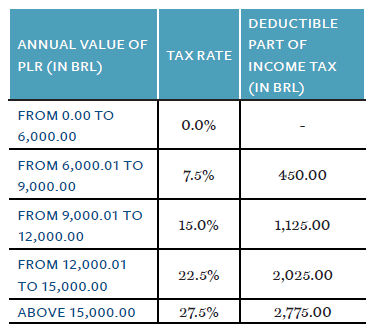

On December 26th, 2012, Provisional Measure No. 597 was published in the Official Gazette. It amended paragraph 5 of Article 3 of Law No. 10101/2000 and modified the table of exclusive taxation at source. The new wording of the Article determines that income tax shall exclusively apply on the PLR at source, separate from other income received, in the fiscal year of receipt, based on the following progressive annual table. It also established that PLR should not enter the calculation basis of the tax due by the beneficiary on the Statement of Annual Adjustment:

Provisional Measure No. 597/2012 also included paragraphs 6 to 10 in Article 3 of Law No. 10101/ 2000, providing that:

(i) for purposes of calculation of income tax, the PLR shall be fully taxed, based on the progressive table above;

(ii) in the cases of more than one payment that refers to the same fiscal year, the income tax shall be recalculated based on the total amount of PLR received by the beneficiary in the fiscal year, through the use of the above table, deducting the amount already taxed at source;

(iii) the incomes cumulatively paid as PLR, i.e. the payments of PLR of more than one fiscal year, shall be exclusively taxed at source, separate from other income received, and shall be subjected to income tax based on the table above on a cumulative basis;

(iv) the amount paid in cash as alimony could be deducted from the calculation basis of PLR as long as the payments are related to this income; however, the same payment cannot be used to determine the calculation basis of other income.

Considering the above, the benefits paid as PLR up to the amount of R$ 6,000.00 are exempt from income tax according to the provisions of Provisional Measure No. 597/2012. Further, the beneficiary who receives more than R$ 6.000,00 as PLR shall be subject to income tax, but at a lower rate than before, due to the new table of exclusive taxation at source.

The changes introduced by Provisional Measure No. 597/2012 on wording of Article 3 of Law No. 10101/2000 came into force on January 1st, 2013.

Previously published on 15 January 2013.

Visit us at Tauil & Chequer

Founded in 2001, Tauil & Chequer Advogados is a full service law firm with approximately 90 lawyers and offices in Rio de Janeiro, São Paulo and Vitória. T&C represents local and international businesses on their domestic and cross-border activities and offers clients the full range of legal services including: corporate and M&A; debt and equity capital markets; banking and finance; employment and benefits; environmental; intellectual property; litigation and dispute resolution; restructuring, bankruptcy and insolvency; tax; and real estate. The firm has a particularly strong and longstanding presence in the energy, oil and gas and infrastructure industries as well as with pension and investment funds. In December 2009, T&C entered into an agreement to operate in association with Mayer Brown LLP and become "Tauil & Chequer Advogados in association with Mayer Brown LLP."

© Copyright 2013. Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.