Rather than inspiring a series of copycat direct listings in Australia, the Spotify proposal, and the broader trend toward later listings of larger companies on the US exchanges, is actually creating a new pipeline for ASX of smaller tech companies looking to list.

Tech companies may get behind an unconventional listing strategy following Spotify's announcement that it is pursuing a unique plan to go public.

The popular Swedish music streaming company has filed an application for a direct listing (or direct public offering (DPO)) of its shares on the New York Stock Exchange (NYSE) which is an unconventional way of debuting as a listed company where no new stock is issued or no capital is raised.

The Securities and Exchange Commission (SEC) is yet to formally approve the application, but if it goes ahead as planned, existing Spotify investors will be able to trade their shares on the open market immediately on listing. How will this play out in Australia?

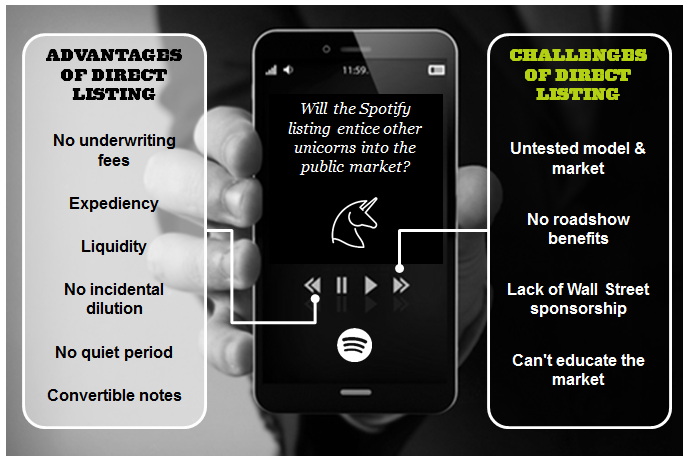

Advantages of direct listing

Unlike many companies that pursue IPOs as part of a broader capital raising strategy, Spotify is in a fortunate position to take advantage of a direct listing. Its status as the world's largest paid music-streaming service, enjoying steady cash flow from over 60 million paying subscribers, means the music giant is not looking for cash.

Other advantages of pursuing a direct listing include:

- No underwriting fees: While Spotify may pay substantial bank advisory fees, it could potentially save millions in underwriting fees as there will be no need to engage investment banks to underwrite the offer.

- Expediency: In the absence of multi-week roadshows spent marketing to key institutional investors, Spotify will bypass a lot of the red tape associated with a conventional IPO, enjoying a more streamlined path to listing.

- Liquidity: Existing shareholders and long term employees of Spotify who would traditionally be restricted from trading all or some of their shares for 6 months after listing under a lock-up imposed by an underwriter in an ordinary IPO, will be free to sell their shares on day one of trading (subject to any existing escrow arrangements).

- No incidental dilution: As new shares are not issued, the interests held by existing shareholders will not be diluted as part of the process because the share count won't increase.

- No quiet period: Given that the company is not selling any of its own shares, there will be no quiet period prohibiting public commentary on the Spotify business and operations.

- Convertible notes: A direct listing can have additional appeal by 'stopping the clock' on provisions in preference securities or convertible notes which become increasingly less attractive to companies the longer they remain unlisted.

Challenges of direct listing

On the flip side, pursuing a direct listing is not without risk and it is possible that the benefits could be outweighed by the burden of foregoing the other forms of value that investment banks provide. For example, the company doesn't have the benefit of investor feedback to assist in determining its share price and the resulting value of the entire company, nor will it have guaranteed buyers lined up; both of these outcomes will be totally dependent on the market.

Other matters to consider include:

- Untested model & market: Whilst a handful of companies have done direct listings over the last decade on the Nasdaq Stock Market, Spotify would be the biggest, and the first for the NYSE. Historically the direct listing model has been used by small-cap issuers and SEC-registered real estate investment trusts (REITs) rather than large tech companies like Spotify. These factors can combine to create an additional layer of uncertainty when it comes to predicting pricing and demand.

- Roadshow benefits: Despite being exhausting and time-consuming, the roadshow can be a valuable process for a company because it often provides management with a formal opportunity to establish relationships with investors that could fortify the company through its next phase.

- Wall Street sponsorship: Although underwriting fees are significant, high-profile companies can negotiate discounts. In addition to the pricing and risk minimisation benefits, the support of investment banks can also enhance after market liquidity in the shares.

- Sector understanding: the traditional listing process can provide an opportunity to educate the market on the industry and business the company operates in. In Spotify's case, the music business is in the early stages of recovery following years plagued by piracy and declining CD sales. Despite being the market leader, Spotify may need to convince investors that streaming music is a good business.

Why is the NYSE trying to change the rules?

Spotify's proposal has forced the NYSE to seek to change its listing standards so that it can secure the company's debut on its exchange before the Nasdaq nabs it.

The NYSE's proposed amendment would change the approval process for private company's seeking to do a direct listing. In order for such companies to go live on the exchange, they must have at least $100 million worth of publicly held shares and the NYSE's current rules require the company to meet this requirement by using the following two different tests (taking the lesser of the two):

- Getting a valuation from a third party; and

- Taking the last price of its shares in the private market.

The problem with the current calculation criteria is that, although Spotify and other unicorns may appear to be big enough to meet the $100 million threshold, there is a technical issue that prevents them from passing the second valuation test (above). The NYSE's definition of a "private market" does not capture the types of transactions in which private shares are traded today, such as Spotify's previous private funding rounds, so these transactions cannot be used to satisfy the NYSE's current admission test.

If the proposed amendment to the rules goes ahead, the exchange will be able to rely solely on a third-party-valuation, subject to company's satisfying other admission criteria for a DPO.

Are we likely to see a trend toward more direct listings?

If Spotify's bold strategy is successful, it could entice other big tech companies such as Airbnb and Uber to follow suit, particularly because, like Spotify, they are well-known consumer brands that do not need to acquaint the public with their products or technology and are less likely to need new capital.

The impacts of the Spotify listing in Australia and on the ASX

A direct public listing is potentially a feasible path to listing under the Listing Rules.

Under the Listing Rules, ASX can admit companies to its official list by way of "Compliance Listings". In these instances, eligible companies that are not issuing new shares or raising capital as part of their listing, are pre-vetted by ASX and only need to prepare an information memorandum by way of disclosure (rather than a prospectus or PDS).

While this avenue is attractive to larger companies that are already listed on a foreign exchange and therefore pursuing an ASX Foreign Exempt Listing, it can be difficult for smaller unlisted companies to pursue this strategy successfully because they would be applying for admission as a Standard ASX Listing and may have difficulty satisfying standard admission conditions. Such conditions include the minimum spread requirement where the company must have a minimum of 300 non-affiliated security holders holding at least $2,000 worth of securities each, and the 20% free float requirement where at least 20% of the entity's main class of securities must be unrestricted securities that are not subject to voluntary escrow and are held by non-affiliated security holders at the time of admission.

Of course, an ASX Foreign Exempt Listing is a real option for large foreign companies with sufficient capital that are already listed on a foreign exchange such as Kirkland Lake Gold (KLA) which was the largest listing on ASX last year with a $3 billion market capitalisation. KLA's status as a foreign company already listed on the Toronto Stock Exchange and NYSE allowed it to be admitted to the official list as a Foreign Exempt Listing. Clayton Utz acted for KLA on its ASX listing in November last year.

This expedited path is obviously reserved for larger companies that can satisfy higher financial prerequisites by having at least A$200 million operating profit before tax for each of the last three years, net tangible assets of at least A$2 billion, or a market capitalisation of at least A$2 billion. Companies pursuing a Foreign Exempt Listing are not required to contend with the typical obstacles to a standard ASX listing such as meeting the minimum spread and minimum free float requirements, because their scale and status as a foreign listed company is the key criteria for their admission.

A perfect storm for ASX?

Ultimately, it seems clear that rather than inspiring a series of copycat direct listings in Australia, the Spotify proposal, and the broader trend toward later listings of larger companies on the US exchanges, is actually creating a new pipeline for ASX where smaller tech companies that are looking to list earlier are seeking out strong and liquid exchanges such as ASX where you don't need to be a multibillion dollar company to get noticed. The risk of under-pricing, the ongoing cost of being listed, and the lack of research coverage and institutional interest in smaller scale businesses, all combine to create a compelling case for "smaller" tech companies to steer away from the world's largest exchanges and consider a public debut on attractive platforms like ASX.

Clayton Utz communications are intended to provide commentary and general information. They should not be relied upon as legal advice. Formal legal advice should be sought in particular transactions or on matters of interest arising from this bulletin. Persons listed may not be admitted in all states and territories.