The Full Federal Court has made final orders in the litigation concerning Resource Capital Fund III LP's exit from its Australian investment. 1

The taxpayer now has 28 days to determine whether it will lodge an application for special leave to appeal to the High Court of Australia. The decision is particularly relevant to large private equity houses with investments in the mining sector.

Pending any appeal, the Full Federal Court's decision raises more questions than answers. The decision was in favour of the Tax Commissioner and resulted in the denial of tax treaty benefits to United States resident investors in a Cayman Islands limited partnership with an investment in an Australian mining company.

In this edition of Corrs In Brief, we analyse the judgment and the implications for foreign private equity investors.

INTRODUCTION

Generally, if a foreign resident sells shares in an Australian company, then any profit on the sale is only subject to tax in Australia:

- for a sale on revenue account, if the profit has a "source" in Australia and a double tax treaty does not preclude Australia's taxing rights; or

- for a sale on capital account, if the shares in the company are "taxable Australian property" and a double tax treaty does not preclude Australia's taxing rights.

The RCF case concerned the interaction of the Australian domestic tax law and the Australia-United States double tax treaty regarding Australia's right to tax a capital gain on the exit from an investment in an Australian mining company.

FACTS

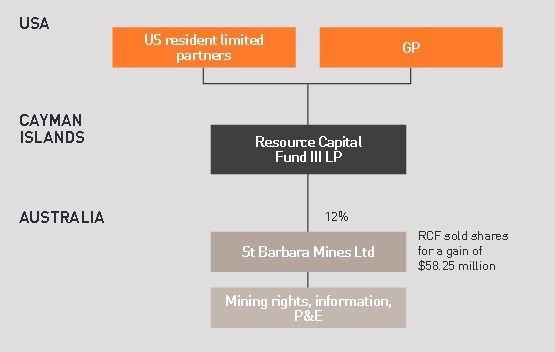

The case related to the following structure:

RCF sold its shares in SBM in two transactions for a total net capital gain of approximately $58,250,000.

The Commissioner assessed RCF to tax on the gain on the basis that the sale was on capital account and resulted in a capital gain. The gain could be subject to tax in Australia only if:

- the shares in SBM were "taxable Australian property" for Australian capital gains tax (CGT) purposes (the Division 855 issue ).

- the assessment and imposition of tax was not contrary to an applicable double tax treaty, in this case the Australia-United States double tax treaty (the DTA issue ).

DIVISION 855 ISSUE

Under Division 855 of the Income Tax Assessment Act 1997 (Tax Act), a foreign resident is taxable on a capital gain on the sale of shares in an Australian company only if the shares are an "indirect Australian real property interest" which is satisfied subject to the following two tests:

- non portfolio test: the shares must constitute a 10% or more interest in the company; and

- principal asset test: the sum of the market value of the company's assets that are "taxable Australian real property" (TARP) must exceed the sum of the market value of the company's assets that are "Non-TARP" assets. TARP assets include real property and mining rights in Australia.

It was common ground that RCF held at least a 10% interest in SBM. The only issue was whether the value of SBM's TARP assets exceeded the value of non-TARP assets. In this regard, there were three categories of assets:

- mining rights, which constituted TARP;

- mining information, which constituted non-TARP;2 and

- plant and equipment, which constituted non-TARP.

In the Federal Court at first instance in 2013, Edmonds J concluded that the correct valuation approach was to value separately each category of assets as if it is the only asset offered for sale in the transaction. On that approach, the value of the mining information and plant and equipment (valued at their cost of recreation) exceeded the value of the mining rights.

Therefore, the capital gain assessed to RCF was not taxable in Australia under the Australian domestic tax law regardless of the DTA issue.

The Full Federal Court rejected this approach. The Full Federal Court preferred an approach whereby the market values of the individual assets "are to be ascertained as if they were offered for sale as a bundle, not as if they were offered for sale on a stand-alone basis". The result was that the Court affirmed the Commissioner's assessment.

DTA ISSUE

The more significant issue with ongoing implications concerned whether RCF could be made subject to an assessment of tax under the interaction between Australian domestic tax law and the Australia- United States double tax treaty.

It is critical to note that RCF, as a limited partnership, is a taxable entity under the Australia domestic tax law. It is taxed generally in the same way as a corporation in Australia. Therefore, on the basis that RCF made a capital gain on shares relating to an "indirect Australian real property interest", the only issue was whether a double tax treaty would apply to preclude the Commissioner assessing RCF.

On the basis that:

- RCF was resident in the Cayman Islands for tax purposes;

- the limited partners in RCF were resident in the United States; and

- for US tax purposes a partnership such as RCF, whether resident in the US for US tax purposes or not, is a "fiscally transparent" or "flow- through" entity not subject to tax,

at first instance, Edmonds J identified that an assessment of RCF as a limited partnership could result in double taxation ie, of RCF under the Australian domestic tax law and the partners under United States domestic tax law. Having regard to the OECD Commentary on the model tax treaty on which the Australia-United States double tax treaty is based (which is incorporated into the Australian domestic tax law by the International Tax Agreements Act 1953 ), Edmonds J found that the assessment of RCF under the Australian domestic tax law would be inconsistent with the outcome contemplated under the Australia- United States double tax treaty which provided for tax (if any) to be borne by the partners and not the limited partnership itself. In the event of inconsistency, the terms of the double tax treaty (as per the OECD commentary) was applied by Edmonds J to treat the limited partners (and not the limited partnership) as the taxpayers and the assessment against RCF could not be upheld.

The Full Federal Court reached a different conclusion. The Full Federal Court concluded that there was no inconsistency because:

- RCF was an independent taxable entity in Australia and liable to tax on Australian sourced income; and

- the Australia-United States double tax treaty does not "gainsay" RCF's liability to tax.

The Full Federal Court's analysis proceeded on the basis that the Australia-United States double tax treaty does not apply because RCF was neither a resident of the United States nor a resident of Australia. Technically, this conclusion follows, but as to the potential for double taxation, the Full Federal Court made the following curious observation:

"Though US law attributes to the partners the liability for any tax payable on the gain made by RCF, Australia attributes the liability for any tax payable to RCF. It may be open to argument by the US partners that they should obtain the benefits of the DTA on the basis that it was appropriate for Australia to view the gain as derived by the partners resident in the US, and to apply the provisions of the DTA accordingly, as discussed in the OECD commentary (about which we express no view) but that consideration is a separate issue to the question of whether the effect of the provisions of the DTA was to allocate the liability for the tax on the gain differently to the Assessment Act."

The Full Federal Court notes, but does not resolve, the very issue raised by Edmonds J about the potential for double taxation of the Commissioner's approach.

TD 2011/25

Many participants in the private equity industry will recall that the Commissioner issued a series of Taxation Determinations concerning various issues relevant to foreign investment and, particularly, foreign private equity investors. Taxation Determination 2011/25 stated the Commissioner's view that Australia would not tax the business profits of a foreign limited partnership to the extent that the limited partners were resident in a treaty country which treated the limited partnership as fiscally transparent.

The Full Federal Court dismissed the argument that RCF was entitled to rely on the position under TD 2011/25, on the basis that the TD applies to "business profits" only and the RCF case was relevant to the taxation of "capital gains" (which are the subject of a different article in the double tax treaty).

WHAT NOW?

As noted earlier, RCF has 28 days to consider an application for special leave to appeal to the High Court of Australia.

As it currently stands:

- if the "look through" approach of Edmonds J applied, there would still be a question of whether an individual limited partner held a non-portfolio (ie 10% ore more) interest in SBM on its own (or on an associate inclusive basis)though this seems unlikely based on the spread of investors in RCF;

- the issue of double taxation for an investment like RCF's investment in SBM is unresolved. For the Full Federal Court's position to apply without double taxation, the United States would need to forgo taxing rights of the limited partners;

- on one view, the decision in RCF should be confined to its facts, particularly the feature of a capital gain arising from an investment in a company with TARP assets ie, mining rights (which would not commonly be a feature of private equity investments in Australian operating businesses);

- in more common private equity investments that involve an exit in a transaction on revenue account and non-TARP assets an investor holding their shares in an Australian company directly from a treaty jurisdiction should be able to avail itself of the benefits of the treaty to shelter any profit from Australian taxation;

- the position of an investor in a treaty jurisdiction investing indirectly through a limited partnership in a non treaty jurisdiction (eg United States limited partner through a Cayman Islands LP) is less clear. Investments held through Caymans Islands LPs (or other fiscally transparent entities in non-treaty jurisdictions) will need to rely on the protection afforded under TD 2011/25 (assuming it continues to be current) in order to apply the benefit of a treaty in their country of residence. Following this case, it is difficult to see how those views reconcile to the Full Federal Court's views in RCF. We note that one feature of TD 2011/25 was the Commissioner's call to private equity GPs that it was their onus to demonstrate that a limited partner is a resident of a tax treaty country and, unless they were willing to engage with the Commissioner, he was more than prepared to adopt a "shoot first and ask questions later" approach to assessments and collection action; and

- for now, we suggest a "wait and see" approach to the taxpayer's response to the final orders of the Full Federal Court and, particularly:

-

- whether RCF will seek special leave to apply to the High Court of Australia; and

- whether the Commissioner indicates any movement in his

- views in TD 2011/25.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Most awarded firm and Australian deal of

the year Australasian Legal Business Awards |

Employer of Choice for

Women Equal Opportunity for Women in the Workplace (EOWA) |