Part one of a three part series of Budget 2017 decoded: Innovation and our Canadian economy

The Canadian economy

The 2017 federal budget demonstrates the government's commitment to innovation, stating that "Canada must do more to encourage innovation. The future success of all Canadians relies on it."1 To foster innovation, the government announced plans to evaluate and modify various programs that fund innovation, with the goal of consolidating and simplifying the programs that support Canadian entrepreneurs. The changes are expected to advance Canada's position as a world-leading innovation economy, improving its ability to create jobs and increase business investment in the country.

Venture capital investment in Canada

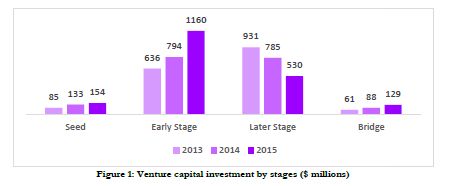

Start-ups and small businesses require funding to grow and reach their full potential. Notably, between 2014 and 2015, Canadian venture capital (VC) investment grew by 12 percent to $2.3B.2 Ontario led the charts nationally, attracting 42 percent of all venture capital investment, while the information and communication technology industry continued to receive the most VC across all sectors. Yet, despite this increase in VC investment, most funds went to support earlier-stage deals rather than those at the later stages (Figure 1).3 As a result, amounts invested in later-stage companies fell by 12 percent.4 Late-stage venture capital is typically offered to young, established businesses with sales and revenue to help the business grow. When funding to this group declines, this is a major concern, as a lack of support for growing companies can prevent them from scaling up—ultimately impacting the Canadian economy. 5

Venture capital investment in Canada

The federal government continues to make changes to encourage Canadian VC investment and help businesses to scale up. One such initiative included in the 2017 budget is the Venture Capital Catalyst Initiative (VCCI). The budget proposes to make $400M available through the Business Development Bank of Canada on a cash basis over the three years.

This program comes after the success of the 2013 Venture Capital Action Plan (VCAP) implemented by the government to encourage investment in early stages of growth. The program supported four successful private sector-led funds, resulting in over $900M in VC being added to the Canadian ecosystem.6 Further building on this success, the VCCI will provide financial support to Canadian companies in the late-stage funding cycle. It is estimated that VCCI's success could inject $1.5B into Canada's innovation capital market.

To access the VCCI funds, private sector parties will have to submit proposals to the government that would be evaluated on the amount of private sector capital already secured, expected benefits for Canadian firms, proposed approach for risk sharing between the government and private sector, and the investment strategy. This type of support for the VC sector will encourage the development of a globally competitive innovation industry.

Stacking funding by leveraging SR&ED credits with VCCI investment

To remain globally competitive, growth-minded companies constantly invest in the research and development of new products and processes. Companies applying for the VCCI may also be able to leverage the Scientific Research and Experimental Development (SR&ED) tax credit. The SR&ED program is the largest source of R&D funding in Canada, which rewards companies for innovation. Claimants from various industries, including manufacturing and information technology, can reap benefits of the program.

Footnotes

1 Budget 2017: Building a Strong Middle Class

2 Canadian venture capital and private equity activity way up – CVCA Report by the Canadian Venture Capital & Private Equity Association. https://www.cvca.ca/wp-content/uploads/2016/02/CVCA-2015- market-overview-press-release.pdf

3 2015 Canadian Venture Capital Market Overview by the Canadian Venture Capital & Private Equity Association. https://www.cvca.ca/wp-content/uploads/2016/04/Venture-Capital-2015-Report_REV-Apr- 2016.pdf

4 Canadian venture capital and private equity activity way up – CVCA Report by the Canadian Venture Capital & Private Equity Association. https://www.cvca.ca/wp-content/uploads/2016/02/CVCA-2015- market-overview-press-release.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.