As communications companies across Asia Pacific continue down the path of transition to International Financial Reporting Standards (IFRS), they face the same wide array of opportunities and challenges as other operators. On the plus side, they can learn from the prior experience of their counterparts elsewhere that have already made the transition. On the downside, they must cope with a regional environment where the move to IFRS and the convergence of standards are progressing at varying speeds, and where interpretation and application continue to differ from market to market. However, Asia-Pacific operators that determine to go beyond mere compliance, and that succeed in using their IFRS transition as an opportunity for transforming their financial reporting processes, controls, and governance, stand to reap substantial benefits in both the competitive environment and capital markets.

The Asia-Pacific region comprises countries at varying stages of economic development, and with significant cultural and historical differences among them. This diversity, however, has not prevented the move to adopt or allow International Financial Reporting Standards (IFRS) from gathering pace. The shift to the new standards is now well under way in most territories.

Countries and operators across Asia Pacific vary widely, both in their approach to IFRS and in how far they have travelled down the road toward adoption. Operators such as Telstra in Australia, Hutchison Telecom in Hong Kong SAR, Telecom New Zealand in New Zealand, and SingTel in Singapore have already reported IFRSequivalent year-end information to their investors and stakeholders. So have the main Chinese operators who currently report under Hong Kong generally accepted accounting principles (GAAP). The Philippines have already harmonized their standards with IFRS. China and Indonesia have plans to do so by 2007 and 2008, respectively. And Malaysia, Korea, Taiwan, and Thailand are all in the process of converting their accounting standards to IFRS, although no specific timetables for completion have been determined.

Operators in some other countries—notably Japan and India—will have more time to get ready for IFRS since no road map has yet been drawn up for the transition.

The variations in approach and adoption raise particular challenges for the region's communications companies and investors. Not least among them are the challenges of understanding IFRS as it is applied globally (and not just as it is documented in regulatory and corporate pronouncements), mapping out the right strategies for transitioning to IFRS, and resolving the specific accounting issues that are confronting (and will continue to confront) many operators during and beyond the transition.

While, clearly, operators making the transition will need to develop IFRS-compliant systems and processes, there are considerable opportunities for exploring potential synergies and savings through initiatives such as streamlining existing reporting processes and minimizing the need for manual intervention. Crucially, the operators likely to experience the greatest benefits from the change to IFRS are those that approach it as an opportunity to position themselves for future success, rather than as an exercise in complying with externally imposed IFRS reporting deadlines.

Creating competitive edge

This likely premium for going beyond compliance reflects the fact that, going forward, the quality, clarity, and credibility of IFRS reporting and disclosures could well become a competitive advantage, with implications for share prices and costs of capital. The likelihood of this was borne out by the PricewaterhouseCoopers/Ipsos MORI survey of fund managers in the United Kingdom, published in June 2006. Two-thirds of the 75 fund managers surveyed said they found the detailed financial accounts "very" or "fairly" useful, and one-third said they had actually changed their investment decisions as a result of IFRS information.

Interestingly, these findings among fund managers appear to contrast with a separate UK survey of senior finance executives in 93 of the London Stock Exchange's FTSE 350 companies, published by PricewaterhouseCoopers/Ipsos just one month later, in July 2006. Only one in five of the executives interviewed believed IFRS would be useful to fund managers and analysts. A mere 11% thought that conversion to IFRS had resulted in a "very" or "fairly" significant impact on the way shareholders and market analysts viewed the performance of their company.

This marked difference in viewpoint seems to reflect investors' perception that strong and immediate benefits will flow from the increased disclosures and pan-European or even global comparability under IFRS. Companies, on the other hand, may have been so preoccupied with bearing the costs—both human and financial—of the conversion process that few have been able to focus on the possible direct benefits in the short term.

Taken together, these findings suggest a substantial and possibly urgent need for a facilitated dialogue between the preparers and the users of accounts. This is especially the case since some 85% of the respondents to the executive survey noted how their company had found it more difficult to explain their results under IFRS. The survey respondents also agreed that further efforts would be required to improve levels of IFRS knowledge among senior executives. Although audit committees were generally seen as relatively knowledgeable about IFRS, chief executives and the board as a whole were seen as having room for improvement.

Moving from "project" to "business as usual"

What are the implications of these findings for communications companies in the Asia-Pacific region? To assess this question, the first step is to establish the current state. Many of the region's operators have already raced for, or completed, their first year-end close. To meet the prescribed deadlines, a number of operators have had to generate some IFRS numbers outside their normal reporting systems, often relying heavily on tactical "fixes" such as spreadsheet reconciliations. Short-term fixes of this type can be difficult and time-consuming to repeat, and may well increase the risk of human error.

To become truly effective, the changes need to be embedded. Otherwise, the reporting processes can become unsustainable, and the risk of control deficiencies and material errors may increase, especially in the complex areas of accounting that are often involved (see Figure 1).

Though many Asia-Pacific entities do not need to comply with the requirements of the Sarbanes-Oxley Act in the United States, it is very evident that the accent on having proper processes underpinning financial reporting is being widely felt. The issue of interpretation discussed later in this article and this increased emphasis on controlled processes are closely related, as is the issue of strategically managing the transition to IFRS by embedding it in management systems. A survey in the US of Securities and Exchange Commission (SEC) filings up to the end of September 2006 shows that the telecommunications industry continues to have the highest proportion of adverse Section 404 opinions of any industry group. Underlining our point is the fact that the most commonly identified material weaknesses involved inadequate accounting documentation and procedures, incidences of material and/or numerous year-end adjustments, and restatements.

Given this background, the key challenge is to manage the reporting processes so as to provide timely and reliable information without a special IFRS project team, thereby turning IFRS from a distinct program or project into "business as usual." To do this, the company needs to put in place systems, processes, and teams capable of responding speedily and decisively to the rapidly changing financial reporting landscape.

Aside from embedding IFRS in business as usual, a further challenge that operators in Asia Pacific face is how to consistently interpret the standards—an issue that the regulators charged with checking compliance also face. Organizations of all kinds are now coming to appreciate that the move to principles-based accounting standards under IFRS gives rise to many questions that need to be answered in specific areas of application. It is no longer satisfactory for a company simply to arrive at an answer from its own experiences. Instead, entities today need hard, verifiable assurance that their answers and approach are defensible in the light of global practice, and that they are consistently applied.

This requirement implies a need for consultation and process. IFRS has come an enormous distance in a relatively short period of time. The convergence of standards and alternative interpretations on a global scale can be expected to take some time, and may well take longer than the initial transition to IFRS has taken to date. Some of the more important areas where divergent views and practices exist are covered below. While the IFRS community—preparers, regulators, standard setters, and the accounting/auditing profession—continues to work toward a consistent set of global interpretations, management must take responsibility for ensuring that their company's accounting policies continue to reflect sound business practices.

Although compliance with the standards has to be achieved, companies should not assume that consistency necessarily means identical application or interpretation of IFRS. Equally important is that IFRS reporting be consistent internally, which helps ensure that new accounting practices form an integral part of everyday activities and that sound IFRS reporting is achieved efficiently and effectively.

In the absence of specific guidance in certain areas, operators—especially foreign private issuers registered in the US with the SEC—have a clear desire to minimize the number of reconciling items under US GAAP. To do this, they may consider turning to US GAAP guidance, to the extent that it does not conflict with IFRS. For example, in the area of revenue recognition, it is widely acknowledged that US GAAP offers extensive guidance that can be usefully adapted for application under IFRS.

Drawing on such guidance may offer an easier route to IFRS compliance. The potential downside, however, is that offsetting uncertainties by reference to rules may prove self-defeating in the move to principles-based financial reporting.

Guidance and regulation

As IFRS is rolled out, the aim is for national guidance on IFRS to be kept to a minimum. Instead, views and priorities are to be fed to the International Financial Reporting Interpretations Committee of the International Accounting Standards Board (IASB) to develop a clear consensus on international interpretations. This approach stems from the expectation that the principles underlying a particular set of facts and circumstances will almost always have a parallel application in other countries.

In moving toward a consensus, the standardsetting bodies must perform a fine balancing act. On the one hand is a need to avoid a plethora of interpretations emerging from various bodies. On the other is a need to recognize that the commercial substance of apparently similar transactions can and does vary among markets and operators.

Regulators are expected to weigh in with their views. But they also must recognize the benefits of working closely together to reinforce the credibility of IFRS, and to achieve convergence toward high-quality global accounting standards that will ensure the providing of transparent, comparable information in general purpose financial reports.

One positive development in that regard is the move by the International Organization of Securities Commissions (IOSCO) to maximize coordination and convergence, and thereby to facilitate consistency, by establishing a system for participating IOSCO members and other independent enforcement organizations to consult and share information. But whatever approaches and structures are used, in the final analysis it is in the interests of all parties—preparers, auditors, and regulators—to do what they can to ensure the robust and internationally consistent application of IFRS.

Specific accounting issues

Achieving a single set of high-quality, understandable, and enforceable global accounting standards—with the aim of overcoming the costs and inefficiencies that stem from differences in accounting methods—is the "holy grail" of accounting.

Beyond issues of general IFRS guidance and regulation, experience elsewhere suggests that operators in Asia are also likely to face a number of specific issues concerning their accounting approach and treatment. Driving some of the issues is the ongoing process of convergence between accounting standards. Driving others is the need to handle rapid and continuing change in the industry, change that ranges across new product lines, revenue streams, billing methods, business combinations, and so on.

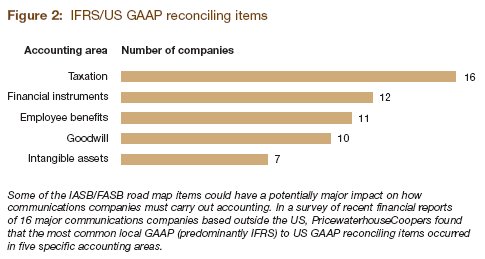

In terms of accounting issues resulting from convergence of standards, a significant development occurred in February 2006. The IASB and the US Financial Accounting Standards Board (FASB) established a 2006–2008 road map for convergence between IFRS and US GAAP. In publishing the road map, both the IASB and the FASB re-affirmed their shared commitment to enhancing consistency, comparability, and efficiency in global capital markets. The main points of the road map and underlying agreement are shown in the box on page 36 and Figure 2 on page 37.

Many of our clients are questioning not only the technical reporting challenges that the new standards present, but also the broader overarching issues. Most notable is the perception that IFRS has complicated their home country accounting. Although it is easy to attribute increased complexity to the new accounting framework, being aware that, in most cases, the standards reflect our current business environment is important. This is especially true for the communications industry.

A wide range of accounting issues arises from the need to transition to IFRS while dealing with rapid, sweeping industry changes. The tremendous upheavals undergone by communications companies, both in the Asia-Pacific region and globally, are reshaping the industry. The need for flexible and durable systems and reporting processes capable of adapting to change is likely to become more pressing. How to ensure that the increasingly complex transactions and arrangements seen in the industry comply with IFRS will continue to be a challenge—as today's complex transactions mean simple accounting answers are a thing of the past.

Following is a summary of the interplay among six major industry changes currently under way and their implications for accounting.

Business combinations. As communications companies search for new markets, new areas of growth, and new business opportunities, they will find that traditional competitors may morph into valuable allies and new partnerships may be formed with start-up entrants. Assets—and even customers— may have to be shared, and mergers and acquisitions (M&A) may surge, allowing fewer but stronger companies to emerge.

IFRS has introduced sweeping changes to the way business combinations are accounted for, and these changes have potentially profound ramifications for financial reporting. For example, more intangible assets are expected to be separately identified and recognized—and the task of determining and explaining "fair values" for them will pose a significant challenge to operators engaged in M&A activities.

The ability to report post-acquisition improvements can be built up only through management actions to integrate the acquired entity and extract cost and revenue synergies, bringing into sharp focus the underlying quality of the M&A deals undertaken by those operators. Some of the more common intangibles to arise in a business combination are licenses and customer-related intangibles such as contracts and customer lists. Each of those poses its own challenges in arriving at fair value and requires careful consideration of the most appropriate valuation technique to apply.

Impairment. The ongoing erosion of communications companies' traditional core voice businesses may well accelerate. Areas that have already been especially hard hit include fixed-line revenues, with tumbling long-distance prices and flat-rate mobile phone plans lowering per-minute charges; and revenues further whittled away by innovative IP-based services and continued mobile subscriber growth. As such trends continue, impairment reviews of acquired goodwill, intangible assets, and other tangible assets will become an established and regular procedure for many operators.

Never have consumers and businesses pushed so hard and so fast to accelerate and incorporate technological changes into the services they buy. To keep up with this demand, operators are being forced to venture into unexplored territory where they face an uncertain return on their considerable investments. One effect of the longer return horizons on investments may be that a higher proportion of value will be realized in the later years. This may involve the use of projections based on forecasts in excess of five years in impairment testing of assets—an approach that will need to be justified in a robust and explicit way under IFRS.

At the same time, many of the long-standing, virtual walls within operators are being eliminated as they experiment with new business models, blurring the distinctions between their traditional businesses. As a result, it is becoming even harder to establish what constitutes a cash-generating unit in impairment testing of acquired goodwill and intangible and tangible assets for accounting purposes. How a cashgenerating unit is defined can also affect what is shown as a "discontinued operation" when a business is disposed of. Operators will need to revisit their approach to this issue when they change the way they generate cash flows or monitor their businesses. Early consideration of the potential implications of strategic business decisions is essential in avoiding unexpected outcomes or surprises.

Restructuring and structured solutions. Communications companies are under continuing pressure to enhance their financial performance and improve their bottom line by driving down the costs associated with network access, provisioning, remediation, maintenance, and service. To achieve this, they may extend their use of outsourcing from traditional functions, such as customer care and data inputting, into complete service solutions. Outsourcing may involve the service provider's taking on an increasing proportion of an operator's businesses or operations, including such areas as network management and maintenance.

Outsourcing arrangements of these types are often complex and multifaceted, with a series of related transactions involving the use of assets in combination with the provision of the related services. The way these arrangements are separated into their individual components to be accounted for can significantly affect the operator's reported results. For example, such arrangements may contain leases that are required to be separated from other elements in the arrangements.

Revenue recognition. The consumption of communications services has continued to grow rapidly in recent years, but downward price pressures exerted both by traditional and nontraditional rivals have prevented profits from doing the same. Customers continue to clamor for more, better, and better-integrated products. Operators are scrambling to evolve new business models based on offering advanced and value-added services. The key accounting issue includes whether the services can be technically and commercially separated and, if so, whether the fair values can be reliably determined.

With the ongoing upheaval in the content, distribution, and technology sectors, communications companies can be expected to seek to own—or at least to secure continuous access to—valuable content in order to meet the needs of consumers. Given the lower-than-expected demand for wireless data services, such as video calling and video downloads, companies are under increasing pressures to demonstrate how data services can be their main driver of earnings growth.

Historically, the local legal structure might have governed the principal/agent relationships between content companies and operations, leading to operators accounting for revenue on a gross basis rather than net. The appropriate revenue recognition treatment under IFRS needs to be considered in light of the individual circumstances but can often lead to net presentations.

Intangible assets. Communications companies know they have to spend money to make money. This awareness reflects the fact that intense price wars, rapid technology shifts, and an uncertain regulatory environment have made it difficult to attract customers—and even harder to retain them. Historically, some operators may have deferred handset subsidies and other customer acquisition and retention costs based on the contracted period. As competition intensifies, operators might find themselves practically unable to or unwilling to enforce their contracts, making it debatable whether such costs can be carried forward.

Emerging from the hangover of high upfront fees for 3G licenses (especially in Europe), and realizing that 3G is unlikely to be an immediate and major source of growth for most carriers, the authorities responsible for the licensing of radio frequency spectrum in most countries are now proceeding more cautiously with their licensing regime. Companies may own the rights to use and operate specified spectrums over a period of time through a combination of up-front fees and periodic minimum fees plus a variable portion (often to be determined on the basis of future revenues from the services). The complexity of these arrangements presents real challenges when it comes to measuring the initial asset to be recorded at acquisition, and the corresponding liability for future payments.

Depreciation and useful lives. Across the content, distribution, and technology sectors, convergence is now emerging as the predominant industry dynamic. The move to triple-play services is putting operators under intense pressures to rapidly upgrade to systems that can price, provide, and bill new voice, video, and data offerings. The increasing pace of technological change requires regular monitoring of the estimated useful lives of assets.

Pushing beyond traditional Boundaries

As the communications industry, in Asia Pacific and worldwide, continues to undergo a sweeping transformation, operators need to be strategically flexible and vigilant in monitoring, anticipating, and responding to relevant shifts in the marketplace. The relentless pace of industry change—coupled with the evolution of an internationally consistent understanding of IFRS and the convergence between IFRS and US GAAP— can be expected to place a fierce strain on operators' current reporting systems, processes, and teams. Operators need to have in place financial reporting capabilities that can respond effectively to this environment. Otherwise, they will end up facing problems that extend far beyond the realm of financial reporting, ultimately affecting every stakeholder in the business.

The good news is that the IASB, having recognized that companies are still finding the transition to IFRS challenging, recently announced that no new standards will be effective until 2009. Although the IASB will continue to develop, amend, and potentially issue new standards and interpretations, adoption won't be mandatory until 2009. This comes as a relief to our clients, many of whom will spend the next few years of stability coming to grips with the standards currently in place.

The IASB/FASB road map Based on the road map the two organizations published in February 2006, the IASB and the FASB agreed to:

- Work toward a conclusion by 2008 about whether major differences in certain areas (listed below) should be eliminated through one or more short-term, standard-setting projects. If so, they will complete or substantially complete work in:

- Fair value option

- Borrowing costs

- Government grants

- Joint ventures

- Segment reporting

- Impairment

- Income tax

- Investment properties

- Research and development

- Subsequent events

- Undertake and make significant progress on joint projects by 2008 in topics regarded as candidates for improvement, potentially including:

- Business combinations

- Consolidation

- Fair value measurement guidance

- Liabilities and equities distinction

- Performance reporting

- Post-retirement benefits (including pensions)

- Revenue recognition

- Derecognition

- Financial instruments (replacement of existing standards)

- Intangible assets

- Leases

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.