- within Criminal Law topic(s)

"In any moment of decision, the best thing you can do is the right thing, the next best thing is the wrong thing, and the worst thing you can do is nothing."

— Theodore Roosevelt

Effective contracting in procurement starts with strategic decision-making about the type of contracting structure and type of pricing methodology to be adopted in the contract, and it ends in effective contract administration and handling of disputes.

This White Paper focuses on the front end of that process and provides a methodology, borrowed from management theory, for deciding between contracting structures and pricing methodologies.

Definitional Issues

For ease of understanding, it is important to define some terminology that is used throughout this White Paper.

Contracting Structure means the manner in which the contract for the provision of the Goods or Services is structured.

Contractor means the party supplying or providing the relevant Goods or Services.

Goods means things provided, such as chattels and fixtures, and includes capital items (e.g. buildings, infrastructure, processing plants, equipment, defence materiel, IT hardware, IT software, etc.) and non-capital items (e.g. consumables used in maintenance).

Price means the amount to be paid by the Purchaser for the relevant Goods or Services.

Pricing Methodology means the manner in which the price for the Goods or Services will be determined or calculated.

Procurement covers the procurement of Goods and/or Services in all sectors by a Purchaser from a Contractor.

Purchaser means the party buying or receiving the relevant Goods or Services.

Risk means an event that might occur and, if it does occur, might adversely affect one or more of the parties, including in terms of increase in cost, increase in time to obtain or provide the relevant Goods or Services, harm to reputation, injury to people or damage to property.

Services means things done and includes design services, operation of Goods, maintenance of Goods, management services, consulting services, IT services, cleaning services, security services, accounting services, etc.

The Difference Between Contracting Structures and Pricing Methodologies

There are many Contracting Structures available to a party who is procuring Goods or Services.

Before considering some of the available options, it is important to clarify the difference, and the relationship, between Contracting Structures and Pricing Methodologies.

Every procurement contract has both a Contracting Structure and a Pricing Methodology. Although some Contracting Structures, by their very nature, are inseparable from particular Pricing Methodologies (e.g. true alliance contracts involve a three-limb pricing methodology1), often the decision as to the Contracting Structure to be used and the decision as to the Pricing Methodology to be used are separate decisions. As a result, there are many combinations available to a party procuring Goods or Services.

The factors for consideration, which may lead to different (although not inconsistent) combinations of Contracting Structure and Pricing Methodology, include:

- the nature of the Goods or Services being procured;

- the uncertainty of the scope of work / the likelihood of scope changes instigated by the Purchaser throughout the transaction;

- the desire for certainty of costs;

- the available timeframe;

- the importance of meeting the relevant completion date and/or milestones;

- the complexity of the procurement of the Goods or Services and the required or desired level of involvement of the Purchaser in the process;

- the nature of specific risks and consideration of which party is best placed to bear those risks; and

- safety and environmental objectives.

In the sections below, we will look at how these factors feed into the selection of the Contracting Structure and Pricing Methodology.

Different Contracting Structures

The available Contracting Structures are many and varied, and their applicability in any particular situation will depend in a large part on the type of Goods or Services being procured and, in particular, whether they are bespoke items or "off-the-shelf items".

Bespoke items are those items that are peculiar to the particular procurement. For example, transport infrastructure will be specifically designed and built to suit the particular project. Contrast this with an off-the-shelf item which is produced in quantities to suit various applications. For example, fuel is, in most cases, an off-the-shelf item, as it will be bought in the form it is offered up for sale and then consumed by the purchaser. Sometimes a category of Good could consist of bespoke items and off-the-shelf items. For example, in the defence materiel space, it is possible to procure particular Goods (such as vehicles) on a bespoke basis or an off-the-shelf basis. Off-the-shelf items do not involve any design as part of the procurement as the design will have been performed prior to releasing the relevant Good to the market. Many consumables are off-the-shelf items.

Bespoke Items. The Contracting Structures available to a Purchaser include:

- Construct Only: This involves the Contractor being given a design and/or a specification (separately procured or prepared by the Purchaser) and agreeing to construct or provide Goods which meet that design/specification. It provides the Purchaser a high level of upfront certainty as to precisely what will be delivered. However, as between the Purchaser and the Contractor, the Purchaser takes responsibility for the design (including any design errors).

- Design and Construct ("D&C"): A design and construct contract involves the Purchaser setting out its requirements (often in functional or performance terms) and the Contractor agreeing to design and construct (or supply) the Goods in a way that meets the Purchaser's stated requirements. It has been favoured in recent times as it removes the interface between design and construction, allowing Purchasers to attribute blame for any quality issues to one person.

- Design, Construct and Maintain ("DCM"): This is a design and construct contract with a maintenance operation (for a period of time) following handover of the Goods. These have been favoured where Purchasers have believed Contractors can provide the maintenance efficiently and the Purchaser wants to minimise whole of life costs of the relevant Goods.

- Design, Construct, Maintain and Operate ("DCMO"): This is a DCM Contract combined with an obligation to operate the relevant Goods for a period of time. It applies where the thing that is delivered has an operational component, for example, a tollroad, hospital, mine or windfarm.

- Engineer, Procure and Construct ("EPC"): These are essentially D&C structures but often have the Contractor bearing more risk than in a normal D&C Contract. They will also involve the Supplier carrying out at least some testing (and possibly some commissioning) before the Goods are accepted by the Purchaser. They are often applicable to projects that have an engineering or process component that requires more pre- (and sometimes post-) completion testing than merely "defects" inspections.

- Construction Management: A true Construction Management structure involves the Contractor entering into contracts, as agent for the Purchaser, for the performance of work by contractors (often called trade contractors) and the management of those trade contractors so as to bring about the provision of the relevant Goods. It can also involve the management of design consultants (in addition to trade contractors). This results in the Purchaser having contracts with many trade contractors and designers and a separate contract with the Construction Management contractor. The Construction Manager does not accept responsibility for delivering the particular Goods by a particular date and agrees only to manage the trade contractors (and, if applicable, designers) and use its best endeavours to have the relevant Goods delivered by a particular date. With this structure, the pricing methodology will depend on the pricing methodologies of the contracts being managed and the fee being paid to the Construction Manager.

- Engineer, Procure and Construction Management ("EPCM"): This structure involves the contractor completing the engineering design of the relevant Goods (so as to meet the Purchaser's stated requirements) and then procuring and managing the construction of the relevant Goods by trade contractors. In this sense, it is similar to Construction Management with the major difference being that the Contractor is responsible for the engineering design.

- Turnkey: These are essentially D&C structures but often have the Contractor bearing more risk than in a normal D&C Contract and also involve the relevant Goods being fully tested and commissioned by the Contractor prior to being accepted by the Purchaser.

- Build, Own and Operate ("BOO"); Build, Own, Operate and Transfer ("BOOT"): These structures are common in the provision of public infrastructure and involve the Contractor agreeing to provide a service to the public by building, owning and operating the relevant Goods in order to provide the relevant services and, in the case of BOOTs, transferring ownership of the relevant Goods to another (often a government) at the end of a term (often called a concession period). Each of these structures will often be associated with the Contractor arranging the financing of the building and operation of the relevant Goods. Operation of the Goods will also include their maintenance. In recent times, governments have financed, in whole or in part, the building and operation of the relevant Goods.

- Alliance Contracting: Alliance Contracting involves the Purchaser and the Contractor working together to bring about the provision of the Goods or Services. The teamwork culture is supported by a no-blame framework, which all but eliminates the ability of any party to bring a claim against any other party, and a three-limb compensation regime (comprising reimbursement of direct or actual costs, a margin and an amount at risk for performance against agreed key criteria).

- Early Contractor Involvement ("ECI"): This structure involves the engagement of a Contractor early on in the process, and often before the Purchaser's requirements for the Goods and the design are anywhere near finalised. Following the finalization of the Purchaser's requirements and possibly some or all of the design, the Purchaser has the right to appoint the Contractor for the completion of any outstanding design and the construction of the Goods. Usually this will be done through a process of the Contractor submitting cost estimates and programs as the Purchaser's requirements (and possibly the design) reach specified stages.

- Standing Offer Arrangement: This structure is used in relation to the purchase of Goods where a number of purchases of the same Goods will be made repeatedly over a period of time but the combination of Goods and/or the timing of the purchases is not known with certainty. It involves the Purchaser and the Contractor entering into a Standing Offer (a master agreement), which sets out the manner in which orders can be placed by the Purchaser and, if placed, the terms upon which the Goods will be provided. Although standing offers are used widely in respect of off-the-shelf items, they can also be used for bespoke Goods.

It is possible for the supply of Goods (including off-the-shelf items discussed below) to be financed by the Purchaser (e.g. by way of a lease). Financing structures are beyond the scope of this White Paper.

In addition the relevant structure could include the provision of any one or more of spare parts for a specified term, options for the provision of additional Goods, and the provision of maintenance and/or operation Services.

Off-the-Shelf Items. The Contracting Structures available to a Purchaser include:

- Contracts of Purchase/Supply Contracts (without installation): As the Goods are off-the-shelf, these contracts will usually provide for the delivery of specified Goods by a specified date or dates.

- Supply of Goods with installation: This structure will consist of the supply of specified Goods by a specified date or dates and also provide for the installation of the Goods (and possibly completion of testing or testing and commissioning) by a specified date or dates.

- Standing Offer Arrangements: These are described above.

It is also possible for the above contracts to include the provision of spare parts and/or maintenance for a specified term.

Services. The contractual structures for Services will involve the doing of things over a period of time where that period is defined by reference to a calendar period or one or more milestones (e.g. the provision of a defined level of service).

The contracting structures used include:

- Traditional Services Agreements: These provide for the provision of specified Services by the Contractor.

- Standing Offer Arrangements: These are very similar to Standing Offer Arrangements for Goods.

Each of these structures can include options to extend the provision of the Services for one or more further periods of time.

Adding the procurement of Goods and the procurement of Services together in one transaction further complicates things, if for no other reason than the fact that a contract for the procurement of Goods involves the delivery of something (sometimes by a contractually required date), whereas a contract for the procurement of Services involves the provision of Services over a period of time (where that period is defined by a calendar period or one or more milestones). Combining the two requires great care to ensure that they marry together properly in terms of timing and responsibility.

Different Pricing Methodologies

Pricing Methodologies are many and varied and include:

- Lump Sum/Fixed Price: This involves the relevant Goods or Services being provided for a set price (either in total or on an item-by-item basis). It can include indexation for increases in cost, including for inflation and foreign exchange.

- Schedule of Rates: This involves the Supplier being paid specified rates for different items of work being performed.

- Remeasurement Contracts: This involves the Purchaser providing a design or specification of services along with estimated quantities of work. The Supplier prices each item of work and a fixed price is arrived at by multiplying the estimated quantities by the bid rates. At the end of the contract, the actual quantities of work are measured and the Supplier receives an adjustment for the differences between the estimated and actual quantities.

- Cost Plus/Reimbursable: Under cost plus or reimbursable contracts the Supplier is paid the actual costs incurred in providing the Goods or Services plus a margin.

- Incentive-Based Contracts: Incentives (or risk reward mechanisms) can be included with any of the above Pricing Methodologies. Usually incentives relate to cost, time or quality. Incentives are most common in Cost Plus/Reimbursable contracts.

Each of the above Contracting Structures and Pricing Methodologies have their pros and cons, highlighting the need to make effective decisions regarding the choice of Contracting Structure and type of Pricing Methodology to be employed in respect of any Procurement.

Effective Decision-Making in Respect of Procurement

The authors have been employing a decision-making tool for many years with clients to assist them in making effective decisions in relation to the choice of Contracting Structures and Pricing Methodologies for major Procurements. The decision-making tool involves the following steps:

- Determining the key objectives for the Procurement ("Key Objectives");

- Defining the key criteria of success for the Procurement ("Success Criteria");

- Weighting the Success Criteria;

- Rating the Success Criteria;

- Calculating a weighted score ("Weighted Score"); and

- Triangulating the decision.

Key Objectives. Before any decisions are taken it is essential for the parties to understand the Key Objectives. The Key Objectives will usually be related to time, quality and/or cost and may include some of the factors outlined above. It is best expressed as a combination of the relevant factors.

For example, the Key Objectives for Procurement of a coal preparation plant might be defined as designing, building and commissioning a [A] tonne per annum plant capable of crushing and washing coal from the [B] mine to product specification by [C] date for a total cost of [D] dollars and an operating cost of no more than [E] dollars per annum with an operating life of [F] years. Meeting a short construction timeframe may be important (so as to achieve revenue as soon as possible). Meeting the performance criteria (and having the Contractor take responsibility for meeting the performance criteria) may be important, but the precise design required to meet it may not be as important.

In the case of a mining project, safety and environmental outcomes will be extremely important (although the authors acknowledge that safety is extremely important in all projects).

Success Criteria. These are criteria by which the success of the Procurement will be gauged.

The Success Criteria will in a sense fall out of the Key Objectives. The Success Criteria are best expressed as one criteria per statement and should be specific and measurable.

Typical types of expressions include:

- The total capital cost of the project is not to exceed ...;

- The project is to be completed by ...;

- The operating costs are not to exceed ...;

- The project must achieve the following performance requirements ...;

- The project must achieve the following quality requirements ...;

- The project is to create no environmental harm;

- The project is have zero safety incidents;

- The project is to have no disputes over design co-ordination;

- The Contractor is to bear the risk of price escalation;

- The Purchaser is prepared to share in cost overruns and cost underruns.

Weighting of Success Criteria. From this point on, the decision-making tool becomes somewhat mathematical based.

The authors encourage weighting the relevant Success Criteria using weights of 1–10, with 1 signalling low importance and 10 extremely high importance.

These weights are judgment based and, importantly, prioritise the Success Criteria.

Giving each of the Success Criteria the same weight should be avoided if at all possible.

Rating the Success Criteria. Following the weighting of the Success Criteria, each of the realistically available Contracting Structures and Pricing Methodologies are identified and each of them rated against each of the Success Criteria.

The authors encourage using ratings of 1–10 with 1 signalling low success of achieving the relevant criteria and 10 signalling high success.

The Weighted Score. After the Success Criteria have been identified and weighted and the realistically available Contracting Structures and Pricing Methodologies identified and scored against the Success Criteria, a weighted score can be calculated for each Contracting Structure and Pricing Methodology.

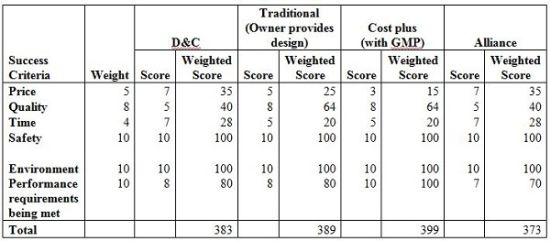

A typical spreadsheet (in a simplified form) will look like Table 1.2

Table 1

As can be seen from Table 1, the weighted scores can be used to determine a preferred Contracting Structure and Pricing Methodology.

Triangulation. Triangulation involves using a decision-making tool or process to confirm the result obtained from another decision-making tool or process.

As the above methodology is judgment based, it is important to use triangulation to confirm the result obtained from it.

One approach to triangulation is to use prior experience with Contracting Structures and Pricing Methodologies on similar projects as a cross reference against, and to confirm the result obtained from, the above decision-making tool.

Conclusion

Successful Procurement requires good planning and good implementation. The planning starts with identifying the key objectives and what success will look like. The success criteria can then be used in a structured decision-making process to decide between different Contracting Structures and Pricing Methodologies. The result obtained from such a process can then be confirmed by triangulation.

The result of approaching the critical decisions around Contracting Structure and Procurement Methodology in this structured way will result in more thoughtful decisions.

Footnotes

1. Alliance Contracts and their Pricing Methodology are

described below.

2. The numbers used are for illustration purposes only and do not reflect the authors' views of the merits of using one particular Contract Structure or Pricing Methodology over any other.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.