On March 22nd, 2018, Alberta Finance Minister Joe Ceci announced the 2018 Alberta Budget. The Budget does not include any changes to personal or corporate tax rates. Below is a summary of some of the tax measures that were included in the Budget.

Personal Income Taxes

Interactive Digital Media Tax Credit

This new refundable tax credit will provide eligible interactive digital media companies with a benefit worth 25% of eligible labour costs incurred after April 1st, 2018. A diversity and inclusion credit enhancement, worth up to an additional 5%, will also be available to companies that employ workers from under-represented groups. Further details on the enhancement will be provided when the regulations are brought forward and program and application details will be available by summer 2018.

Investment Tax Credits

The Alberta Investor Tax Credit ("AITC") and the Capital Investment Tax Credit ("CITC") were announced during the 2016 Alberta Budget and could be claimed starting in 2017.

The AITC provides a 30% tax credit to investors who make equity investments in eligible Alberta businesses doing research, development or commercialization of new technology, new products or new processes. The AITC is also applicable to businesses engaged in interactive digital media development, video post-production, digital animation or tourism. The AITC was planned to operate for three years and will now be extended until 2021-2022. Investors will also be eligible to receive an additional 5% credit if they invest in eligible business corporations that meet diversity and inclusion criteria. Details on the new diversity and inclusion credit requirements will be provided when the corresponding regulations are introduced. The annual maximum refundable credit amount for individuals remains the same at $60,000 per year. For corporations, the AITC is non-refundable and there is no limit on the credit that can be claimed.

The CITC is available to corporations and provides a 10% non-refundable tax credit of up to $5 million for a corporation's eligible capital expenditures on manufacturing, processing and tourism infrastructure. This credit was planned to operate for two years and has been extended until 2021 – 2022.

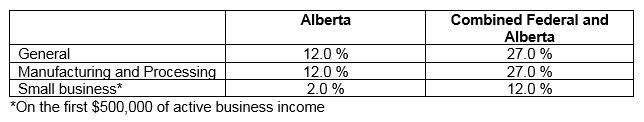

Corporate Income Taxes

There were no changes announced to the corporate income tax rates. As of January 1, 2018 Alberta's corporate income tax rates remain as follows:

For more information on the 2018 Alberta Budget, please visit the Alberta Government website at the following address: https://www.alberta.ca/budget.aspx.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.