AUSTRAC issued its latest guidelines on de-banking in June 2023, aiming to encourage affected businesses to establish transparent communication with financial institutions and showcase the measures they implement to mitigate the risks inherent in their operations.

What is De-Banking?

De-banking is the practice by financial institutions of refusing, or limiting their banking services across whole industries where the industry is assessed as having a higher money laundering (ML) or terrorism financing (TF) risk. Industries commonly affected include the remittance, digital currency exchange and financial technology industries.

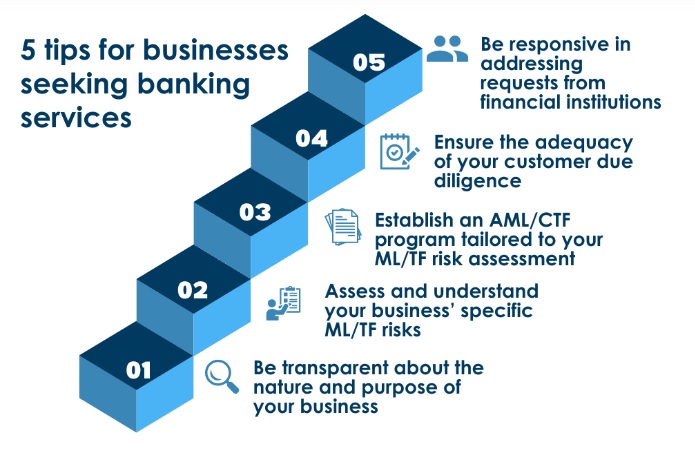

AUSTRAC's guidance encourages businesses seeking banking services to engage in open communication to ensure that the financial institutions understand correctly the risks presented. This approach can assist financial institutions to better grasp the business-associated risks and more effectively address them.

The Role of Remitters, DCEs, FinTechs and other Reporting Entities

Be transparent about the nature and purpose of your business

For remitters, digital currency exchanges and financial technology enterprises, the initial step toward increasing the likelihood of receiving banking services from financial institutions is to openly convey the nature of your business and the intentions behind seeking the proposed services.

Be prepared to provide information to the financial institutions to:

- assist them in understanding your business' legal structure and identifying the ultimate controllers of your business;

- provide an in-depth explanation of the services and demonstrate compliance with all licensing and regulatory requirements;

- disclose outcomes from your internal assessments of your own regulatory and risk management systems, including subsequent actions taken (where permitted);

- share insights into your customer types (excluding individual customer identification);

- provide specifics regarding the geographical regions where your customers are located and/or where they transfer value using your services; and

- indicate anticipated transaction volumes expected through the financial institution's services.

Assess and understand your business's specific money laundering and terrorism financing (ML/TF) risks

Specifically, conduct your ML/TF risk assessment to ensure that it is tailored to your business, including:

- the specific products and services you offer,

- your customer demographics,

- the jurisdictions you operate within, and

- your service delivery methods.

Relying on an off-the-shelf risk assessment that lacks customisation to your business or asserting that all your services are of low risk may raise questions regarding your understanding of the ML/TF risks and your ability to effectively counter those risks.

Establish an Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) program tailored to your ML/TF risk assessment

Your AML/CTF program must incorporate risk-based systems and controls to manage and mitigate the risks from your ML/TF risk assessment.

You can help financial institutions to better understand the residual ML/TF risks tied to your business by being ready to demonstrate that:

- your AML/CTF program was customised to your business;

- senior management oversees and supports the implementation of your AML/CTF program;

- relevant personnel in your business, including those who deal with customers, understand and implement your AML/CTF program and receive appropriate training; and

- you have an AML/CTF compliance officer equipped with the requisite seniority, competency and resources to oversee AML/CTF program compliance, and who can also effectively engage with a financial institution about the systems and controls you deploy.

Ensure the adequacy of your customer due diligence

Financial institutions lack direct interactions with your clients, which means when offering you their services, they are placing reliance on your ability to identify, alleviate, and manage the ML/TF risks presented by your customers. Consequently, financial institutions might seek to understand your customer types and the services you provide, including the foreign jurisdictions you operate in. This data, coupled with insights into your internal governance, aids in understanding the ML/TF risks inherent in your business model.

Be responsive in addressing requests from financial institutions

Throughout your business relationship with financial institutions, they may seek additional information from you. It is crucial for them to be updated of your business and its corresponding ML/TF risks. When contemplating substantial shifts in your business model, such as ownership or management changes, or introducing new services, make sure you communicate with your financial institution proactively.

The Role of Financial Institutions

The decision of financial institutions to provide financial services is one that must be made by the institution itself. However, recognising the significant consequences that refusing services to whole industries can have on customers, AUSTRAC's guidance urges financial institutions to establish systems and controls that enable decision-making processes to be objective and proportionate to the level of ML/TF risk identified for each individual customer.

Background

De-banking, also known as 'derisking,' can adversely affect legitimate businesses and has been on the rise in the past decade.

When denied access to the established financial system, the businesses seeking banking services may resort to unregulated channels. The risk associated with de-banking is that it might can lead these businesses to disclose less information about the genuine nature of their business activities to financial institutions, thereby reducing transparency and elevating risk. The consequences of de-banking can escalate the ML/TF risks across Australia's economic landscape. AUSTRAC persistently discourages the unselective and widespread closure of accounts throughout entire industries.

Further Reading

AUSTRAC's Statement on De-Banking

Guidance on De-Banking: Financial services for Customers that Financial Institutions Assess to be Higher Risk

Risk Assessments and Financial Crime Guides

Independent remittance dealers in Australia Risk Assessment 2022

Remittance corridors: Australia to Pacific Island Countries Risk Assessment 2017