Your concerns, our solutions

- At Moore Stephens we view an organisation from the same outlook your stakeholders do – a business perspective.

- Whether you are grappling with the risks in a global market, starting a new business in your local market or need assurance that your financial information is true and fair, Moore Stephens will service your requirements.

- We realise it is essential to understand your business and so we closely align our approach with your key business risks and corporate governance requirements.

- With significant expertise in the NFP sector throughout Australia, Moore Stephens will tailor an audit solution for your organisation.

NDIS – The Basics

- The NDIS will provide long term, high quality support for people who have a permanent disability that significantly affects their communication; social interaction; learning; mobility; self-care; self-management; and capacity for social and economic participation. It will also include intensive early intervention, particularly for people where there is good evidence that it will substantially improve functioning or delay or lessen a decline in functioning.

- The NDIS will also include a comprehensive information and referral service to help people with a disability who need access to mainstream, disability and community supports

- From July 2013, the NDIS will be launched across South Australia focusing on children aged birth to 5 years with significant and permanent disability. By 2014 the age limit will be extended to 13 years and in the third year of launch all children up to 14 years. A total of around 5,000 children with significant and permanent disability are expected to benefit from the first stage of the scheme.

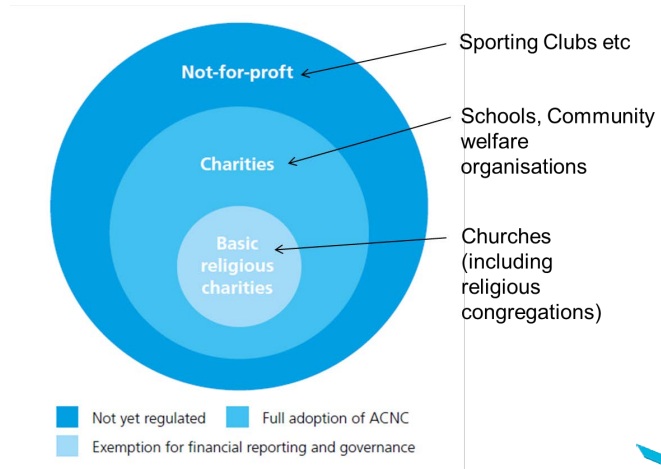

ACNC – The Basics

- Commencement date – 3 December 2012

- Initially Charities only, NFP excluded

- Registration will occur automatically for currently endorsed charities utilising the entity's ABN. Separate registration for each ABN.

- ACNC will regulate the Charity on a range of matters including financial reporting, governance and in the future fundraising activities.

- Reporting requirements proportional to entity size

- Commences FY2012-2013

-

- (i.e. from the date the ACNC Acts commence)

- Statement due 31 December 2013

-

- (or six months after reporting period)

ACNC Regime

ACNC Financial Reporting Requirements

Reporting and auditing (Registered Charities Only)

| Tier | Threshold | Requirements |

| Small | Annual revenue less than $250,000. | Annual information statement (e.g. entity's purpose, activities, governance, short-form financial information) |

| Medium | Annual revenue less than $1 million and not 'small' |

Annual information statement (more detailed) Financial report that has been reviewed |

| Large | Annual revenue of $1 million or more (includes DGRs) |

Annual information statement (more detailed) Audited financial report |

The External Audit Process – General

What is the nature and purpose of audit?

- To enhance the degree of confidence that intended users may obtain in a financial report (i.e. greater level of confidence in their reliability and credibility)

- The purpose is achieved by the auditor expressing an opinion on whether:

-

- financial report is presented fairly

- in accordance with the applicable financial reporting framework

- compliance with relevant laws and regulations

- Users of the financial reports such as shareholders, members, investors, government agencies and the general public, rely on the external auditor to present an unbiased and independent audit report on the organisations state of affairs.

The External Audit Process – Objectives

ASA 200 Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Australian Auditing Standards

Overall objectives of the auditor:

- To obtain reasonable assurance (not absolute) about whether the financial report as a whole is free from material misstatement, whether due to fraud or error, thereby enabling the auditor to express an opinion on whether the financial report is prepared, in all material respects, in accordance with an applicable financial reporting framework; and

- To report on the financial report, and communicate as required by the Australian Auditing Standards, in accordance with the auditor's findings to those charged with governance.

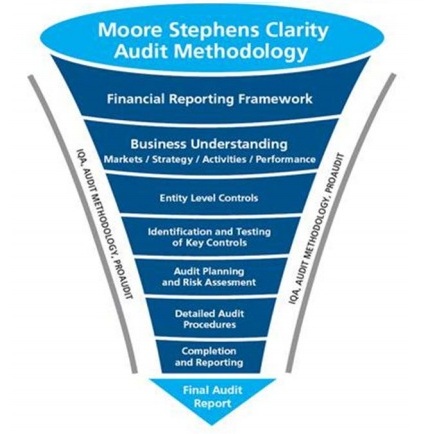

The External Audit Process – Moore Stephens Audit Methodology

The External Audit Process – Audit Report

Key Aspects of the Audit report:

- Committee members' Responsibility:

-

- includes preparation of the Financial Report thereof and the provision of internal control as determined necessary to enable the preparation of a financial report that is free from material misstatement, whether due to fraud or error.

- Auditor's Responsibility

-

- is to express an opinion on the financial report based on our audit but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control.

The External Audit Process – Audit Findings in aManagement Letter

ASA 260 Communication with Those Charged with Governance

- In entities where governance is a collective responsibility, auditor's communications may be directed to a subgroup of those charged with governance, such as an audit committee.

- Auditor would determine whether there is also a need to communicate with the entire governing body based on:

-

- the respective responsibilities of the subgroup and the governing body

- the nature of the matter to be communicated

- relevant legal or regulatory requirements, and

- whether the subgroup has the authority to take action in relation to the information communicated and can provide further information and explanations the auditor may need.

Effective Use of the External Auditor

- Regular communication with your auditor (rather than subsequent to the reporting date) about your organisations activities during the course of the year including financial results, major transactions not in the ordinary course of business and complex accounting issues – recommend communicate quarterly with the external auditor providing a snap shot of the business

- Active involvement with the auditor during the planning process of the external audit on an annual basis – request to have the audit plan tabled at the audit committee for due consideration, seek to provide input and assist with the risk identification process

- Understand the external audit process and facilitate an efficient and effective conduct of the audit by providing the necessary information and supporting documentation for the conduct of the audit – this will contribute towards lower audit fees and facilitate more time to focus on risk areas

Effective Use of the External Auditor

- Promote regular visits during the year by the external auditor during the audit program to assist with early detection of errors or irregularities or to provide recommendations for improvements with accounting processes and internal controls of the business operations – recommend at least 2 visits per audit year.

- Request assistance or commentary with the design and implementation or effectiveness of key internal controls in the accounting processes of your business organisation on a regular basis if your business operations and activities are subject to change due to the environment you operate in.

- Request audit findings, commentary and recommendations to be communicated on various aspects of the business operations including – internal controls, regulatory aspects including , governance and reporting requirements in a timely manner.

Effective Use of the External Auditor

- Request the external auditor to provide assistance with the preparation of the annual statutory financial statements given their knowledge of Accounting Standards and regulatory requirements and the need for them to be constantly up to date with reforms and developments

- Request the auditor to provide or notify your organisation in a timely fashion of emerging issues in the Accounting and regulatory environment – seek to obtain their publications

- Grant Acquittals – discuss your funding arrangements required outcomes and acquittal requirements at the commencement of your funding arrangements so this can be factored into the audit process.

- Ensure the auditor has considered the risk of fraud and error in your organisation and has effectively communicated to those charged with governance it's findings during the audit process

The External Audit Process – Fraud

- Purpose of Auditing Standard ASA 240 The Auditor's Responsibilities Relating to Fraud in an Audit of a Financial Report

- Fraud relevant to the auditor includes misstatements resulting from misappropriation of assets and misstatements resulting from fraudulent financial reporting;

- auditor's responsibility for maintaining an attitude of professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures that are effective for detecting error may not be effective in detecting fraud;

The External Audit Process – Fraud

Auditor is required to:

- discuss among the engagement team members how and where the entity's financial report may be susceptible to material misstatement due to fraud, including how fraud might occur;

- obtain an understanding of the entity and its environment, including the entity's internal control and obtain information for use in identifying the risks of material misstatement due to fraud at the financial report level and at the assertion level; and

- determine responses to address the assessed risks of material misstatement due to fraud;

- obtain written representations from management relating to fraud;

- communicate to management and with those charged with governance on matters related to fraud if discovered during audit.

Key Areas for Fraud and Misappropriation

Top Ten Fraud Risk Indicators:

- Key documents missing

- No separation of financial duties

- Accounting systems in disarray

- Lack of policies that establish controls

- Inadequate monitoring to ensure these controls work as intended

Key Areas for Fraud and Misappropriation

Top Ten Fraud Risk Indicators (continued):

- Ineffective accounting, information technology or internal auditing staff

- Documentation that is photocopies or lacking essential information

- Unusual employee behaviour

- Tips or complaints about fraud and unethical behaviour

- Lack of established code of ethical conduct

Key Areas for Fraud and Misappropriation

Common Red Flags for fraud and misappropriation

- Personal financial pressure

- Vices such as substance abuse and gambling

- Extravagant purchasing or lifestyle

- Real or imagined grievances against the organisation or management

- Increased stress, irritable, defensive and argumentative

- No vacations / sick leave / excessive overtime

- Dominant personality

- Protective of area of administration and missing documents and files from their area

Key Areas for Fraud and Misappropriation

| Type of Fraud | Controls to mitigate |

|

Fictitious Employees (Ghosts) How – create employees in payroll (full time or casual) and pay salary into controlled bank account. |

|

|

Misappropriation of cash How – theft of cash by manipulating the cash deposits prior to receipting and banking. |

|

|

Expense Fraud – Manipulate Master File / Phantom Vendor / Cheque Fraud How – Creditors Clerk manipulates Master File or EFT upload file prior to up loading into bank. Manipulated pay run then forwarded directly to a controlled account; How – Phantom vendor and invoices created by Creditors Clerk and paid directly to controlled account; or How – Pass fraudulently approved cheques and bank to there own account. |

|

|

Expense Fraud – Staff Reimbursement and Petty Cash How – Misappropriation of monies by submission for reimbursement of fraudulent and or inappropriate expense claims. |

|

|

Expense Fraud – Staff Reimbursement and Petty Cash How – Misappropriation of monies by submission for reimbursement of fraudulent and or inappropriate expense claims. |

|

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2011 Moore Stephens Australia Pty Limited. All rights reserved.