Australian investors maintain a natural bias to the local share market which is not too dissimilar to investors in the US and UK. The incentive for local investors to invest onshore are the higher yield expectation, greater tax incentives and a solid performance record relative to overseas markets, over the very long term.

Prior to the last three years, Australians were not highly rewarded for investing overseas. In addition, the impact of the GFC and the rising Aussie dollar offset much of the gains achieved, thereby muting performance in overseas markets. This had led to a further home bias.

To understand what is on offer overseas, we should first reflect on the opportunity set available at home. The Australian stock market is made up of over 2,000 listed companies with a combined market capitalisation of $1.49 trillion (as at 15 Nov 2013). The top 20 companies by size represent around $900 billion in size with a majority of that held in the big four banks, two large miners, two large supermarkets and a phone company. Therefore market performance is determined largely by a very small number of large corporations.

The performance of the local share market has been lifted over the past 10 years in large part by these index dominant businesses. As the mining boom peaked and the GFC passes us, investors more recently have sought high yielding stocks as we note later in this report.

The concerning point being, the mining boom has passed us and higher yielding defensive stocks have rallied significantly. While Australia confronts an environment where miners are under pressure, we seek growth from other sectors while at the same time investors need to consider broadening the very narrow domestic bias. On a global scale based on market capitalisation, the Australian index represents only 2% of the total global market capitalisation.

So where to invest Offshore?

Investing offshore can provide exposure to brands with products that are either consumed, applied, utilised, watched or enjoyed by Australian's every day. Companies include: Apple (iPhone, iPad), Google (internet search engine), Microsoft (computer software), Johnson and Johnson (bathroom products) and Exxon Mobil (petrol/ energy). It would be difficult to find a household globally that doesn't have a product or two from these and other multinationals. And these are just US based companies. They not only have sales and profits driven from mature (some would say more stable) markets, they are also benefiting from the faster growing emerging markets.

The global listed opportunity set consists of over 15,000 companies (those that are contained in the MSCI World index). The diversity in company names, their underlying revenue streams, sectors, countries and exposure to varying economic factors provides the Australian investor with greater opportunities in healthcare, technology and retailing.

Asia continues to be a growth engine for the global economy. A misconception of Asia being that it is predominantly developing rather than developed should be challenged. The likes of China (7% GDP growth), South Korea (4%), Taiwan (4.7%) and Indonesia (6%) are all expected to grow greater than global GDP in FY14 and beyond. Global corporations such as Samsung, HSBC, China Mobile, and Petro China are all businesses which have originated out of Asia that are investment opportunities for global equity managers.

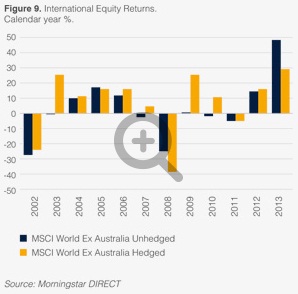

Investing offshore raises the issue of exchange rates and their impacts to the performance of an investment. The decision to be unhedged or hedged to the Australian dollar, or leave it up to the fund manager (active currency management) is a decision for you and your financial advisor.

The surge in the Australian dollar through 2009 and 2010 to push through parity with the US dollar, has been driven in part by the commodities boom, our high interest rates relative to other "AAA-rated" nations (only 7 globally) and our perceived economic safety. This was a positive period for hedged investors.

For those in Australia, you could argue that many of the major Australian listed companies are global businesses with a large portion of customers and operations overseas. However given the Australian market is only 2% of world equity markets, the benefits of thinking more broadly, can provide diversity in growth and income for a portfolio over the longer-term.

Related links

- Ten best investment ideas 2014 - Focus on your own goals, not the Jones's

- Ten best investment ideas 2014 - Have a process to guide you allowing you to focus on what matters to you

- Ten best investment ideas 2014 - The innovators

- Ten best investment ideas 2014 - Servicing the demographic

- Ten best investment ideas 2014 - The new political regime

- Ten best investment ideas 2014 - Urbanisation and the growth of the middle class

- Ten best investment ideas 2014 - Yield does not equal income

- Ten best investment ideas 2014 - Infrastructure and property – the new annuities

- Ten best investment ideas 2014 - What to do with the banks?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.