INTRODUCTION

Since 2002 when price cap regulation at Australian capital city airports was abolished and replaced with lighthanded price monitoring by the Australian Competition and Consumer Commission (ACCC), airports and airlines have negotiated terms and conditions of use of aeronautical services without any regulatory intervention or oversight by the ACCC, National Competition Council (NCC) or the Commonwealth Government.

The Productivity Commission (PC) in 2006 and again in 2011 found that there was no evidence to justify the introduction of any heavier-handed forms of regulation at Australian capital city airports, including a return to price cap regulation. Significantly the Commonwealth Government in 2012 unequivocally accepted the PC's recommendation in this regard and even demonstrated more confidence in the current light-handed regime than the PC by not accepting the PC's recommendation to marginally enhance the current form of regulation of airports by giving the ACCC power to issue "show cause" notices to the airports. The Commonwealth Government considered the current form of regulation of Australian airports was working well and no additional powers were needed by the ACCC.

The current economic regulatory framework for Australian airports is not due to be formally reviewed again until 2018, subject to the outcome of the PC's current non-industry specific review of Part IIIA. Therefore, Australian airports will have, until 2018 at least, significant flexibility in structuring and setting charges for aeronautical services without any immediate or credible threat of regulatory intervention should agreements not be reached with airlines.

However, in the United Kingdom (UK) the pricing of airport services is currently the subject of hot debate and provides a good insight for Australian airports not only about how heavy handed regulation in the form of price controls can operate but also invaluable insights into using a building block approach for setting prices for aeronautical services in the current Australian light handed regulatory regime. This note briefly explains the status of the debate as to how Heathrow should be regulated and the level of the charges it can impose.

THE PATH TO ECONOMIC LICENCING OF UK AIRPORTS

The introduction of the Civil Aviation Act 2012 (UK) (Act) requires airports that satisfy a market power test (MPT) to obtain a licence to be able to recover charges for aeronautical services as of April 2014. The Civil Aviation Authority (CAA) is currently determining whether Heathrow, Gatwick and Stansted pass the MPT. The Act requires certain conditions be included in a licence issued to an airport that satisfies the MPT, including the form of price controls to be applied.

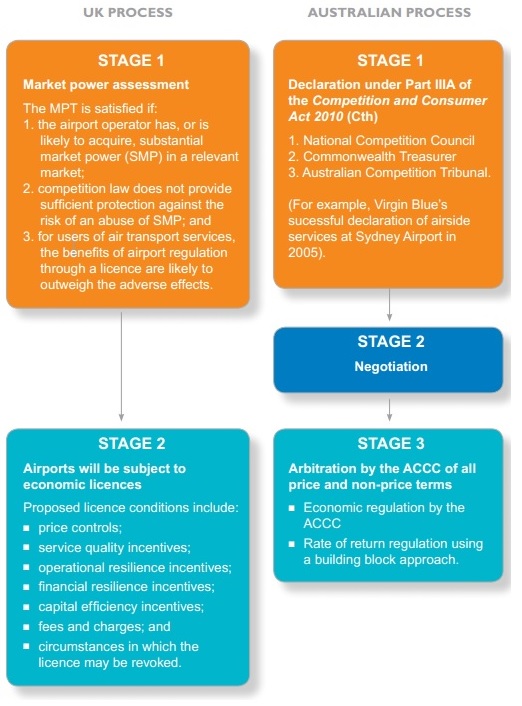

The diagram on the following page shows the path to economic licencing of aeronautical service charges and what is involved at each stage.

COMPARISON OF THE UK AND AUSTRALIAN FRAMEWORK

UK TIMELINE

- May 2011: Commencement of assessment.

- February 2012: Initial views published.

- 30 April 2013: Initial proposals for consultation.

- 25 June 2013: Closing date for consultation.

- October 2013: Final proposal.

- December 2013: Notice proposing to grant licence.

(Draft economic licences are being developed alongside the Stage 1 assessment).

- 1 April 2014: Commencement of licence.

- 1 April 2019: End of regulatory term.

The focus of this note is Stage 2, as that is where the form of regulation of Heathrow is determined including the structure and level of charges it can impose. Stage 1 whilst raising interesting issues is not currently relevant to Australian airports as the existing light handed regulatory regime in Australia will be in place until 2018 at least and the prospect of services at an airport being declared are very low (assuming the airport is acting reasonably, albeit firmly).

HEATHROW PAX PRICE CAP

The CAA has developed a draft licence for UK airports that satisfy the MPT by benchmarking approaches to regulating charges in other economic regulated sectors in the UK.This benchmarking has confirmed that the existing approach of the CAA of using a building block approach to regulate airports is appropriate. The building block approach applied in regulated industries in the UK, and as applied by the CAA, is the same general approach applied to the regulation of electricity, gas and water distribution and transmission services in Australia by the ACCC/Australian Energy Regulator (AER) for the past 20 years.

The draft licence for Heathrow proposes a price cap per passenger calculated by dividing the regulated revenue requirement of Heathrow by the forecast number of passengers for the five year regulatory period. The licence conditions will specify how this price cap is to be adjusted to reflect changes in demand, under or over spending relative to the development capex allowance, bonus factors and other adjustments.

BUILDING BLOCKS

Where:

- The cost of capital and depreciation are derived from the Regulatory Asset Base (RAB).

- The RAB is calculated at the start of the regulatory period and capex is added to it over time.

PRICE CONTROL LICENCE CONDITION

Applying the building block approach to Heathrow the CAA has provided the following price cap estimations in 2011/12 prices:

| 2014/15 | 2015/16 | 2016/17 | 2107/18 | 2018/19 | Total | |

| Net revenue requirement (£ million) | 1,482 | 1,458 | 1,422 | 1,401 | 1,365 | 7,128 |

| Passengers (million) | 70.8 | 70.7 | 71.5 | 72.3 | 73.1 | 358 |

| Price cap per passenger | 20.93 | 20.61 | 19.88 | 19.38 | 18.68 | n/a |

THE HOT DEBATE

As occurs in Australia in the setting of the revenue and price caps of electricity, gas and water distribution and transmissions services the components of the building blocks are being hotly debated in the UK. The issues that are being debated are the components of the weighted average cost of capital (WACC), the level of capex and opex, what costs are pass through events and the level of annual indexation. In Australia the regulated electricity, gas and water companies regularly challenge the determinations of the building blocks by the ACCC/AER in the Australian Competition Tribunal, particularly the components of the WACC.

The table below summarises the different views of Heathrow Airport Limited (HAL) (Heathrow Airport's operator), the CAA and British Airways (BA) on some of the key components of the building block approach.

| HAL's initial proposal | CAA's response to HAL's intial proposal | BA response to the CAA's initial proposal | HAL's response to the CAA's initial proposal | |

| Pre-tax WACC | 7.1% | 5.35% | 4.5% | 6.74% |

| Opex | £5,234 | £5,017 million | No proposal provided | No revised figure provided |

| Capex | £3bn | £3bn | Does not present a view but states that £3bn is achievable where the maximum change in the price cap is RPI - 9.8%. | £2bn |

| Maximum change in the price cap, where RPI is the change in the index | RPI + 5.9% | RPI - 1.3% | RPI - 9.8% | RPI + 4.6% |

The proposals consider the impact of different building block values on Heathrow and its consumers. For example:

- WACC: BA submitted a report from its independent consultants stating that the CAA's proposed WACC will increase costs for airlines and affect their ability to invest in aircraft and routes, which will impact passenger experience, and therefore a WACC of 4.5 percent is more appropriate. HAL, in response to the CAA, stated that a WACC of 5.35 percent would put new investment in the airport at risk, as "alternative investments in UK utilities [would] offer investors the same or better returns at lower risk."

- Opex: BA submitted that HAL's proposed opex would mean that airlines and passengers would pay HAL £1bn more than if HAL were efficient. Furthermore, BA submitted that the correct approach is to determine the level of opex required to run Heathrow efficiently, offer that sum to HAL, and if HAL does not accept the efficient opex amount, the licence could go to a more efficient operator.

- Capex: In proposing £2bn of capex as a response to the CAA's proposed WACC, HAL submitted that its priorities would now have to be sustaining the passenger experience and protecting capacity and resilience. It stated that some projects which support airline cost reduction and improve passenger experience would no longer proceed.

- Price cap: The CAA, in comparing the proposed price caps of HAL and other airlines, stated that in 2011/12 prices, by the end of 2018/19, HAL's proposal will involve an average airport charge per passenger of £27.30 compared to the

- airlines' proposal of £12.56.

LESSONS FOR AUSTRALIA AIRPORTS

The hot debate in the UK about the form of regulation of Heathrow and in particular the structure and level of charges it can recover from airlines provides a good case study for Australian airports. Whilst the UK outcomes are not directly applicable to Australian airports the issues raised by all stakeholders are relevant and can provide good insight into how Australian airports can structure pricing regimes or improve pricing mechanisms in Air Service Agreements to maximise returns on aeronautical assets.

MAXIMISING RETURNS

DLA Piper is a leader in rate of return regulation in the Australian regulated industries of electricity, gas, water, rail, ports and telecommunications. We work with our clients across all regulated industries to develop strategies to maximise their regulatory return. Whilst Australian airports are not subject to formal rate of return regulation the principles, methodologies and strategies to maximise regulated returns in Australian regulated industries can be adopted in the commercial negotiations for aeronautical services in Australia.

Watch this space for our next update on "the final UK decision" due out in October.

© DLA Piper

This publication is intended as a general overview and discussion of the subjects dealt with. It is not intended to be, and should not used as, a substitute for taking legal advice in any specific situation. DLA Piper Australia will accept no responsibility for any actions taken or not taken on the basis of this publication.

DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities. For further information, please refer to www.dlapiper.com