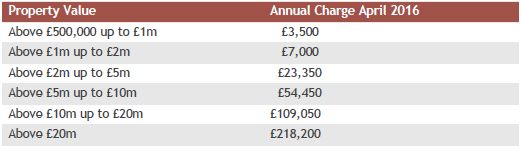

The ATED charge initially applied to UK residential properties held in corporate and similar structures if worth more than £2m in April 2012, or at acquisition if later. The ATED charge was extended to such properties worth more than £1m from April 2015, and those worth more than £500,000 from April 2016. Note that even for the new ATED thresholds the valuation is also that at 1 April 2012, or at acquisition if later.

The new charges were set at £7,000 and £3,500 per annum for properties in these two bands.

The ATED return for properties first falling within the charge from 1 April 2016 is due by 30 April 2016, with any payment due by the same day.

There are various reliefs from paying ATED, for example, where the UK residential property is let on a commercial basis to third parties. Such relief has to be claimed annually, but there is now a single annual return for all properties subject to the same relief.

ATED charges for properties worth more than £2m have increased significantly from 1 April 2015. Some companies may wish to give further consideration to 'de-enveloping' the properties as a result of these increases. The annual charges are currently as follows:

The Financial Conduct Authority does not regulate all of the services or products discussed in this publication.