ALL EMPLOYERS

By February 28, 2013

If you paid salary, employment commissions or employee benefits from January 1 to December 31, 2012, you must complete and file:

- T4 Summary and Supplementary reporting forms provided to you by the federal government.

- Retiring allowances, including termination and severance pay, must now be reported on T4s. Note that amounts eligible for transfer to an RRSP are reported separately on this form from those that are ineligible for such transfers.

By March 15, 2013

Employers must complete and file the Ontario Employers' Health Tax Annual Return. You should receive this from the government in January 2013.

Employers are exempt from Ontario Employers' Health Tax on the first $400,000 of Ontario payroll. This exemption amount must be shared among associated employers.

Other filings

Employers are required to complete and file Ontario Workers' Compensation Returns on the dates indicated on their particular forms.

General

In preparing the T4s for your employees, you must calculate and report the value of all employee benefits in addition to reporting actual salary or wages. [See the latest version of the Employers' Guide to Payroll Deductions for a detailed listing of benefits.]

Ensure that all employee benefits that are taxable supplies (other than special-rated employer-paid automobile operating expenses, exempt supplies or zero-rated supplies) are grossed up for the effect of the Harmonized Sales Tax (HST).

See Appendix I to help you calculate complex GST/HST-included automobile benefits and employee loan interest benefits.

On each employee's T4, you must report contributions to Registered Pension Plans in 2012 and his/her pension adjustment (PA) figure for the year. Your plan administrator can assist you in determining your employees' PA figures, the calculation of which is quite complex for defined benefit plans.

T4 forms are available at our office and we can assist you in their preparation.

All taxpayers

By February 28, 2013

You must complete and file a T5 Summary and Supplementary reporting form if you:

- paid or owed accrued interest (generally, from inception to each anniversary day);

- paid dividends (including eligible and non-eligible dividends, and certain deemed dividends); or

- paid royalties.

Please note that exceptions to this rule include:

- interest paid by one individual to another, such as interest paid on private mortgages;

- interest paid on loans from banks or other financial institutions;

- interest paid or credited to non- residents of Canada (which must be reported on separate NR forms);

- capital dividends paid to Canadian residents by corporations; and

- total amounts paid for the year if they are $50 or less per recipient.

Electronic filing

If you file more than 50 T4 slips or 50 T5 slips for a calendar year, you must file the information returns over the internet.

T5 forms are available at our office, and we can assist you in their preparation.

Be sure to use current versions of T4 and T5 Summaries and Supplementaries to accommodate government scanning requirements.

By April 1, 2013

If you are the trustee of an inter-vivos trust or a testamentary trust with a December 31, 2012 year-end, you must complete and file the following:

- T3 Trust return and Supplementary forms by April 1, 2013. Please note the requirement to separately disclose eligible and non-eligible taxable dividends; and

- T4 and T4A reporting forms for executor or trustee fees paid (as noted above, these are due by February 28, 2013).

If you have paid or credited an amount to a non-resident of Canada such as:

- investment income (interest, dividends);

- estate or trust income;

- pension or annuity income;

- rents; or

- royalties;

you must complete and file an NR4 Summary and Supplementary reporting form by April 1, 2013.

Forms are available at our office, and we can assist you in their preparation.

APPENDIX 1

CALCULATION OF CERTAIN EMPLOYEE BENEFITS

Employee-owned automobiles

The amount of any payment (or benefit) received by an employee, relating to automobile operating expenses attributable to personal use of the automobile, must be included as a taxable benefit in the employee's income. The value of this benefit would normally be computed as follows:

[All operating costs (including

HST)

paid by the employer] x

[personal use kilometres]

Total kilometres

Employer-provided automobiles

If an automobile is provided to an employee, a shareholder, or a related person for personal use, a taxable benefit must be reported on his/her T4 slip. This benefit is calculated in two parts, as follows:

- standby charge; plus

- personal portion of operating costs.

Standby charge

Company-owned automobiles - Two per cent (1.5% for automobile salespeople) of the original cost of the automobile for each thirty-day period during which the automobile was made available to the employee or shareholder (or related person). For this purpose, cost includes HST. Please refer to the example in this appendix.

Company-leased automobiles - Two-thirds of the cost of leasing the automobile for the time the automobile was available to the employee, shareholder, or related person. The cost of leasing the automobile for this purpose includes HST but excludes insurance included in the lease cost.

The standby charge may be reduced where all of the following apply:

- the employee's personal use of the automobile is less than 20,004 km per year;

- the employee is required by the employer to use the automobile in the course of his/her employment; and

- the automobile is used at least 50% for business purposes.

This reduced amount is calculated by multiplying the standby charge by the following fraction:

Number of non-business kilometres

the

automobile was driven in the year

1,667 x number of 30-day periods the

automobile was made available to the

employee in the year

To qualify for this reduced standby charge, the employer or the employee must keep detailed records to substantiate business use (i.e., a log of kilometres driven for the year).

Any amounts paid by the employee or shareholder to the employer for the use of the car should be deducted from the standby charge.

Personal portion of operating costs

Operating costs generally include such items as licensing, gas, insurance, ordinary repairs and maintenance, but not parking for business purposes.

Option one

Where an employer provides an employee with an automobile and pays the related operating costs, the employee has the option of having the operating cost benefit calculated as 50% of the gross standby charge (prior to any reimbursement by the employee). This method may only be used where:

- the employee uses the automobile primarily for business purposes (more than 50%); and

- the employee notifies the employer in writing, before the end of 2012, to have this method apply.

Option two

For employees not eligible to use option one, or those who choose not to do so, a second option applies for calculating the operating cost benefit. This method is designed to reduce the record-keeping burden for employers. Under this method, the operating cost benefit is calculated based on a fixed rate of 26 cents/km of personal use (23 cents/km for automobile salespeople).

Under either option, the benefit is reduced by amounts reimbursed (relating to the operation of the car) by the employee within 45 days after the end of the year (i.e., February 14, 2013).

Please refer to the example calculations on the following page.

Remitting HST

Most employers, who report HST taxable benefits on T4s, must normally add and remit notional HST with their February 2013 HST liability otherwise calculated on business sales.

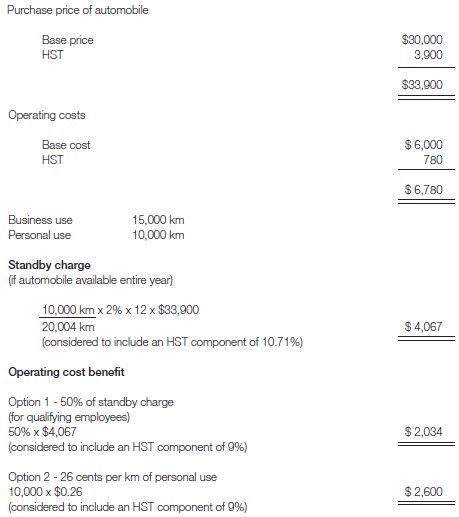

In the following example, the HST on the standby charge is $436 (10.71% x $4,067). This amount, along with the imputed HST on the operating benefit of either $183 or $234 [9% of either $2,034 (option 1) or 9% of $2,600 (option 2)], must be remitted.

If regular HST plus this notional HST exceeds credits claimed, the difference must be paid to Canada Revenue Agency (CRA). This HST payable is considered to represent the recovery of a portion of the input tax credit otherwise claimed for an automobile, relating to its personal use by employees.

EXAMPLE

TAXABLE BENEFIT ON AN EMPLOYER-PROVIDED AUTOMOBILE

Assumptions1

- The employee receiving the benefit reports for work to an establishment of the employer located in Ontario

- The employee is not an automobile salesperson

- The employer is not subject to recapture of ITC

(1) HST rates applicable in the calculations of the taxable benefits will var y depending on the province of employment, on the nature of the employment and on whether the employer is subject to the recapture of input tax credits for the provincial part of the HST. More information can be found in the T4130 Employers' Guide - Taxable Benefits and Allowances, available on the CRA website.

Specific GST/HST benefit rules

Only a certain group of employers may escape remitting this notional GST/HST.

The following employers are not required to remit the notional GST/HST included in employee benefits even though they must be reported as an inclusion on the T4 slip:

- an employer who is not a registrant;

- employers who are either registered individuals or partnerships where the automobile owned by them is not used exclusively (at least 90%) in commercial activities;

- a registered employer corporation, other than a financial institution, where the automobile owned by them is not used primarily (more than 50%) in commercial activities; and

- other limited exceptions.

Large businesses may be subject to special rates when determining the amount of notional HST included in the automobile operating expense benefits in Ontario.

Automobile allowances

If an employee is paid an allowance that is not reasonable (please see below), the entire allowance must be included in the employee's income and reported on his/her T4.

An allowance is considered unreasonable if:

- It is not kilometre-based or cannot be converted into a kilometre-based allowance (as discussed below); and

- The employee received a reimbursement for any direct automobile costs (excluding business-related parking and some other limited expenses). CRA considers the payment of even one gas bill sufficient to preclude the receipt of a tax-free allowance. Therefore, if, inadvertently, a reimbursement was made, and you wish the allowance to be tax-free, the employee should pay the money back to the employer and thus negate the reimbursement.

Kilometre-based allowances paid by an employer are only deductible by the employer to the extent of CRA's prescribed per-kilometre amounts for the year. The per-kilometre reimbursement rates which CRA allows as a deduction are 53 cents/km for the first 5,000 km and 47 cents/km thereafter. It is arguable that a reasonable kilometre-based allowance may exceed the above rates per-kilometre. Such a reasonable allowance is not taxable to employees, notwithstanding a limitation on deductibility to the employer.

Where an employer and employee agree, at the beginning of the year, that the employee is to receive a stated per-kilometre allowance paid as a set periodic advance, such an advance may be received as a tax-free allowance provided there is a year-end accounting. That is, at the end of the year, the total amounts advanced will be compared to the number of kilometres travelled for business purposes multiplied by the per-kilometre amount. Any excess or shortfall will be reimbursed to the employer or paid to the employee. Any excess amount cannot simply be added to the employee's T4 slip. In order to ensure tax-free treatment, the per-kilometre amount, the amount of each periodic advance and the projected annual kilometres must be reasonable.

Any other lump sum payment is fully taxable and should be treated as an element of normal salary subject to withholding.

There is no GST/HST taxable component on car allowances to an employee. However, the employer may claim a GST/HST input tax credit on reasonable allowances paid, calculated as 13/113 of the allowance amount, if the allowance was paid in 2012 if the province of employment is in Ontario (other rates apply in other HST participating provinces).

Employees can choose to include their kilometre-based allowances in their income and claim their car expenses directly, provided that they meet the requirements set out on Form T2200 (Declaration of Conditions of Employment).

Interest-free and low-interest loans

Loans to employees, shareholders, or persons related to them, may result in taxable interest benefits. The rules relating to these interest benefits are:

1. The taxable benefit is calculated by multiplying the principal outstanding by CRA's prescribed interest rate for the period of time during which the loan was outstanding. Any interest actually paid by the employee to the employer on the loan, during 2012 and until January 30, 2013, reduces the taxable benefit.

There are certain exceptions:

- There is no taxable benefit where interest is charged on the loan at the rate that would be charged between arm's length parties.

- The taxable benefit on a Home Purchase Loan is limited to the benefit that would be computed by using the prescribed rate in effect at the time the loan was made. Where the actual prescribed rate during 2012 is less than the prescribed rate that was in effect at the time the loan was made, the taxpayer's benefit will be based on this lower rate. For a home purchase loan that has a term exceeding five years, the balance outstanding on every fifth anniversary is considered to be a new loan on that date, and accordingly, the next five years taxable benefit will be limited to the prescribed rate at that time.

A Home Purchase Loan is a loan provided to a taxpayer by virtue of his/her office or employment to either purchase a home or to repay a previous Home Purchase Loan.

- There is an offsetting deduction for the taxable benefit on up to $25,000 of a Home Relocation Loan (for up to five years).

A Home Relocation Loan is a loan received by an individual as a result of an employment relocation. In order to qualify for this exception, the individual's new residence must be at least 40 kilometres closer to his/her new work location than the old residence.

- There is no taxable interest benefit where the principal amount of the loan is required to be included in a shareholder's income.

2. The interest rate to be used in computing taxable benefits (the prescribed rate) is adjusted quarterly. For 2012, the rates were:

|

1st Quarter |

1% |

3. Taxable interest benefits with respect to loans received by a taxpayer, by virtue of that taxpayer being a relative of an employee, are taxable in the employee's hands rather than the recipient's.

4. The benefit rules apply to all forms of indebtedness, not only to loans.

5. If a taxable benefit for a Home Loan is included on the T4 slip, this must be disclosed in the other information area at the bottom of the T4 slip.

Example: Code (36) Home Loans $________ .

6. The employee may deduct the interest benefit in calculating taxable income where the loan proceeds were used to earn business income, to earn investment income or to acquire an automobile for business use. (However, there are rules, which may limit the amount of interest that can be deducted for a business-use vehicle.)

7. There is no GST/HST effect on interest-free and low-interest loans.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.