International economy

Overview

The pace of global growth has broadly accelerated since our July commentary. The United States has added over 2 million jobs in the past year and robust corporate profits have driven sharemarkets higher. The slowdown in China has at least been temporarily reversed with another round of stimulus reviving the rate of growth to above 7.5%. In addition, the Eurozone came out of recession in the June quarter.

Global GDP and manufacturing output PMI

Source: Markit ... JP Morgan Global All Industry output index at 2 1/2 year highs In August

United States

The US recovery has broadly been driven by a lean and profitable corporate sector that has benefited from low interest rates, a favourable exchange rate, a flexible labour market and cheaper energy costs courtesy of the coal seam gas boom. This has helped sustain the recovery since the Global Financial Crisis (GFC). Nevertheless, the recovery has been one of the weakest in history due to the significant wealth erosion caused during the GFC. This is perhaps best exemplified by looking at real household disposable incomes which remain around 9% below their 1999 peaks. But the recovery has finally gained sufficient self sustainability for the Federal Reserve to consider winding back its Quantitative Easing (QE) program if unemployment, currently at 7.3%, falls to at least 6.8%. This of course is a positive development but also means that the US must now more aggressively reduce its huge government debt burden which will ensure that growth remains below trend for many years to come.

Emerging Markets

The very announcement that the United States would begin 'tapering' its QE policy has had unintended consequences on emerging markets. Growth has slowed sharply in many countries (including India, Indonesia, and Brazil) as funds have begun to be repatriated to developed markets on the expectation of higher returns. These outflows have been especially problematic for those countries that rely on foreign funds to finance large current account deficits.

Eurozone

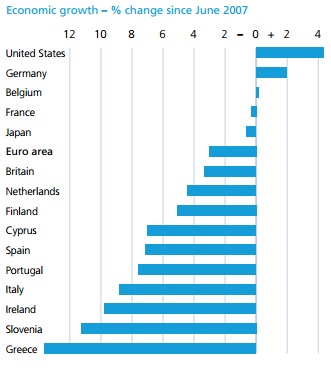

The Eurozone has confounded most expectations in recent months by returning to growth in the June quarter. Germany remains the strongest performer but manufacturing data shows that the recovery in Ireland is gathering pace and that Italy and Spain moved out of contraction in August. While the data suggests the recovery is becoming more broad based, it remains off a very low base (total output in the EZ remains 2.9% lower than it was at its peak in 2008) which means that the strength of the recovery remains very weak. This becomes more obvious when the dire unemployment figures have yet to show any signs of improvement. Meanwhile the region's sovereign debt problems remain acute and progress towards a more definitive solution remains uncomfortably slow. The risk of further significant financial market instability arising from these problems remains ever present.

China

After slowing from 7.7% growth in the March quarter to 7.5% in the June quarter, expectations were high that the transition from an investment-led economy to a consumption-led economy would cause the growth rate to continue to slow. Yet recents stimulus measures seemed to have halted the trend, with industrial production showing a marked improvement in Ausgust (+10.4%pa).

Nonetheless, we believe the recent improvement is likely to be short-lived. Much of China's growth since the GFC has been financed by a debt binge by local governments (via special purpose entities) and state owned enterprises (SOE's), part of which was spent on unproductive infrastructure that is underutilised and unprofitable. It is understood that a number of local governments are now struggling to make the interest repayments on monies borrowed, making a bailout by the central government almost inevitable in coming years. Similarly, debts by many SOE's are also understood to be very high and their profits falling rapidly as a result of increasing interest commitments. Of course this can only lead to a period of deleveraging by SOE's and local governments alike that, in all likelihood, will significantly reduce the growth potential of China's economy.

Conclusion

It is now just over 5 years ago when in September 2008 the global financial crisis reached its peak with the collapse of Lehman Brothers. Since that time most of the world's largest economies have been on life support, propped up by aggressive monetary policy initiatives orchestrated by Central Banks. What was true then remains true today. Central Banks cannot repair household or corporate balance sheets, restore the sustainability of government finances or enact necessary structural reforms to restore sustainable growth. All that Central Banks can do is provide sufficient monetary support to borrow time and hope that governments, corporates and households use that time wisely. Time is not yet running out, but much more work needs to be done.

Economic growth – % change since June 2007

Source: Eurostat, The Economist ... GDP remains well below pre-crisis levels in the Eurozone

Australian economy

Overview

In September the Australian public elected a new Liberal/ National Government. The change of government, whether coincidental or not, has already had a profound impact on confidence. In anticipation of a LNP victory The NAB business confidence survey held just before the election recorded its highest level since May 2011. Similarly, the Westpac-Melbourne Institute September consumer confidence index, completed just after the election, rose to its highest level in almost 3 years.

Expectations are clearly high that a change of government can improve Australia's economic prospects. There certainly has been a number of encouraging developments in recent months.

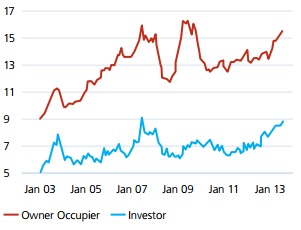

The significant cash rate reductions over the past 2 years have finally started to translate into greater activity in the housing sector. Over the 12 months to July, growth in home loans (excluding refinancing) grew by 17%. The value of investor loans is up 25% and owner occupier loans 14%. This has translated into a much improved outlook for residential construction. Building approvals rose by over 10% in July and are up 28% over the year.

Housing finance (by value)

Source: ABS, St George ...Lower interest rates ?nally translating into new home loans

In addition, according to RP Data, house prices have risen by over 5% for the year to August, and are likely to rise further. This will no doubt be welcome news to policy makers as strength in the housing sector has significant flow on effects through the economy which will help offset at least some of the impending weakness from the end to the mining investment boom. Normally, strength in house prices coupled with improved share markets will make households feel wealthier and increase their propensity to spend, adding to aggregate demand.

Yet there is a reason why this time growth outcomes may be more lacklustre.

First, Despite 5 years of deleveraging, household debt remains very high ( as do housing costs) by any measure and the recent spate of new loans will only add to the problem. A large part of household income is already allocated to home loan repayments or rent payments, which reduces the ability to spend in other areas. Of course interest rate cuts have reduced interest commitments but most households have elected to maintain mortgage repayments (hence the stubbornly high savings ratio) rather than spend the difference.

Second, lower interest rates have reduced retiree incomes and in turn reduced their ability to spend.

Third, the above two factors combined, coupled with an uncertain employment outlook have contributed to the rather anaemic retail sales outcomes over the last few years. To highlight, retail sales were flat in June and rose by just 0.1% in July. Annual trend growth of 1.6% was the weakest result since at least 1982 (earliest available data).

Fourth, the decade long mining boom is in its last stages. While it is true that sharp falls in commodity prices last financial year have reversed in recent months as China's leadership tries to revive growth, these gains are likely to be short-lived. China's debt-fuelled infrastructure and construction binge that has driven growth over recent years has taken its toll on the finances of local governments, their financing vehicles and state owned enterprises. Materially lower growth is now inevitable. In turn demand for key inputs for infrastructure and buildings, namely Australian iron ore and coal, will fall. A fall in demand is likely to be exacerbated by the increase in global supply that has emanated from the investment boom in recent years, probably leading to much lower commodity prices.

China's debt by sector

Source: FT, JP Morgan ... China's debts fuelling unsustainable growth – trouble looming

Fifth, recent data shows that the mining investment boom has probably peaked. Mining investment rose 6.4% in the June quarter but was broadly flat over the year. 2014 FY estimates suggests that investment will stay very high in outright terms as a number of very large projects remain in various stages of progress, but will begin to fall as they complete.

Sixth, as these very large mining and energy projects complete, output and productivity will increase but construction workers will be displaced leading to a likely rise in unemployment. Job ads have been in decline for some time now (the ANZ job advertisement survey fell 2% in August, the sixth consecutive monthly decline) and unemployment rose in August to 5.8%.

Seventh, the country's narrow manufacturing base remains weak and relatively uncompetitive despite modest falls in the exchange rate. This is reflected in non-mining investment, which remains very weak (June quarter business spending in the non-mining sector contracted by 5.3% on the prior corresponding period.)

Eighth, recent governments have failed to exercise appropriate fiscal disciplines. It is incumbent on good government to save money during the good times so that the surplus can cover increased unemployment benefits and fiscal stimulus during the bad times. Unfortunately recent governments saved little during the mining boom, instead providing generous tax concessions and handouts that are now politically difficult to reverse. Government taxation receipts remains too low and spending commitments too high to remain sustainable, especially given the spiralling Age Pension and healthcare costs associated with an ageing population. It is no surprise that government revenues have deteriorated now that the mining boom is ending. Perversely, the usually fiscally conservative LNP has made an additional $19.8 billion of spending promises that it will find challenging to fund in such an environment.

ANZ job advertisement series

Source: ANZ ... Job ads continue to fall

Conclusion

Although the mining investment boom has peaked, still very high levels of outright activity in that sector coupled with improved residential construction activity should ensure modest growth outcomes over the next 6 months. Yet continued weakness in non-mining sectors is likely to lead to rising unemployment which will continue to temper consumption and ensure growth stays moderately below trend.

Beyond 6-12 months, the outlook remains particularly concerning. The looming end to the mining investment boom, along with an impending slowdown in China's rate of growth as its debt fuelled infrastructure boom unwinds, remain significant challenges to the Australian economy in coming years.

Australian equities

Overview

Over the quarter ending 30 September 2013 the ASX 200 Accumulation index rose by 10.20%.

S&P ASX200 Accumulation

Source: Iress

The August corporate reporting season brought very few surprises. Earnings for the ASX 200 fell by around 3% over the financial year ending 30 June. Much lower commodity prices prompted a 20% fall in the profits of the Resources sector, while Industrials rose by around 5%.

Stocks in our model portfolio that reported strong results included Ramsay Healthcare, Telstra and Woolworths. In addition, portfolio stocks that benefited from upgrades to FY14 earnings expectations included Telstra, Woodside, Westpac, Commonwealth Bank, Transurban, Crown and BHP.

Valuations

Analysts are expecting ASX 200 corporate earnings for 2014FY to grow by around 15%. Banks are expected to grow earnings by 6%, Resources over 30%, and Industrials by 10%. Based on these expectations, the market is relatively fully valued (currently trading on a multiple of around 14.5 times FY14 earnings).

Outlook

Challenging economic conditions in recent years has forced many Australian companies to improve their efficiency amidst lacklustre revenue growth. This means that any improvement in either margins or top line revenue should translate into much improved profitability. Our brief outlook on the two largest sectors follows:

Resources

Recommendation: Underweight Higher volumes and the short term resurgence in China have boosted commodity prices and should translate into much improved profits for mining companies. Yet we suspect this will be somewhat of a false dawn as China will soon be forced to deal with the unsustainable debt binge undertaken by local governments and SOE's, most probably in 2014. This is likely to have a negative impact on mining company profitability at that time.

Banks

Recommendation: Neutral Bank profits were buoyed last financial year by their decision not to pass on the full extent of the RBA cash rate reductions. It remains to be seen whether the banks will employ this strategy again. Regardless, the resurgence in home lending will benefit banks in the short run.

Conclusion

Since the onset of the GFC the Australian share market has traded at a moderate discount to its long term average (a multiple of around 15 times current year earnings). This discount has gradually been eroded over the last 15 months. To justify further sustainable gains, corporate earnings will have to rise. Given the challenges facing both the Australian and global economies this remains uncertain. We recommend maintaining a neutral exposure to Australian equities.

International equities

Overview

Over the quarter ending 30 September 2013, the MSCI World Index (USD) rose by 7.59%

MSCI World (Ex-Aus) (USD)

Source: MSCI, Iress

Ever since Mario Draghi made a commitment to do 'whatever it takes' back in July 2012 to keep the Eurozone intact, global markets have staged a relief rally. Given that markets were factoring in potentially dire outcomes at that time, the rally has been justified as markets were rising off such low bases.

As noted earlier, the US recovery has reached a stage where stimulus is no longer required to maintain growth. This provides the backdrop for US corporates to sustain further earnings growth to drive share markets higher. On this basis we remain positive on US equities in the short run. In contrast, the EZ recovery remains very weak and fragile and remains a long way off from being sustainable. That said, European sharemarkets continue to trade at significant discounts to longer term averages and so further gains in the short run could be expected.

Valuations

Sharemarket valuations are no longer compelling but, as they are still coming off relatively low bases, value remains should the global recovery continue. As an example, while US sharemarkets look stretched on trailing earnings, upside remains should forward earnings estimates meet expectations.

Source: Standard & Poor's, Moore Stephens Sydney

Conclusion

Although the continued recovery in the United States, the world's largest economy, augurs well for global equities, investors have perhaps began to overlook the daunting challenges that remain in Europe that continue to have the potential to cause significant financial instability. On balance, we recommend maintaining a modest underweight exposure to international equities.

Australian real estate investment trusts (AREITs)

Overview

The ASX 200 AREIT Accumulation index rose by 0.05% over the quarter ending 30 September 2013.

S&P ASX200 AREIT Accumulation

Source: Iress

The AREIT index underperformed equities over the quarter as investors shifted into assets perceived to provide higher returns for three main reasons. Firstly, the emerging housing recovery has typically been associated with more buoyant economic activity which should translate into higher corporate profits. Secondly, the US announcement that it was considering tapering its QE program triggered a rise in global bond yields which reduced the relative attractiveness of listed property. Thirdly, the outlook statements offered by AREIT's during the August reporting season were rather subdued.

Earnings in the sector grew by 0.8% overall in FY13, driven more by lower interest repayments than top line growth as the cost of capital fell. The office sector was the best performer where Net Operating Income (NOI) grew by 2.4%. Retail and Industrial each grew NOI by 1.7%. Debt levels in the sector remain reasonable with debt to asset levels hovering around 30%.

Outlook

The outlook for key sectors is as follows:

Conclusion

Overall, AREITs are expecting earnings growth of around 5–6% in FY14. Although this is lower than growth expectations from the broader equity market, the recent modest share price correction in the sector means that value is now more reasonable. We recommend maintaining a neutral exposure to this asset class.

Fixed interest

Overview

Fixed interest returned 1.04% over the quarter ending 30 September 2013 while cash returned 0.70%.

UBS Composite Bond Index

Source: Iress

In August the Reserve Bank of Australia (RBA) cut the official cash rate by another 0.25% to an all-time low of 2.50%. Rates have remained unchanged since then. Recent Minutes suggest that the RBA is hoping that the economy will respond to the interest rate reductions in a number of ways, including:

- Intention: Reduce the exchange rate to improve the competitiveness of manufacturing and tourism

-

Outcome: The exchange rate has fallen from well over $1.00 and so policy has exerted some effect. However, exchange rates continue to be driven predominantly by global relativities and so to a large extent remain out of the RBA's immediate control. Should countries like Japan, the US and Europe continue to run very supportive monetary policies then the Australian dollar is unlikely to fall sufficiently for manufacturing and tourism to benefit. Further, Australia is a large importer of consumer goods and capital equipment. A fall in our exchange rate increases input costs for many businesses.

- Intention: Stimulate credit growth in the business sector

-

Outcome: Business credit grew by 0.2% in August to an annual pace of 1.4% in August. This remains very weak.

- Intention: Stimulate credit growth in the household sector

-

Outcome: Although it remains well below the levels experienced in the decade before the GFC, demand for housing credit has begun to improve markedly in recent months, as have building approvals. This will benefit the residential construction industry and should boost the retail sector somewhat (especially furniture, whitegood and homeware retailers).

- Intention: Stimulate asset price growth and improve consumer confidence

-

Outcome: Some investors have responded to low cash rates by rotating out of cash and into riskier assets such as shares and property. The additional demand has increased asset values and made households feel somewhat wealthier, which in turn has contributed to a boost, albeit modest, in consumer confidence in recent months.

Outlook

The impact of very loose monetary policy always has a lag effect and is still working its way through the system. The rather sharp pick-up in home loans and building approvals is a clear sign that policy is working, even though the rises are coming off low bases. Whether it is sufficient to offset the slowdown in activity in the mining industry, and the very weak conditions in manufacturing, remain yet to be seen. On balance, and failing any further deterioration in the global economy, we expect the RBA will keep interest rates on hold over the next quarter as they adopt a wait and see approach. In conclusion, we recommend maintaining an overweight cash allocation and a heavy underweight fixed interest position.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2011 Moore Stephens Australia Pty Limited. All rights reserved.