The 2015 changes to the VAT rules will require businesses which supply taxable telecoms, broadcasting and e-services B2C in the EU to report and pay VAT in the Member State of their customers. Operators can opt for multiple VAT registrations, or alternatively will be able to account for VAT across the EU via a single electronic declaration under the Mini One Stop Shop Scheme.

The Mini One Stop Shop scheme (MOSS)

The MOSS is an optional scheme which will allow businesses to declare and pay the EU VAT due in one EU Member State (in the case of EU businesses, this will be the Member State where they are established) rather than where their customers are located. A Supplier who opts to use the scheme will submit quarterly VAT returns electronically to the Member State of Identification, declaring the VAT charged and collected in the EU Member States where the customers are located. The EU VAT payments will be made to that Member State, which will then transmit the funds to the respective EU Member States. This scheme is intended to simplify the EU VAT compliance obligations for operators who would otherwise be required to have multiple VAT registrations.

Extension of the current One Stop Shop Scheme

The proposed MOSS is essentially an extension of the current One Stop Shop system which already applies to non-EU suppliers of electronic services to EU consumers. The current system has allowed non-EU traders who supply e-services to EU consumers, and which should charge and collect VAT in the country of the consumer, to choose a single EU Member State within which to register for VAT and to submit EU VAT payments.

With effect from 1 January 2015, this One Stop Shop system (as modified) will apply to non-EU businesses which supply broadcasting and telecom services to EU consumers, and to EU businesses which supply taxable telecoms, broadcasting and e-services to EU consumers.

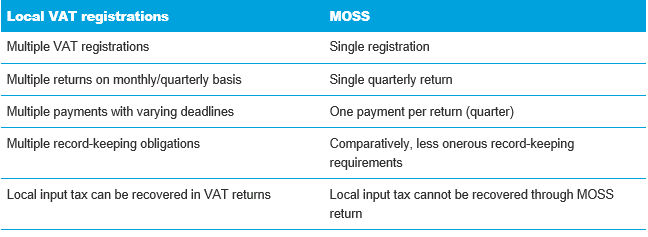

Multiple local VAT registrations vs. MOSS

The MOSS is optional, and suppliers can therefore decide whether to register for VAT in each Member State in which its customers are located, or to opt for registration under MOSS. Some of the differences are:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.