The changing landscape for Australian clothing retailers and wholesalers

"Suppliers shocked as Myer and David Jones dump brands"

Sydney Morning Herald, 26 July 2015

Last month Myer notified about 100 men's, women's, children's, footwear and clothing brands they will no longer be stocked in its stores and launched a 'spring clean' sale less than a week after closing its mid-year clearance. Myer's decision came just a few months after David Jones deleted about 180 of its 2,400 brands, with 80 alone in womenswear.1

Number of brands recently de-listed

Sales growth

Beyond the attention grabbing headline, is this significant?

Yes, and No.

It is not unusual for there to be a changeover of brands at the end of the financial year. And whilst Myer and David Jones have declined to identify the deleted brands, industry commentators suggest some of them had minimal presence in their stores.2

So are the headlines just a media 'beat up', stoked by Myer's PR department seeking to maximise media coverage of its sale?

Perhaps, but only in part. The launch of a 'massive' spring clean sale less than a week after closing a mid-year sale suggests this year's brand cull is more significant. Indeed, the volume of discounted brands made available in the latest sale was sufficient to crash Myer's website, as discounts of 30% to 50% attracted unprecedented customer demand.3

Private label brands

The make up of the deleted brands is also significant. Whilst many of the deleted brands are small international and local designers, the Myer Exclusive Brands are also a significant component. Myer's private label brands, including Piper, Basque, Regatta, Chloe and Lola, Trent Nathan, Wayne by Wayne Cooper, Charlie Brown, Howard Showers, Miss Shop and L Lisa Ho, featured in the list of heavily discounted apparel and footwear brands.

The private label brands have helped Myer differentiate its offer from David Jones and Target and have been a key driver of sales and margin growth over the past few years, with sales reaching $638 million, or 20% of group sales, in 2014. The retailer owns or stocks 66 Myer Exclusive Brands after buying several distressed brands, such as Trent Nathan and Charlie Brown, and developing in-house labels.4

But the strategy clearly needs attention. Whilst David Jones sales rose 6.4% in the year ending June and more than 10% in the June half (the strongest rate of growth since 2007), Myer's sales in the 10 months ending April have risen only 1.7%. Taking into account inflation and store growth, in real terms Myer's sales are actually declining.5

|

David Jones David Jones appear to have taken a proactive approach. Since the Woolworths takeover last year, for example, David Jones chief executive Iain Nairn has removed more than 180 brands (80 in womenswear alone), replacing niche labels with larger mid-market brands such as Seed, FCUK, Marcs, Country Road and Witchery. Nairn's meticulous market research showed these were brands David Jones' customers were buying outside David Jones' doors.7 |

Myer Myer, by contrast, appears to be playing catch up and the latest brand cull and heavy discounting appear more reactive than proactive. If Myer chief executive Richard Umbers, who took the helm from Bernie Brookes in March, had been hoping the new brands would be as successful in luring shoppers and generating sales growth as they had been at David Jones, then he clearly has had a re-think.8 |

What this means for Australian clothing wholesalers andbrand owners?

There will be winners and losers.

The losers, clearly, are those brands that have been culled. Myer and David Jones are key distributors for many clothing brands, especially smaller brands without standalone stores. Department stores represent about 25% of total demand for Australian clothing wholesalers.9Given softness in the current retail climate, the prospects of finding new customers to replace Myer and David Jones are challenging.

The winners, at least in the short term, are those brands that were not culled. With more focus on a smaller number of brands, the remaining brands should see an uplift in promotion and sales.

|

"I think it's positive because one of my criticisms is they have way too many brands and don't have enough volume to do justice to some of the brands"10 [Department store clothing supplier] The new management at Myer and David Jones are placing much more focus on returns and productivity per square metre than we've ever seen before, which is very positive"11 [Department store clothing supplier] |

Longer term – structural changes will challenge both retailers and wholesalers

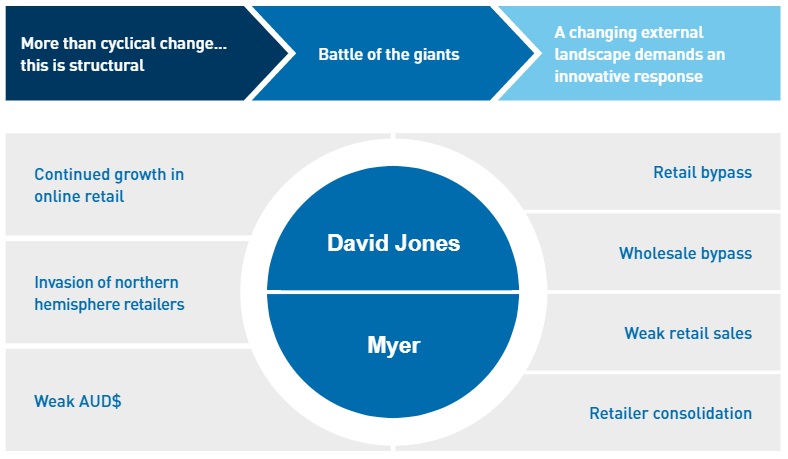

The current challenges facing Myer and David Jones (and the retail sector generally) are not merely cyclical – they are structural.12

The landscape of retail in Australia is being profoundly re-shaped by external forces. This is forcing Australian retailers to reconsider how they do business. In turn, their wholesaler suppliers will be forced to do the same.

The 'war of attrition' being played out between Myer and David Jones is in response to these structural changes and the impacts will reverberate through both the Australian clothing retail and wholesale industries.

Continued growth in online retail and loss of market share to northern hemisphere retailers will lead to further rationalisation in the Australian retail sector. The big will get bigger, with smaller niche players at the other end of the spectrum. The 'middle ground' will prove a difficult place to trade for medium sized retailers.15

In this environment, the biggest risk for clothing wholesalers will be wholesale bypass. With continued downward pressure on sales volume and profitability, larger retailers will increasingly purchase directly from local and overseas clothing manufacturers and cut out the wholesalers all together. There will continue to be wholesale demand from niche retailers who lack the size or reach to bypass wholesalers, but this will be cold comfort for those clothing wholesalers who are dependent upon demand from mid sized and larger retailers.16

|

Upcoming publication Next month we will be issuing an in depth publication that critically examines the issues raised in this paper. Myer and David Jones have responded to the changing external environment with broad ranging 'customer centric' initiatives and are settling in for a long, drawn out battle. Given their dominant size, casualties will inevitably extend to other Australian retailers and wholesalers. But will the greater threat be from online and northern hemisphere retailers? Does Zara's radically different approach to supply chain management sound the death knell for clothing wholesalers? And is there a need for the entire economic model of revenue and profitability for retailers and their suppliers to be radically reassessed? |

Footnotes

1Suppliers shocked as Myer and David Jones

dump brands, The Sydney Morning Herald, 26 July 2015. Web 29 Jul

2015

http://www.smh.com.au/business/retail/suppliers-shocked-as-myer-and-djs-dump-brands-20150729-gim9bu.html

2"Myer clears out private labels as part of brand

cull", The Australian Financial Review, 29, July 2015. Web 30

July 2015

http://www.afr.com/business/myer-clears-out-private-labels-as-part-of-brand-cull-20150729-gimzin

3Ibid

4Ibid

5Suppliers shocked as Myer and David Jones dump brands,

The Sydney Morning Herald, 26 July 2015. Web 29 Jul 2015

http://www.smh.com.au/business/retail/suppliers-shocked-as-myer-and-djs-dump-brands-20150729-gim9bu.html

6Myer is My Disaster: can anyone save the ailing retail

giant?, crickey.com.au, 8 October 2014. Web 29 July 2015

http://www.crikey.com.au/2014/10/08/myer-is-my-disaster-can-anyone-save-the-ailing-retail-giant/?wpmp_switcher=mobile

7Tables turned on Myer as David Jones gears up for war

of attrition, The Australian Financial Review, 25 July 2015. Web 30

July 2015

http://www.afr.com/business/tables-turned-on-myer-as-david-jones-gears-up-for-war-of-attrition-20150724-gijbq9

8Suppliers shocked as Myer and David Jones dump brands,

The Sydney Morning Herald, 26 July 2015. Web 29 Jul 2015

http://www.smh.com.au/business/retail/suppliers-shocked-as-myer-and-djs-dump-brands-20150729-gim9bu.html

9Clothing Wholesaling in Australia, IBISWorld, May

2015

10Suppliers shocked as Myer and David Jones dump

brands, The Sydney Morning Herald, 26 July 2015. Web 29 Jul 2015

http://www.smh.com.au/business/retail/suppliers-shocked-as-myer-and-djs-dump-brands-20150729-gim9bu.html

11Ibid

12Worst yet to come for Myer and David Jones, The

Sydney Morning Herald, 19 January 2015. Web 30 July 2015

http://www.smh.com.au/business/retail/worst-yet-to-come-for-myer-and-david-jones-says-expert-20150118-12sznp.html

13Ibid

14Clothing price rises 'inevitable' as dollar

drops, The Australian Financial Review, 28 January 2015. Web 29

July 2015

http://www.afr.com/business/retail/clothing-price-rises-inevitable-as-dollar-drops-20150128-130f3m

15Tables turned on Myer as David Jones gears up for war

of attrition, The Australian Financial Review, 25 July 2015. Web 30

July 2015

http://www.afr.com/business/tables-turned-on-myer-as-david-jones-gears-up-for-war-of-attrition-20150724-gijbq9

16Clothing Wholesaling in Australia, IBISWorld, May

2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.