DEFINITION

The Luxembourg SPF (Société de gestion de patrimoine familial) refers to a special tax regime applicable to companies whose sole purpose is management of private wealth of individuals. An SPF is the most widely used personal wealth management tool in Luxembourg.

OBJECTIVE, PURPOSE

The corporate purpose of an SPF is limited to acquisition, holding, management and disposal of financial instruments, cash and other types of assets. An SPF may not perform any type of commercial activity. The name of the company should include a designation "SPF".

An SPF is available only for investors managing their private wealth. Shares of an SPF cannot be used for public placement and cannot be quoted on a stock exchange. Benefits of the SPF regime are not available to corporate investors and they cannot be used within a corporate group.

Eligible investors within the meaning of the SPF law are:

- individuals managing their private wealth, or

- private wealth management entities acting for one or several individuals (trust etc.), or

- intermediaries acting on behalf of either of the above; or

- intermediaries holding shares in the SPF on a fiduciary basis or in a similar capacity, on behalf of investors who are themselves eligible.

Private wealth management entities usually (but not exclusively),

An SPF may create, acquire, manage and sell a portfolio of securities (shares, bonds, warrants, stock options, etc.) issued by public or private organizations in Luxembourg or abroad.

An SPF may borrow from a banking institution or a shareholder. There is no maximum debt ratio. However, if debts exceed eight times the amount of the paid-up capital, an additional registry tax (taxe d'abonnement) will be payable.

NOT PERMITTED ACTIVITIES

An SPF is not allowed to conduct any commercial activity of any kind.

An SPF cannot acquire immovable property since direct investments are deemed equivalent to an exercising of commercial activity. However, an SPF is allowed to acquire immovable property indirectly through a subsidiary, provided it is not fiscally transparent (i.e. not through a partnership).

The granting of remunerated loans and advances is not allowed, even to a company in which the SPF holds an equity stake. However, the SPF may, on an ancillary basis and strictly without remuneration, make an advance or stand guarantee for the commitments of the company in which it holds an investment.

LEGAL BASIS

The Law of 11 May 2007 on Creation of a Private Wealth Management Company (SPF – Société de gestion de patrimoine familial).

LEGAL FORM

An SPF company can be incorporated within the framework of one of the following corporate forms:

- Société anonyme (S.A.) – similar to a Public Limited Company or an Aktiengesellschaft (AG);

- Société à responsabilité limitée (S.à r.l.) – similar to a Private Limited Company or a Gesellschaft mit beschränkter Haftung (GmbH);

- Société en commandite par actions (SCA) – similar to Partnership Limited by Shares or a Kommanditgesellschaft auf Aktien (KGaA);

- Société co-operative (S.C.) – similar to a co-operative (a co-operative can also be incorporated as a public company).

SFP's ACTIVITIES

PERMITTED ACTIVITIES

An SPF is allowed to hold equity stakes provided that it does not interfere in the management of the company in which such stakes are held by the SPF. An SPF cannot exercise a directorship role in decision-making bodies

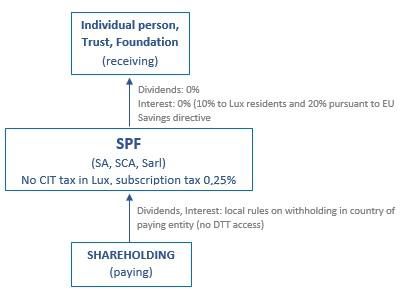

Apart from the withholding on interest under the Savings Directive, interests and dividends paid to non-residents will not generally be subject to any Luxembourg tax. Gains realized by non-residents due to the sale of shareholding in an SPF or due to liquidation of an SPF will not be subject to tax in Luxembourg.

Due to its special tax status an SPF cannot access benefits granted under double tax treaties. Local withholding rates of the jurisdiction of the entity paying out the income applies.

SUPERVISION

The tax supervision of the SPF is carried out by the Administration de l'Enregistrement et des Domaines of GD Luxembourg. This audit is limited to checking facts and data concerning the company's tax status.

If an SPF is found to be in breach of any of the rules on eligible investors and/or investments and/or activities, its special tax status may be suspended.

TAX TREATMENT

An SPF is exempt from corporate income tax, municipal business tax and wealth tax.

An SPF is subject to an annual registration tax (taxe d'abonnement) at the rate of 0.25%, subject to a minimum of 100 EUR and a maximum of 125,000 EUR. The tax base is the amount of the paid-up capital plus any existing share premiums. The portion of debts that exceeds eight times the amount of the paid-up capital and the share premium is also included in the tax base for the registration tax.

Distribution of dividends by an SPF to its shareholders is exempt from withholding tax at source in Luxembourg regardless of tax residency of individual shareholder.

Dividends paid to Luxembourg shareholders (individuals) will be fully taxed when they are received and may not benefit from the 50% exemption defined in article 115/15a of the Luxembourg Law on Taxation of Income, given the subjective exemption granted to the SPF.

Interest paid by an SPF on its debts towards individuals are subject either to the final 10% withholding tax for individuals resident in Luxembourg or subject to withholding tax under the provisions of the "Savings Directive" for EU resident individuals.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.