In July 2015 the government introduced a notional interest deduction on new equity capital (paid-up share capital and share premium) injected into companies and permanent establishments of foreign companies on or after January 1 2015 for the purpose of financing business assets, calculated by applying a reference rate to the new equity. The reference rate is three percentage points above the Cyprus 10-year government bond yield or three percentage points above the 10-year government bond yield of the country in which the assets funded by the new equity are used, whichever is the higher. The bond yield rates to be used are as at December 31 of the year preceding the year of assessment.

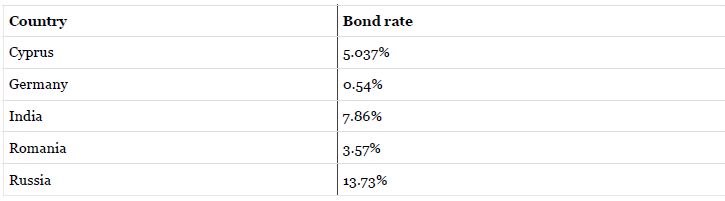

The Tax Department recently announced the 10-year government bond rates at December 31 2014, on which the notional interest deduction for the 2015 tax year will be based, for the following countries.

Thus the notional interest deduction for equity introduced during 2015 in order to fund assets used in India will be 10.86% of the amount of new equity introduced; and for equity introduced in order to fund assets used in Russia, it will be 16.73% of the amount introduced.

For equity used to fund assets used in Cyprus or in the other countries listed (whose rates are lower than the Cyprus rate), the notional interest deduction will be 8.037% – three percentage points above the Cyprus bond rate.

Originally published in ILO, February 19 2016The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.