Vacancy levels in the Perth office market are at a 20 year high and forecast to increase further. Tenant demand for office space is subdued, with the recent mining and resources sector downturn forcing related businesses to become far more cost conscious and efficient.

In addition, 150,000 sq.m of new office supply will enter the Perth CBD in 2015, with only 65% pre-committed. Asa result, the current high incentive levels and declining rents are likely to continue for some time as the market absorbs this excess supply.

As tenants find upgrading to better located and higher grade accommodation more affordable, older buildings and those in suburban or secondary locations are particularly at risk.

Landlords, lenders, and other stakeholders should be implementing strategies to proactively manage their office assets and cash flow during this challenging phaseof the cycle.

Tenant demand slows with end of construction investment cycle

Western Australia is one of the global powerhouses in oil, gas, mining and resources investment. Over the last decade we have experienced a period of high commodity prices, driven by the rapid urbanisation of China and global growth. This resulted in the ramping up of construction of new oil and gas, iron ore and other resources projects and associated infrastructure, to satisfy global demand and benefit from the high prices (see circa 2011 in Figure 1 below). The construction of these mines and infrastructure requires vast numbers of associated personnel to design, project manage, finance and construct these facilities.

The Perth office market is a hub for this design and construction activity. At the peak of the investment and construction cycle, the insatiable demand from engineering and mining related companies soaking up available office space caused the vacancy rates to fall as low as 3.8%, and some premium rents to peak at nearly $1,000/sq.m.

Most of these mines, infrastructure and other projects are now complete and we have entered the production phase, with significant uplifts in volumes of iron ore, gas and other commodities being produced. The production phase requires far fewer designers, engineers and service providers and as a result these companies have been consolidating their office requirements through sublease arrangements, lease expiries and in some cases assignments or lease payouts. At the same time commodity prices have now fallen dramatically, exacerbated by the global increase in supply. Thus, companies are under even more pressure to consolidate and reduce costs as their revenue continues to fall.

On the brighter side, many non-mining office users have been sitting to the side of the market for many years and are now relishing the downturn as a unique opportunity to upgrade their office accommodation at more attractive commercial terms.

Perth CBD – office market indicators

Vacancy rates

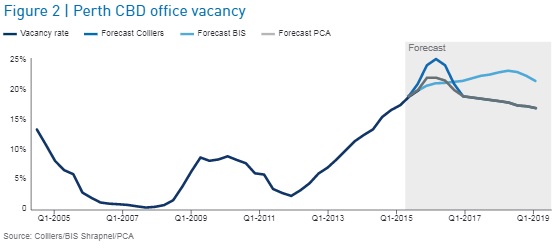

The Perth CBD office market vacancy rate has hit 18% and with 150,000 sq.m of new supply coming online in 2015, most industry researchers are forecasting it to exceed 20% by the end of the year.

Most forecasts show a modest decline from late-2016 through to 2018 as surplus supply is slowly absorbed by the market, albeit, BIS Shrapnel predict a constant high rate that peaks in 2018 (see Figure2).

Older buildings and fringe office markets are expected to experience more pronounced increases in vacancies as tenants upgrade to better located and higher grade accommodation. JLL has already reported the CBD secondary office market vacany rate is pushing above 20%.

Absorption rates

The Perth CBD recorded negative net absorption of 50,434 sq.m over the calendar year to June 2015 according to Savills, as company contraction and tenant relocation impacted the office market.

Office leasing agents advise tenant enquiry levels remain low and this trend will continue throughout 2015. Together with the substantial supply of new office buildings, most of which are only partially committed, absorption rates will continue to remain low for some time.

Rents

The increasing vacancy level is putting pressure on office landlords to accept lower rents to attract tenants. Prime net effective rents are now approximately $430 sq.m and are expected to soften further during 2015.

The metropolitan office market in general is likely to continue to see reducing net effective rents due to the increasing vacancies and subdued demand.

Rental conditions are expected to continue to favour tenants, with higher grade buildings becoming more affordable.

Incentives

Increasing incentives are another reflection of Perth's current office market conditions. According to CBRE, present incentive levels are in excess of 35% and likely to track above 40% over the coming 12 to 18 months.

There is already speculation in the market of some deals being struck with incentives as high as almost 50%.

In order to draw tenants from their existing accommodation, landlords will need to provide

significant incentives, most likely in the form of new office fit outs. This minimises the cost of relocation for tenants, however, increases the importance of landlords having access to capital.

The current market conditions offer tenants greater negotiating power and flexibility in their accommodation options and lease terms. Accordingly, landlords will continue to face pressure to provide substantial incentives to remain competitive and secure tenants.

Future apply

There is currently around 150,000 sq.m of office space under construction in eight new office towers which will be completed in 2015, nearly a 10% increase in supply to the existing 1,625,000 sq.m of PerthCBD office space.

These eight new developments have varying levels of pre-commitments:

- KS 2 (Shell), KS 3 (John Holland/Leighton) and Treasury Building (WA Government) are fully committed to major tenants.

- Space remains available in KS 4 (70% committed to HBF), 32 St Georges Terrace (50% committed to Legal Aid and Slater & Gordon), 999 Hay St (60% committed by GHD), Brookfield 2 (over 60% committed to Deloitte, Wesfarmers, Corrs, Ashurst & Brookfield Multiplex), and KS 1 which is seeking commitment

Overall, 65% of this new supply has been pre-committed, resulting in over 52,000 sq.m of new vacant office space likely to be added to a market already flooded with stock.

Furthermore, the pre-committed tenants relocating into these new buildings will leave considerable vacant backfill space in existing buildings in the Perth market, further increasing available stock.

While a number of projects have been mooted beyond 2015/2016, new builds in the short to medium term seem limited to developments with significant pre-commitments such as Woodside's Capital Square, as the market will need time to absorb the current levels of supply.

Figure 7 | Major Perth CBD office supply

Considerations for stakeholders

Office owners and asset managers

- Get close to your existing tenants (well in advance of lease expiries) and do whatever it takes to hold onto them. Understand the other options they may have available elsewhere in the market.

- Understand the market and other buildings that your building is competing with, including rental value and all associated terms, incentives and key attributes.

- Don't look at your asset with rose coloured glasses and hope that everything will be fine. Hope is not a strategy.

- If there is a new tenant interested in your building stay close to them, understand all of their needs and identify ways you can assist them. Target those tenants who traditionally have not played in the CBD or fringe markets.

- Understand the competitive advantage of your building whether it is location, age, aesthetics, services and work out where you could spend money to improve that competitive advantage to make it more attractive to more tenants.

- Ensure you have cash available for refurbishments, upgrades and cash and fitout incentives.

- If your building is secondary and nearing the end of its cycle consider if there are alternate uses for the building.

- For sites with an office development approval, consider if a reconfiguration to residential, hotel or other development schemes may be more suitable.

Financiers

- Regularly communicate with your clients to understand the strategy in managing their buildings.

- Seek updates on lease expiries and strategies to retain existing tenants.

- Understand specific weaknesses of the building and the clients' strategies to overcome these.

- Understand current and forecast rental rates for the building and likely incentives for new deals.

- Request cash flow forecasts and ensure capital is available for building upgrades and tenant incentives.

- Does the property owner have the cash available for refurbishments, upgrades and fitout incentives.

Tenants

For office tenants looking for a new deal, this could be a once in a lifetime opportunity to reset your corporate culture, location and amenity and obtain a better quality building and fit out.

Key tips for tenants before entering negotiations include:

- Consider what really matters to your company and brand including location, building quality, building size and surrounding amenity.

- Take a long term view on your accommodation requirements that will best suit your business and itsgrowth.

- Do your research – arm yourself with the knowledge of current deals and terms that are being agreed in the market.

- There are a lot of options available – landlords are offering significant incentives which minimises the cost of relocation, however, your existing landlord is likely to be open to recutting an attractive deal.

Overall, the Perth office market is going through a major correction. Landlords, lenders and other stakeholders should have active strategies in place now to manage their office assets and accommodation requirements during this phase of the cycle.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.