INTRODUCTION

Users of open access supply chains frequently seek to collectively negotiate various arrangements between themselves and with the supply chain operator. These negotiations and subsequent agreements often involve discussions amongst competitors of price matters, non-price matters and capacity allocation. Users therefore risk breaching the cartel provisions, exclusionary provisions, secondary boycott provisions and the anticompetitive agreement provisions in the Competition and Consumer Act 2010 (Cth) (Act). Users may apply to the Australian Competition and Consumer Commission (ACCC) for authorisation of discussions and agreements which may breach the Act.

KEY COMPETITION ISSUES

This article outlines key competition issues that may arise in sharing infrastructure and seeking authorisation to collectively negotiate and make agreements.

Development and expansion

Parties seeking the development or expansion of facilities such as coal terminals, may wish to collectively bargain with the facilities manager in order to improve the speed of construction, reduce transaction costs and develop a uniform view of the project's needs. These joint discussions or agreements may contain cartel provisions, exclusionary provisions or may be arrangements that substantially lessen competition.

| In 2012 Carabella Resources, Macarthur Coal, Middlemount Coal, New Coal, New Hope Corporation and Peabody Energy Australia sought authorisation to collectively negotiate with Dudgeon Point Project Management for the development of and access to the port facilities, expansions to the terminal and associated infrastructure necessary to support the terminal. The ACCC granted the authorisation, stating that collective negotiations may increase transaction cost savings, decrease delays in the terminal construction and assist in identifying proposals that satisfy the relevant parties' needs more fully. |

Capacity allocation and supply chain coordination

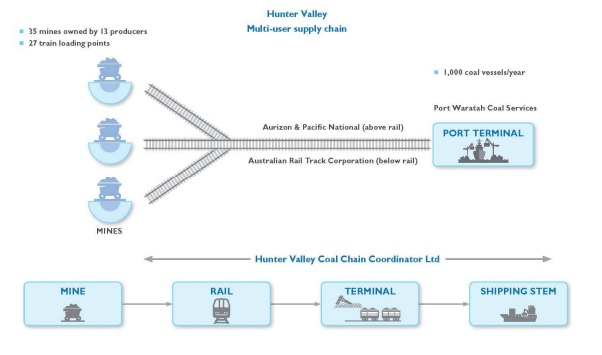

Capacity constraints at ports can create an imbalance between the demand for services and the capacity of the supply chain resulting in long queues of vessels at ports, demurrage charges and delivery delays to recipients. In order to address these issues, the owners and operators can apply for authorisation to develop queue management processes or capacity framework arrangements. These agreements may contain cartel provisions, exclusionary provisions, anti-competitive arrangements or secondary boycott provisions.

| In 2009, Port Waratah Coal Services, Newcastle Infrastructure Group and the Newcastle Port Corporation sought authorisation of their 'Capacity Framework Arrangements' (Framework) to address capacity constraints in the Hunter Valley. The Framework included the allocation of port capacity to access seekers under long term contracts. The ACCC allowed the authorisation, stating that the Framework would facilitate the alignment of contractual obligations and incentives in the supply chain, increase the accuracy and timeliness of investment decisions and increase demurrage savings. |

Increased bargaining power

Collective negotiations by users of a supply chain with owners and operators enable parties to negotiate access on better terms and conditions than if they engage in individual negotiations. Parties may make direct agreements as to the price of access, the mechanism by which price reviews will occur and also non-price matters. Without authorisation, these discussions and agreements could breach the cartel provisions or anticompetitive arrangement provisions of the Act.

| In 2010, the North West Iron Ore Alliance (NWIOA), sought authorisation on behalf of its shareholders, to collectively negotiate terms and conditions with BHP Billiton, Rio Tinto and Fortescue Metals Group for the acquisition of above and below rail access in the Pilbara, including on matters such as price, services and obligations. In granting conditional authorisation, the ACCC noted that BHP and Rio Tinto had not provided rail services to other iron ore producers in the previous 40 years and that without authorisation participants of the NWIOA would have little bargaining power in negotiating terms of access with infrastructure owners such as BHP Billiton, Rio Tinto and Fortescue Metals Group. |

LOOK OUT FOR

Look out for our future update on 'Marketing agreements between joint venture partners' and 'Exclusivity in supply chains.'

© DLA Piper

This publication is intended as a general overview and discussion of the subjects dealt with. It is not intended to be, and should not used as, a substitute for taking legal advice in any specific situation. DLA Piper Australia will accept no responsibility for any actions taken or not taken on the basis of this publication.

DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities. For further information, please refer to www.dlapiper.com