INTRODUCTION

In response to concerns about systemic risks in over-the-counter ("OTC") derivatives markets, the Group of Twenty (G20) initiated a reform programme in 2009 to reduce the systemic risk from OTC derivatives. As initially agreed in 2009, the G20's reform programme comprised four elements:-

- All standardised OTC derivatives should be traded on exchanges or electronic platforms, where appropriate;

- All standardised OTC derivatives should be cleared through central counterparties ("CCPs");

- OTC derivative contracts should be reported to trade repositories ("TRs"); and

- Non-centrally cleared derivative contracts should be subject to higher capital requirements.

In 2011, the G20 agreed to add margin requirements on non-centrally cleared derivatives to the reform programme and called upon the BCBS (i.e. the Basel Committee on Banking Supervision) and IOSCO (i.e. the International Organisation of Securities Commissions) to develop for consultation, consistent global standards for these margin requirements.

Both the EU1 and the US2 have adopted the primary legislation which aims to fulfil the G20 commitments that all standardised OTC derivatives should be cleared through CCPs and that all derivative contracts should be reported to TRs (and the related commitments to a common approach to margin rules for un-cleared OTC derivative transactions). However, the EU and the US regulators paused progress on their proposals for margin rules for non-centrally cleared derivatives pending the outcome of the BCBS-IOSCO consultation on common international standards.

In addition, the US legislation addresses issues relating to the execution of OTC derivative contracts on electronic trading platforms, post-trade transparency and position limits for commodity derivatives. The EU is addressing these issues (and others relating to trading and transparency of OTC derivative markets) in the proposals to replace the existing Markets in Financial Instruments Directive ("MiFID") with a new restated Directive ("MiFID 2") and a new EU Regulation ("MiFID"). This European legislation is expected to be adopted in the fourth quarter of this year at the earliest and will itself also require extensive implementing measures before it comes into effect.

As referenced above, the primary legislation in the EU which aims to fulfil the G20 commitments is EMIR which entered into force on 16 August 2012. EMIR introduced a new era for OTC derivative markets and introduced the following obligations;

- risk mitigation requirements for non-centrally cleared trades;

- reporting to TRs;

- clearing obligations relating to standard OTC derivatives; and

- requirements for CCPs and TRs.

Furthermore in March 2013, the European Securities and Markets Authority ("ESMA") published a series of Regulatory Technical Standards ("RTS") and Implementing Technical Standards ("ITS") which were detailed in our last EMIR Client Memorandum3 in March 2013 titled "EMIR – Key Points and Dates Applicable to Financial Counterparties".

However the following RTS / ITS are still outstanding:-

- Collateral Exchange – EMIR requires procedures that provide for the "timely, accurate and appropriately segregated exchange of collateral" for non-centrally cleared OTC derivative transactions. The European Banking Authority ("EBA"), European Insurance and Occupational Pensions Authority ("EIOPA") and ESMA, collectively the European Supervisory Authorities ("ESAs") have been charged with drafting RTS which will determine the precise level and exact type of collateral to be exchanged. The ESAs have delayed their submission of RTS covering the collateral exchange requirements to the European Commission pending the outcome of the BCBS and IOSCO report on margin requirements for non-centrally cleared derivatives. However given this report was just finalised and issued in early September 2013, we expect that the associated EMIR consultation and technical standards may be published later this year. Until the applicable RTS enters into force, counterparties must apply their own rules on collateral but will be required to change those rules once the RTS relating to the exchange of collateral enters into force.

- Extraterritoriality – EMIR provides that the clearing

obligation and obligations relating to the risk mitigation

techniques for non-centrally cleared OTC derivatives may apply to

OTC derivative contracts entered into between non-EU counterparties

(also referred to as "Third Country

Entities" or "TCEs") that

would be subject to such obligations if they were established in

the EU provided that the contract has a direct, substantial and

foreseeable effect within the EU or where such an obligation is

necessary or appropriate to prevent the evasion of any provisions

of EMIR. With this in mind, ESMA is obligated pursuant to EMIR to

draft RTS specifying the contracts that are considered to have a

direct, substantial and foreseeable effect within the EU or the

cases where it is necessary or appropriate to prevent the evasion

of any provision of EMIR.

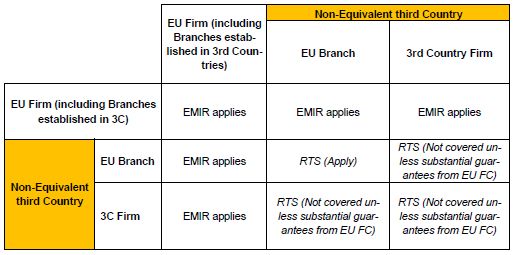

On 17 July, 2013 ESMA published a consultation paper containing draft RTS (the "Consultation Paper") in which it is proposed that EMIR's clearing and risk mitigation requirements will apply to transactions between TCEs when rules in both jurisdictions are not considered to be equivalent to EMIR and either (a) one of the two TCEs is guaranteed by an EU financial counterparty for at least €8bn of the gross notional amount of OTC derivatives entered into and for an amount of at least 5% of the OTC derivatives exposures of the EU financial counterparty; or (b) both TCEs execute the transaction via their EU branches. A summary of the scope of the application of EMIR to TCEs under the draft RTS included in the Consultation Paper and Article 13 of EMIR is as follows:

ESMA has invited comments on the Consultation Paper and will consider all those received by 16 September 2013. It is intended that ESMA will update the draft RTS following a consideration of responses to its Consultation Paper and will then send its final report to the European Commission for endorsement. - Equivalence – Under EMIR4, the European

Commission may adopt implementing acts declaring that the legal,

supervisory and enforcement arrangements of a non-EU country are

equivalent to the requirements laid down in EMIR relating to the

clearing, reporting, nonfinancial counterparties and risk

mitigation obligations under EMIR. In this regard, EMIR5

clarifies that any implementing act on equivalence shall imply that

counterparties entering into a transaction subject to EMIR shall be

deemed to have fulfilled the above detailed obligations where at

least one of the counterparties is established in that third

country. Furthermore under EMIR6, the European

Commission may adopt an implementing act determining that the legal

and supervisory arrangements of a third country ensure that CCPs or

TRs authorised in that third country comply with legally binding

requirements which are equivalent to the requirements laid down in

EMIR, and that those CCPs or TRs are subject to effective

supervision and enforcement in that third country on an ongoing

basis. For a CCP or a TR established in a non-EU country to provide

its services in the EU, an equivalence decision is one of the

requirements that must be fulfilled before ESMA will grant access

of the CCP or TR to EU investors.

The European Commission requested ESMA to provide its technical advice on the equivalence of certain non-EU countries in order to assist it in formulating its equivalence decisions, starting with the US and Japan.

On 3 September 2013, ESMA published its technical advice to the European Commission on the equivalence of the legal and supervisory frameworks of the US and Japan. The scope of the advice covers the recognition of non-EU CCPs and TRs, the clearing obligation, reporting obligation, NFCs and risk mitigation obligations under EMIR (i.e. portfolio reconciliation, dispute resolution, portfolio compression and margin requirements for non-centrally cleared OTC derivatives).

ESMA's technical advice to the European Commission also included advice on the regimes for CCPs and TRs for Australia, Hong Kong, Singapore and Switzerland, despite the deadline for that advice being 1 October 2013. ESMA continues to work on the advice on other areas for these jurisdictions (i.e. the clearing obligation, reporting obligation, NFCs and risk mitigation obligations) and is also working on technical advice for the regimes in India and South Korea.

TO WHOM DOES EMIR APPLY?

An entity's obligations under EMIR vary on its categorisation under EMIR. EMIR introduces two categories of counterparty;

- Financial Counterparty ("FC") which

is broadly defined as a person authorised under one of the EU's

financial services directives e.g. a MiFID authorised investment

firm, a bank, an insurer, a UCITS fund, an alternative investment

fund ("AIF") managed by an authorised or

registered alternative investment fund manager

("AIFM"). Non-UCITS funds not managed by

an authorised or registered AIFM would not fall within the

definition of a FC. However such funds will fall within this

definition once they are managed by an authorised or registered

AIFM (which should occur by 22 July 2014).

The definition of "FC" would capture a Cayman fund managed by an EU AIFM, once the EU AIFM is authorised or registered under the EU Directive 2011/61/EU on Alternative Investment Fund Managers (the "AIFM Directive"). - Non Financial Counterparty ("NFC")

is defined as an entity established in the European Union which is

not a FC. NFCs are further divided into non-financial

counterparties subject to the clearing obligation (each a

"NFC+") and non-financial counterparties

not subject to the clearing obligation (each a

"NFC-"). A NFC+ means a NFC whose

derivative trading positions exceeds one of the clearing thresholds

which are referred to in Article 10(4)(b) of EMIR and detailed in

Article 11 of the Commission Delegated Regulation (EU) No 149/2013

of 19 December 2012 supplementing Regulation (EU) No 648/2012 with

regard to regulatory technical standards on indirect clearing

arrangements, the clearing obligation, the public register, access

to a trading venue, non-financial counterparties, and risk

mitigation techniques for OTC derivatives contracts not cleared by

a CCP ("RTS 149/2013")7 A

summary of the clearing threshold value per class of OTC derivative

contract is as follows. Once the threshold value for one class of

OTC derivative contract is surpassed, the NFC exceeds the clearing

threshold and constitutes a NFC+.

Value of the clearing thresholds:

- EUR 1 billion* Credit derivative contracts;

- EUR 1 billion* Equity derivative contracts;

- EUR 3 billion* Interest rate derivative contracts;

- EUR 3 billion* Foreign exchange derivative contracts;

- EUR 3 billion* Commodity derivative contracts and others.

* in gross notional value

In calculating the positions referred to above, the NFC shall include all derivative contracts entered into by the NFC or by other non-financial entities within the group to which the nonfinancial counterparty belongs, which are not objectively measurable as reducing risks directly relating to the commercial activity or treasury financing activity of the non-financial counterparty or of that group. The term "group" is broadly defined and includes group companies established both inside and outside the EU and also captures intra-group transactions for the purposes of assessing whether the above thresholds have been breached.

NFCs are required to start calculating the clearing threshold from the date the RTS 149/2013 entered into force; i.e. from 15 March 2013, and are required to send a notification to ESMA and the relevant national competent authority when they are above the relevant clearing threshold. NFCs are required to notify the relevant national competent authority on the first day that they exceed any of the clearing thresholds. In this regard, at the date of this Memorandum, the Central Bank of Ireland (the "Central Bank") has not yet been appointed as the competent authority under EMIR. However, it is expected that the Central Bank will be appointed as the competent authority under EMIR in due course. In the case of a group which has legal entities which trade OTC derivatives, a single notification should be submitted to ESMA, listing all of the NFC group legal entities within the EU which trade OTC derivatives.

As stated above in the "Introduction" section of this Memorandum, EMIR provides that the clearing obligation and obligations relating to the risk mitigation techniques for non-centrally cleared OTC derivatives may also apply to OTC derivative contracts entered into between Third Country Entities or TCEs that would be subject to such obligations if they were established in the EU provided that the contract has a direct, substantial and foreseeable effect within the EU or where such an obligation is necessary or appropriate to prevent the evasion of any provisions of EMIR.

To read this article in full, please click here.

Footnotes

1 Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories ("EMIR")

2 US Dodd-Frank Wall Street Reform and Consumer Protection Act which was enacted in July 2010

3 See http://www.dilloneustace.ie/download/1/EMIR%20-%20Key%20Points%20and%20Dates..pdf

4 Article 13(2) of EMIR

5 Article 13(3) of EMIR

6 Article 25(6) in respect of CCPs and Article 75 in respect of TRs

7 See http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2013:052:0011:0024:EN:PDF

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.