Overview

Much has been written in the press recently about whether or not we are already in or are on the cusp of a housing bubble in Australia. House prices are a function of a number of variables including demand (household sizes and population growth) and supply (existing and new dwellings), ability to access funding and affordability (ability to make repayments).

Over short periods of time, demand and supply can fluctuate but historically equilibrium will eventually be found as more dwellings are built to accommodate a rise in demand.

Similarly, interest rates tend to fluctuate over time. When interest rates are low, households may be able to borrow larger sums and buy more expensive homes. When demand for funds exceeds supply, the cost of money eventually rises to quell demand until a new equilibrium is reached. In this instance, long term equilibrium can be defined as when interest rates are at normalised levels. By normalised we mean the rate which adequately reflects the risk of lending funds when the economy is performing at mid-cycle levels.

It follows that the cost of funds and the demand/supply of housing can and do have significant short term impacts on house prices but over the long run, the main determinant is usually the growth in incomes. All other things being equal, an increase in income increases the amount that can be borrowed which increases the potential price of housing that can be afforded. Over the long run, a reasonable rule of thumb that can be used to assess whether or not house prices are under or overvalued is to assess their value relative to the growth in incomes:

In other words, in the long run, when demand and supply are in equilibrium:

| % growth in house prices > % growth in incomes = overvalued housing |

| % growth in house prices < % growth in incomes = undervalued housing |

Are house prices overvalued?

The underlying data reveals the following:

- House Price Growth

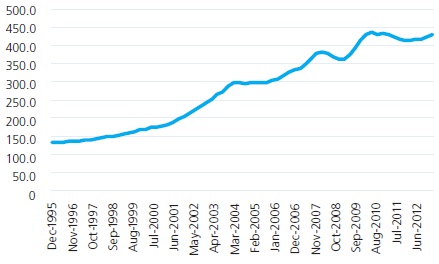

The house price index for Australia since December 1995 is as follows:

Australian median house prices

Source: Australian Bureau of Statistics (ABS)

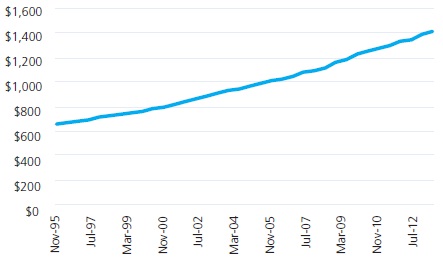

- Income Growth

Full time adult ordinary time earnings since December 1995 are as follows:

Average weekly earnings – Australia

Source: Australian Bureau of Statistics (ABS)

In summary, Australian house prices rose by:

- 223% between January 1996 and March 2013.

- 118% between January 1996 and December 2003

- 48% between December 2003 and March 2013

Similarly, Sydney house prices rose by:

- 183% between January 1996 and March 2013.

- 131% between January 1996 and December 2003

- 23% between December 2003 and March 2013

- House Prices relative to Income Growth

Outcomes can be summarised as follows:

| Over the period January 1996 to March

2013, House price growth (223%) > Income growth (115%) = 50% overvalued |

| Over the period January 1996 to December

2003, House price growth (118%) > Income growth (41%) = 55% overvalued |

| Over the period December 2003 to March

2013, House price growth (48%) > Income growth (53%) = 3% undervalued |

On examining the underlying data, it becomes apparent that the divergent views expressed in the media are in most instances a by-product of the different data ranges used to support the argument being put forward.

Over the last 10 years house prices have moved in lock-step with income growth. In other words they don't appear overvalued. However when we move the time frame to the start of the last major housing boom (the end of 1995) the result is significantly different. Australian house prices have risen by 224% while income has only grown by 115%. It is true that a small part of this rise can be attributable to house improvements over time. Regardless, the evidence would still support the view that house prices are still significantly overvalued.

Why do prices continue to rise?

The above outcomes are at odds with our natural instincts. If house prices are continuing to rise then surely this could only happen if prices were still reasonable?

The answer to this question is a little more complex but is related to:

- demand and supply

- affordability

We look at each one in turn.

- Demand and Supply

Analysts believe that around 170,000 new dwellings need to be built each year to keep pace with demand (source: Housing Industry of Australia). The chart below shows that dwellings built have been running well below these levels in recent years (although commencements have picked up considerably in recent months).

This demand and supply equation is difficult to reconcile precisely because when migrants enter Australia, or when affordability is low, some individuals seek share accommodation (which does not add to new dwelling demand) or move in with friends or family. Nevertheless the fact that rental vacancy levels have remained very low across most major cities suggests that the existing housing supply is rather tight. Although house prices may well be significantly overvalued, robust employment levels and a lack of supply are helping to support the price premium.

Dwellings built

Source: Australian Bureau of Statistics (ABS)

Wealth Management – Summer update 2013

- Affordability

Affordability is perhaps best expressed as that percentage of your earnings required to meet your loan repayments. An individual or household is said to be in mortgage stress if they spend 30% or more of their disposable (or after-tax) household income on mortgage repayments. The level of stress becomes very high above 40%.

Obtaining accurate and timely household disposable income data is not straight forward (the latest ABS household disposable income data is from 2009/10) but using that data, the average household income equates to around 1.25 times the ordinary average full time adult earnings. (Note: almost two-thirds of the working population earn less than the average).

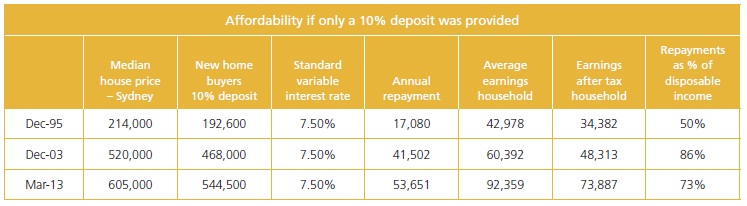

The table below highlights the change in affordability since 1995, as follows:

| Notes: | 1 Average new loan taken out for purchase of an established

house, new dwelling or construction of new dwelling. 2 Household income = 1.25 x average ordinary times full time adult earnings 3 After tax income = disposable income (Y) = household income less 20% average rate of tax 3 Loan repayments based on a 25 year P&I loan 4 House Prices represent the median price of Established House Sales |

Source: Moore Stephens Sydney, ABS

At first glance, the table above would lead you to believe that affordability today (repayments exhaust 36% of after-tax earnings) is actually better than in 1995 when the median Sydney house price was only $214,000. This of course shows the complete and utter folly of this measure but equally provides a valid explanation of why house prices have continued to rise. Incomes have certainly risen but very low interest rates have allowed borrowers to borrow more and, by extension, pay more for housing.

When interest rates eventually normalise (to say 7.50%pa), then you can see from the table below that the average new borrower would be under mortgage stress.

Finally, the average new loan size written represents the average of all new loans written during that period and so includes all types of borrowers ranging from very high income earners to low income earners. The reality for most first home buyers is that the size of the loan they are taking out is often much more than the average. Indeed, it is not uncommon for the average first home buyer to borrow 90% of the purchase price (or more) to fund their way into the market. The mortgage required to buy an average house in Sydney is now simply prohibitive as the table below shows.

Conclusion

Australian house prices remain expensive by almost any measure. While low interest rates have provided the illusion of relative affordability, the reality is that households with mortgage repayments that constitute more than 30% of their disposable income remain vulnerable to either a sharp rise in interest rates or a significant increase in unemployment. After the onset of the Global Financial Crisis (GFC), house prices plummeted in numerous countries around the world when retrenched workers could not afford to meet their repayments. Australia is not immune to this possibility should a recession eventuate in the next 5 or so years.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2013 Moore Stephens Australia Pty Limited. All rights reserved.