- within Corporate/Commercial Law topic(s)

- with Inhouse Counsel

From catwalk to customer

1 Australian fashion retailing

The short-term outlook for the Australian fashion retail industry is continued disruption by new technologies and innovative competition. There will be no single formula for success. Traditional retailers must look to unlock the physical store as a formidable weapon to fight the onslaught of online retail and northern hemisphere retailers.

Casualties in the retail war of attrition

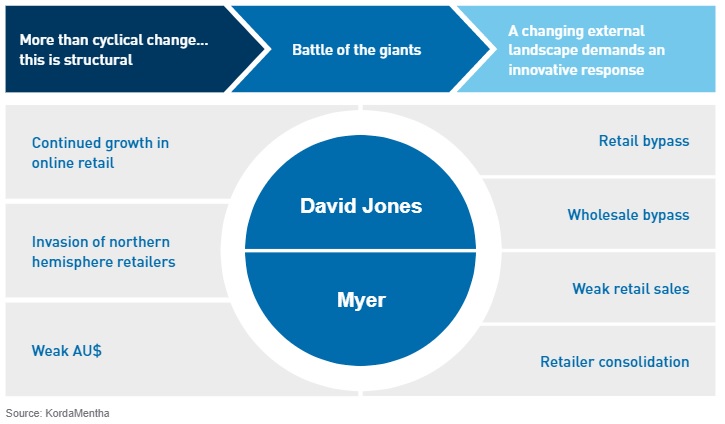

In our August 2015 publication, 'Casualties in the retail war of attrition', we identified structural changes in the apparel retail market. While the battle to adapt to these changes is publicly played out by department store giants Myer and David Jones, the impact will reverberate through both the Australian clothing retail and wholesale industries.1

Battle of the giants

Continued growth in online retail and loss of market share to northern hemisphere retailers will lead to further rationalisation in the Australian retail sector. The big will get bigger, with smaller niche players at the other end of the spectrum. The 'middle ground' will prove a difficult place totrade for medium sized retailers.2

In this environment, the biggest risk for clothingwholesalers will be wholesale bypass(whereby retailers cut out the middle manandsource direct from manufacturers). Withcontinued downward pressure on sales volume and profitability, larger retailers will increasingly purchase directly from local and overseas clothing manufacturers and cut out thewholesalers altogether. There will continue tobedemand from niche retailers who lack thesizeor reach to bypass wholesalers, but thiswillbe cold comfort for those clothing wholesalers who are dependent upon demand from mid-sized and larger retailers.3

The retail store is dead.Long live the retail store.

As online retailing continues to gain on traditional bricks and mortar retail, questions are being asked that challenge the essence of traditional retailing. Is the physical store dead? No, on the contrary – it has the potential to be a formidable weapon in the traditional retailers' arsenal. However, unlocking its value will require significant investment and innovation.4

Our dependence on stores to serve as distribution points for products is diminishing as digital media, in all forms, becomes more effective at fulfilling our shopping and distribution needs which, until relatively recently, could only be fulfilled by physicalstores.

How can retailers continue to buy products in massquantity at wholesale, manage them and attempt to sell them, when the consumer has a myriad of options, channels and brands through which to buy?

New retail models

"There is a new retail model emerging in Australia – one that is very customer-centric, very focused on the customer but also strongly digitally enabled as well."

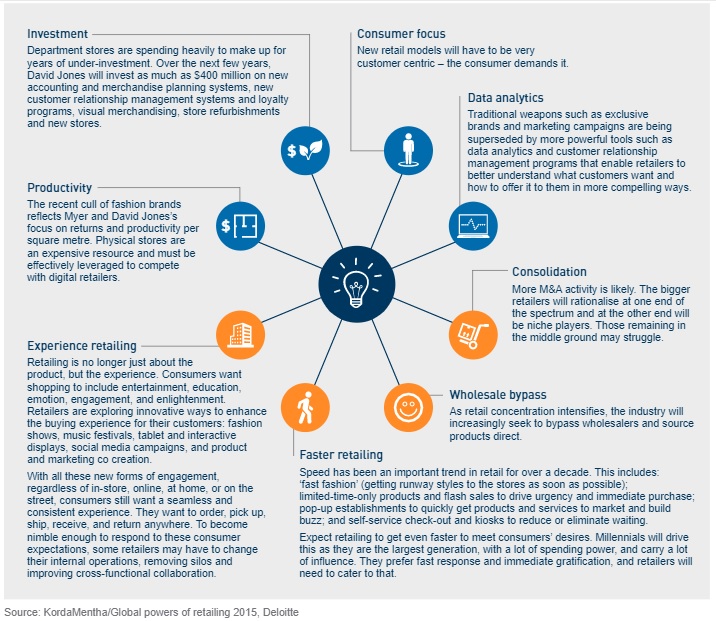

Retail trends demand an innovative response

The short-term outlook for the Australian fashion retail industry is continued disruption by new technologies and innovative competition. There will be no single formula for success.5

The near future of the retail industry is about adaptation and embracing change. The speed ofinnovation and the disruption it causes will notstop, and the demands of customers will continue to escalate. To thrive in this environment retailers will respond quickly to threats and opportunities with innovations of their own by connecting strategy, capabilities, and specific initiatives, guided by the insights provided by market data.

The right talent with the right skill set is key to successful execution. Retailers will need to focus on finding, recruiting, and retaining the best people. However, the reality is that no retailer will have all the appropriate talent in-house, making it essential that they develop an arrangement of partnerships and specialised resources. So whenneeded, they can quickly call upon the right expertise to drive the kind of innovation inproduct offerings, business models, and customer engagement that will enable them tostay ahead of the competition.6

Trends and innovations

2 Case Study: Zara

Retail trends demand an innovative response. And no retailer illustrates this better than Zara. Due to wage cost differentials, the majority of worldwide apparel production is located in low-cost regions such as Asia. This has resulted in a global supply chain. Zara's supply chain is radically different. Eschewing cost for speed and agility, Zara's supply chain is focussed around its headquarters in Spain, and can cram a traditional 12-month design and production process into as little as 10 to 15 days. As a result, Zara is four times more profitable than the average fashion retailer and achieves markdowns as low as 10%, compared with around 50% for traditional retailers.

Fast Fashion and the 'Zara Gap'

No one has captured the essence of 'Fast Fashion' to the extent that Spanish retailer Zara has.

With an EBIT/Inventory ratio of more than 1.5 times, Zara significantly outperforms speciality retailers, wholesale brands and department stores. Zara's superior market capitalisation reflects this performance.

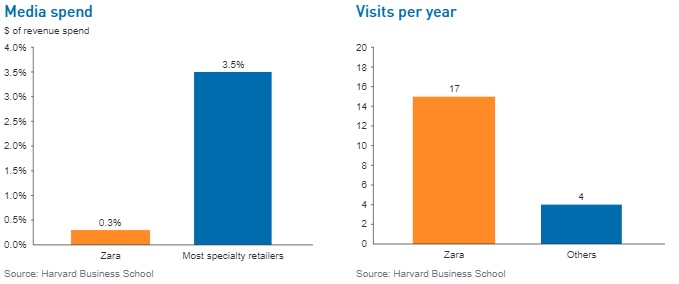

Zara is four times more profitable than the average fashion retailer due mainly to higher margins, turnover and reduced inventory risk. Zara trades on the impulses of trend-chasing consumers and, by delivering what its customers want, Zara's markdowns are as low as 15%, compared with around 50% seen with traditional retailers.7

What drives this and how can other retailers and wholesalers replicate it? The answer is Zara's innovative (and contrarian) approach to total supply chain management.

The Zara Gap

| Failure rates on new products average only 1%, compared with 10% for most fashion retailers... | ..resulting in item markdowns of only 15%, compared with a competitor average of over half. |

| Zara spends only 0.3% of revenue on advertising, compared to an industry average of3.5%.. | ..yet their customers visit their stores on average 17 times per year (more than four times the industry average) |

Traditional supply chain management

How does Zara do it? Before we can answer what Zara does differently, let's look at the accepted norms for fashion retail supply chain management.

Apparel production is fragmented. On average, apparel manufacturing firms employ only a few dozen people, although internationally traded production can feature tiered production chains comprising hundreds of companies spread across many countries.

Despite extensive investment in substituting capital for labour, apparel production remains highly labour intensive. As such, and not surprisingly, world production of fashion is focussed in developing countries with lower wage costs.8

Trading companies have traditionally played the primary role in orchestrating the physical flows of apparel from factories in exporting companies to retailers in importing countries. Over time, the complexity and specialisation of their operations have increased. Hong Kong's largest trading company,Li & Fung, derives about three-quarters of its turnover from apparel.9

The Zara difference – localised supply chain

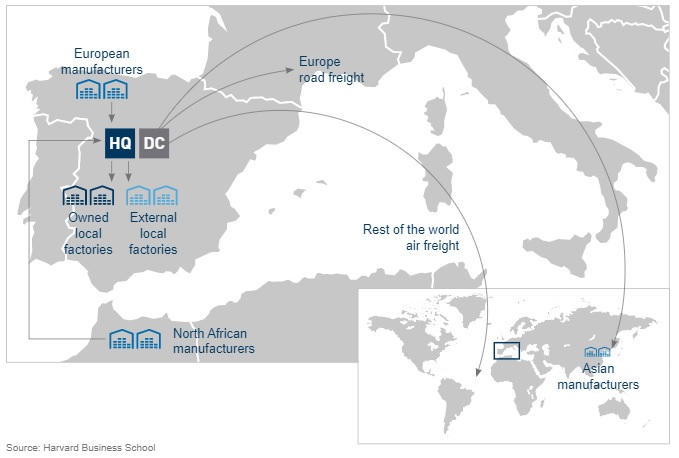

Zara's supply chain is radically different. Eschewing cost for speed and agility, Zara breaks the traditional supply chain rules by cramming the entire production process into a 10 to 15-day time span, rather than the tradition 12 month process.10

Landed cost of a men's shirt

The landed cost of apparel manufactured in Spain is about 50% higher than that of Asian manufactured garments. In the cost-conscious world of fashion retail, this cost difference drove the development of the traditional, global supply chain.

Zara chose a different route by leveraging an arsenal of automated factories located in its home country of Spain, as well as a network ofover 300 small finishing shops through the Iberian peninsula, North Africa and Turkey. Unfinished 'greige goods' (raw fabric before undergoing dyeing) are sent to finishing shops and turned into products ready to ship ona 'justin time' basis.11

Sourcing and manufacturing

About one-half of fabric is purchased 'greige' to facilitate in-season updating with maximum flexibility. Much of this volume is funneled through Comditel (Zara's sister company), that deals with more than 200external suppliers of fabric and other raw materials. Comditel manages the dyeing, patterning, and finishing of greige fabric, and supplies finished fabric to independent as well as in-house manufacturers. This process, reminiscent of Benetton's, means that it takes only one week to finish fabric.

Further down the value chain, about 40% of finished garments are manufactured internally, and of the remainder, approximately two-thirds of the items are sourced from Europe and North Africa and one-third from Asia. The most fashionable items tend to be the riskiest and, therefore, are the ones that are produced in small lots internally or under contract by suppliers who are located close by, and reordered ifthey sell well. More basic items, that are more price-sensitive than time-sensitive, are outsourced to Asia since production in Europe is typically 50% more expensive for Zara. About 20 suppliers account for 70% of all external purchases, and while Zara has long-term ties with many of these vendors, it avoids formal contractual commitments to them.12

Zara supply chain

Distribution

Zara owns a centralised distribution system, consisting of an approximately 400,000square meter facility located in Arteixo (Spain) and much smaller satellite centers in Argentina, Brazil, and Mexico, that consolidate shipments from Arteixo. All Zara's merchandise, from internal and external suppliers, passes through the distribution centre in Arteixo.

The warehouse is regarded as a place to move merchandise rather than to store it. The vast majority of clothes are in the distribution centre for only a few hours, and none ever stays at the distribution center for more than three days.

Shipments from the warehouse are made twice aweek to each store via third-party delivery services. Approximately 75% of Zara's merchandise is shipped by truck by a third-party delivery service to stores in Spain, Portugal, France, Belgium, the United Kingdom, and partsof Germany. The remaining 25% is shipped mainly by air. Products are typically delivered within 24–36 hours to stores located in Europe and within 24–48 hours to stores located outside Europe.

Consumer driven fulfilment

Zara achieves superior trading performance by delivering what their customers want. Using an agile supply chain, in some cases Zara does not need to commit to final production until after the season has already commenced, compared with the much longer lead times demanded by more traditional supply chains. Indeed, Zara undertakes 35% of product design and raw material purchases, 40%–50% of finished product purchases from external suppliers, and 85% of in-house production after a fashion season has started.13

Product precommitment (traditional)

Each of Zara's three product lines (women, men and children) has a creative team consisting of designers, sourcing specialists and product development personnel.

The process of adapting to trends places greater reliance on high-frequency information. Frequent conversations with store managers are as important in this regard as the sales data captured by Zara's IT system. Other sources of information include industry publications, TV, Internet, and film content; trend spotters who focused on venues such as university campuses and discotheques; and even Zara's young, fashion-conscious staff. Product development personnel play a crucial role in linking the designers and the stores and are often from the same country in which the stores they deal with are located. On average, several dozen items are designed each day, but only one-third of them proceed to production.

As a result, failure rates on new products are around only 1%, compared with an average of 10% for the sector.

Zara business system

3 Australian fashion wholesaling

The outlook for the Australian fashion wholesaling industry is subdued. The impact of wholesale bypass by retail customers will continue to grow as globalisation and retail consolidation further increases retailer power relative to wholesalers. To combat declining demand from retailers, some wholesalers are venturing into the online sphere and bypassing their retail customers. By bypassing retailers, wholesalers can generate both demand and higher profit margins.

The Clothing Wholesaler Industry

Customer segments

The Clothing Wholesaling industry's markets canbe broadly broken down into four main categories: female clothing retailers, department stores, male clothing retailers, and sleepwear, underwear and infant clothing retailers.

The Department Stores industry is a major market for clothing wholesalers, representing a quarter of total revenue. Demand has fallen from this customer segment over the last five years aslarger retailers are often able to bypass independent wholesalers and source products directly from manufacturers.

By contrast, demand from women's and girls' clothing retailers (the largest customer segment) increased over the same period as specialty retail stores increased their share of the retail market. Specialty retailers tend to be smaller in size compared with department stores, and many are still reliant on clothing wholesalers as they lack the resources and global reach to bypass them.14

Historical and projected revenue

Stagnant revenue

Over the five years through 2014–15, revenue for the Clothing Wholesaling industry declined by an annualised 2.2%. The decline was due to subdued retail trading conditions, and the increasing prevalence of wholesale bypass by large retailers with global reach.

Although global economic conditions are expected to improve gradually, industry growth is projected to remain constrained over the next five years. Factors that drive consumer spending at the retail level will influence the industry, such as consumer sentiment, household disposable income and interest rates. Wholesale bypass will increasingly affect the sector, with more retailers purchasing directly from manufacturers. This trend will constrain industry growth, with revenue forecast to increase by an annualised 0.3% to reach $8.4 billion in 2019–20.15

Wholesale bypass will continue to be a threat

Wholesale bypass is a major threat to the Australian Clothing Wholesale industry. Given the fragmented nature of the industry, and increasing retail globalisation and retail consolidation, this threat will continue to grow.

As a result of the Customs Tariff Amendment Bill 2004, the tariff rate on textile, clothing and footwear items was reduced from 17.5% in 2005 to 10.0% in 2010, and to 5.0% in 2015. The fall in tariff rates has increased the level of globalisation in the industry because imports are relatively cheaper at the lower tariff rate (compared with Australian manufactured apparel).16

Falling tariff rates and retailer consolidation is driving globalisation

Recent acquisitions by major global retailers are also set to have a significant impact on the Australian retail market. Through its acquisition of David Jones, South African-based retailer Woolworths SA has significantly increased its footprint in Australia. With its ownership of Country Road and now David Jones, it has become a major player in the Australian retail market.

Similarly, the $6.7 billion global acquisition of Pepkor by Steinhoff Holdings will help further expand its retail footprint in Australia. Steinhoff already has significant operations in Australia in the form of retail brands Freedom, Snooze and Poco. Following the acquisition of Pepkor, Steinhoff will take ownership in Australia of the discount department store chains Harris Scarfe and Best & Less.

With a weakening Australian dollar and ever increasing competitive pressures, we are likely to see further interest by overseas retailers in underperforming Australian retail companies.17

Wholesale bypass will continue to be a threat

As wholesale becomes less relevant to large retailers, and mid-sized retailers are increasingly squeezed out of the market, speciality niche retailers will become an important driver of wholesale demand.

Australian clothing retailers

Australian clothing wholesalers

Opportunities for retail bypass

To combat declining demand from retailers, some wholesalers are venturing into the online sphere, setting up online stores and allowing consumers to buy wholesale items directly. By bypassing retailers, wholesalers can generate both demand and higher profit margins.

Clothing Wholesale revenue is forecast to grow at a meagre 0.3% annualised over the next five years, toreach $8.4 billion in 2020. While rising household spending and wage growth will boost demand for clothing, the performance of the Clothing Wholesaling industry depends on how it responds to growth in the online segment. If recent trends continue, wholesale bypass and internet shopping will become more popular, shutting wholesalers out of the supply chain. Yet, the industry may recover if wholesalers can take advantage of the growth in the online segment and capture new markets through this channel.18

Online models of e-retailing are proliferating, and some of these are particularly relevant to wholesalers looking to deal directly with consumers. In particular, third-party marketplaces are becoming an increasingly important driver of growth for online retailers (and perhaps online wholesalers).

Proliferation of e-retailing models

Besides cost-effective customer acquisition in anoften unfamiliar territory, third-party marketplaces offers sellers a range of essential support services – including payment, fulfillment, customer service, marketing, and promotion – necessary to operate their businesses. Without the capital investment, time, and risk required tolaunch their own e-commerce operations, wholesalers looking to bypass retailers will find that e-marketplaces can be a quicker, easier, andmore efficient way to tap into growth marketsaround the world.19

Alibaba Group, China's most popular e-commerce destination, is the world's largest e-marketplace company with gross merchandise value (the value of all merchandise sold) of US$272.8 billion in 2013, nearly twice that of Amazon. Alibaba operates a third-party platform business model consisting of two main e-commerce sites: Taobao, where consumers sell to other consumers, and Tmall, where retailers sell directly to consumers.20

Case Study: Pacific Brands

Pacific Brands is a case study in how clothing wholesalers can leverage owned brands to develop new retail channels and mitigate the impact of wholesale bypass.

While the majority of Pacific Brands revenue is derived through traditional wholesale channels (64% oftotal revenue), over recent years the proportion of direct to consumer retail sales has consistently increased as the company continues to roll out new retail stores, improve in-store execution and grow online. Continued investment in retail channels remains an important element of Pacific Brands strategy, driving an increase in retail sales from 30% of total revenue in FY14 to 36% in FY15.21

Vertical integration and retail bypass

Upstream integration

Decreasing reliance on wholesale channel through expansion of retail bypass.

Outlook: continued margin erosion

Clothing wholesale margins are declining and the outlook is for further erosion.

Margin erosion

The average industry profit margin has fallen from 6.4% in 2010 to an estimated 5.8% in 2015. The continued contraction of the retail sector and the growth of large, vertically integrated retail entities have placed constant pressure on wholesalers' profit margins.22 Globalisation and retailer consolidation will likely see margin pressure continue.

Falling dollar will continue to exert downward pressure on margin

The continued weakness of the Australian dollar is placing upward pressure on input costs. While a fall in tariffs in January 2015 and weaker cotton prices have helped to cushion the effect to date, the unwinding of forward FX hedge cover will inevitably lead to pricing pressures.

A 10% to 15% increase in wholesale prices would translate into a 4% to 6% increase in retail prices. However, Australian retailers have not managed price increases well in the past, and the situation is exacerbated by a relatively weak spending environment.

Given previous attempts to manage rising input costs through product de-spec-ing (using cheaper fabrics or removing embellishments) have resulted in quality issues, Australian clothing wholesalers can expect pressure from retailers to absorb the price increases through further margin reduction.23

Footnotes

1Casualties in the retail war of

attrition, August 2015, KordaMentha

2Clothing Wholesaling in Australia, May 2015,

IBISWorld

3The future of retail is the end of

wholesale,businessoffashion.com

4The Global Powers of Retailing 2015,

Deloitte

5The Global Powers of Retailing 2015,

Deloitte

6The future of fashion retailing revisited: Part 2

– Zara, forbes.com

7Zara: Fast Fashion, Harvard Business School,

December 2006

8Zara: Fast Fashion, Harvard Business School,

December 2006

9The future of fashion retailing revisited: Part 2

– Zara, forbes.com

10The future of fashion retailing revisited: Part 2

– Zara, forbes.com

11Zara: Fast Fashion, Harvard Business School,

December 2006

12Zara: Fast Fashion, Harvard Business School,

December 2006

13Clothing Wholesaling in Australia, May 2015,

IBISWorld

14Clothing Wholesaling in Australia, May 2015,

IBISWorld

15Clothing Wholesaling in Australia, May 2015,

IBISWorld

16The Global Powers of Retailing 2015,

Deloitte

17Clothing Wholesaling in Australia, May 2015,

IBISWorld

18Global Powers of Retailing 2015,

Deloitte

19Global Powers of Retailing 2015,

Deloitte

20FY15 Annual Report, Pacific Brands

21Clothing Wholesaling in Australia, May 2015,

IBISWorld

22Clothing price rises 'inevitable' as dollar

drops, Australian Financial Review, 28 January 2015

23Tables turn on Myer as David Jones gears up for

war of attrition, The Australian Financial Review, 25 July

2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]