Value Added Tax

VAT is imposed on the provision of goods and services in Cyprus, as well as on the importation of goods into Cyprus and on the acquisition of goods from the European Union.

Taxable persons charge VAT on their taxable supplies (output tax) and are charged with VAT on goods or services, which they receive (input tax).

If output tax in a VAT period exceeds total input tax, a payment has to be made to the state. If input tax exceeds output tax a repayment is due from the state.

With regard to intra-community acquisitions the trader does not pay VAT on receipt of the goods in Cyprus but instead he accounts for VAT using acquisition accounting. This involves a simple accounting entry in the books of the business whereby he self-charges VAT and at the same time claims it back if it related to taxable supplies thereby creating no cost to the business.

VAT rates

The following rates apply to the taxable supplies:

- Zero rate (0%)

- Reduced rate (5%)

- Reduced rate (8%)

- Standard rate (15%)

Zero rated goods and services include the following:

- Exports

- Food for human consumption(excluding catering)

- International air and sea transportation of persons, and goods and related services

- Pharmaceutical products

- Supply of goods to other EU member States

- Ship management services.

Reduced rated goods and services of 5% include the following

- Animal feeding stuffs

- Fertilizers

- Services of road cleaning

- Funeral services and supply of coffins

- Services of authors, composers, artists and critics of works of art

- Supply of seeds

- Supply of live animals of a kind generally used for human consumption

- Newspapers, magazines and books

- Non-bottled water

- Ice-creams, ice-cream products and similar products

- Dry nuts, potato crisps, cheese puffs, cereal and similar products

- Gas in cylinders

- Rural and urban bus services.

Reduced rated goods and services of 8% include the following:

- Taxi services

- Tourist, excursion and long distance bus

- Hotel accommodation services

- Catering services and supplies of goods in the course of catering with the exception of alcoholic drinks which are subject to VAT at the standard rate.

- Air and sea transportation services within Cyprus.

Standard rated (15%) goods and services

All supplies of goods or rendering of services, except those taxed at 0%, 5%, 8% or exempt.

Exemptions Certain goods or services are exempted from VAT including:

- Rents

- Medical services

- Insurance and financial services

- Educational services

- Building land

- Supply of immovable property for which a valid application for planning permission was submitted before 1st of May 2004

Future changes From 1 January 2008 the following will be subject to VAT at the standard rate (15%):

- Pharmaceutical products (currently zero rated)

- Food for human consumption (currently zero rated)

- Catering services and hotel accommodation (currently reduced rated 8%)

- Building land (currently exempted)

Difference between zero rate and exemption

The difference between zero rate and exemption is that businesses that only make exempt supplies are not entitled to register to VAT therefore the input VAT on their purchases, expenses or imports cannot be recovered.

Irrecoverable input VAT

Input VAT cannot be recovered in a number of cases, which include the following:

- When businesses make only exempt supplies

- Purchase, import or hire of saloon cars

- Expenditure for entertainment of persons other than staff

- Housing expenses of directors

Registration

Obligation for VAT is compulsory when:

- at the end of any month, if the value of the taxable supplies (supplies taxed at the rates of 0% and/or 5% and/or 8% and/or 15%) exceeded CY£9.000 during the 12 preceding months.

- at any time, if there are reasonable grounds for believing that the value of the taxable supplies in the following 30 days then beginning will exceed CY£9.000. Businesses with a turnover of less than CY£9.000 can be registered voluntarily if they are trading in taxable supplies.

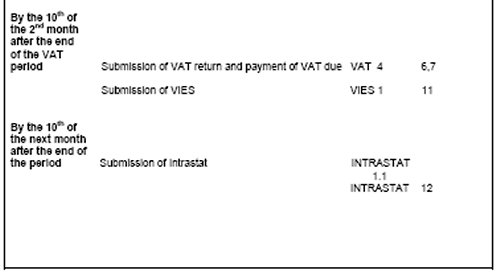

VAT declaration, payment/return of VAT

VAT returns must be submitted quarterly and the payment of the VAT must be made within 40 days from the end of each quarter.

Where in a quarter input tax is higher than output tax, and therefore a repayment is due, the difference is refundable or is transferred to the next VAT quarter to be credited against any payable account.

International Business Companies (IBCs)

IBCs are subject to the same registration rules. However the activities of most IBCs fall outside the scope of VAT and thus there is no obligation for registration. If there is no obligation to register there is the option of voluntary registration. This means that IBCs will not charge VAT on their sales and the VAT charged by Cypriot suppliers is refunded.

Cyprus accession to the European Union

Due to Cyprus accession to the European Union on 1 May 2004, the relevant changes are applicable:

(a) Intra-community trade

This refers to supply of goods between Member States and their VAT treatment. The sales are zero rated in the first Member State if the following criteria are satisfied:

- The seller has adequate proof that the goods have left the first Member State and have entered another Member State and

- The buyer has an EU VAT number

b) Triangulation trade

This is the case where three Member States are involved, there is only one actual movement of goods but two invoices are issued, one from the first country to intermediary and another from intermediary to the recipient of goods. The intermediary supplier must apply the simplification procedures and the invoice issued to the recipient must include the phrase "VAT, EU Article 28, Simplified Invoice".

(c) Administration of Intra-community trade Participants of intra-community trade must perform the following actions:

Suppliers

1. Complete the VIES return form on a quarterly basis. The VIES form is submitted within 40 days after the end of the relevant quarter.

2. Complete the Intrastat return form for supply of goods on a monthly basis.

3. Record intra-community supplies on the VAT return form.

4. Include the EU VAT number of the buyer in the invoice. Buyers

1. Complete the Intrastat return form for acquisition of goods on a monthly basis. The Intrastat forms are submitted within 10 days after the end of the relevant month.

2. Record Intra-community acquisitions on the VAT return form.

3. Inform the supplier of their EU VAT numbers prior the issuance of the invoice.

(d) Provision of services

I. General Rule

The general rule states that services are taxable in the country from where they are provided. Therefore, provision of such services from Cyprus to another Member State is taxable in Cyprus at the rate of 15%.

(d) Provision of services (continued)

II. Services of Third Schedule

Services fall within the 3rd Schedule (consultancy, accounting, legal, intellectual property, advertising etc) are taxable in the country of the recipient and therefore qualify for zero rate VAT in the member State from where they are provided if the buyer has an EU VAT number. The buyer will apply the reverse charge procedures

Penalties and interest

Late registration CY£50.00 for every month of late registration

Late deregistration CY£50.00 one-off

Late submission of VAT form CY£30.00 one-off

Late payment of outstanding tax 10% of the outstanding amount plus 9% interest

Late submission of Intrastat form CY£5.00 per working day up to the maximum of 30 working days

Late submission of VIES form CY£30.00 for every month up to the maximum of three months

Immovable Property Tax

Immovable Property Tax is imposed on the market value as at 1 January 1980 and applies to the immovable property owned by the taxpayer on 1 January of each year.

This tax is payable on 30 September each year. Physical and legal persons are both liable to Immovable Property Tax.

Tax rates

Exemptions

The following are not subject to Immovable Property Tax:

- Public cemeteries.

- Churches and other religious buildings.

- Public hospitals.

- Schools.

- Immovable property owned by the Republic.

- Foreign embassies and consulates.

- Common use and public places.

- Property under Turkish occupation.

- Buildings under a Preservation Order.

- Buildings of charitable organizations.

- Agricultural land used in farming or stock breeding, by farmer or stock breeder residing in the area.

Transfer Fees By The Land Registry Department

The fees charged by the Land Registry department for transfers of immovable property are as follows:

In the case of property transferred to a family company, transfer fees are refundable after five years if the property remains with the company and the shareholders remain the same.

In the case of property transferred from a company whose shareholders are spouses/and or children, to one of the two spouses or their children or to a relative up to third degree of relation the transfer fees are calculated on the value of the property as follows:

|

Transfer to a spouse |

8% |

|

Transfer to a child |

4% |

|

Transfer to a relative |

8% |

Also the following rates are applicable in the case of free transfers:

|

From parents to children |

4% |

|

Between spouses |

8% |

|

Between third degree relatives |

8% |

|

To trustees |

CY£5.00 |

Value in these cases is the one written on the title deed which refers to values of the year 1907.

In the case of companies’ reorganizations, transfers of immovable property are not subject to transfer fees by the Land Registry department.

Trusts

A trust is established by an individual «the settlor» and is a means whereby property «the trust property» is held by one or more persons«the trustees»for the benefit of another or others« the Beneficiaries» or for specified purposes.

Trusts have traditionally been very important tax planning devices. Even today a very high proportion of tax saving schemes involve trusts.

International trusts

International trusts are governed by the International Trusts Law of Cyprus. International Trusts are not taxed in Cyprus. In fact, Cyprus International Trusts enjoy important tax advantages, providing significant tax planning possibilities. The following advantages are indicative of the possible options for tax minimization.

- All income, whether trading or otherwise, of an International Trust (i.e. a Trust whose property is located and income is derived from outside Cyprus) is not taxable in Cyprus.

- Dividends, interest or other income received by a Trust from a Cyprus international business company are neither taxable nor subject to withholding tax.

- Gains on the disposal of the assets of an international Trust are not subject to capital gains tax in Cyprus.

- An alien who creates an International Trust in Cyprus and retires in Cyprus is still exempt from tax if all the property settled and the income earned is abroad, even if he is a beneficiary.

- The assets of an international trust are not subject to estate duty in Cyprus.

- Trusts are usually used by wealthy individuals for the purpose of protecting their inheritance or capital gains taxes in their home country. They can also be used by expatriates settling into a trust before repatriating, assets acquired while working abroad, to protect such assets from the tax net of their home country.

Stamp Duties

The table provided gives the amount or rate of duty payable on certain documents. Transactions which fall within the scope of reorganizations are exempt from stamp duty. Also, any contracts relating to assets situated outside Cyprus or business affairs that take place outside Cyprus are exempt from stamp duty. Nature of documents

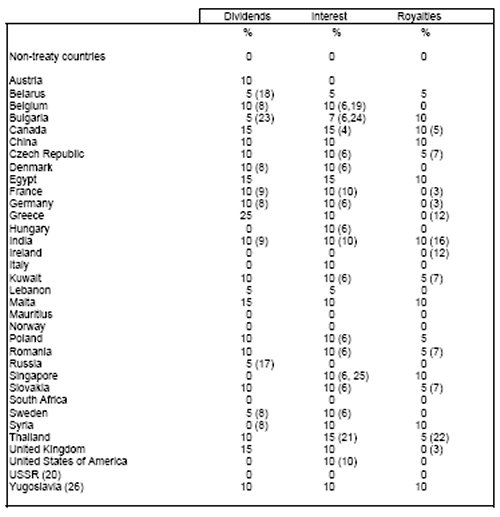

Double Taxation Agreements

Paid from Cyprus

Notes

1. No withholding tax is imposed in Cyprus upon payment of dividends, interests and royalties to non-residents of Cyprus.

2. 10% when the royalties are used within the Republic.

3. 5% on film and TV royalties.

4. Nil if paid to a Government or for export guarantee.

5. Nil on literary, dramatic, musical or artistic work.

6. Nil if paid to the Government of the other state.

7. This rate applies for patents, trademarks, designs or models, plans, secret formulate or process, or any industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific experience.

8. 15% if received by a company controlling less than 25% of the voting power.

9. 15% if received by a company controlling less than 10% of the voting power.

10. Nil if paid to a Government, bank or financial institution.

11. The treaty provides for withholding taxes on dividends but Greece does not impose any withholding tax in accordance with its own legislation.

12. 5% on film royalties.

13. 5% if received by a company controlling less than 50% of the voting power.

14. This rate applies to individual shareholders regardless of their percentage of shareholding. Companies controlling less than 10% of the voting shares are also entitled to this rate.

15. 10% for payments of a technical, managerial or consulting nature.

16. Treaty rate 15% therefore restricted to Cyprus legislation rate.

17. 10% if dividends paid by a company in which the beneficial owner has invested less than US$100,000.

18. If investment is less than EUR200,000 dividends are subject to 15% withholding tax which is reduced to 10% if the recipient company controls 25% or more of the paying company.

19. No withholding tax for interest on deposits with banking institutions.

20. Armenia, Azerbaijan, Kurghystan, Moldova, Tatzikistan, Uzbekistan and Ukraine apply the USSR/Cyprus treaty.

21. 10% on interest received by a financial institution or when it relates to sale on credit of any industrial, commercial or scientific equipment or of merchandise.

22. This rate applies for any copyright of literary, dramatic, musical, artistic or scientific work. A 10% rate applies for industrial, commercial or scientific equipment. A 15% rate applies for patents, trade marks, designs or models, plans, secret formulate or processes.

23. This rate applies to companies holding directly at least 25% of the share capital of the company paying the dividends. In all other cases the withholding tax is 10%.

24. This rate does not apply if the payment is made to a Cyprus international business entity by a resident of Bulgaria owning directly or indirectly at least 25% of the share capital of the Cyprus entity.

25. 7% if paid to bank or financial institution.

26. Slovenia and Serbia/Montenegro apply the Yugoslavia/Cyprus treaty.

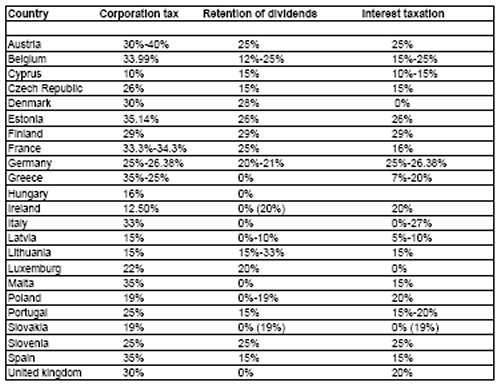

Tax Rates Applicable in EU Member States

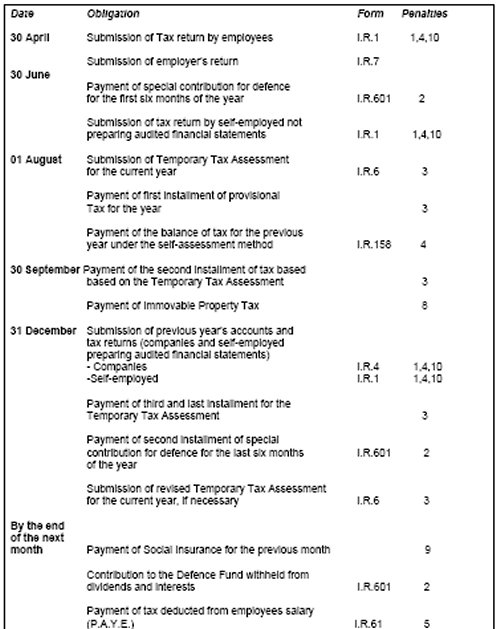

Tax Calendar

Penalties

1. A penalty of CY£ 10.00 per day for as long as failure continues is imposed or imprisonment up to twelve months or both. Any person who without any excuse ommits any object of the tax from the return shall be liable, on conviction to a fine up to CY£ 2,000 plus the tax due plus in amount equal to two times the difference between the amount of tax properly imposed and the amount of tax that would have been imposed had the assessment been based on the return.

2. Interest at the rate of 9% per annum is imposed from the first day after the end of the six-month period (interest is calculated daily).

3. Failure to pay any installment of the temporary tax assessment by the due date:

- Interest at the rate of 9% per annum is imposed (Interest is calculated for complete months).

- If no temporary tax assessment was submitted and an assessment is issued by the Inland Revenue, interest at 9% per annum is payable on the overdue installment plus an additional penalty of 5% on the whole amount of the temporary tax.

- In addition, a penalty is imposed equal to 10% of the difference between the tax due per the final assessment and the tax per the temporary assessment if the temporary taxable income is less than 75% of the taxable income per the final assessment (interest is calculated for complete months).

4. Failure to pay tax by the due date:

- Interest is imposed at the rate of 9% per annum (Interest is calculated for complete months).

- Any tax due is liable to an additional penalty of 5% in the case where the tax return is not submitted within 30 days after the deadline and payment of the tax due is not made.

5. Failure to pay P.A.Y.E. and Defence tax by the due date:

- Interest is imposed at the rate of 9% per annum from the due date and an additional penalty of 1% per month as long as the delay continues

- The total amount of the additional penalty cannot exceed 11% of the tax due (interest is calculated for complete months).

6. Late submission of the VAT return:

- Imposition of a penalty of CY£30.00 per VAT return form.

7. Late payment of outstanding VAT:

- Penalty at the rate of 10% of the outstanding amount.

- Interest is imposed at the rate of 9% per annum on the amount of the penalty (interest is calculated for complete months).

8. Late payment of immovable tax results in the imposition of interest at the rate of 9% per annum from the due date.

9. Late payment of Social Insurance results in the imposition of a penalty of 3% for each month of delay as long as the delay continues. The total amount of the penalty cannot exceed 15% of the amount due.

10. Late submission results in the imposition of penalty equal to CY£30.00.

11. Late submission of VIES results in the imposition of a penalty of CY£30.00 for each late month up to 3 months. If the form is not submitted within 3 months then fine up to CY£1,500.00 may be imposed.

12. Late submission of INTRASTAT results in the imposition of a penalty of CY£5.00 for each late working day up to 30 working days. If the form is not submitted within 30 working days then fine up to CY£1,500.00 may be imposed.

* From 1 January 2007 onwards the interest imposed on late payments has been reduced from 9% to 8%.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.