NSW infrastructure contributions reform – implications for conveyancing practices

In 2022, the NSW Government is set to reform the NSW infrastructure contribution system, which in turn will have considerable implications for NSW conveyancing practices. The Legislative Council is expected to pass the proposed legislation in early 2022, with a commencement date of 1 July 2022. However, in our view, further legislative change is required to ensure conveyancing processes can adequately support the proposed land value contribution framework.

In 2021, the NSW Government introduced the Environmental Planning and Assessment Amendment (Infrastructure Contributions) Bill (Bill) and the draft Environmental Planning and Assessment Amendment (Infrastructure Contributions) Regulation 2021 (Draft Regulations). The Bill largely amends Part 7 of the Environmental Planning and Assessment Act 1979 (EP&A Act), with other minor consequential amendments to the Conveyancing (Sale of Land) Regulation 2017 and the Valuation of Land Act 1918. The Bill responds to the Productivity Commission's Review of Infrastructure Contributions in the New South Wales: Final Report dated November 2020 (Review).

The Review and reason for change

The Review found that the current NSW infrastructure system prevents the state and local government from providing the infrastructure required to support development. The Review made 29 recommendations designed to improve the system, all of which were accepted by the NSW Government in March 2021.

Currently, the EP&A Act permits the rezoning of land before a contribution plan has been developed. This means there is often a delay between rezoning and when councils acquire the land required for public infrastructure. This is a major financial risk, as the value of land can increase significantly and rapidly in response to or through speculation about rezoning. Consequently, councils are often required to absorb financial shortfalls when delivering public infrastructure.

Accordingly, the Review recommended the introduction of a direct land contribution framework into the EP&A Act to facilitate early and adequate funding for land.

Proposed changes - land value contributions

The Bill introduces a new type of local infrastructure contribution called a 'land value contribution' (LV Contribution). Councils can either elect to collect contributions for land acquisition under the existing section 7.11 framework (which has been minimally amended) or elect to apply a LV Contribution for land within a 'land value contributions area' (LVC Area).

A LVC Area is identified in a contributions plan and is the area of land subject to a change in planning controls that results in an increased need for public amenities and services. The LV Contribution relates to the proportion of the LVC Area that is required for the public amenities and services. The LV Contribution is expressed as a percentage, with the maximum being 20 per cent of the LVC Area required for local infrastructure. LV Contributions are calculated based on the value of land for rating purposes, as determined by the NSW Valuer General, at the time the LV Contribution is triggered.

A LV Contribution can only apply if:

- the concurrent planning proposal results in more intensive development of the land and, as a result, increases the value of the land

- the intensive development will require land to be provided for a public purpose.

Accordingly, LV Contributions are specifically designed for greenfield release areas where changes to planning controls enable more intensive developments which result in higher land values.

Councils who elect to apply for a LV Contribution must:

- do so as part of their request for a gateway determination

- submit a draft contributions plan as part of the planning proposal for the same land

- exhibit both the planning proposal and contributions plan for a minimum of 28 days.

While a LV Contribution is triggered when land is rezoned, the LV Contribution is only payable upon either the sale or development of the land, whichever occurs first after rezoning. This is to ensure the immediate beneficiary of the rezoning makes the LV Contribution.

Development of Land

If land is subdivided or developed before it is sold, a LV Contribution will be payable (either monetarily or by way of land dedication) as a condition of consent to development.

Sale of Land

Land which is subject to a LV Contribution cannot be transferred to another person, unless the LV Contribution has first been satisfied. Accordingly, the LV Contribution framework has implications for NSW conveyancing practices. We expect there will be an increase in commentary and/or additional amendments to conveyancing legislation in the coming months as there has been little scrutiny about the implications from a conveyancing perspective.

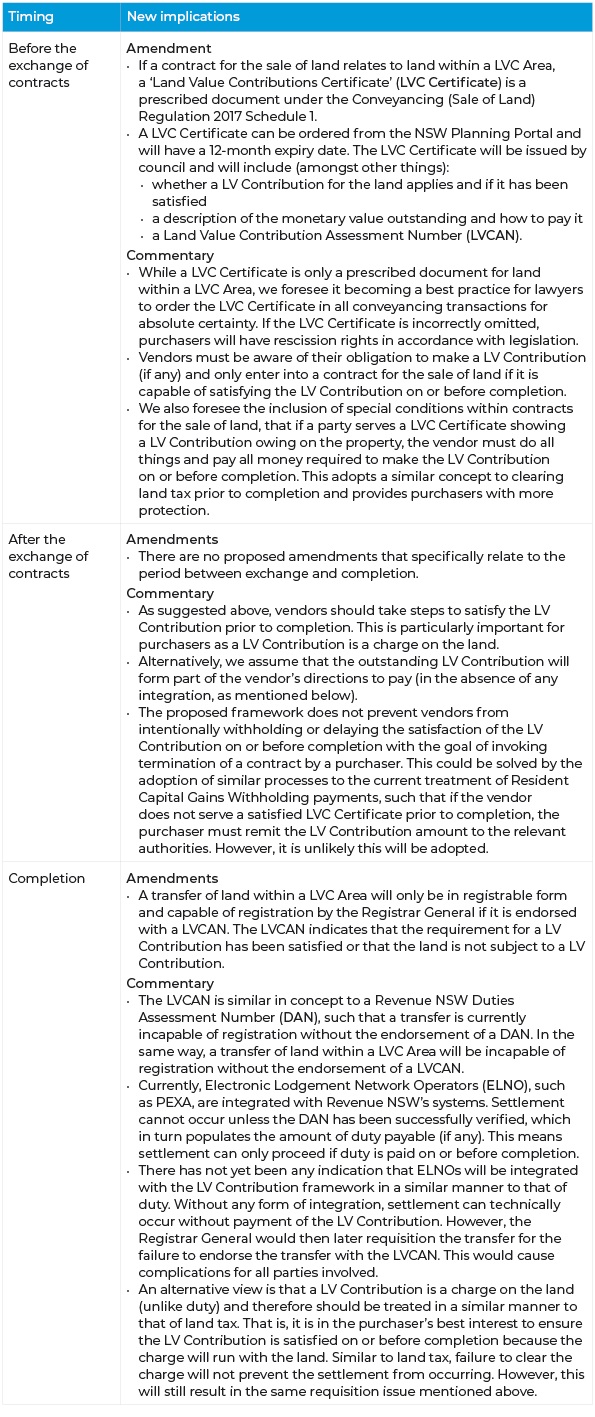

In the table below, we set out the implications of the proposed framework for NSW conveyancing practices.

This publication does not deal with every important topic or change in law and is not intended to be relied upon as a substitute for legal or other advice that may be relevant to the reader's specific circumstances. If you have found this publication of interest and would like to know more or wish to obtain legal advice relevant to your circumstances please contact one of the named individuals listed.